6 min

0 result

Is your company planning to go public this year? If so, you’re not alone. In addition to the growing list of companies eyeing an initial public offering (IPO) this year, many more are considering other private-to-public options such as a direct listing or special purpose acquisition company (SPAC).

If you’re an employee at one of these companies, congratulations! You’ve worked hard for this unique — and rare — milestone. And while you’re hopefully feeling a lot of excitement and pride, you’re probably also starting to wonder about some of the logistics, especially around your stock options.

What exactly should you be doing to prepare?

For most people, the answer isn’t a simple one. Your HR or finance department may have offered some guidance, but legal restrictions prevent your employer from telling you what to do — and every personal situation is unique. We suggest that you 1) educate yourself (we can help with that!) and 2) consider engaging a tax or financial advisor.

As you navigate the stock option learning process, we’re here to help you feel empowered and informed — so you can make a smart plan for this important financial decision. Here’s what you need to know about stock options before your company goes public.

The first thing to know is that it’s never too early to start thinking about what to do with your stock options. In fact, the most common mistake that employees make is waiting until after an IPO to exercise options. The simple reason is that if you exercise well in advance of the IPO, you’ll be able to benefit from the long-term capital gains tax rate.

For example, if you wait until the IPO to exercise your stock options, you could pay as much as 37% in taxes when selling your equity. But if you exercise your options 12 months before the IPO, you could only pay 15-20% in taxes. You can use our Stock Option Tax Calculator to compare your potential tax bills.

Exercising early is a challenge for most people, since exercising stock options is usually an expensive endeavor. But as time passes and company valuations increase, it becomes even more costly..

Everyone’s financial picture is different, and it may make sense for you to wait. But if you’re interested in exercising before your company goes public — and unlocking the long-term capital gains savings I just described — here are some steps that you can take.

If you have vested stock options, more specifically incentive stock options (ISOs) or non-qualified stock options (NSOs), you must follow the schedule in your employment contract to exercise them. It may take several years for you to earn the right to purchase your stocks outright. In other words, your stock options do not have value until you are eligible to purchase them.

Note that if you leave your company before the full vesting period (typically four years), you may only be entitled to a certain percentage of your options. After identifying how many of your options are available to exercise, check to see if there’s a deadline to do so. You may only have a finite window of time to exercise your shares.

A good first step is to review your employment contract or speak with your HR team to evaluate your unique situation.

Your options do not have monetary value until you exercise them. So how much will they be worth relative to your purchase price? To calculate that, you’ll need to identify your number of grants and strike price. Most people can get this information from Carta or Shareworks.

With these data points in-hand, you can use our Stock Option Exit Calculator to estimate the value of your options.

To understand the full cost, you’ll need to consider both the exercise costs plus the tax costs. Prepare yourself for some big numbers, but don’t be discouraged just yet (we have some good news in the next section).

You can use our Stock Option Tax Calculator to get a feel for your tax bill. The tax costs can be high — that’s often the thing that holds employees back from exercising.

