0 result

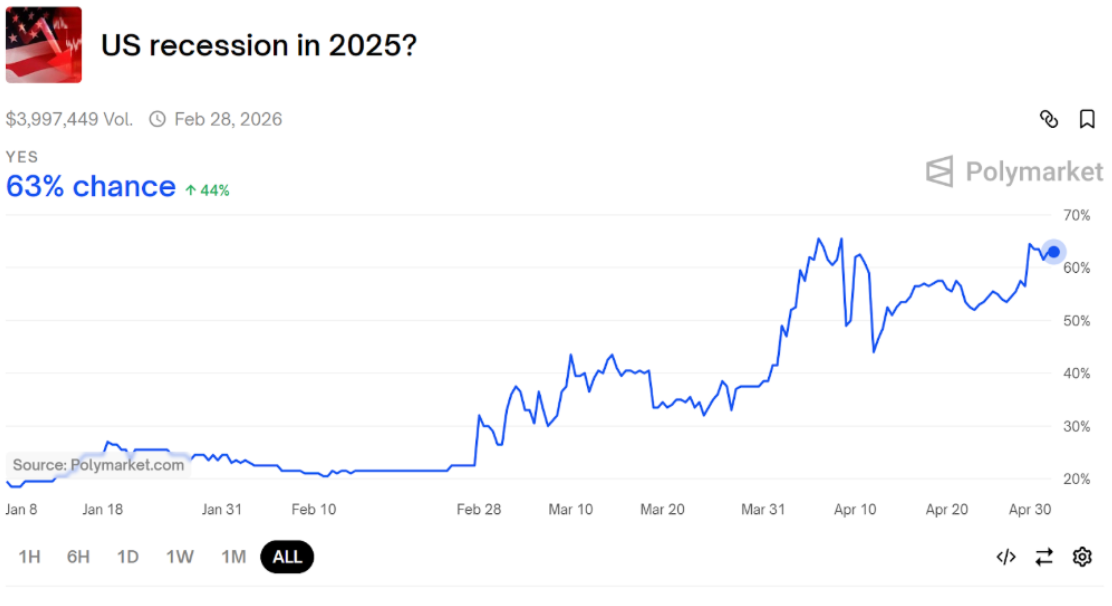

John here this week and with the Q1 GDP report out on Wednesday, I’m in a macroeconomics mood. The last month has been dominated by geopolitics and economy-shaping policy announcements. Investors have been trying to digest it all and understand what it means for portfolios. The initial Q1 GDP estimate indicated the economy shrunk by 0.3%. This was the first negative quarterly GDP report since the first quarter of 2022. The odds of a recession have increased with Polymarket pegging the probability of a recession in 2025 at 63%. People are understandably jittery about their portfolios and have been asking about moves they might need/want to make in light of a potential recession, so let’s talk about it!

Source: Polymarket.com

Recessions are officially declared by the NBER (National Bureau of Economic Research) and are defined by a, “significant decline in economic activity that is spread across the economy and that lasts more than a few months.1” We measure economic output primarily via estimates of “Gross Domestic Product” (GDP). The formula for GDP is the following:

GDP = Consumption + Investment + Government Spending + (Exports - Imports)

GDP attempts to measure everything an economy produces. To simplify, think of consumption as everything people buy, investment as everything businesses buy, and government spending as everything the government buys. Anything we export is not consumed by us but is produced by us while everything we import is consumed by us, but not produced by us, hence the subtraction of imports in the formula2. This adjustment is getting a lot of headlines in this Q1 GDP report. One reason is because net exports were substantially negative. Why? Because people and businesses have been rushing to import goods ahead of the implementation of tariffs. Does that mean that we’ll see the opposite effect next quarter?

The other components of GDP for the quarter had mixed impacts. Consumption and Investment were positive contributors to GDP while government spending fell and detracted. Is the increase in consumption and investment a pull forward of demand from the future as people and businesses stock up ahead of tariffs? Or does it indicate a more resilient spending profile? With so many moving parts, it’s hard to tell, but these are the questions economists and investors are asking and looking at data to confirm or deny. I won’t predict the outcome, but I will predict that we’ll continue to see higher volatility than we’ve been accustomed to in the past.

