0 result

DoorDash is public as of today. Shares are trading at $180+. An amazing IPO, valuing the company at a staggering $60 billion!

That's great for founders, investors, and employees with equity. Of course the share price may fluctuate before they can sell their shares (there's the usual lock-up period), but all signs indicate growth.

Unfortunately, growth stories like this can be bittersweet when you consider how it plays out for employee stock options.

That's about $924,000 per employee who received options.

Here's how that works:

If after the IPO an employee sells their equity, they're approximately taxed on the gains at the following rates:

That 37% is because for shares you hold on to for a year, the gain you make counts as long-term capital gains. (By the way, I'm assuming California rates.)

What does that look like for DoorDash? Well if we look into the S1 filing, we learn that:

If we assume the shares will sell for $180 apiece, then these stock options give a pre-tax gain of $180 - $2.41 = $178.

But what's the after-tax gain? That depends on the tax rate:

That's a tax savings of $28 per share by having exercised early.

If we multiply that amount by the number of unexercised stock options, there's a total of $954,231,260 in untapped tax savings.

That amount could've ended up with employees, but is now on its way to the IRS.

DoorDash currently has 3,279 employees. But they stopped awarding stock options (switching to RSUs) in 2018, when they had 1,032 employees. So let’s use 1,032 as our upper bound on the number of stock option holders.

The average DoorDash employee is missing out on $924,643.

Most startup employees don’t know the tax benefits of exercising. Often companies work hard to educate their teams, but it's a complicated system. Add in the fact that exercising stock options constitutes an investment and there's only so much advice a company can legally provide.

Another problem is that they often don't find out until it’s too late. How can it be "too late"?

Well, the paradox of hyper-growth startups is that as the stock price goes up, exercising options becomes more expensive and unaffordable.

