Eric Thompson, CFP®

Lead Financial Advisor

As a CFP® at Secfi, Eric guides clients through the complexities of equity compensation, integrating it into their broader financial goals.

0 result

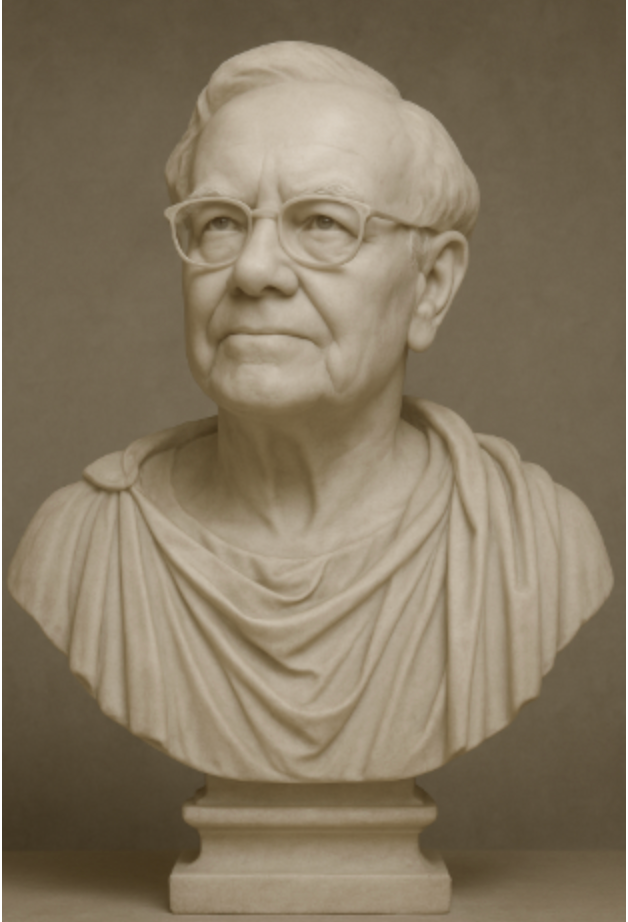

Eric here this week, in the wake of the news that Warren Buffett plans to step down as CEO of Berkshire Hathaway at the end of the year. I’ve never been one for the idolatry of athletes, political figures, or business titans, but there’s always been something refreshing about Warren Buffett. A man who has lived for 67 years in the modest house he purchased before his riches. A leader who has consistently emphasized the importance of integrity and reputation over money. A mentor who champions self-improvement, education, and independent thinking. While he’s not immune from critique, his character is admirable. I imagine history will look kindly upon Buffett - not just because of his stature in the investment world, but because of his philosophy.

As a fan of the Stoics, I’ve often noticed the parallels between Buffett and figures like Seneca or Aurelius. So this week, I thought I’d share some of my favorite Buffett quotes that have resonated with me over the years and offer you a moment to sit back, take a deep breath, and reflect on timeless wisdom.

“In the business world, the rearview mirror is always clearer than the windshield.”

It is easy to judge the past, but so difficult to envision the future. Whether you’re contemplating a career opportunity, exercising your options, or making a major life decision, you must act with the incomplete information you have at hand. Once a decision is made, you shouldn’t judge yourself strictly by the outcome of the decision (which may look genius or foolish in hindsight), but by the soundness of the process that led to it. A good decision is one made through a clear, deliberate process of observation, orientation, and analysis, even if the outcome isn't ideal. This is how we look to approach advice with our clients: we have a good “ex-ante” reason for every decision, whether it’s advice on an options exercise or portfolio positioning.

“Our favorite holding period is forever.”

In today’s hyper-distracted, instant-gratification culture - patience remains a virtue. The ability to think and plan long-term is an advantage in investing and in life. It often rings true that the stock tip your buddy passed along at the bar, or the crypto rec your Uber driver shared is more of a top indicator than sound investment advice. The ability to avoid the “shiny new object” and think in terms of decades, rather than months or quarters, creates a more intentional investment approach. A long-term mindset lets you stay the course with less stress and greater conviction in your decisions (not to mention the tax benefit in never selling). When you find that outsized opportunity, having the focus, decades-long outlook, and the conviction allows you to take bigger swings.

“Big opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.”

Financial advice often touts diversification and risk mitigation—the slow and steady wealth management playbook. This time-tested approach has built and sustained wealth across the middle class for the last few decades, as the rising tide of economic growth has lifted countless boats.

But for those striving to build considerable wealth, accelerate their path, or who are comfortable with calculated financial risk and volatility, a different strategy can mean taking big, intentional, and concentrated swings—a large time allocation into one job opportunity or a large capital allocation into one investment.

When life offers something extraordinary, be it the job with a pay cut but incredible upside, an investment in a startup poised to dominate its market, or going to see about a girl1 when you have World Series tickets, seizing these moments can shape one’s life into something exceptional. Playing it safe rarely produces outsized outcomes. Indeed, acquiring wealth and keeping wealth requires different approaches and skills. We work with clients to assess these opportunities, scenario plan potential outcomes, and advise if the calculated risk is worth the potential reward.

“Basically, when you get to my age, you'll really measure your success in life by how many of the people you want to have love you actually do love you.”

The path towards wealth, accolades, and career success is a journey. The beauty of that journey is often found in the in-between. Not the galas, award dinners, the promotions, or pinnacles of success - but the daily interactions that fall in between these highlights of your life. The deep conversations with long-time friends over a drink or the date night you prioritized over working late. These simple, but meaningful interactions with loved ones occupy far more of our time than the spotlights of triumph and tend to mean more as we age.

As Bronnie Ware observed in her memoir on end-of-life reflections, two of the most common regrets are: “I wish I hadn’t worked so hard,” and “I wish I had stayed in touch with my friends.” As wonderful as career and financial success are (and we aim to be part of that work alongside you), making time in your ever-busy schedule for friends and family, will have lasting benefits that money can never replace.

Buffett’s legacy teaches us that success is more than capital gains. It’s character, conviction, and clarity of purpose. Whether you’re navigating your equity decisions, weighing career moves, or building a life of meaning, there is value in slowing down, reflecting, and embracing his stoic-like principles. And we’re here to help you - both in your financial life and beyond - along the way.

1 Son of a b* stole this line.