0 result

Welcome to the inaugural article of "Stock Option Deep Dives", a series where we take a detailed look at equity and financial situations inspired by real-life tech employees.

Our first deep dive focuses on “Dan,” a fictional software engineer at Reddit, which has been rumored to be planning an IPO in 2024. Through an in-depth analysis of Dan's financial situation and Reddit’s valuation, this case study aims to provide a relatable and informative blueprint for tech professionals navigating the complexity of financial planning with stock options.

This article uses real company data from Reddit. Dan's financial data is meant to be representative of a Reddit employee. Additional financial data provided by Caplight.

Dan's financial journey over the past two years has been nothing short of a rollercoaster. Experiencing a nearly 60% drop in net worth in such a short time is a rare event for someone in the corporate world, but one that's all too familiar for startup employees. For them, navigating these turbulent waters should be at the top of their agenda.

To stabilize his financial situation, Dan has to diversify his investments beyond tech stocks, since most of his net worth is concentrated in Reddit stocks. This means diversifying across sectors and countries and perhaps adding fixed-income assets to lower the volatility and risk of his portfolio.

For his Reddit equity, it’s crucial to assess the situation thoroughly. He can assess the way his wealth changes in different exercise, financing, and exit scenarios. Should he finance an exercise, or come out of pocket? Should he wait til the exit and do a cashless exercise and sale? Should he sell a portion now to reduce risk and finance the exercise of his remaining shares? Each option has different tradeoffs that need to be considered in the context of Dan's life and goals.

For our analysis of Dan's situation, we first dove into his key assets and his perspective on Reddit. This broke down into three main parts:

This approach allows Dan to adjust his strategy as new information and circumstances arise.

