John Klingler

Senior Manager

John’s an Senior Manager at Secfi, helping founders, executives and employees navigate equity compensation and access to liquidity through his expertise in finance.

0 result

John Klingler here. Long-time reader, first-time writer for the Founders + Funders newsletter. I’ve been with Secfi for ~4.5yrs on the Secfi Liquidity team, working closely with our clients and the companies we support through our liquidity solutions. This week, I’ve been handed the turkey baster and asked to write our special Thanksgiving edition.

I don’t know about you, but I love Thanksgiving food. I think it’s the perfect meal to have once a year. The turkey (or turducken if you’re at my family’s Thanksgiving), the stuffing, the sweet potatoes, the gravy, mmm mmm mmm…the list goes on.

And what would Thanksgiving be without pie? Pumpkin, pecan, chocolate mousse…so much to choose from. Why not take a slice of each!

Well, apparently Morgan Stanley, Charles Schwab, and Goldman Sachs do. The three financial giants took large slices out of the private secondary markets pie via their recent acquisitions of EquityZen, Forge, and Industry Ventures, respectively. All announced within the last few months*.

While each acquisition represents a slightly different flavor (really grasping at straws to string together the pie analogy), the common thread is that three major financial institutions are grabbing hold of the private market asset class in a major way.

I’ve seen this topic written about in various articles, blogs, and newsletters in the last couple of weeks, but I wanted to highlight it further and explore the possible implications for you as an employee who holds private company equity.

Without going into too much detail on each, I think it’s important to first state the specific trends these acquisitions further solidify:

So what does this say about the world of private investing and its key stakeholders and participants?

Across venture capital funds, high-net worth investors, and retail investors, the private market pie is growing, and so is investor appetite.

Due to the rising demand for alternative investments, private market investing is seemingly inching further into retail investors’ asset allocation (& asset location): private investments in your 401K, private investments in your Robinhood account, private investments everywhere. If they aren’t already, financial advisors will more frequently encounter questions from their clients on how they can get involved in alternative investing. The firms that can offer it and integrate it into client portfolios may provide the necessary differentiation to win and retain clients.

Even personally, I received emails in the last week to my work and personal email highlighting different alternative investment opportunities. I’m not here to offer my opinion whether it’s a good thing or a bad thing - but it’s happening.

Charles Schwab, Morgan Stanley, and now Robinhood’s introduction of Robinhood Ventures furthers the trend as it aims to “democratize access to private markets globally.” There may soon be no shortage of places to turn to for access into these markets.

Beyond the financial and investment standards (e.g., accredited investor designation), creating a barrier to private investing becoming mainstream, a longstanding burden has been the operational headache of getting involved in these opportunities.

However, with large financial institutions putting dollars towards technology and infrastructure, we are likely to move towards a more seamless process, building a smooth on-ramp for investments to flow easily in and out of the market. It may more closely mirror the public investing experience than the clunky, cumbersome ways of the private investing past.

There’s much more to dig into on this topic alone, but best saved for a future newsletter.

TLDR: It looks like more, not less investors of all kinds will be involved in private market investing moving forward. The technology is being aggressively built to support it. This should lead to additional liquidity in the market. All signals point to this trend not reversing anytime soon.

First, let’s restate the trend: companies are staying private for longer.

There are arguments on both sides of the discussion about this.

What we do know is that if the qualifications for an “IPO ready” company stay at today’s metrics, the “private for longer” trend will likely continue. I’m not talking about the upper echelon of private companies who may stay private forever (or at least, are in no particular rush).

But for the traditional, VC-backed company intending to exit someday, the current rules of the road have added on years of building in order to achieve the proper milestones (scale, strong growth, profitability / clear path to profitability).

With exits pushed further down the line, that does not mean the need for liquidity, for the company and its employees, will follow suit. Companies may need additional primary fundraising rounds to boost growth plans, execute acquisition strategies, and solidify their balance sheet on the path to IPO.

Additionally, companies may need to address liquidity concerns among their talented executives and employees. Keeping folks aligned on a company vision for a long time with an ever-moving finish line can be a difficult task.

