0 result

Netskope has become a standout in cloud security, backed by strong growth, major enterprise adoption, and top-tier investors. The company formally filed its S-1 with the SEC in September 2025, confirming its plans to go public. According to the filing, Netskope generated $1.16 billion in revenue for fiscal year 2024, representing 39% year-over-year growth, though it also reported a net loss of $479 million. The S-1 highlights its customer base of more than 3,400 enterprises worldwide, including over 40% of the Fortune 100, underscoring both its scale and competitive positioning in the cybersecurity market.

If you've been granted stock options at Netskope, that moment could turn your equity into something significant. But the tax implications and timing decisions are complex—and worth understanding well before any public offering happens.

Let's walk through what employees should consider when evaluating their options.

To illustrate the key considerations, let's look at a hypothetical scenario. Taylor is a Senior Engineer at Netskope, living in San Francisco. She earns $250,000 in salary and joined the company in 2020, receiving 35,000 Incentive Stock Options (ISOs) at a $2.41 strike price. Today, those shares are fully vested. The company's current 409A valuation is $17.01/share, with a latest preferred price of $20.45/share.

Taylor's current situation

| Metric | Amount |

|---|---|

Shares | 35,000 |

Strike price | $2.41 |

409A | $17.01 |

Last preferred price | $20.45 |

Hypothetical IPO price | $30/share (for modeling purposes) |

Annual salary | $250,000 |

Location | San Francisco, California |

Now Taylor faces a decision that many Netskope employees might be considering: exercise now or wait until the IPO?

What it means: Taylor exercises her options now, paying the strike price and holding the shares through the IPO.

This strategy is fundamentally about managing the timing and amount of your Alternative Minimum Tax (AMT) exposure. The key difference isn't the final tax rate—with proper planning, both strategies can achieve long-term capital gains treatment. Instead, it's about when and how much AMT you pay.

If Taylor exercises today, she pays AMT on the current spread ($17.01 - $2.41 = $14.60 per share). If she waits until IPO, she'd pay AMT on the much larger spread (IPO price - $2.41), assuming she holds for the required period to qualify for long-term capital gains treatment.

Potential advantages:

Potential drawbacks:

With Taylor's $250,000 salary, California residency, and assuming she's married filing jointly, let's explore how the tax math might work.

Understanding AMT: Every year, taxes are calculated under both the regular tax system and the Alternative Minimum Tax (AMT) system. The greater of the two is what you actually pay in taxes, which for most people is the regular tax.

ISO exercises don't trigger regular income tax, but they do get added to your AMT calculation. This means when you exercise ISOs, the spread between your strike price and the fair market value becomes part of your AMT income.

The key benefit with ISOs is that if you hold onto the shares for a year after exercise and two years are grant date, you can convert all your gains to long-term capital gains rate which is a lower tax rate than ordinary income.

Let’s explore what the math could look like at hypothetical $30, $40, and $50 IPO pricing.