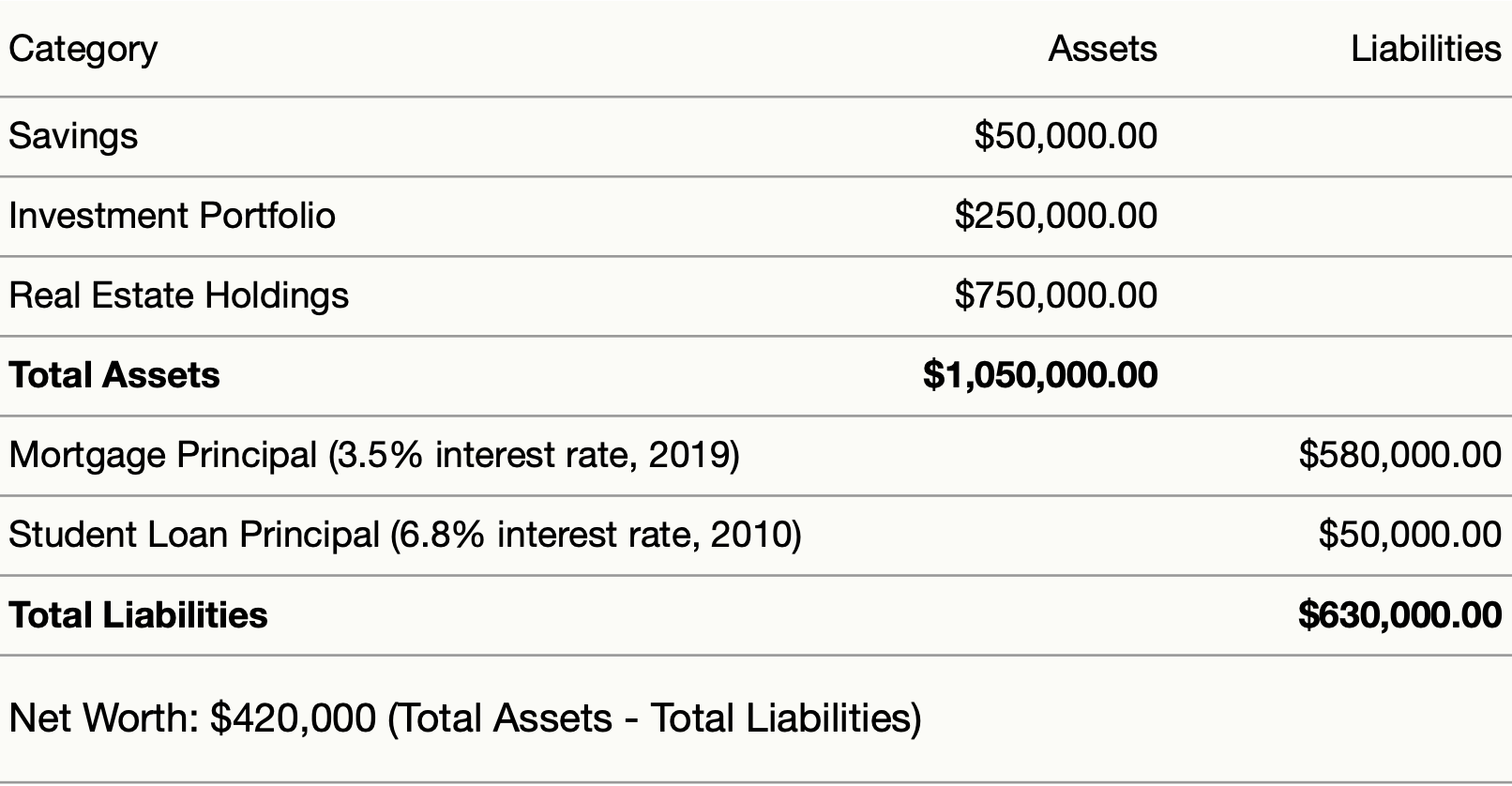

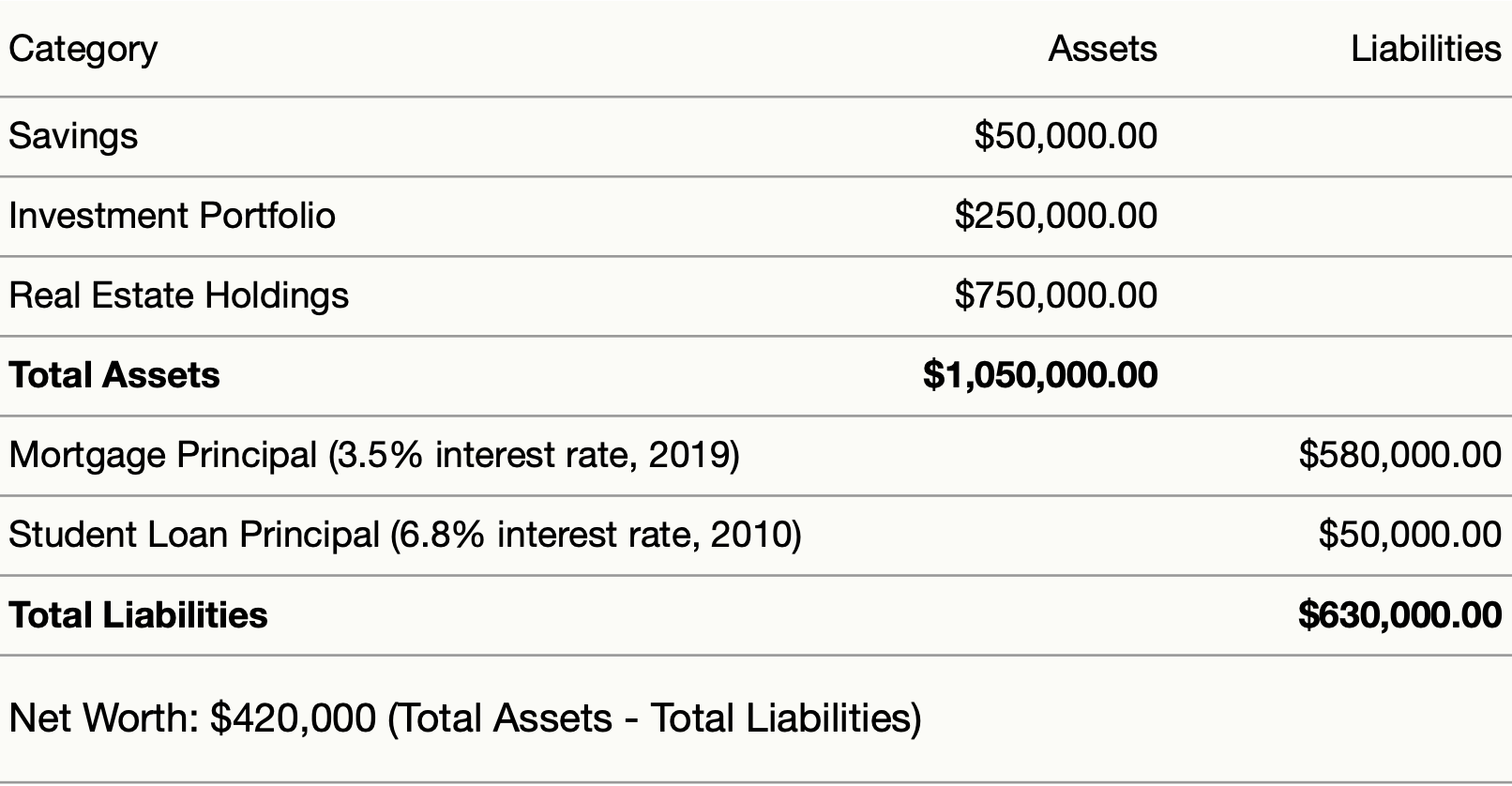

At 37, Dan's financial situation extends beyond his salary and stock options at Reddit. In a region known for its high cost of living, he's managed to build a diverse financial portfolio. His journey hasn't been without its challenges. Juggling a demanding tech career in the Bay Area, Dan has had to be smart about where and how he saves and invests his money. His approach involves a mix of regular saving, careful investing, and keeping an eye on the Bay Area's pricey real estate market. Here's a closer look at the various components of Dan's financial landscape, which illustrate the realities faced by many tech professionals in his position.

Dan's got his eyes set on the FIRE goal: Financial Independence / Retire Early. But in the up-and-down world of tech, he knows it's not all smooth sailing. So, he’s mixing it up – aiming for growth to hit his early retirement dreams, while staying smart about the risks. It's all about finding that sweet spot between making his money work and keeping it safe.