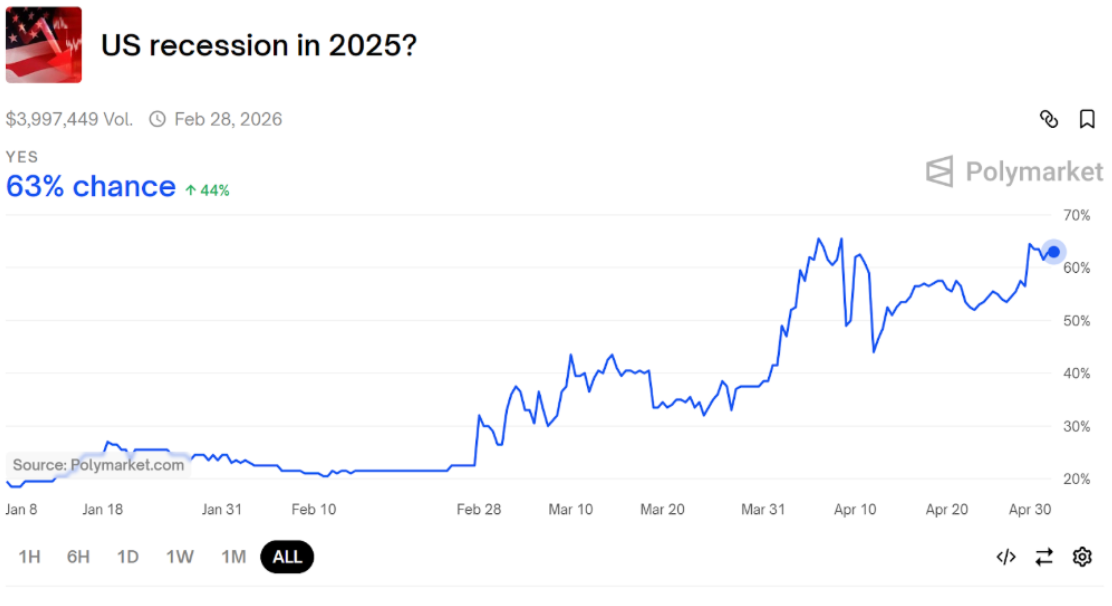

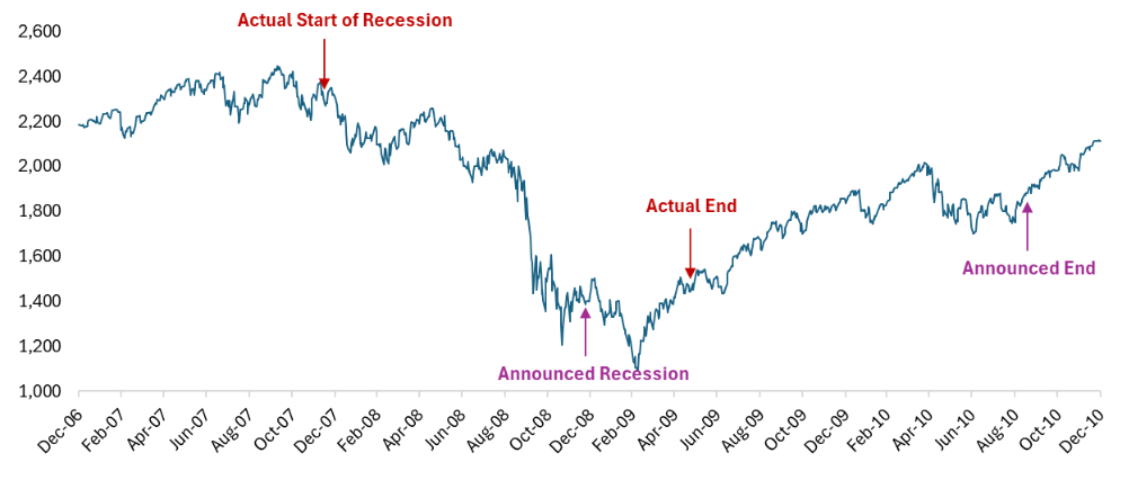

Why does a recession matter for stocks? Because stockholders are entitled to profits (i.e. whatever is leftover after paying everyone else you need to pay to operate a business). When output goes down, profits tend to go down too. Investors know this and are constantly trying to look around the corner to understand if stocks are priced too high or too low based on what’s likely coming down the pipeline. And this leads me to my practical point about investing in a recession, if you’re reading about it in the news, it’s probably too late. Investors are forward looking. Check out the market moves in the last two recessions. In both cases, the market declined before we knew we were in a recession and it bottomed before we were out of the recession, and long before it was announced that we were out of the recession. If you’re waiting for the “all clear” signal before investing, you’re likely going to be too late.

