0 result

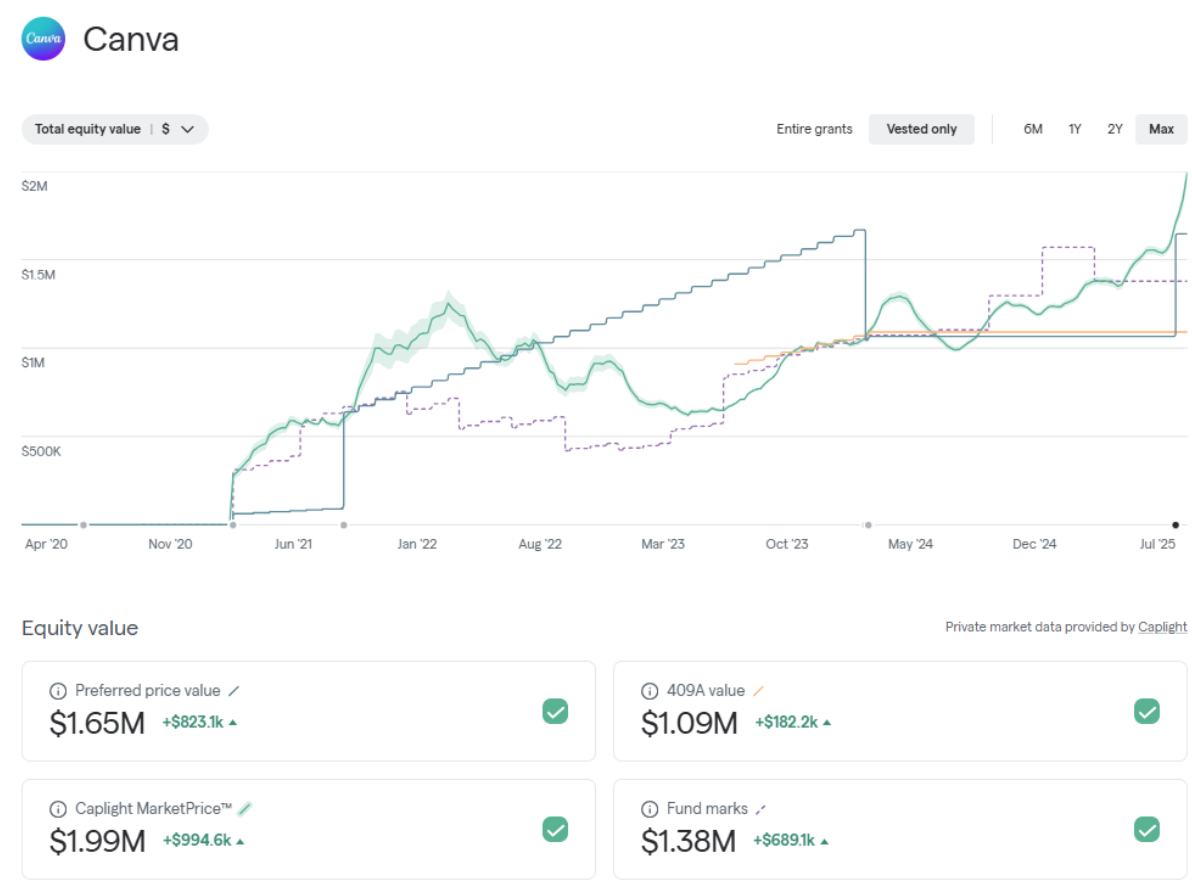

Canva has just completed a major employee share sale, at a $42 billion valuation, in a process widely seen as a prelude to its anticipated 2026 IPO. Eligible current and former employees ('Canvanauts') were allowed to sell up to $3 million of their vested equity at a price of $1,646.14 per share, in a round that was significantly oversubscribed, reflecting huge investor demand.

If you’ve been at Canva long enough to accumulate stock options, now is the time to think about how you’ll handle them before an IPO. Planning now could mean the difference between a major tax bill and a potentially life-changing outcome.

Exercising your options early could help you:

✅ Reduce your tax burden

✅ Maximize your post-tax gains

✅ Gain financial flexibility before and after an IPO

So, don’t leave it to chance.