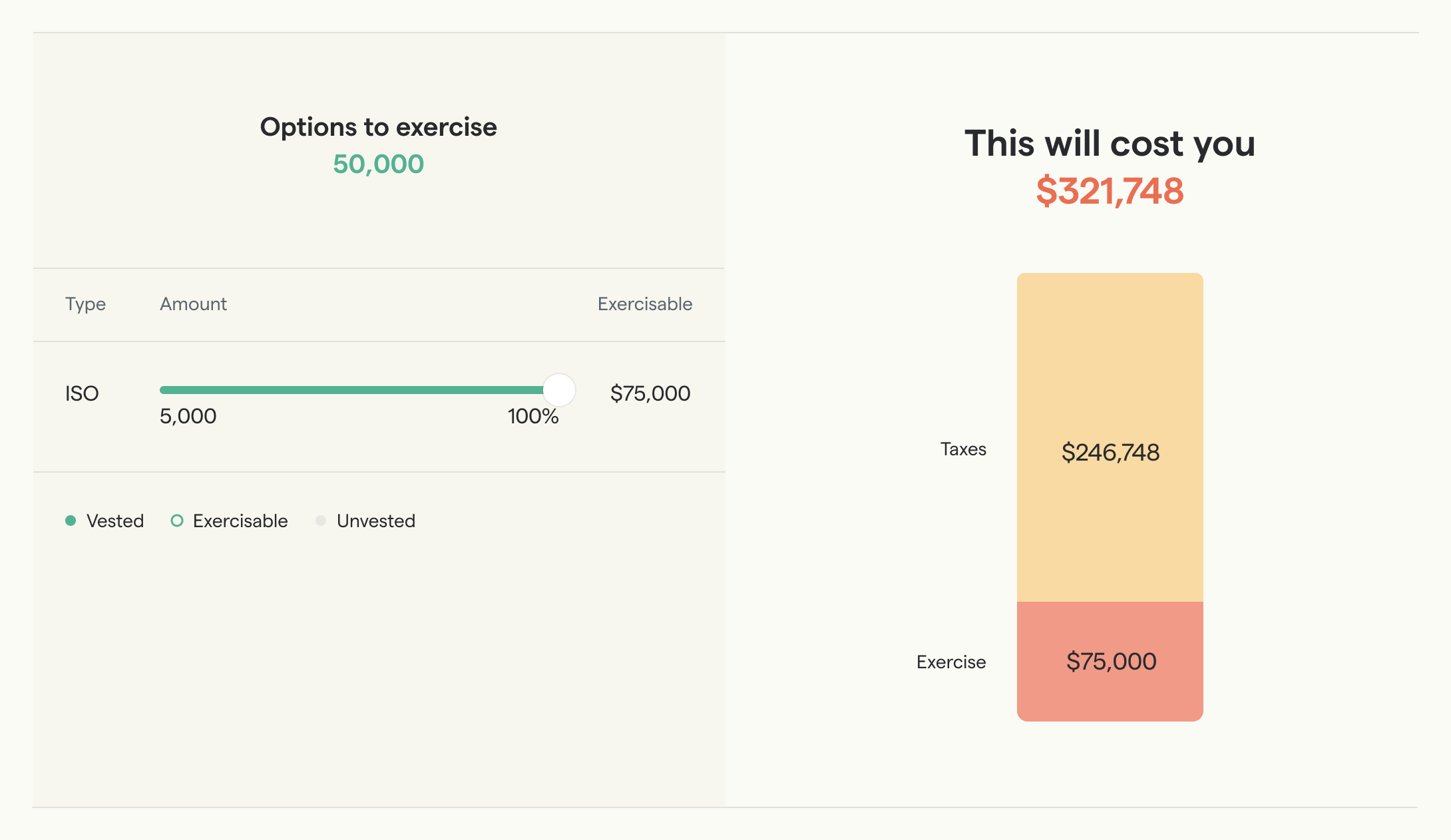

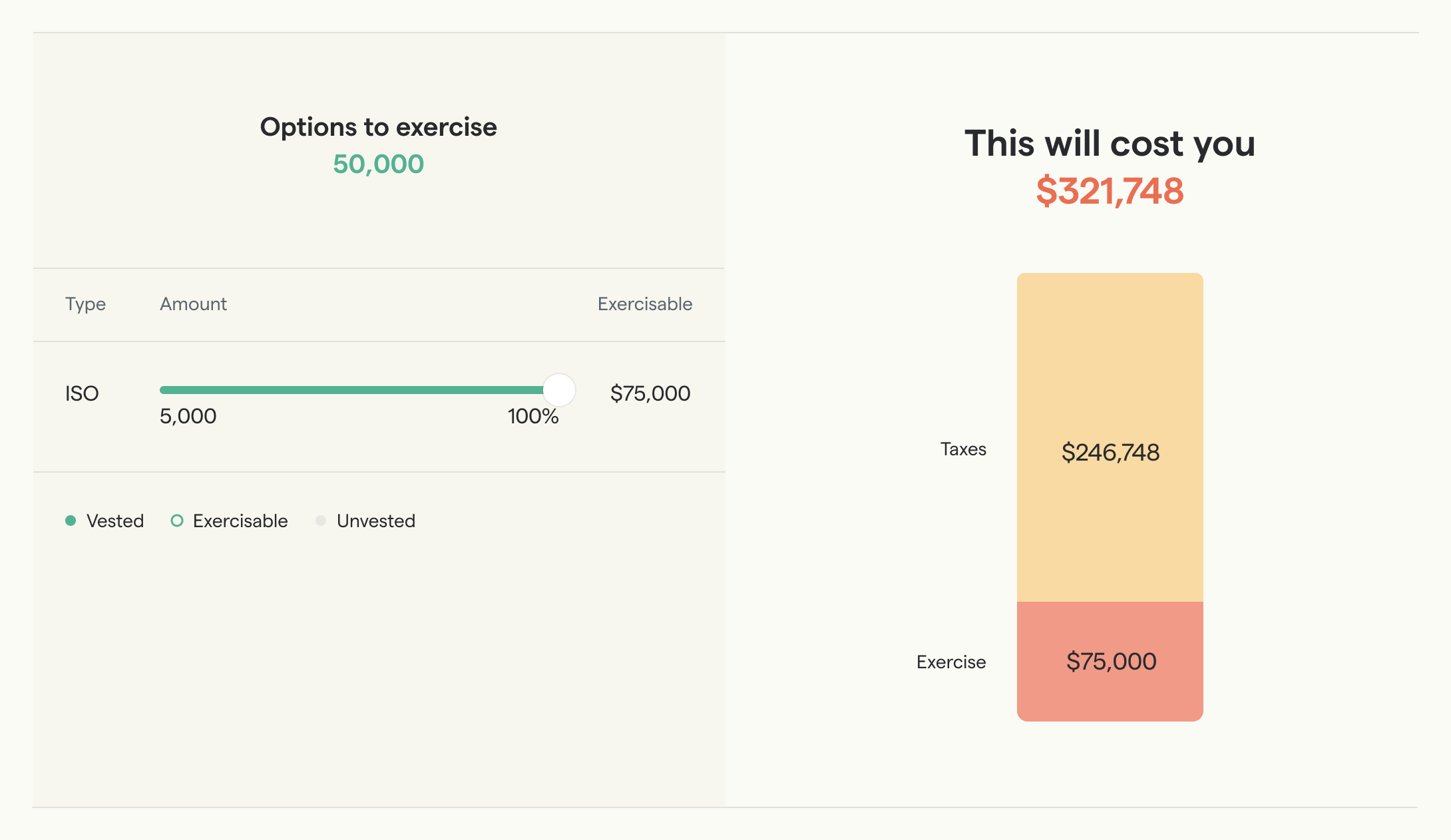

Say in 2017 you join DoorDash as an engineer and get 50,000 ISOs at a $1.50 strike price.

Let's ignore vesting for simplicity, and assume you're able to exercise all of your options from the get-go. Disregarding taxes, that would cost you 50,000 * $1.50 = $75,000.

Say two years into the job, you consider exercising. Assuming the 409A value (also known as fair market value) is now around $15, exercising would trigger a tax bill of $246,748 for a total cost of $321,748.

You decide not to exercise.

