🔁 Q2 Private Market Recap

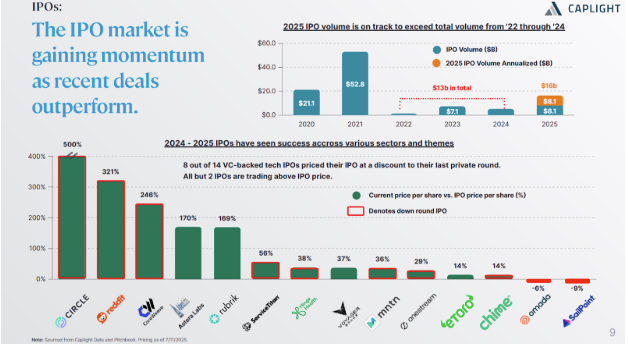

There is much more optimism in the private markets right now, especially after some successful IPOs. Investors are opening their checkbooks again and buying shares, hoping to catch another successful IPO.

0 result

Vieje back here again, writing from San Francisco. I’m back here visiting my Dad with my family after a few days for a wedding in the Seattle area. I don’t think I’ve ever been this happy to see the summer fog after dealing with this humidity the last few months in New York.

In our last newsletter, my colleague Jaime wrote about how IPOs are back. Naturally, the questions we heard from you all were around what that meant for your company and your equity. We saw a handful of private tech companies make the leap into the public markets in Q2, but what does this mean for liquidity for the other companies out there? Let’s jump into our private market recap in Q2.

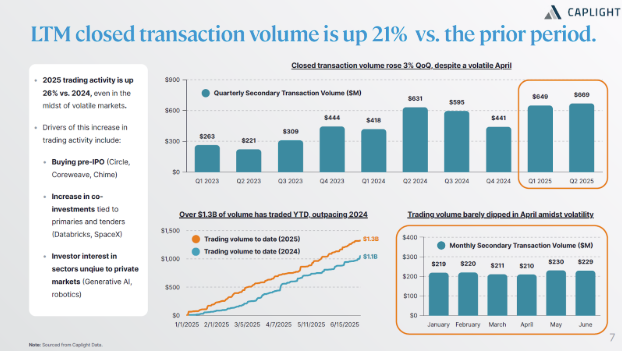

Our friends and partners at Caplight put together a great deck with data from their platform in Q2, and I’ll bring in some slides from that deck to guide the narrative today.

In a nutshell, the theme of the last 18 months has continued through Q2. The secondary markets are heavily concentrated to the top ~5% of companies, which are primarily very large companies in hot sectors such as AI or are in the immediate IPO backlog. Caplight describes these companies as the “Haves”.

Almost all the companies on the list are ones that are worth multi-billions of dollars and/or in the AI space. Despite having unicorn status, the vast majority of companies worth $1B+ do not have an active secondary market. It is worth noting that some companies could have transfer restrictions and otherwise would have buyers, and also, this data is not exhaustive, but it very much describes the reality of the secondary markets today.

This is a frustrating situation for the vast majority of startup employees who are building the other ~95%. Liquidity is just not there right now for them. There could be some good news coming, though.

Volume in 2025 is on track to be much higher compared to 2024. There was a large increase in volume from Q4 2024 to Q1 2025, but closed volume stayed around similar levels in Q2 compared to Q1.

Well, if your company is in or soon to be in the immediate IPO backlog, this could mean that liquidity is coming. Successful IPOs lead to more IPOs and more investor interest in the secondary markets. While the requirements to go public are still very high compared to previous IPO windows, there is hope that we’ll see a handful of companies test the waters after Labor Day, and many more start the process behind that.

If you hold equity in a company still some years away from being in the IPO backlog, there is also hope in the near term. As companies exit through an IPO or M&A, investment firms distribute capital back to their Limited Partners who invest in those funds. There is a bit of a flywheel effect as those LPs will reinvest that capital back into other funds who will then start buying shares of companies in that next wave.

We’ll need the market to continue to open up before we start to see that reinvestment in hopefully a much larger subset of the market. Until then, the most important thing is to continue building and growing your company. Investors will reward the companies that can show an ability to get into that IPO pipeline in the next few years.

Whether you’re at a pre-IPO company or at one growing to become one, there’s no better time to start planning around your stock options and liquidity needs now as well. That planning years ahead of that potential IPO or liquidity event could mean a large difference in what you end up taking home due to taxes.

As always, let us know if you have any questions or just want to say hi!

Things we’re digging: