Eric Thompson, CFP®

Lead Financial Advisor

As a CFP® at Secfi, Eric guides clients through the complexities of equity compensation, integrating it into their broader financial goals.

0 result

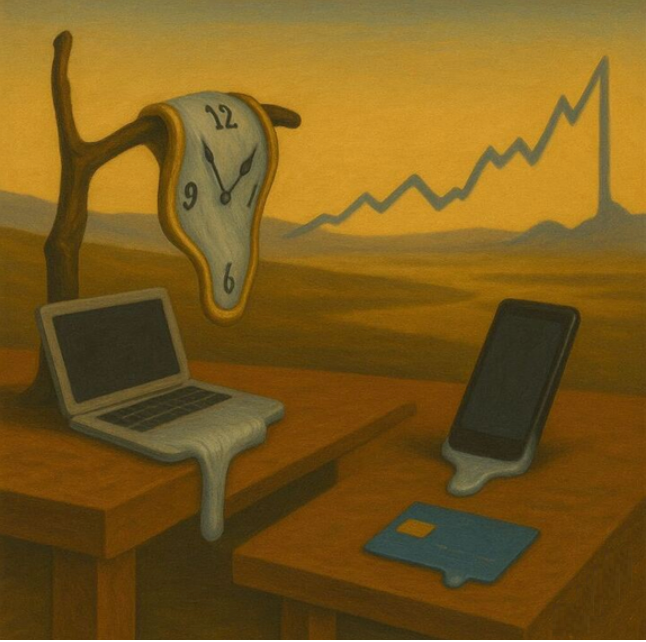

Eric here this week with a newsletter about time. If you're building wealth through startup equity or you’ve already hit your first major liquidity moment, you know your time is no longer just a line item. It's leverage. It's opportunity. It's the scarcest asset you have.

“This isn’t worth my time.”

An empowering thought. While often said out of frustration, the sentiment rings especially true for those starting to build a bit of wealth. There are countless things we engage in throughout our day that simply aren’t worth our time. Chasing minuscule discounts. Deal research. Endless credit card point maximization. Taking the long route to avoid a toll. DIY everything. To what end? Spending two hours of your time to save $12? Taking on a project that ended up costing you as much, if not more than outsourcing?

I’m a big DIY guy. In my spare time, I tackle countless home projects from building out a mudroom to installing a new dishwasher. I mow my own lawn. I’m currently planning the installation of a paver patio in my backyard. (There’s still time for someone to talk me off the ledge and tell me how backbreakingly bad an idea this is.)

If I were honest with myself, and assessed the cost of materials, new tools I need, and my own cost of labor, I’d be paying myself a minuscule hourly wage. The pride of ownership and the knowledge that I did it myself is often immense. But sometimes I end up annoyed that I didn’t simply hire someone to do it in a fraction of the time for a very reasonable cost.

I rarely value my personal time the same way I do my professional time. If I did, I’d be left with a slightly lighter wallet but way more free time to focus on work, to pursue my hobbies or relax on that patio instead of tamping gravel and sand. (Really guys, how bad of an idea is this DIY patio?)

Enough about me. Let’s focus on you and wax poetically on finding your purpose and valuing your time.

Honestly, if you’re reading this, chances are you’re likely doing well financially or at least on a well-paved road to financial success. You’ve followed the Naval Ravikant importance of owning equity in what you help build, so your time and labor compound through leverage.

It’s also likely that you went through a period of bootstrapping in your life. Classic ramen dinners. Peanut butter and jelly sandwiches. Cramming nutritionless calories when money was tight. But many retain a hangover from early-career frugality. A useful trait in your 20s that starts to hold you back in your 30s and 40s as time becomes your scarcest resource.

Time is finite. If your net worth puts you in the top 20% of U.S. households, you can expect to live around 4,500 weeks on this planet (because yes, wealth is correlated with life expectancy).1

At age 30, you’ve already spent about 1,500 of them. By 40, that number climbs to roughly 2,100. At 50, you’ve used up around 2,600 weeks.

This gut-punch reminder on the brevity of life is often glossed over in the busyness of our days. Meetings. Deadlines. Errands. Racing kids to their activities. Amongst those hours, days, and weeks are activities that could be automated or outsourced to give you back your time.

Buying back your time isn't indulgent. It's the most meaningful form of wealth.

Expertise is valuable. When you're deep in your field, surrounded by colleagues who speak the same shorthand and solve similar problems, it’s easy to forget how specialized you really are. The engineers and designers with a decade of experience have crafted a knowledge base and mental framework that is so foreign to the physician, theatrical performer, or tradesperson. And they’ve done the same in their respective crafts.

There’s a well-known anecdote that’s part parable, part Picasso legend, that illustrates this point:

While sitting in a park, Picasso is approached by a woman who recognizes him and eagerly asks if he’d be willing to draw her. He agrees, and within minutes produces a striking sketch. The woman is thrilled, amazed by how well the drawing captures her.

“How much?” she asks.

“5,000 francs,” he replies.

“But it only took you a few minutes!”

“No, madam,” Picasso says. “It took me my whole life.”

Tackling projects on your own may be good enough, but it may also miss the mark on the quality or perfection you’d expect from others. The trade secrets and processes that a weekend warrior misses, but a craftsman has perfected for years or decades, and justifies their cost.

Yes, you probably could do it yourself. You could remodel the bathroom, tune up your car, and handle your own taxes. But will the quality match someone who has spent their entire career refining that skill? Will the time and energy cost be worth it? It’s not about capability. It’s about tradeoffs.

With personal wealth comes valuing experience in yourself and in others.

We’re all familiar with the idea of opportunity cost: the benefit you miss out on when choosing one action over another. Yet in our personal lives, we rarely stop to ask: What else could I be doing with this time?

What if those hours were spent:

When you consider the cost of your time versus the cost to outsource a task, it’s not just about convenience. It’s about consciously choosing how to spend your most finite resource. Building intentionality into your decision-making.

Sometimes, the answer isn’t to delegate but to repurpose. Turn cooking dinner into time with a loved one. Make a DIY project a chance to teach your child something new. Merge utility with meaning. Other times, you may be best served by letting a professional step in.

You already push automation at work. What can you automate at home? You already delegate to your team. What can you outsource in your life?

The goal isn’t to avoid work. It’s to make room for the right kind of work and build an intentional life of meaning.

Those financial tasks sitting on your plate? They’re some of the easiest to offload and what we specialize in at Secfi Wealth. That Excel model you’ve been building to decide whether to exercise your options? We’ve already built it and use it every day. Worried whether your investment approach is positioned for the market risks ahead? Our strategy is built specifically for equity holders navigating concentrated exposure. Curious how to lower your tax bill? We run that analysis for every client, every year.

Secfi Wealth helps founders, startup employees, and tech professionals reclaim time and turn complexity into clarity so you can focus on building the life you actually want.

(When I started writing this piece, I fully intended to install the patio myself. After writing, I’ve taken my own advice and hired out this project. Hopefully, you can reflect on the value of your time and find a place to do the same.)