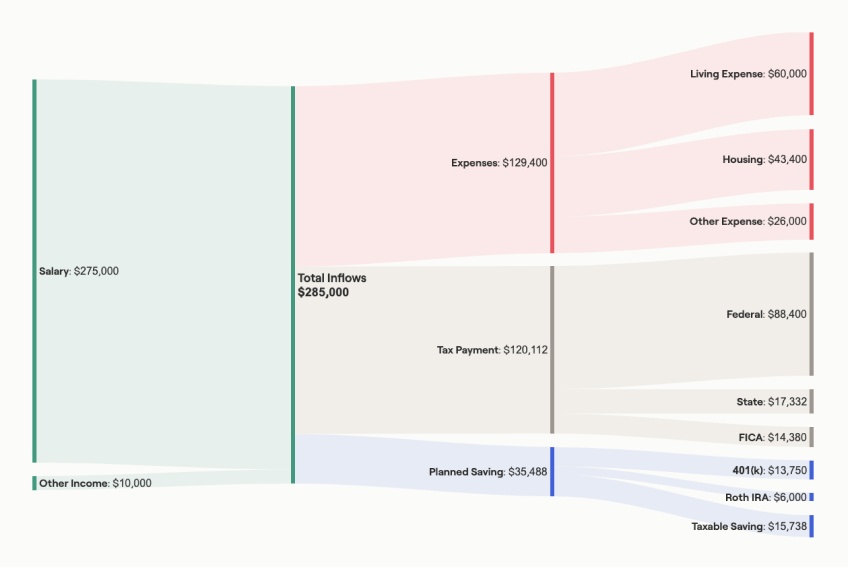

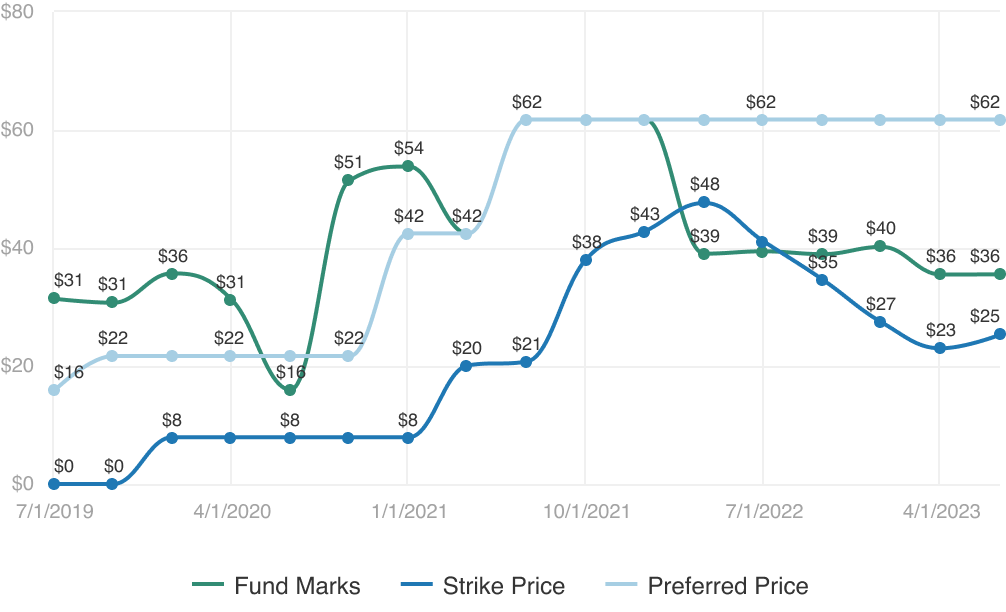

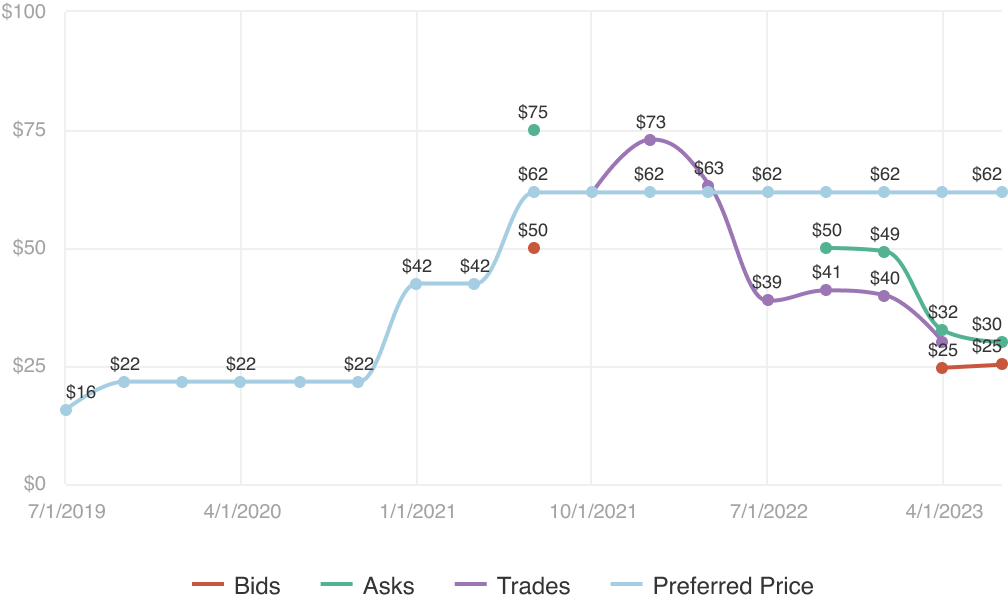

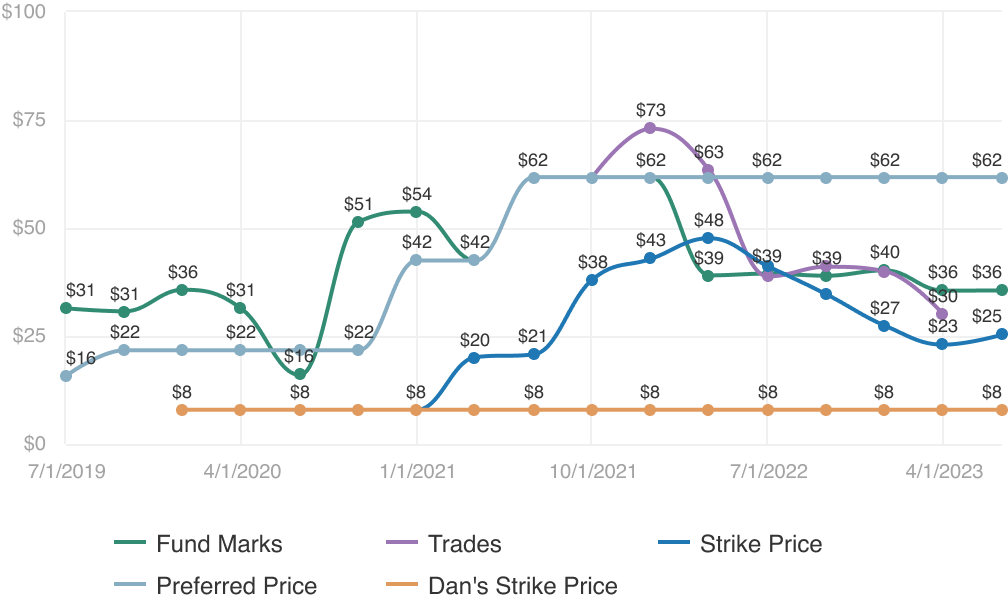

Getting a grip on Reddit's valuation is more about looking at a range of numbers than pinning down one exact figure. You've got different methods playing into this - like the price venture capitalists think it's worth and the 409A valuation that affects stock option prices. Then, there are the public fund marks, where big investors decide how much their piece of the pie is worth, plus all the action in the secondary market with its bidding and trading. And let's not forget about how similar companies are doing - that adds another piece to the valuation puzzle. All these bits and pieces come together to give us not just one definite price, but a whole spectrum of what Reddit could be worth. It's about piecing together all these clues to come up with a solid guess on the company's value.

