Tim Lee, CFP®

Financial Advisor

Tim’s a CFP® at Secfi. He specializes in helping tech professionals navigate the complexities of equity compensation and integrate it into their holistic financial plans.

0 result

"Should I sell in a tender offer or hold out for an IPO"?

If you are asking yourself this question, this guide is meant to equip you with a framework for how to evaluate this question in the context of your overall financial situation.

First & foremost, this is a personal decision. There can be a lot of chatter in Slack channels when a tender offer is announced. Your co-workers will all have their opinions about the valuation of the company, how much they are planning to sell (or not sell), and maybe even some discussion around the tax implications of selling shares or options as a result of participating in the tender offer.

It’s important to remember that your co-workers may be in a very different life stage & financial situation than you. They may have experienced a liquidity event from a previous company or worked for a publicly traded company and received equity compensation. Some may be current homeowners, whereas others may be aspiring to buy their first home. A few may have young children who are dependent on them financially, and therefore their capacity to take risks may look very different than someone who does not have anyone else reliant upon their financial decisions.

Assessing the following can be helpful to evaluate if selling shares is prudent for your situation.

If this is your first startup job, you may be asking “What the heck is a tender offer?”.

This is an opportunity for you to receive some liquidity from your hard-earned stock options based on the growth of your company since you were granted options, even as your company remains private.

Tender offers typically coincide with a fundraising event in which the company sets a predetermined allocation with current investors to purchase shares from current employees. Employees are generally eligible to sell up to a certain percentage of their vested equity (Ex. 25% of your vested shares or stock options) at a set price that investors have agreed upon.

Another common question we receive from employees, “Is a tender offer a discounted price compared to what my shares will be worth upon an IPO?”.

When advising individuals on equity decisions, we believe it’s helpful to use data to provide context for making these decisions.