If the company’s valuation continues to climb, so could your tax bill. Now is the time to understand your options and take control of your outcome.

Let’s break down what Canva employees need to know to make the most of their equity before a liquidity event.

In the lead-up to an IPO, a company’s 409A valuation often rises and that can have a major impact on your stock options. The 409A sets the Fair Market Value (FMV) of your shares, which determines the tax implications when you exercise.

As the FMV increases:

💸 Exercising your options becomes more expensive.

🧾 Your potential total tax bill increases.

🕒 Waiting too long could limit your ability to plan strategically.

If Canva goes public, your ability to sell shares may also be subject to a lock-up period, often lasting six months or more. That means you’ll want to have a plan in place well before the IPO to avoid being caught off guard.

After Canva’s recent, we’re assuming the company’s latest 409A valuation (FMV) is approximately $$1,646.14 per share.

If you have stock options, your strike price was set when your options were granted, and that number doesn’t change.

But here’s what does change: the FMV of your shares. And that can have a big impact on your taxes.

📌 Here’s why this matters:

When you exercise, you may owe taxes on the spread, that’s the difference between your strike price and the FMV.

As Canva’s 409A valuation increases, so does that spread, and your potential tax bill.

Waiting to exercise until right before or after an IPO could mean facing a much higher tax burden than if you exercised earlier.

Imagine you’re a Canva employee with 1,000 vested Incentive Stock Options (NSOs). Exercising now could save you $200,000 in taxes. That’s money you could keep and use towards a down payment, a big trip you’ve been holding off on, etc., instead of handing it over to the IRS.

Let’s break it down. Here are some of the assumptions we’re using for this example:

Scenario 1

| Metric | Amount |

|---|---|

Strike price | $27.72 |

409A valuation (FMV) | $1,646.14 |

Most recent preferred price | $1,646.14 |

For this case study, we’re also assuming the employee is able to sell their shares at $2,500 per share, a 50% premium to Canva’s most recent tender offer price of $1,646.14. That’s not a guaranteed IPO price, but it’s a reasonable estimate based on how many high-growth companies are priced relative to their last funding round. The actual price could be higher or lower depending on market conditions.

💡 Want to see how things change at a different exit price? You can sign up for Secfi’s tools and run your own personalized scenarios using your actual strike price, number of options, and estimated sale price.

Assuming the FMV continues rising in the lead-up to an IPO, employees who exercise now can establish a lower cost basis and potentially qualify for long-term capital gains tax treatment, reducing their future tax burden. On the other hand, waiting until the IPO to do a cashless exercise could result in significantly higher ordinary income taxes on the difference between the FMV and the strike price.

