5 min

0 result

If you’re reading this, it’s likely because you have a strong interest in creating or maintaining financial security for you and your family. Investing your financial capital is a big part of achieving that goal.

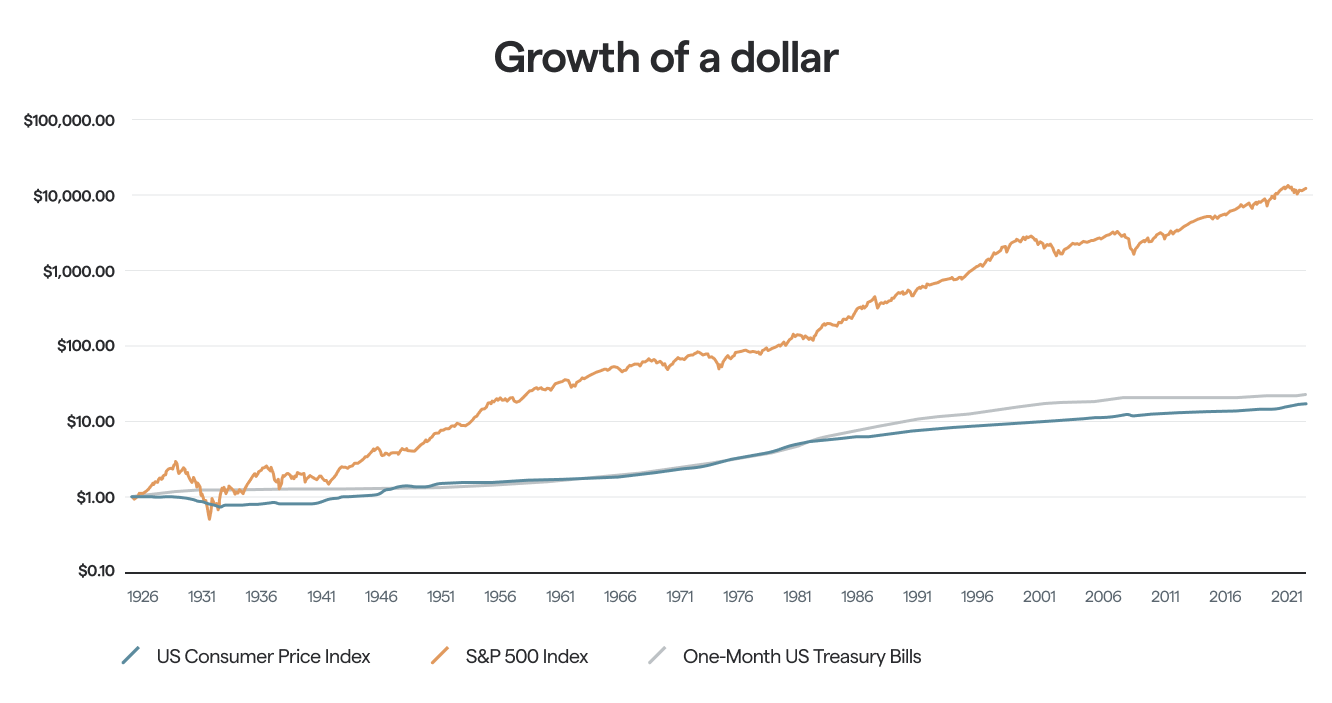

But not investing is also risky. To preserve or grow the purchasing power of your hard earned savings, we believe you must put your money to work in productive ways. One dollar, hidden under a mattress, lost 94% of its purchasing power over the last ~100 years. That same dollar invested in virtually riskless treasury bills kept pace and even exceeded the inflation rate, growing to ~$22. And a dollar invested in the S&P 500 Index of stocks grew to an astounding $12,639 over the same period.

