Wellhub employees: Don’t leave six figures on the table

The difference: $107,000

Start exploring your options

Submit a request0 result

Wellhub employees - Your equity could be one of the most valuable parts of your compensation package, or one of the easiest to lose out on if you don’t plan ahead.

With Wellhub’s global growth and recent rebrand from Gympass, speculation about a future IPO is growing, underscoring the company’s mission to “make every company a wellness company”. If and when that happens, the people who planned ahead will win. The people who waited may watch a big chunk of their upside disappear to taxes.

In the lead-up to an IPO, a company’s Fair Market Value (FMV) often rises, and that directly impacts your stock options.

Now is the time to consider exercising, while the FMV is still relatively low.

Let’s imagine Megan, a Senior Product Manager, joined Wellhub in 2020.

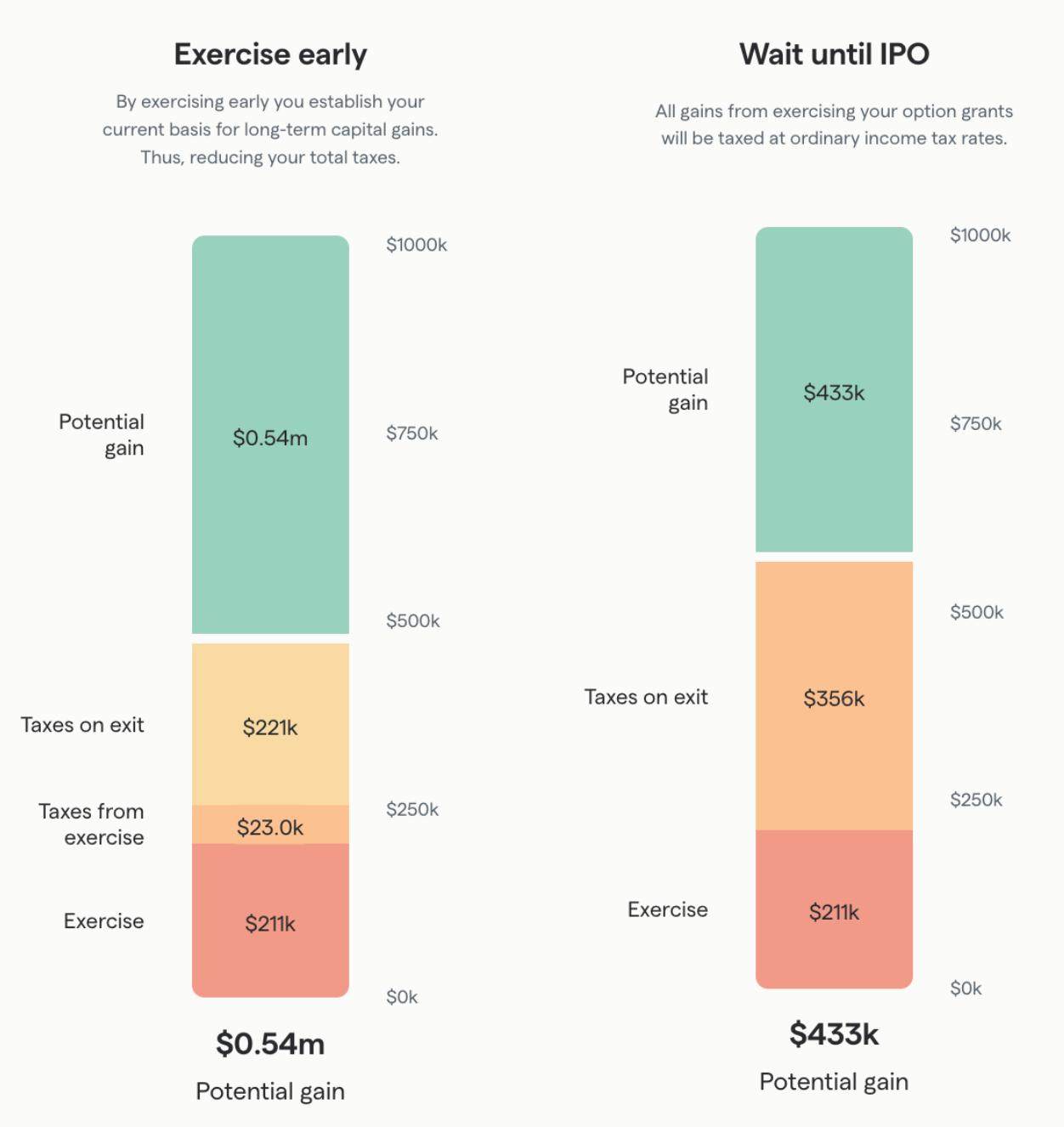

Megan has two possible paths with Incentive Stock Options (ISOs):

| Exercise now | Wail until the IPO |

|---|---|

Pay the strike price (and AMT) now | Do nothing now; cashless exercise later |

Hold the shares for 1 year after exercise (and 2 years after grant) | No holding period advantage |

Pay long-term capital gains (~15-20%) | Pay income taxes (~40%+) |

Outcome: $540,000 after taxes | Outcome: $433,000 after taxes |

For this case study, we’re also assuming Megan is able to sell her shares at $50 per share—a 28% premium to Wellhub’s most recent preferred price of $39. That’s not a guaranteed IPO price, but we think it’s a reasonable estimate based on how many high-growth companies are priced relative to their last funding round. The actual price could be higher or lower depending on market conditions.

Assuming the FMV continues rising in the lead-up to an IPO, employees who exercise now can establish a lower cost basis and potentially qualify for long-term capital gains tax treatment—helping reduce their future tax burden. On the other hand, waiting until the IPO to do a cashless exercise could result in significantly higher ordinary income taxes on the difference between the FMV and the strike price.

The problem? By the time IPO is announced, it may be too late to act. AMT (Alternative Minimum Tax) can hit you with a surprise bill if you wait until shares are worth more

Exercising early can be expensive. That’s where Secfi’s non-recourse financing comes in:

✔ Exercise without tying up personal savings

✔ If the stock doesn’t increase, you owe nothing

✔ Reduce AMT surprises with a personalized strategy

Wellhub’s growth shows no signs of slowing down, and when the company eventually goes public, things could move quickly. Making a plan now ensures you’re ready when the time comes, whether that means exercising early, understanding your tax exposure, or preparing for liquidity.

We’re ready to help Wellhub employees evaluate their options, navigate tax implications, and access financing so they can make the best decision for their equity before an IPO changes the game.