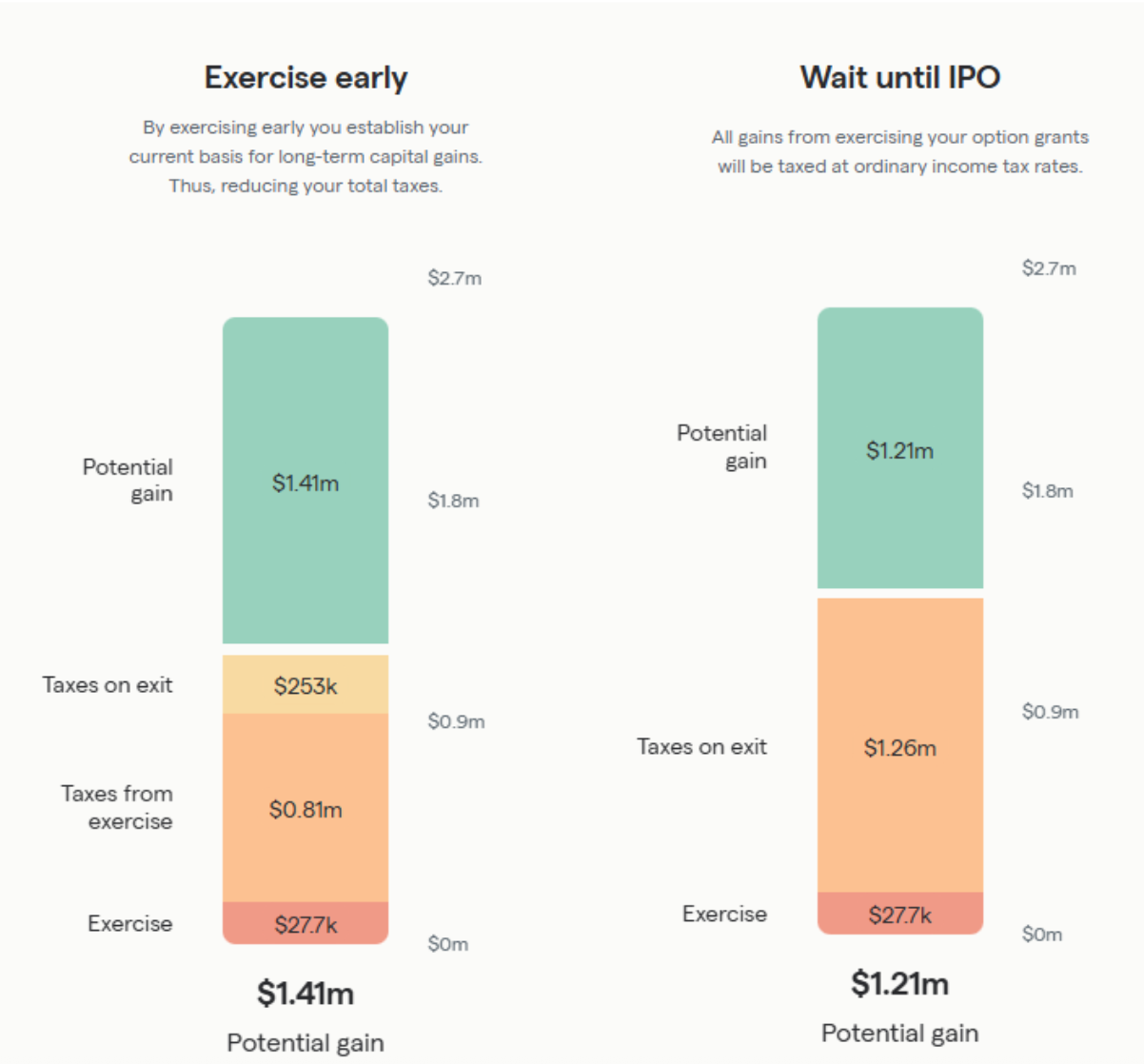

Let’s compare what our example employee’s outcome could look like if they exercised now versus waiting until after the IPO. We’re assuming they have a $250,000 income, live in California, and are married filing jointly.

Cost and tax comparison

| Exercise early (before IPO) | Wait until after IPO | |

|---|---|---|

Exercise cost | $27,700 | $27,700 |

Taxes on exit | $253,000 | $1.26M |

Taxes on exercise | $810,000 | None |

Potential gain | $1.41M | $1.21M |

If this employee exercises now, they could increase their net gain by $200,000 in potential tax savings.

Let’s explore some features of each option:

Option 1: exercising early (before the IPO)

Option 2: waiting until after the IPO

🔎 Key takeaways:

The last 3-4 years have been a rollercoaster for private company valuations, shaped by shifting market conditions, investor sentiment, and public market volatility. These fluctuations have directly impacted secondary market pricing, offering insight into how companies like Canva are valued ahead of a potential IPO.

💡 If trends continue, waiting to exercise could result in a higher FMV, and higher taxes.

For many Canva employees, the biggest barrier to exercising early is the upfront cost. That’s where Secfi’s non-recourse financing comes in:

✔ Exercise now without tying up personal cash.

✔ If your stock doesn’t increase in value, you owe us nothing.

✔ Avoid AMT surprises with a personalized strategy.

What's your next move?

Canva’s growth shows no signs of slowing down, and when the company eventually goes public, things could move quickly. Making a plan now ensures you’re ready when the time comes. Whether that means exercising early, understanding your tax exposure, or preparing for liquidity.

We’re ready to help Canva employees evaluate their options, navigate tax implications, and access financing so they can make the best decision for their equity—before an IPO changes the game.