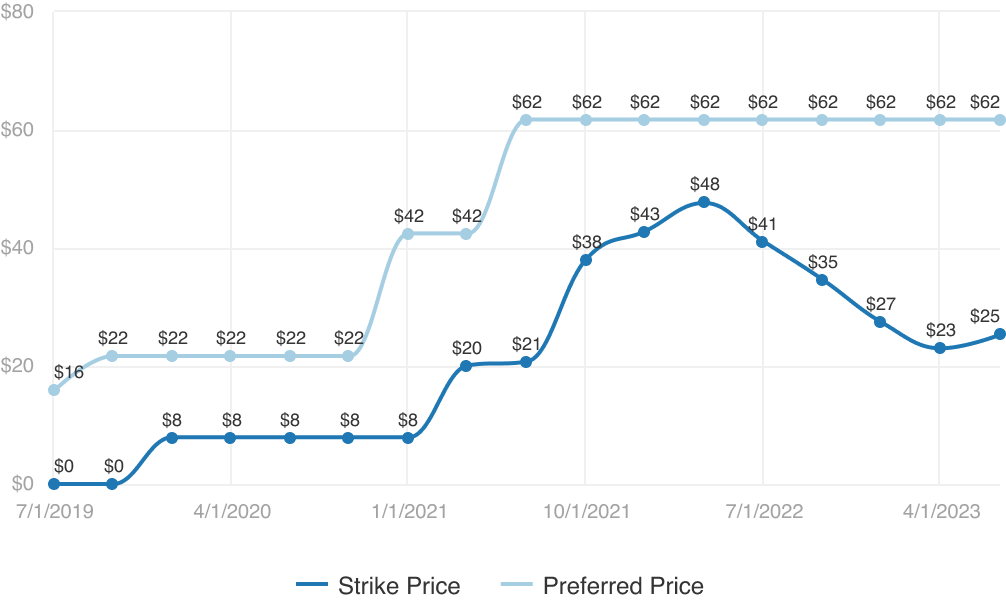

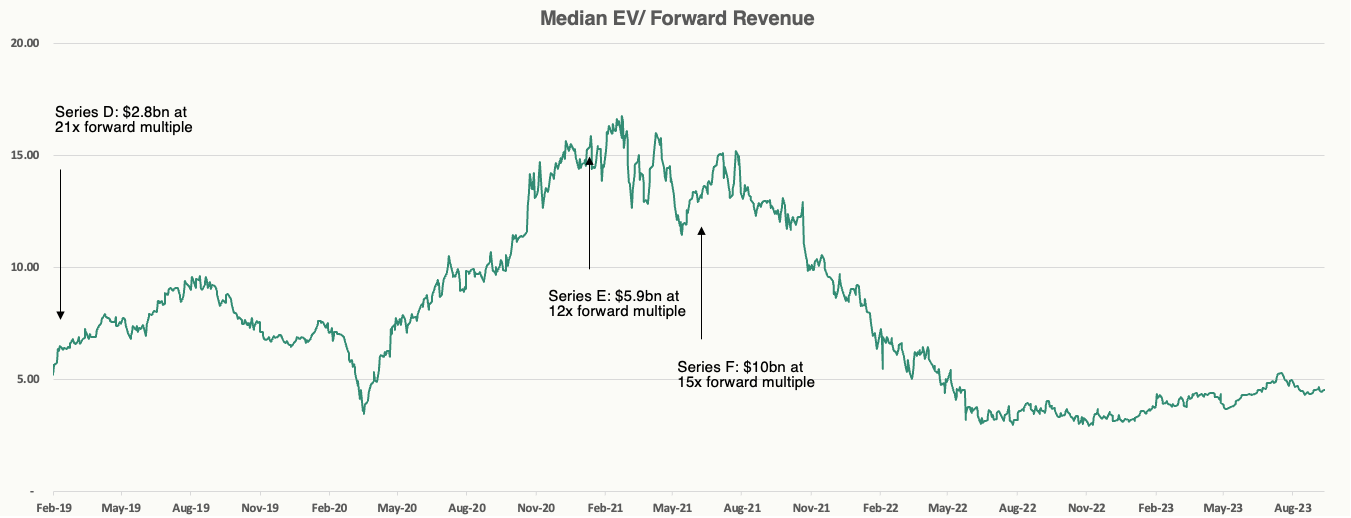

Reddit's funding rounds, especially the last one from three years ago, can offer a peek into how venture capitalists valued the company at different stages. But here's the thing: With the latest round being three years old, we've got to take that preferred price with a grain of salt. A lot can change in a few years, as shown recently by the effects of record high interest hikes causing significant downloads across the space

The strike price of options, like the ones Dan has, is set using something called the "409A valuation" also referred to as the Fair Market Valuation. This isn't just any valuation; it's a specific method that the IRS keeps an eye on. It's like getting a snapshot of what Reddit's worth in the eyes of the tax folks, and it's super helpful for figuring out the potential gains for employees who jumped on board at different times in Reddit's journey. As a company matures and approaches an exit, the 409a typically converges towards the valuation expected in public markets, providing useful insight into the potential value at an hypothetical IPO.

Late-stage investors that have invested in Reddit, like Fidelity, have to regularly mark the value of their stake. These prices reflect how investors are marking the current price per share of Reddit stock, relative to their entry point, based on updated financial information, market comparable and overall sentiment.

Reddit shareholders have the option to sell their shares on the secondary market under specific conditions, offering yet another perspective on the company's valuation. However, it's worth noting that the trading volume here is relatively low, and getting solid info can be a bit of a challenge. So, while these trades do give some clues about Reddit's worth, it's wise to take them with a healthy dose of caution.