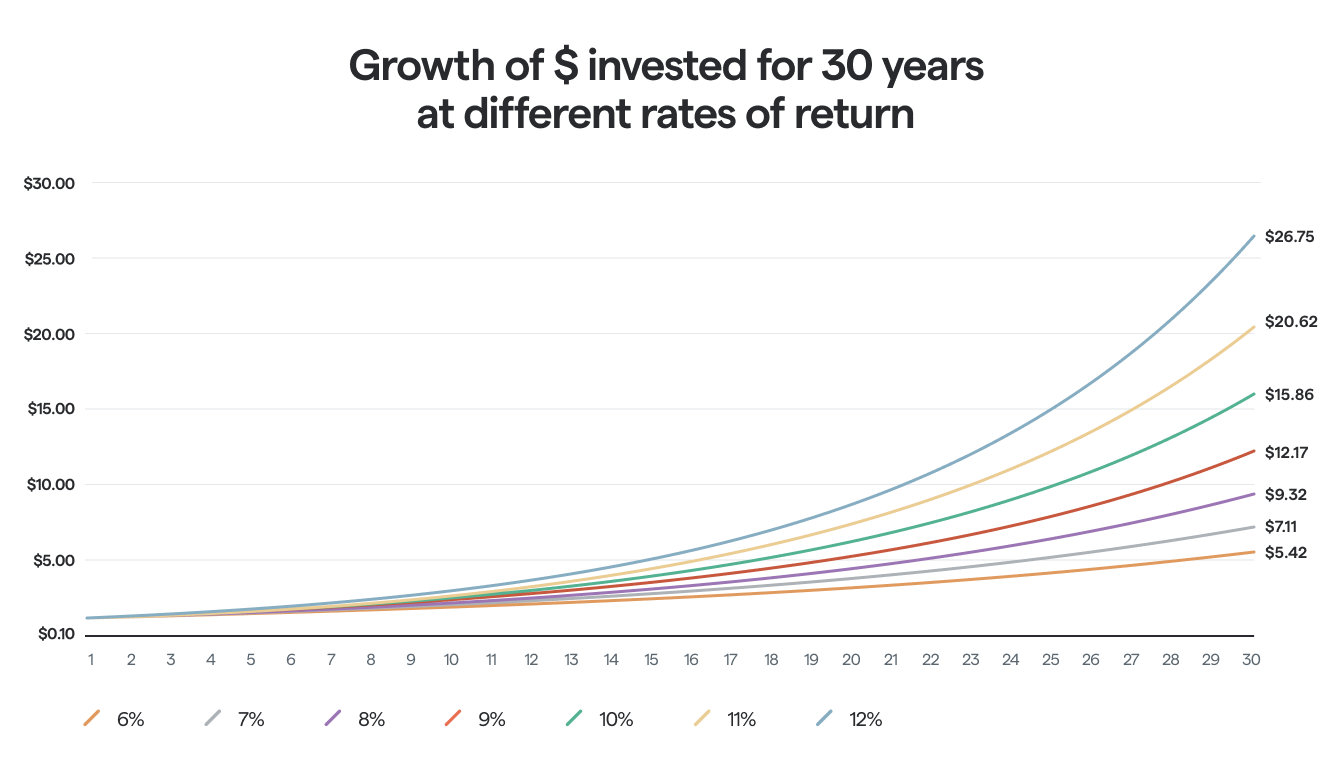

Most of us don’t have 100 years to compound returns, but the power of compounding can be dramatic even at shorter time horizons. In the chart below, I show the value of a dollar invested for 30 years at different compound annual rates of return ranging from 6% to 12%. Even just a 1% difference in realized returns over a lifetime of investing can result in dramatic differences in wealth. You simply cannot afford to neglect your investment portfolio if you want to secure your future.

There are over 10,000 individual stocks listed on global stock exchanges, hundreds of thousands of bonds, and 140,000 ETFs and Mutual Funds that package these stocks and bonds into portfolios. Not to mention the millions of potential real estate deals, hedge funds, private equity funds, direct investment deals, etc. To further complicate matters, taxes and costs can eat into your returns and turn a wonderful gross return into a middling or poor net return.

There are nearly limitless ways to combine these various assets and investment vehicles into a portfolio. And we believe building a “good” portfolio is incredibly important because even small differences in returns can turn into large differences in wealth when compounded over time.

Our investment approach is supported by the latest financial academic research and takes into account your unique situation as a startup employee with equity. The approach is designed to be complementary to your implicit and explicit exposure to startups. It also seeks to outperform index fund investing over the long-run.

What does this mean for your Secfi managed portfolio?

First things first, we build a foundational portfolio of diversified assets that you can rely on. The clients we serve have different investment profiles depending on where they are in their professional and financial journeys.

A young professional may have 90% of their total wealth tied up in their illiquid private stock options. The remaining 10% can be invested in tax efficient solutions, like ETFs. We believe that just because the liquid portion of the portfolio is small relative to the overall pie does not mean it should be ignored (see the power of compounding above). We invest with your entire balance sheet and tax status in mind and build a portfolio that looks to complement your illiquid wealth. The result is a diversified portfolio, which seeks to outperform over the long-run, through factors that simultaneously diversify your concentration risk. Beyond building the portfolio, we handle the day-to-day and focus on things we can control, like tax-loss harvesting, and rebalancing.