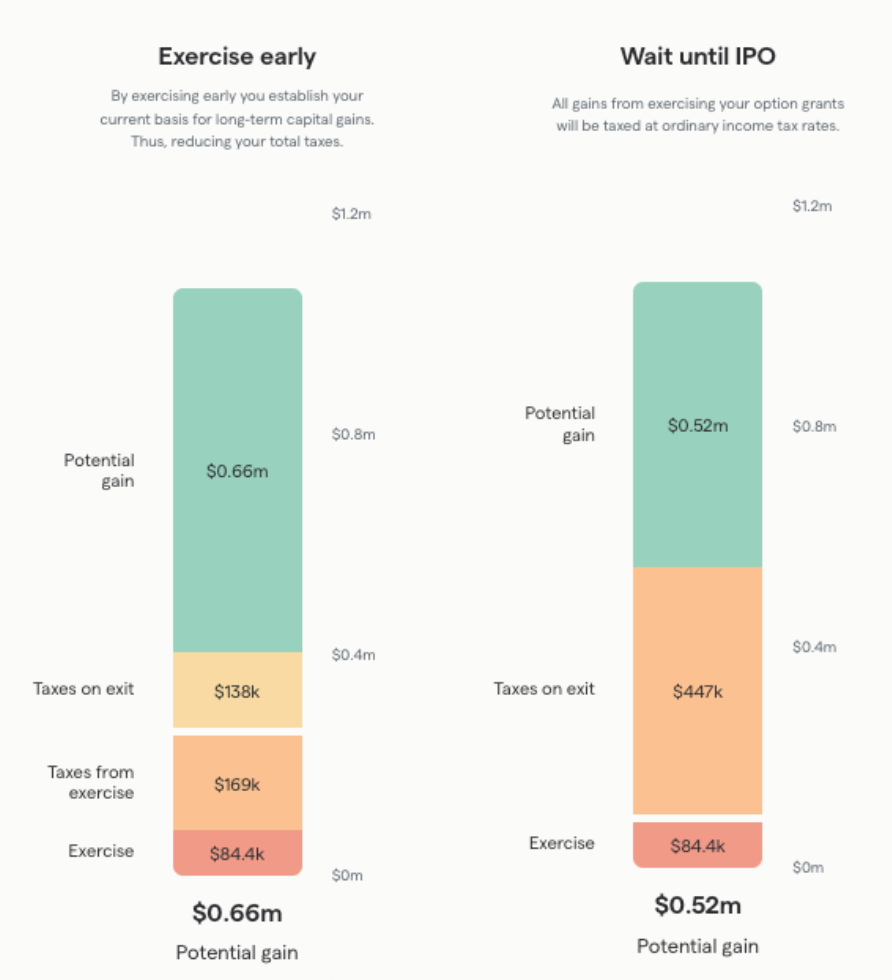

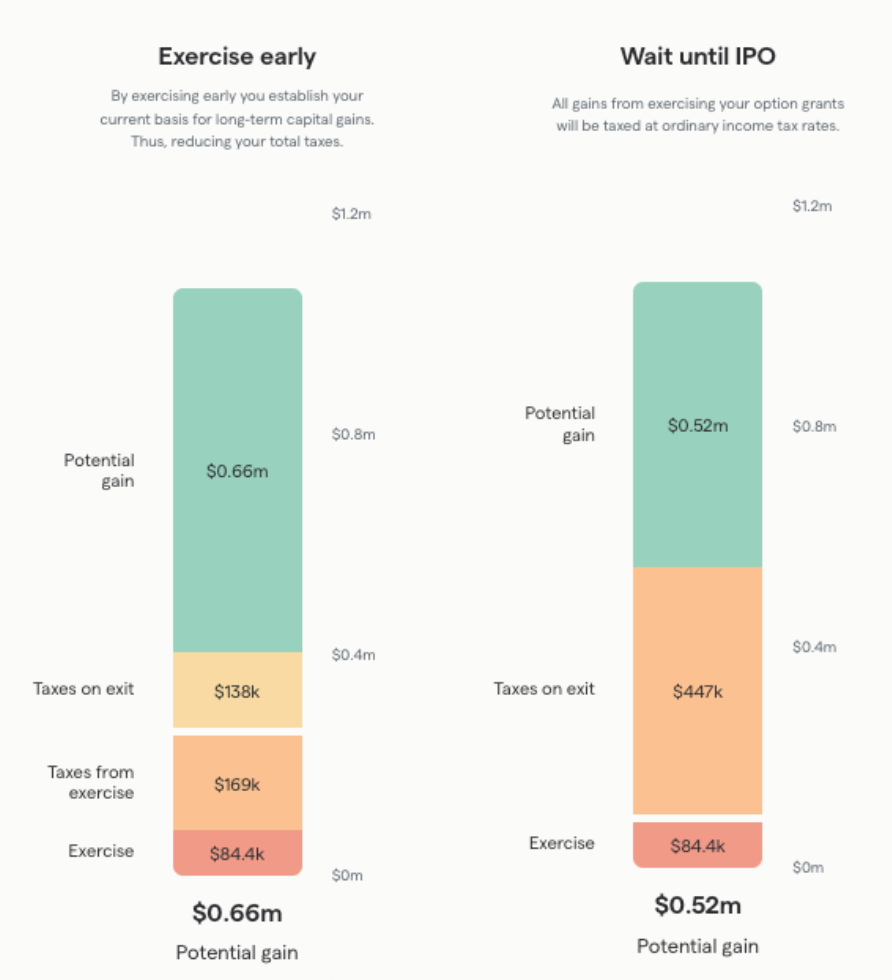

Early exercise at a hypothetical $30 IPO (after holding for long-term treatment):