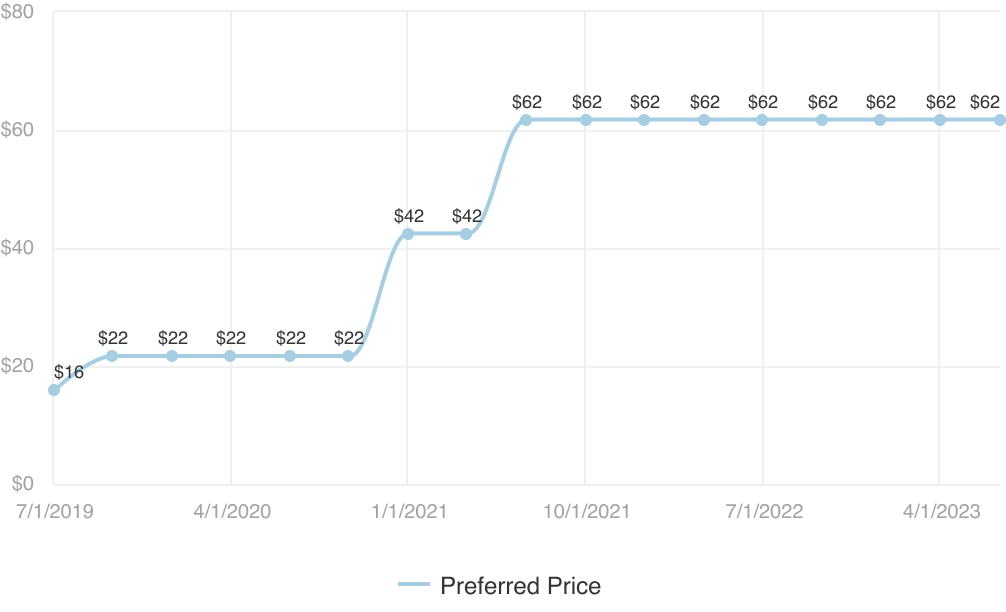

A relatively simple way to analyze Reddit's valuation in real time would be to do a comparable company analysis (CCA). This involves selecting a group of Reddit's most comparable public company peers, and benchmarking what a relative valuation would look like if Reddit were a publicly traded company. A key benefit of this method is it leverages the collective wisdom of the market, incorporating industry-specific norms and considering the ongoing sentiments of investors. Typically valuations for high-growth SaaS companies, use enterprise value-to-revenue (EV/Revenue) multiples for CCA analysis, multiplied by the companies next-twelve-months-revenue. In the case of Reddit, Snapchat, Meta, and Pinterest are considered as the closest comp group. You can see based on comparables, Reddit's implied valuation has oscillated significantly in the past 36 months as multiples have been volatile, but a more stable valuation range has begun to emerge.

For Dan, these valuation insights are not just academic; they are crucial in informing when he might exercise his options or potentially plan for a sale. Despite the volatility, Dan’s strike price is still below all the valuations we looked at, which currently offers him some upside. This wouldn’t be the case if Dan had joined Reddit in early 2022.