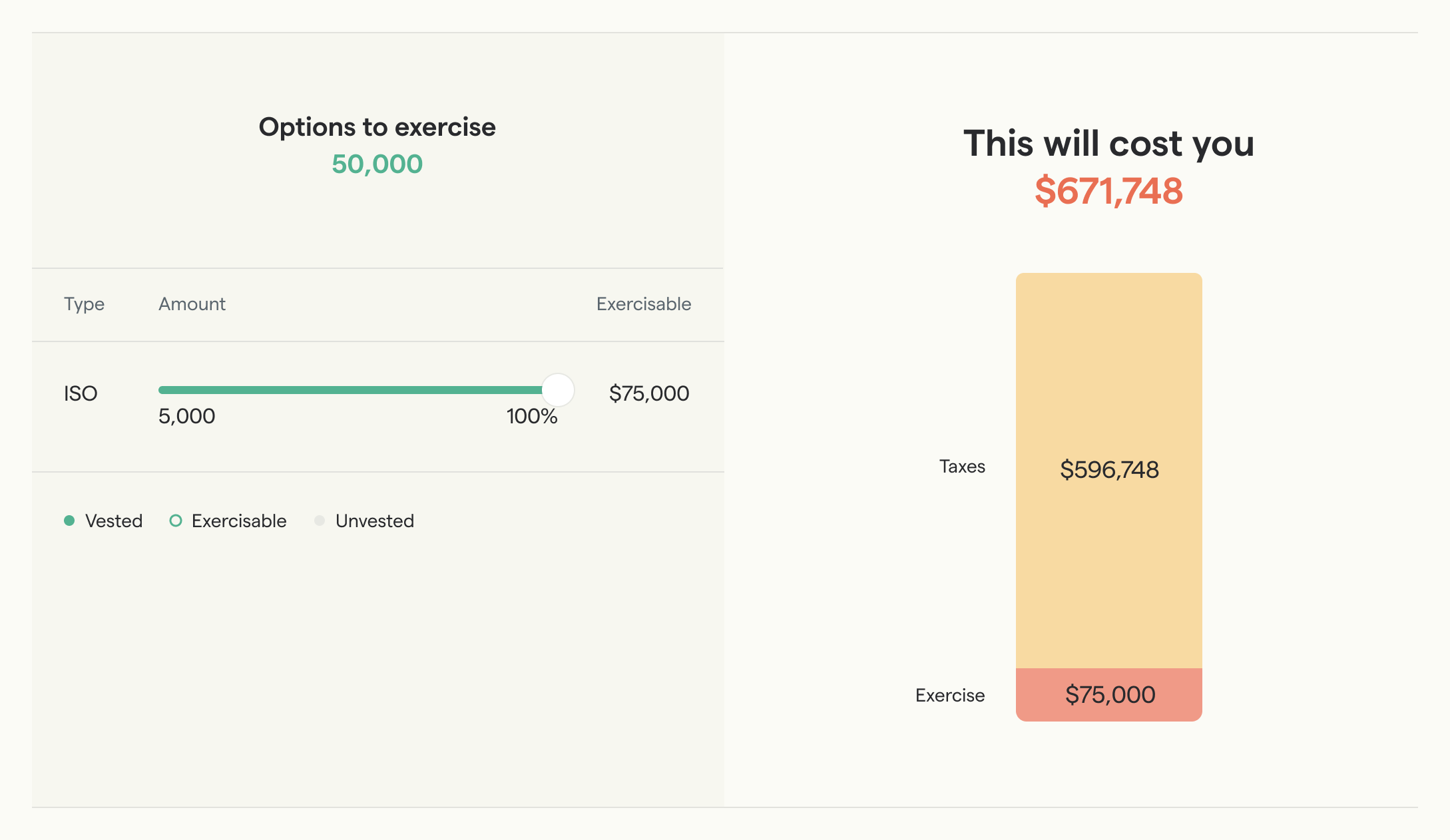

Fast-forward to September 2020. Rumors of an IPO start to spread, and you look into your ISOs again.

Now, the 409A value has grown to around $35. This increases your tax liability to $596,758, bringing total exercising costs to $671,748.