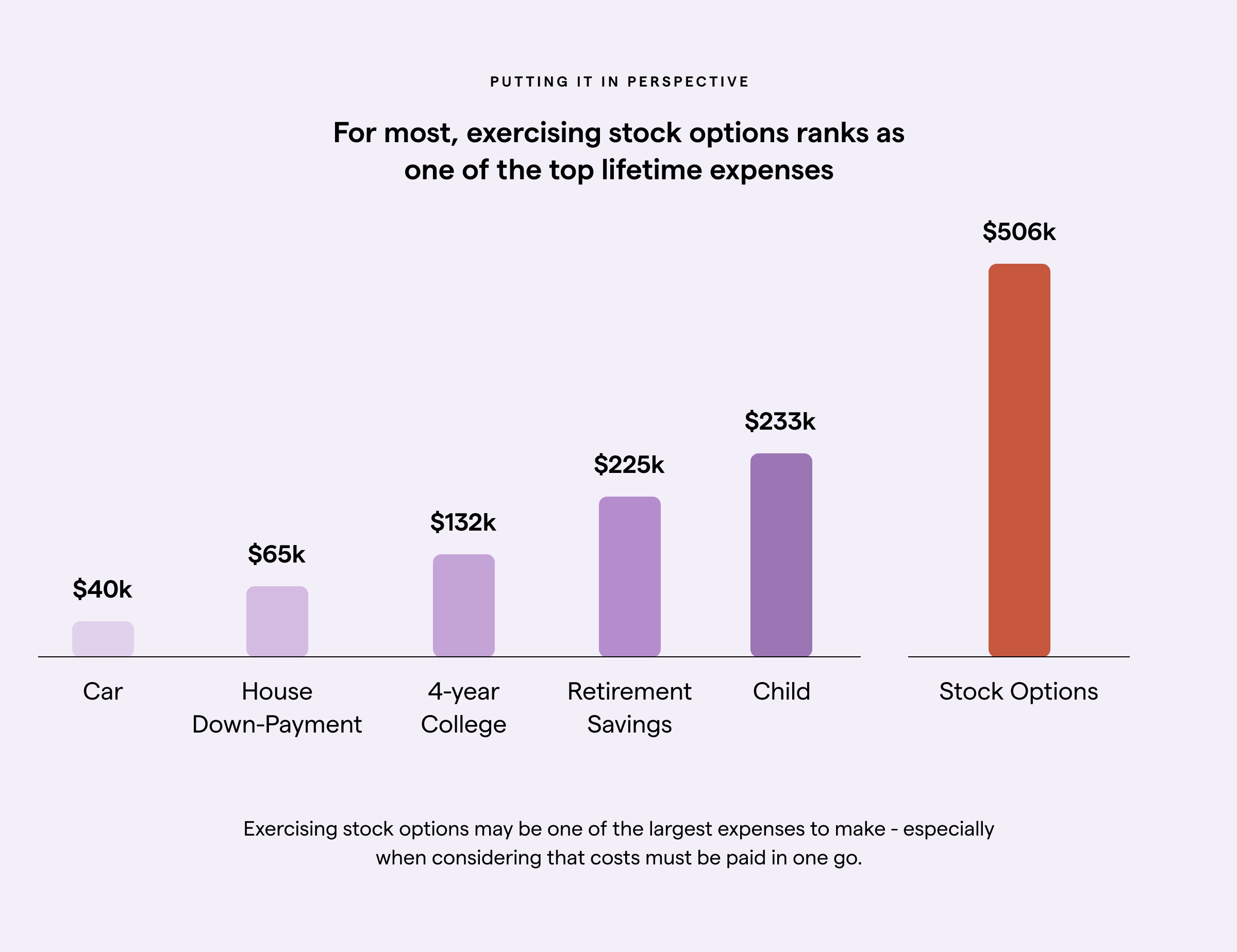

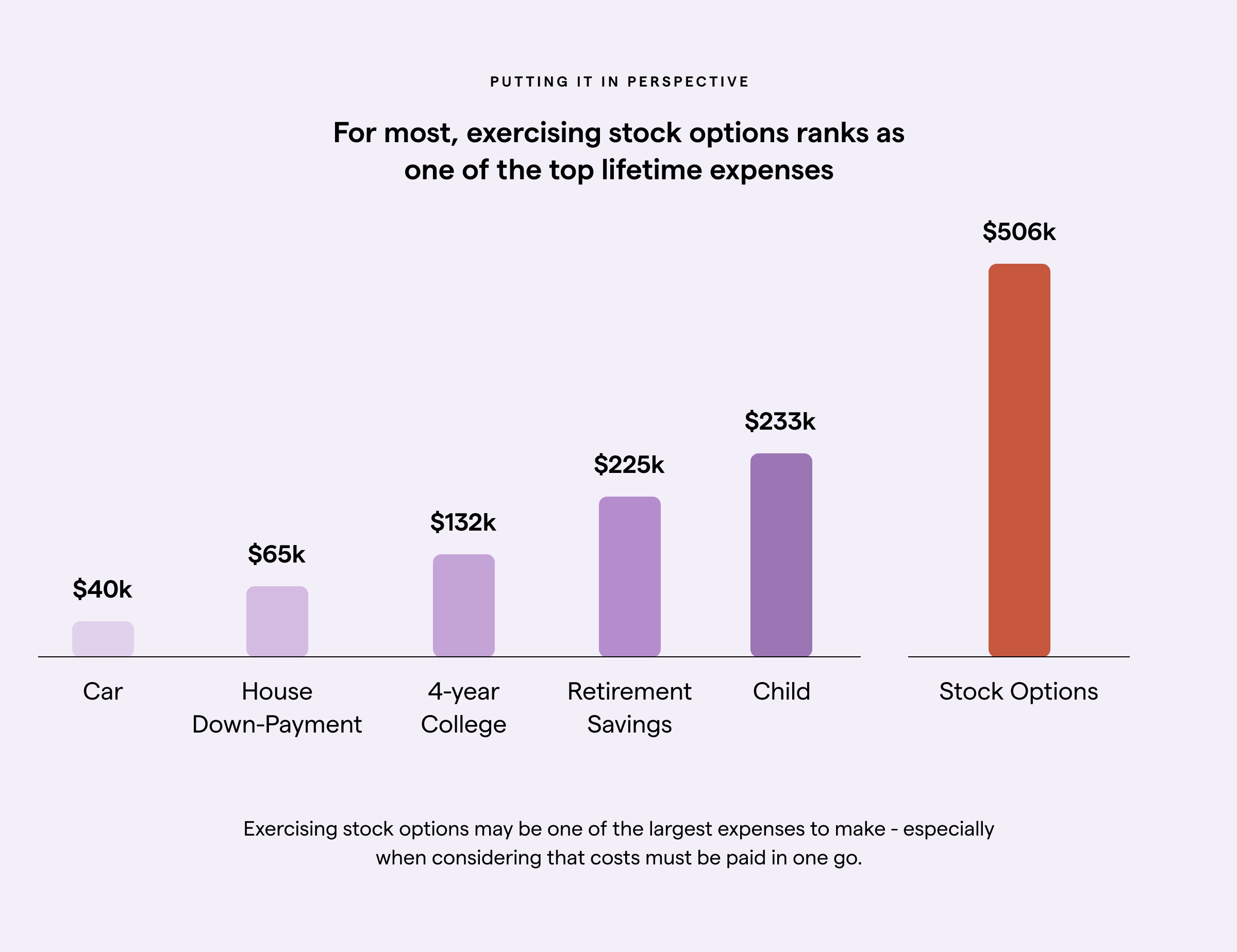

The higher your company’s valuation is, the more expensive it becomes to exercise your options. For many people, exercising stock options rank as one of their top lifetime expenses. For instance, among Secfi clients on average it costs nearly twice the average household income to exercise options.

Source: www.secfi.com/learn/2020

The good news is that there are a number of ways to exercise your pre-IPO options, even if you don’t have cash on hand to make this purchase.

The first option is non-recourse financing, which is what Secfi offers. Our company provides financing for employees of companies to purchase their options prior to an IPO. If the company exits, you’ll pay us back the cash advance along with fees at that time. If your company does not IPO, then you don’t pay anything at all. If you’re wondering how this is possible, here’s the deal: We pre-vet the startups that we work with, so we’re able to take on that calculated risk.

Another option is to sell your pre-IPO stocks on the secondary market through a platform like Forge Global (formerly SharesPost) or EquityZen. These platforms will give you a cash inflow to purchase some of your stock options and cover your taxes, but you will have to sacrifice some of your equity in exchange, forfeiting the upside on those shares. With Secfi Secondaries, we can help you sell your shares through access to our exclusive network of secondary markets, buyers, and other participants.

Some employees use other types of loans to fund an exercise — for example, a home equity line of credit (HELOC), personal loan or margin loan. Keep in mind with these options that if your company does not go through with its IPO, your personal assets are on the line. These lending products may also come with high interest rates.

Exercising your options and becoming a shareholder in your company has the potential to be life-changing. But it’s a big decision that deserves a plan — and we’re here to help with that plan. Ask us anything in our chat, and learn more in our Stock Option Starter Guide.