4 min

0 result

Today, we’re announcing the latest addition to our equity planning suite: The Equity Planner. The first, and only, online guide that provides startup employees with a personalized equity plan in mere minutes — at no cost.

The biggest question we get from startup employees is “when should I exercise my options?” And the answer is usually, “it depends.” That’s because everyone’s equity and personal financial situation is different, as are their financial goals. But many don’t know where to start or even the different options available to them, let alone how to compare those options.

That’s why we built The Equity Planner, so that every startup employee can get a clear understanding of when, and how, they can exercise and the pros and cons of each. Now, they’ll be able to review those plans, side-by-side, as well as save it and update it whenever they need or want to. Plus, all information entered is completely private and never shared.

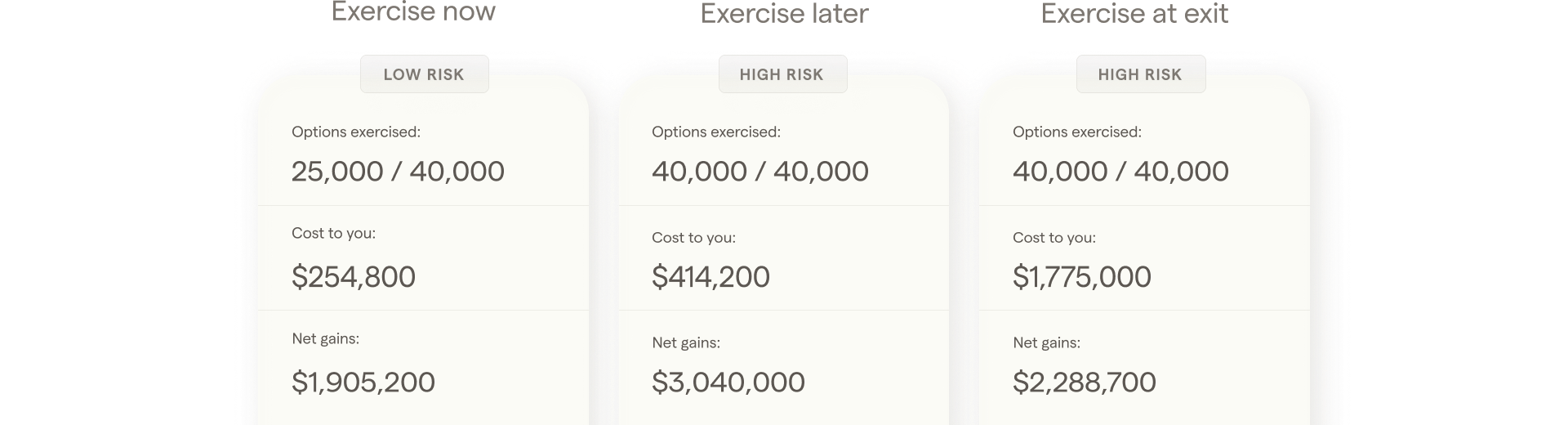

While the front end may be simple, there’s actually quite a lot going on behind the scenes. The main culprit? Taxes. Stock options are likely to be taxed both when exercising, and later when selling those shares. But the Equity Planner clearly lays out the costs and potential gains in the three most common scenarios of exercising, or buying, stock options: now, later, or after an IPO.

Getting started is easy and only takes about 10 minutes. Here are the steps:

Along the way, we’ll show you the calculations based on the information you provide. We do this so you can better understand all the different factors at play when considering what to do with your stock options.

You’ll then see all the choices available to you, and can compare them side-by-side. You’ll know how much your equity is worth today, how much it could be worth after an IPO, the costs (including taxes) to exercise at various points, and the potential gains you could see between the options.

This offers a simple view of all the different factors, and costs involved, to make a more informed decision about what to do with your stock options. But many of these factors could change — your company could update the Fair Market Value, or the timeline for an IPO could change. That’s why we made it easy to save your plan, and update the information you entered without needing to start from scratch.

The Equity Planner is completely self-guided and gives an objective view of your equity based on the information you input. And, it’s backed by years of experience and knowledge about stock options and related tax laws. But understanding the various options for your stock options may just be a start.

If you need even more personalized guidance, you can easily set up time with one of our knowledgeable Equity Strategists to help talk you through your equity plans. And, if you need help affording the cost of exercising, they may be able to help with that too.