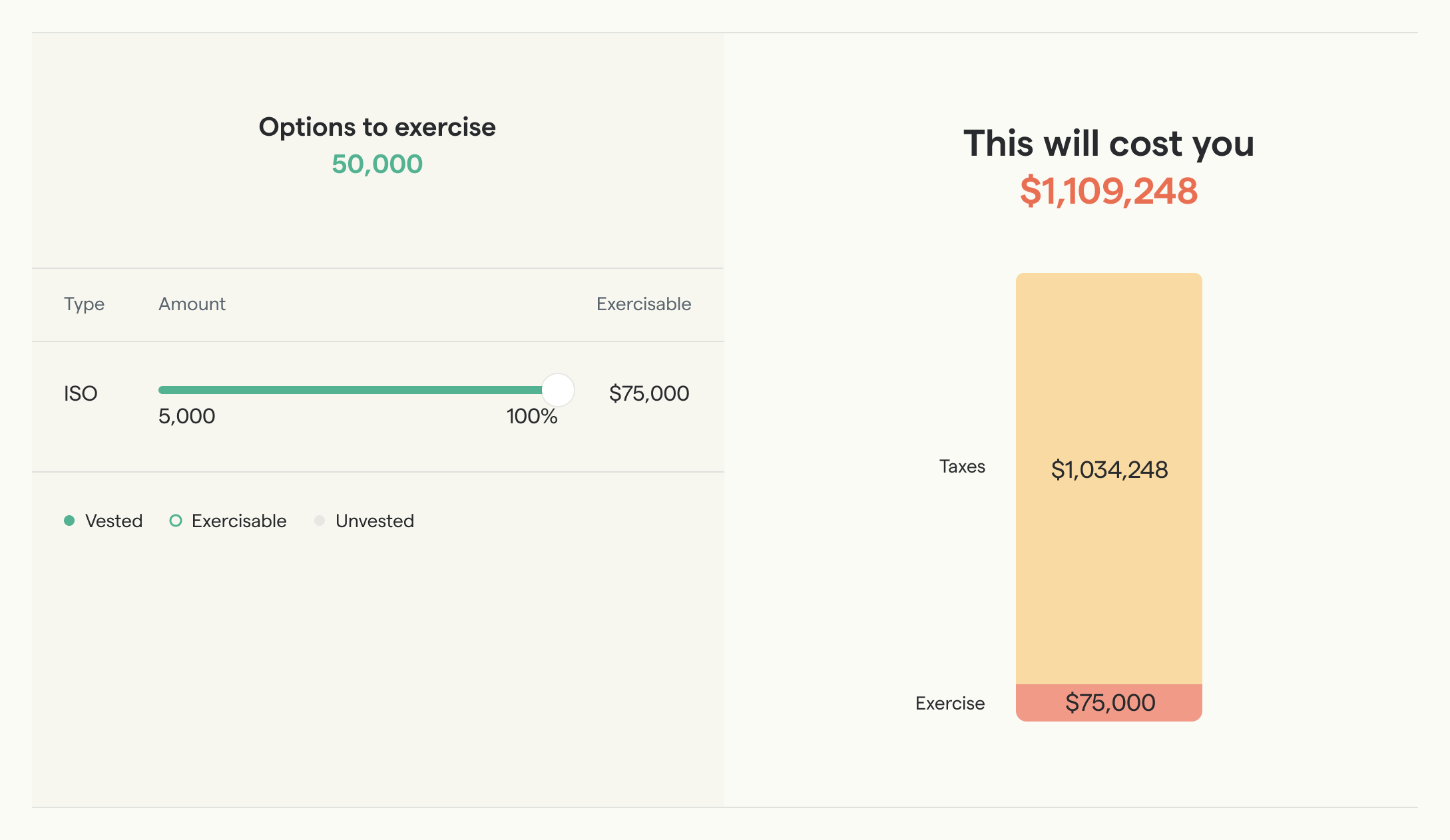

Nearing the IPO, at some point you’re informed about a deadline: the last chance to exercise your stock options pre-IPO.

After that deadline, there’s a blackout and you won’t be allowed to exercise.

Needless to say, exercising your ISOs has been pretty much impossible from the start and it’s only gotten worse with each 409A update.

So instead, you just wait for the IPO.