S&P 500 Total Return Index and Actual vs. Announced Recession Timing

Source: Ycharts data accessed on 4/30/2025. Recession data via NBER Past Performance is not indicative of future results.

S&P 500 Total Return Index and Actual vs. Announced Recession Timing

Source: Ycharts data accessed on 4/30/2025. Recession data via NBER. Past Performance is not indicative of future results.

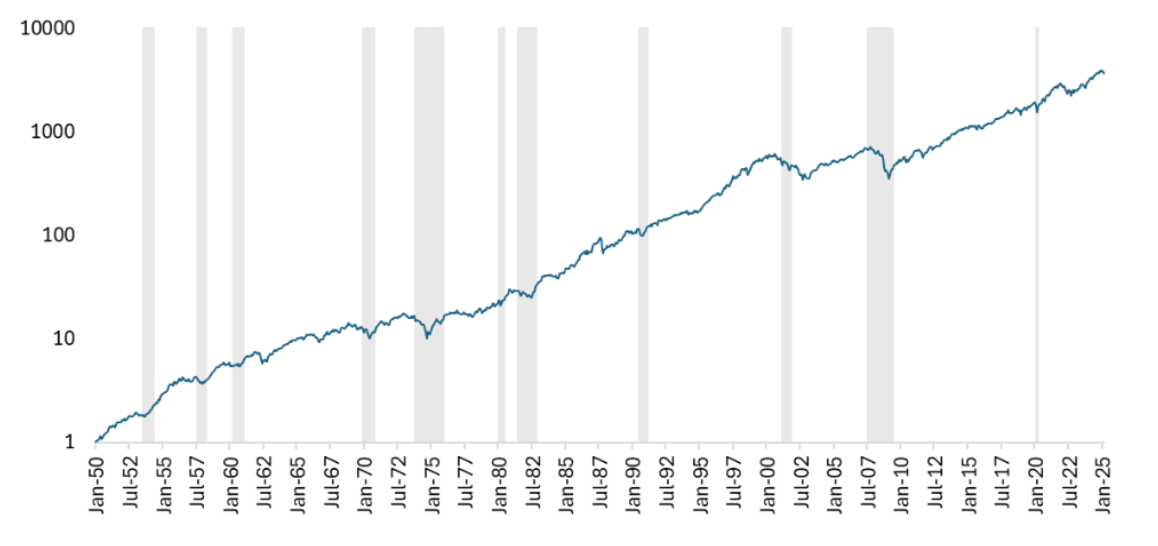

Trying to get ahead of the market and time your exit and re-entry ahead of the moves is dangerous. Primarily because you have to be right TWICE, both on the way out, and on the way back in. Check out the long-term market returns through recessions in Exhibit 3 below and take a long-term view of your portfolio. Yes it can be painful to invest THROUGH the recession, but that’s what you should do in our opinion.

Recessions shaded in grey

Besides, it’s always darkest before dawn. The best market returns often happen while we’re still in a recession.

Source: Ycharts data accessed on 4/30/2025. Recession data via NBER. Past Performance is not indicative of future results. For Illustrative purposes only.

January 1990 - April 2025

Source: YCharts data accessed on 4/30/2025. Past Performance is not indicative of future results.

When we build portfolios for our wealth management clients, we’re building them to be held for the long term. We don’t build a portfolio to benefit from a particular market trend or thesis. We play a different game because our client’s financial goals should not be subject to our ability to correctly predict the future. Instead, we use the science of portfolio management to build a portfolio that will work in a variety of potential outcomes. In other words, we try to build resilient portfolios for our clients. It helps them sleep at night and it’s the right way to invest for the long run in our opinion. Many things can happen, but only one thing will happen. We don’t know which possible future we’ll be in 5 years from now, so we build a portfolio that will work in lots of market environments and we stick to it. In practical terms, that means our client portfolios are broadly diversified in a way that takes into account our client’s concentration in their company stock. Take a look at some of our past newsletters to understand our investment approach in more detail. And if you’re looking for someone to help you on your wealth journey, consider reaching out to our team here.

1 Many folks think an official recession is two consecutive quarters of negative GDP growth, which probably would be called a recession too, but isn’t actually the official definition. The recession associated with Covid did not result in two consecutive quarters of negative GDP growth, but is considered a “recession”. Bring this up if you want to be popular at parties.

2 Importantly, importing goods does not reduce GDP, it has nothing to do with “domestic production”, but to measure GDP, we estimate everything we buy and export and subtract everything we import from that number.