Upon a liquidity event, like your company’s IPO, it’s important to continue to invest in a diversified way to secure and build your foundation. We feel doing so can help you have more freedom and opportunities going forward. Your ability to take risks in your career or swing for the fences with angel investments or other opportunities that come your way can increase with a stronger financial foundation. Post-exit, the implementation of the Secfi managed portfolio may change. Sometimes it can make sense to own stocks and bonds directly, rather than through funds, and aggressively harvest losses to minimize the tax on the capital gains associated with your liquidity event. Sometimes it can make sense to continue owning tax efficient, diversified investment vehicles like ETFs and mutual funds. It can also make sense to add alternative investments like venture capital, direct lending, private real estate, etc. to the portfolio if your foundation allows for it and it’s consistent with your goals. At Secfi we have access to managers in venture capital and other private investment opportunities. At the right time and in the right dose, we can help add these opportunities to your portfolio to potentially increase expected returns and diversification.

Part of the benefit of managing your wealth with Secfi, is that we can use our experience to figure out what makes the most sense for you and your family, walk you through the rationale and the tradeoffs to give you confidence that you’re making the right decision.

There is no “right portfolio” but there are plenty of wrong portfolios, and the implications of getting it wrong can be devastating.

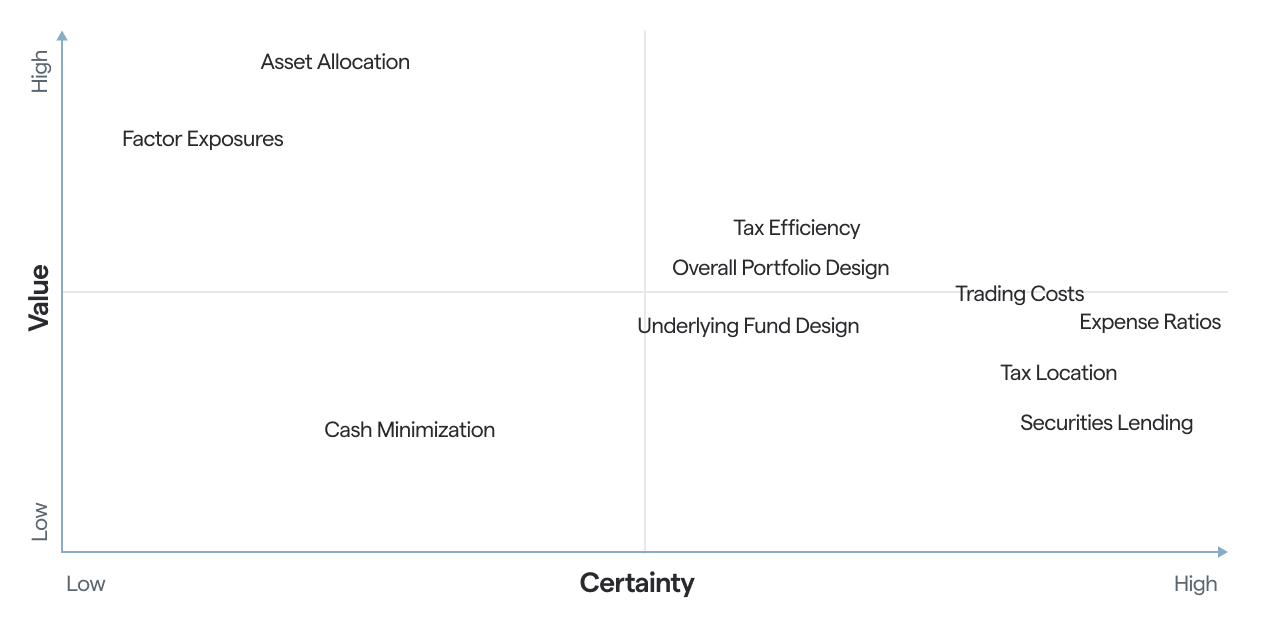

The following framework sheds light on areas where we can add value relative to going it alone. Some value adds are fairly certain but small and others are uncertain over the short run since financial markets are inherently volatile, but large in impact over the course of an investment lifetime.

Becoming wealthy and staying wealthy sometimes require different skill sets. We can apply our skills to your financial portfolio so you can focus on applying your skills and time where they are best suited. We always try to lead with education so you know what we’re doing and why. However, at the end of the day, you hire us to think about this stuff so you don’t have to. That requires a large degree of trust. We believe the wealth team at Secfi checks all the boxes that should be checked when hiring a financial advisor. We have the experience, the credentials, and the fiduciary duty our clients need. But you’ll have to evaluate the intangibles to determine if we’re the right fit for you. We hope we are.