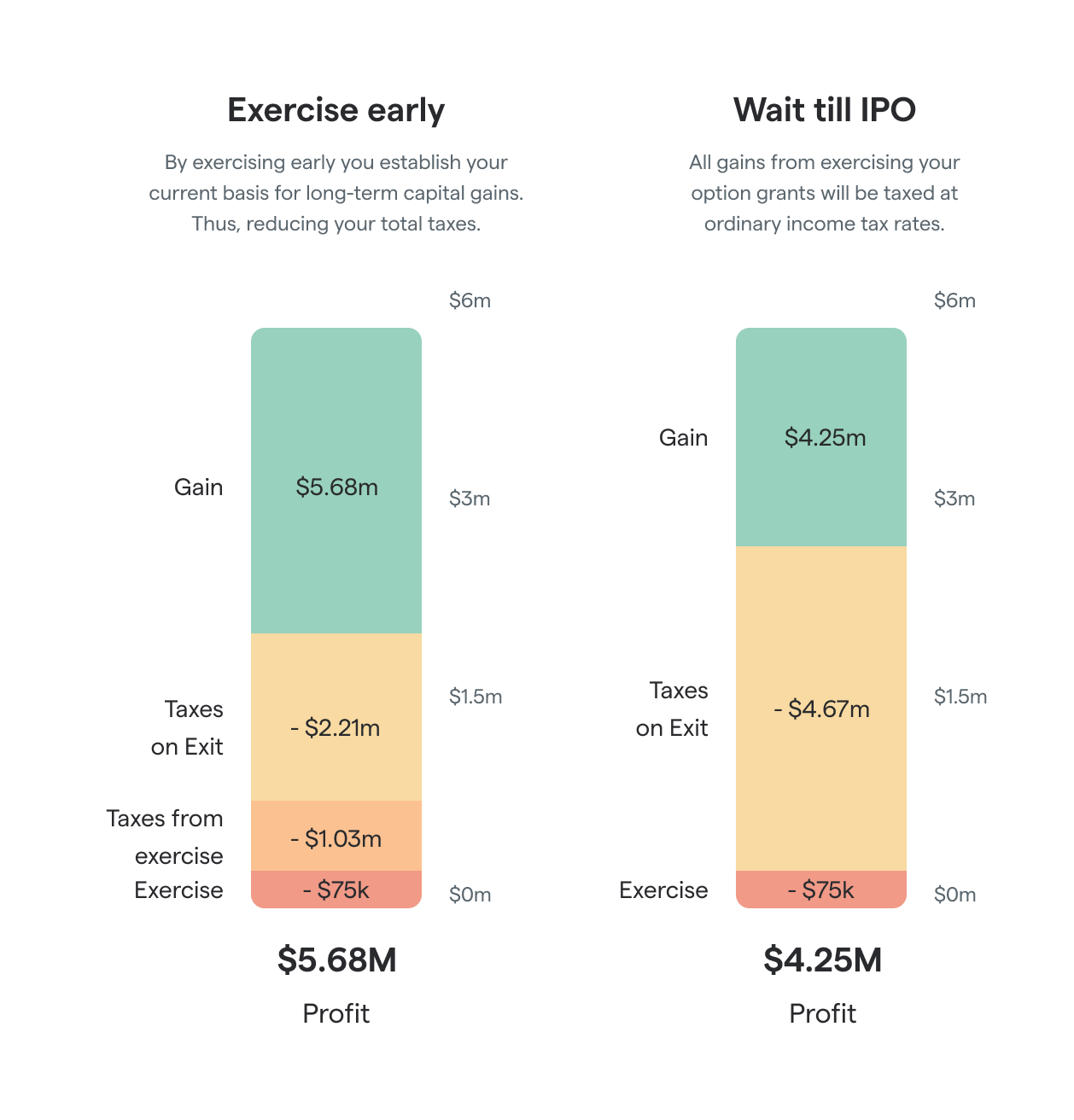

But that’s a shame because if you exercise at the IPO by selling shares to cover the cost, you won't qualify for long-term capital gains. You have to hold on to your equity for two years after grant and one year after exercise in order to get that preferential tax treatment. This is where the tax savings are forfeited.

Don't get me wrong, both are AMAZING outcomes... But $1.4 million is no small difference 😅

Even at the cost of $1.1 million right before the IPO, that's still a 128% net return. Not too shabby.

(Note that the $1.4 million is a difference in net gains so the $1.1 million spent on exercising the ISOs is already factored in.)

We have a culture of employee equity, which I love. We're definitely moving in the right direction.

The equity vehicle of choice is the stock option, but it’s not without its flaws. Paradoxically, it’s the biggest success stories that bring out the best and the worst of how they work.

So, startup employees: Make sure you're being conscious about your stock options. Know the potential risks and benefits of exercising. If you don't know how to approach this topic, talk to an equity strategist or people who do know. There's too much money on the table to just ignore it.