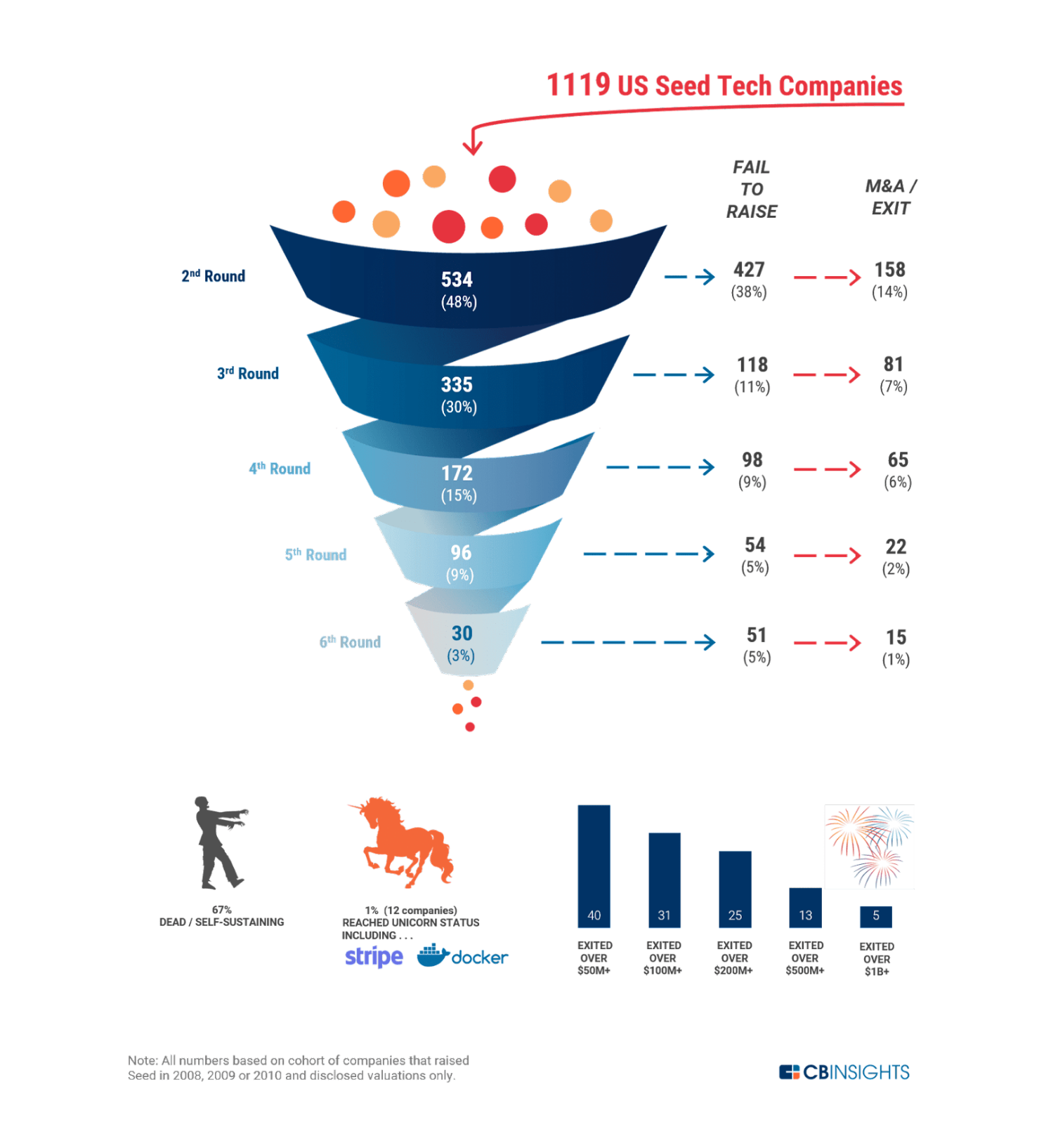

The chart below displays a nice visual of the universe of startups that have raised a Seed round and how many go on to achieve the coveted accomplishment of becoming a publicly traded company.

Source: CB Insights

The data shows that only 1% of all startups have matured into companies with a valuation > $1 billion, which is typically a valuation that a company must surpass if they have aspirations of going public. In addition, only about 15% of companies raise 4 or more rounds of financing, which is typically a stage when companies will begin offering liquidity opportunities to employees.

The price at which employees are able to sell is often the “preferred price”. This is the price that investors are paying for convertible preferred shares in the company. This is a separate valuation than the internal valuation or Fair Market Value, which is relevant for tax purposes when employees are exercising stock options.

The value of your equity could certainly continue to grow if your company’s valuation increases in the future. On the flip side, you can see how rare it is for a company to reach an IPO. So the take-aways to inform your decision are:

So now that you know what a tender offer is and some facts about startup companies that reach the stage of offering employees the opportunity to receive liquidity for their equity, let’s unpack some considerations for how you can determine if you should participate and how much makes sense to sell.

I would encourage you to ask yourself the following questions.

The answers to these questions will vary based on your stage of life, career plans, attitude towards the risk of owning a concentrated stock position, and your overall financial situation.

Once you have reflected on these questions, then the more tactical planning begins. When making any decisions with your equity (exercise or sale decisions), understanding up-front what your all-in costs or net proceeds will be, after factoring in taxes, is incredibly important.

If you have previously exercised options, knowing the original type of stock option (Incentive Stock Options or Non-Qualified Stock Option) is critical in determining the tax implications upon the sale of shares. In addition, the date of exercise and the Fair Market Value of your company stock on the date of exercise are significant factors that contribute to the type of tax you owe upon sale and your ability to potentially recover Alternative Minimum Tax (AMT) you have paid in previous years.

If you do plan to participate in the tender offer, then it’s likely to result in a higher than normal income year. This may present some unique tax planning opportunities such as, exercising additional ISOs to take advantage of a higher AMT threshold, “bunching” additional tax deductions into a high income year, or realizing capital losses from other investments to offset the capital gains from selling shares of company stock.

At Secfi, we believe that your company equity is just one piece of your overall financial picture. The actions you take (or don’t take) with your equity have a significant impact on the wealth you ultimately retain from any liquidity events.

If you find yourself asking any of the following questions, we would love to chat with you and discuss how we incorporate equity planning in the context of your overall financial situation.

The decision to participate in a company-sponsored tender offer is one of the many decisions that a startup professional is faced with. There are many nuances & complexities involved with startup equity and we want you to feel confident making these decisions each step of the way. If you are interested in further exploring how a Secfi Financial Planner can help you, you can learn more here.