A common playbook for this is the tender offer. Tender offers, historically reserved for companies 5-10yrs+ in tenure, may be leveraged by companies (and welcomed by investors eager to participate in the private markets) earlier in their lifetime. Of course, tender offers are not new, but their resurgence in 2024 is likely to be sustained in 2025 and beyond.

The possible result of all of this?

More frequent and widespread company-sponsored tender offers, company-sponsored financing programs, and maybe even open cap tables, allowing employees to trade their equity freely, could be where we are headed.

So if more investors are seeking private investments, more advisors are recommending private investments, and more companies are staying private longer, then surely there must be a widespread secondary market across many private companies today, right?

Well, that’s not exactly the story.

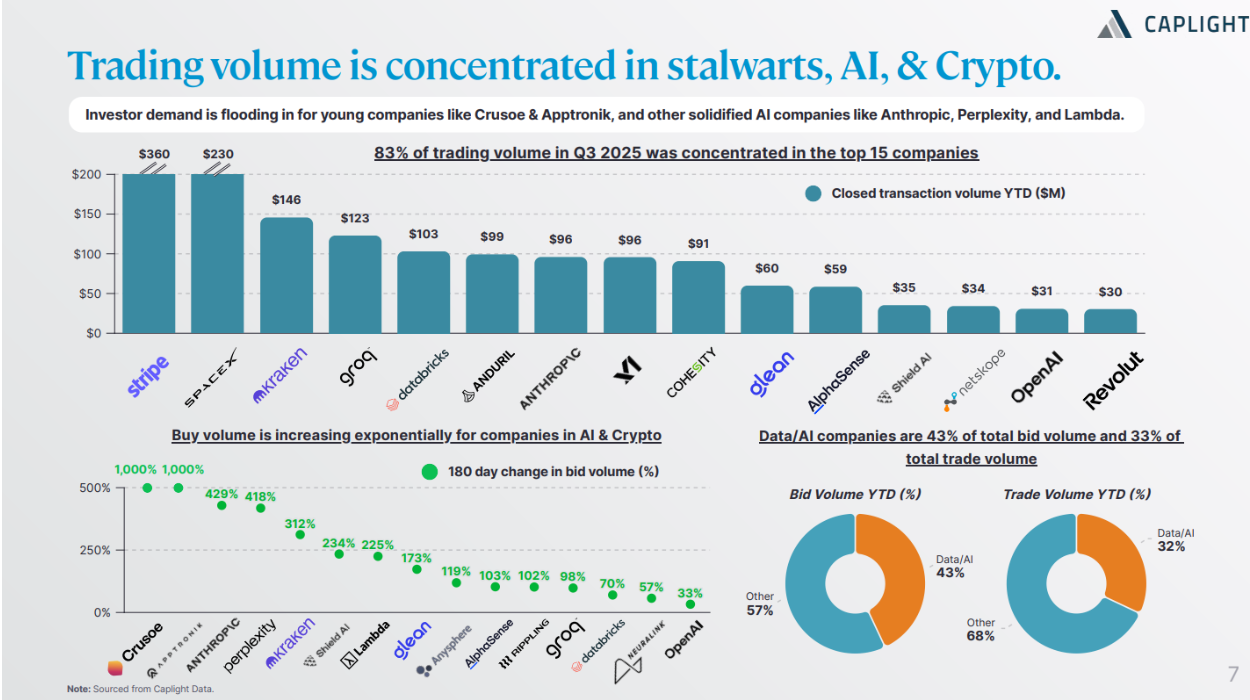

According to our friends at Caplight, 83% of trading volume is concentrated across the top 15 companies. At least right now, it seems most of the dollars in the market are chasing the same investments.

However, if all of the previously stated trends continue, the breadth of the universe of actively traded companies in the secondary market may expand beyond the “blue chip” companies.

For executives and employees with stock options and shares, additional liquidity heading ‘downstream’ to a wider set of companies would be a welcome shift.

The pie is getting bigger, and there should be enough to go around, potentially benefiting more than just the active participants described above. We believe there should be rise in demand in:

And just like at your Thanksgiving dinner, there’s (hopefully) enough pie to go around.

Wishing you a holiday filled with good food, great people, and maybe even a little turducken.

Happy Thanksgiving from all of us at Secfi!