| Metric | Amount |

|---|---|

Total gross value | $1.05M |

Exercise cost | $84.4k |

Taxes from exercise | $169k |

Taxes on exit (net of AMT credit) | $138k |

Potential gain | $660k |

Early exercise at a hypothetical $40 IPO (after holding for long-term treatment):

| Metric | Amount |

|---|---|

Total gross value | $1.40M |

Exercise cost | $84.4k |

Taxes from exercise | $169k |

Taxes on exit (net of AMT credit) | $275k |

Potential gain | $870k |

Early exercise at a hypothetical $50 IPO (after holding for long-term treatment):

| Metric | Amount |

|---|---|

Total gross value | $1.75M |

Exercise cost | $84.4k |

Taxes from exercise | $169k |

Taxes on exit (net of AMT credit) | $418k |

Potential gain | $1.08M |

These calculations assume current 2025 tax rates and Taylor’s specific income level. For reference, federal long-term capital gains rates are 15%–20% (plus the 3.8% Net Investment Income Tax where applicable), while ordinary federal income tax rates range from 10%–37%. California state tax rates range from 1%–12.3%, with an additional 1.1% surtax on income above $1 million. Actual results depend on other deductions, income changes, tax law modifications, and AMT credit utilization timing. For Illustrative Purposes Only.

What it means: Taylor waits until the IPO, then exercises and sells simultaneously.

With Taylor's California residency and $250,000 base salary, waiting until IPO creates a significant tax burden:

Wait-to-exercise at a hypothetical $30 IPO:

| Metric | Amount |

|---|---|

Total gross value | $1.05M |

Exercise cost | $84.4k |

Taxes on exit | $447k |

Potential gain | $520k |

Wait-to-exercise at a hypothetical $40 IPO:

| Metric | Amount |

|---|---|

Total gross value | $1.40M |

Exercise cost | $84.4k |

Taxes on exit | $630k |

Potential gain | $690k |

Wait-to-exercise at a hypothetical $50 IPO:

| Metric | Amount |

|---|---|

Total gross value | $1.75M |

Exercise cost | $84.4k |

Taxes on exit | $810k |

Potential gain | $850k |

This calculation assumes all option gains occur in a single tax year. Actual results depend on other income, deductions, and potential tax planning strategies.

| Scenario | Net proceeds | Key tax considerations |

|---|---|---|

Early exercise | ~$660,000 | All gains taxed as long-term capital gain if held for 1 year after exercise |

Wait until IPO | ~$520,000 | All gains taxed as ordinary income |

Potential difference | $140,000 | The early exercise strategy could yield significantly more after-tax proceeds |

These projections assume current tax law, the hypothetical IPO price, and successful long-term capital gains treatment. Individual results will vary based on market performance, tax law changes, and personal circumstances.

While tax optimization is important, it's not the only consideration:

For Taylor's situation, early exercise would require significant upfront cash:

If exercising pre-IPO makes strategic sense but cash flow is a constraint, some employees explore non-recourse financing. This approach lets you exercise without using your own cash, though it comes with its own trade-offs to evaluate:

Potential benefits:

Key considerations:

For Taylor's situation specifically:

Rather than rushing into either approach, consider working through these questions:

Both early exercise and waiting until IPO have merit—the right choice depends entirely on your individual circumstances, risk tolerance, and financial goals.

The key is understanding your options and their implications before you're under IPO timing pressure. With Netskope's potential IPO on the horizon, the window for early exercise planning is closing fast. The difference between strategies could be $140,000 or more in Taylor's case, making it worth understanding your options now.

Whether you choose early exercise, waiting until IPO, or some combination approach, having a clear plan can help you make the most of your Netskope equity.