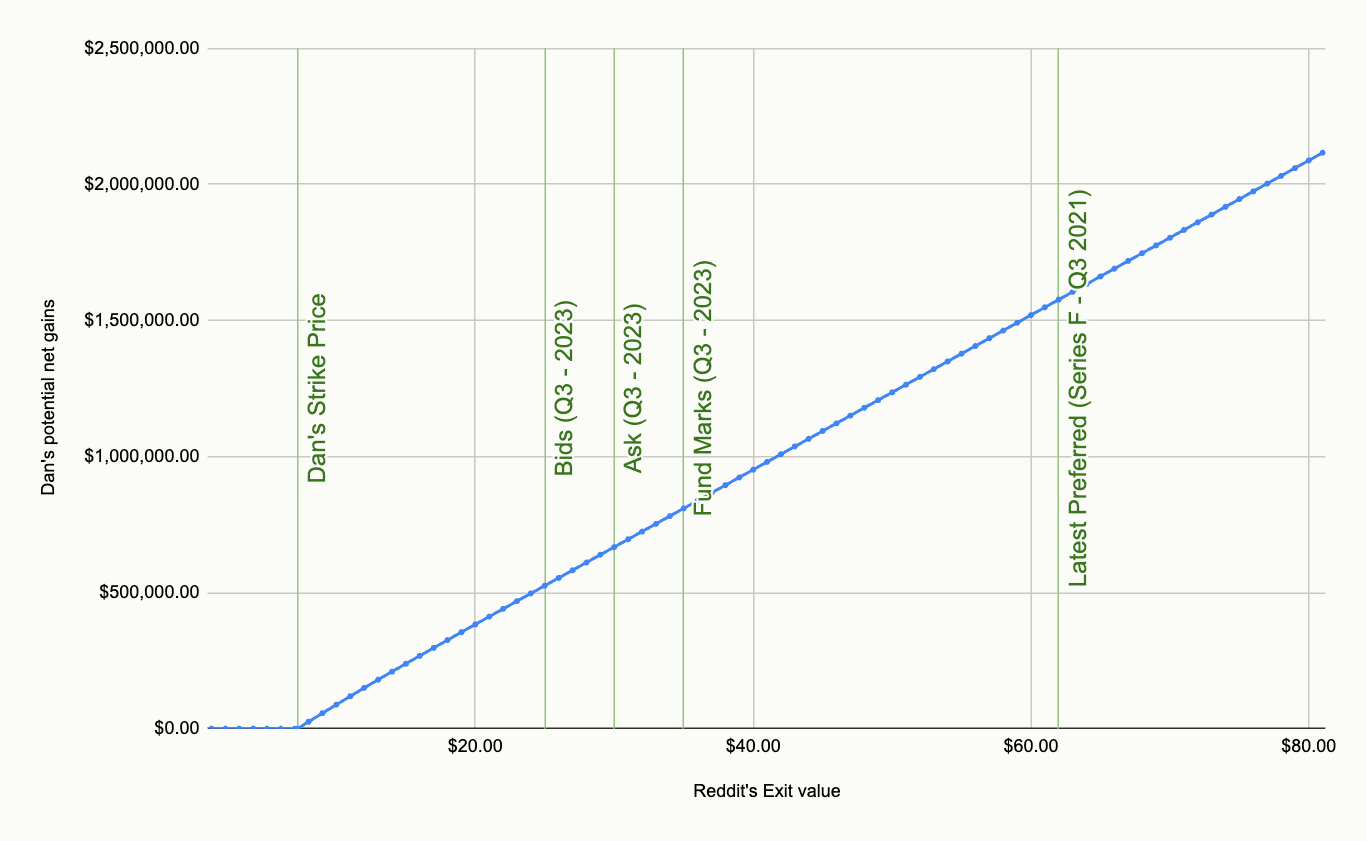

To map out Dan's potential financial windfall from his Reddit stock options, we delve into a bit of number crunching. First, we factor in the exercise costs of his options and the taxes he'd need to pay at various exit prices. This involves calculating the cost of buying the shares at his strike price and estimating the tax impact based on the selling price. With these numbers in hand, we can then determine Dan's net equity value for different potential exit prices of Reddit.

Using Secfi’s tax and equity engine, we are able to run those calculations across a wide range of exit values. Below we plot it from $0 to $80. To help you connect the dots, we also included the values mentioned above.

When it comes to Dan's financial future, the timing of Reddit's potential exit – whether through an IPO or acquisition – plays a huge role. The impact of this timeline on Dan's net gains is mainly due to capital gains tax implications and lock-up periods post-IPO. Let's break it down.

Decide when to exercise your options

We made a tool so you can compare the difference in costs and future gains between short-term and long-term capital gains taxes.

Discover the exercise timing plannerNavigating through the financial complexities as a Reddit employee like Dan involves strategic planning, especially when it comes to managing risk and diversifying assets. Let’s break down some of the key strategies.

Dan’s net worth is heavily concentrated in Reddit and tech stocks, which makes him vulnerable to risks related to Reddit and the tech sector in general. Not to mention the fact that his employment is in the tech sector and he lives in the bay area where tech companies dominate the economy.

Diversifying away from technology stocks might be a smart move until his concentrated stake in Reddit has been sold.

Reddit stock, being non-liquid, poses a challenge for diversification. Dan can’t simply sell off his shares anytime he wants, especially pre-IPO.

A practical way for Dan to reduce his exposure to Reddit and increase liquidity is through secondary market sales. But it's important to remember that these sales often come at a discount and mean giving up future gains if the stock performs well long-term.

Non-recourse financing allows Dan to diversify without fully letting go of his potential upside. By using his Reddit shares as collateral, he can access funds to invest in other areas while retaining a stake in Reddit’s future.

For someone in Dan’s position, navigating through what could be life-changing wealth creation opportunities is complex. It requires a balance of understanding market trends, personal financial goals, and the nuances of different financial strategies.

In conclusion, while the potential for significant wealth creation exists for Dan and similar Reddit employees, it comes with its set of challenges.

Professional advice and a well-thought-out strategy are crucial to navigating this landscape successfully.