0 result

Figma went public on July 31, 2025. Shares priced at $33 and closed their first day at $115.50, giving the company a nearly $70 billion valuation. It was one of the most impressive IPOs in years.

But IPO highs don’t always last. On September 4th, Figma released its first earnings as a public company. Shares plunged about 18% in after-hours trading. That must have been a tough sight for employees.

Subsequently, on September 5th, the first early lockup expired. At 9:30 am, employees could finally sell their stock. Nearly 12 million shares traded at around $54, showing just how much supply hit the market all at once.

The S-1 showed that at IPO, Figma had:

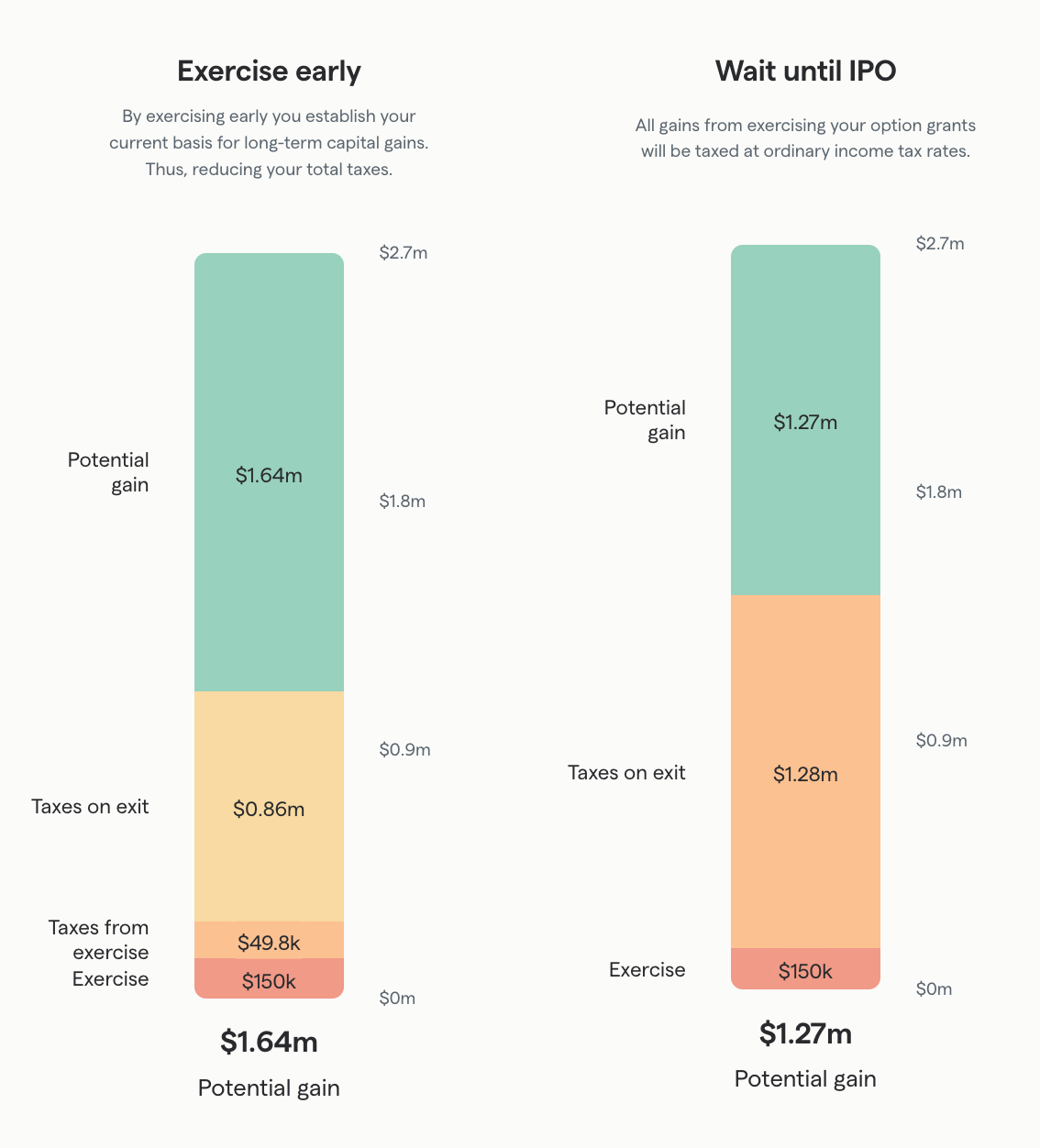

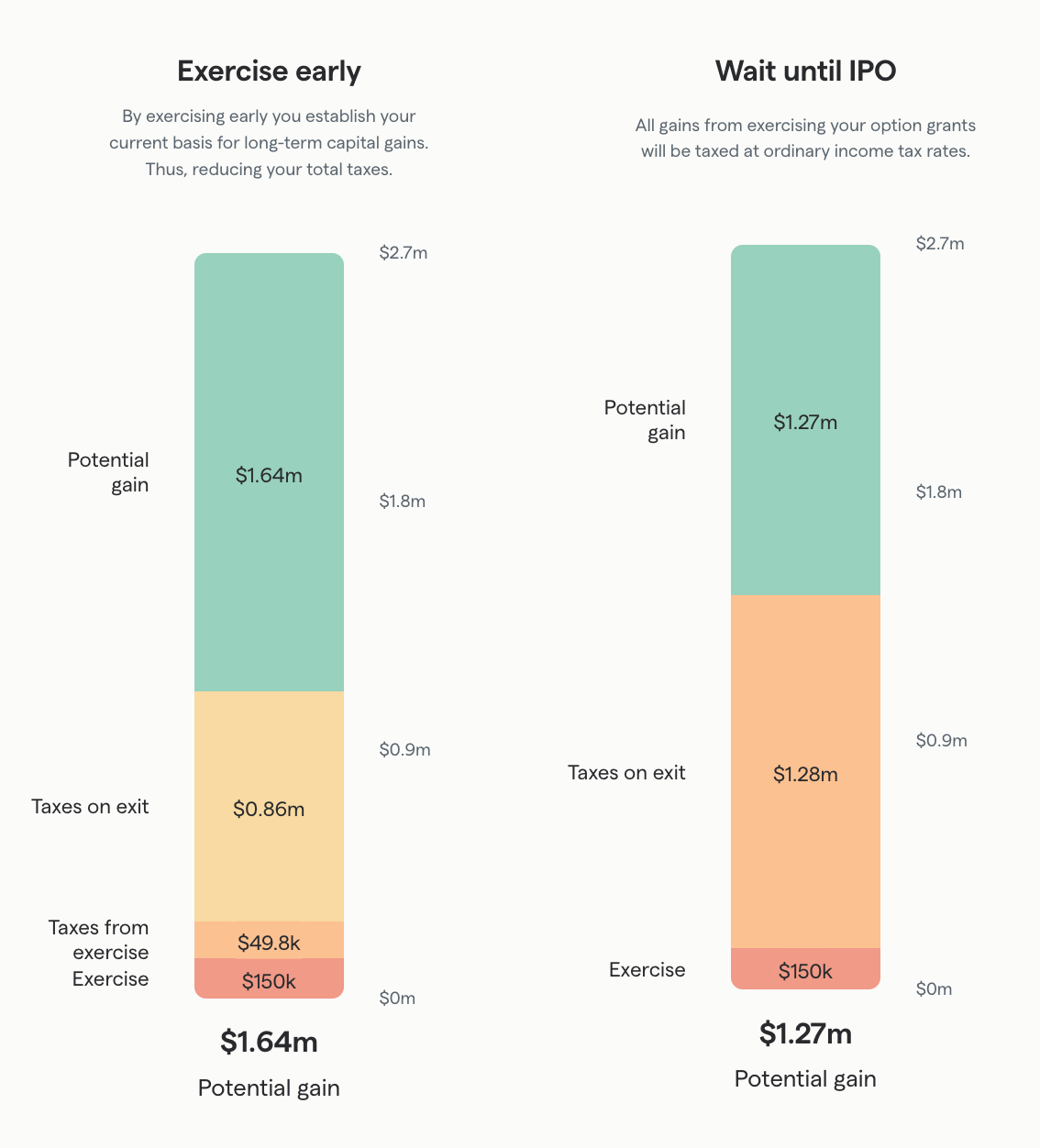

So when lockups expire, those unexercised options often flood the market. And here’s the catch: when employees sell without exercising earlier, their gains are taxed as ordinary income, at rates around 53% in California.

If they had exercised earlier and qualified for long-term capital gains, the rate would be closer to 37%. That difference of 16 percentage points applied to millions of shares adds up fast.

Let’s do the math at September 5th's $54 price:

That’s not hypothetical. That’s real money gone.

Take a Figma engineer who joined in 2021 with 50,000 ISOs at a $3 strike.

Now that’s still a great outcome, as the vast majority of startup employees will never go through an IPO. But that’s close to $400,000 lost to taxes simply because employees didn’t properly plan. Even after the stock fell by more than half from IPO highs, the tax difference could be life-changing.

Figma’s stock drop wasn’t a surprise. IPOs are volatile, and employee unlocks almost always add selling pressure. What makes the volatility sting more is when employees haven’t planned around taxes.

On September 5th, Figma employees finally got to sell, and many paid the steepest possible tax bill. The difference between ordinary income rates and long-term capital gains cost them hundreds of millions.

If you’re at a company preparing for an IPO, don’t make the same mistake. The earlier you plan, the more you can save.

👉 If your company is heading toward a public listing and you want to maximize your equity, don’t hesitate to get in touch. We can help you build a strategy so when the markets move, you’re ready.