0 result

Hi there,

Vieje here again. It’s August and I’m fully expecting a ton of OOO replies to flood my inbox as this goes out. I hope a lot of you are reading this on a beach or somewhere awesome. Send me a pic if you’re somewhere amazing – I need some ideas for my next trip.

For those of you that are on vacation this week, it was a great week to get away. The start of this week was anything but calm and relaxing in the markets. Most of us woke up on Monday to a wall of red as the stock market took a tumble.

The markets have since recovered a bit since Monday, but I thought it would be a great time to write about market declines. Stocks go up and they go down and no one can perfectly predict the market. That’s part of the journey of investing. While it’s not fun to watch your investments lose value, there will unfortunately be more days like Monday in the future. With the election around the corner, there may be more whipsaw days in the months ahead. When that happens, you don’t need to panic.

On Monday, my financial advisor and colleague John Morrison, who you all hear from on this newsletter often, sent out an email to all Secfi Wealth clients (which includes myself) and wrote a bit more about the market decline. I’ll quote some things that he wrote and also add some commentary myself. Then I’ll discuss how a market decline may impact the private markets as well. Let’s jump in.

If you read the news on Monday, you were probably greeted with a screen of alarming headlines as the news reported doom and gloom.

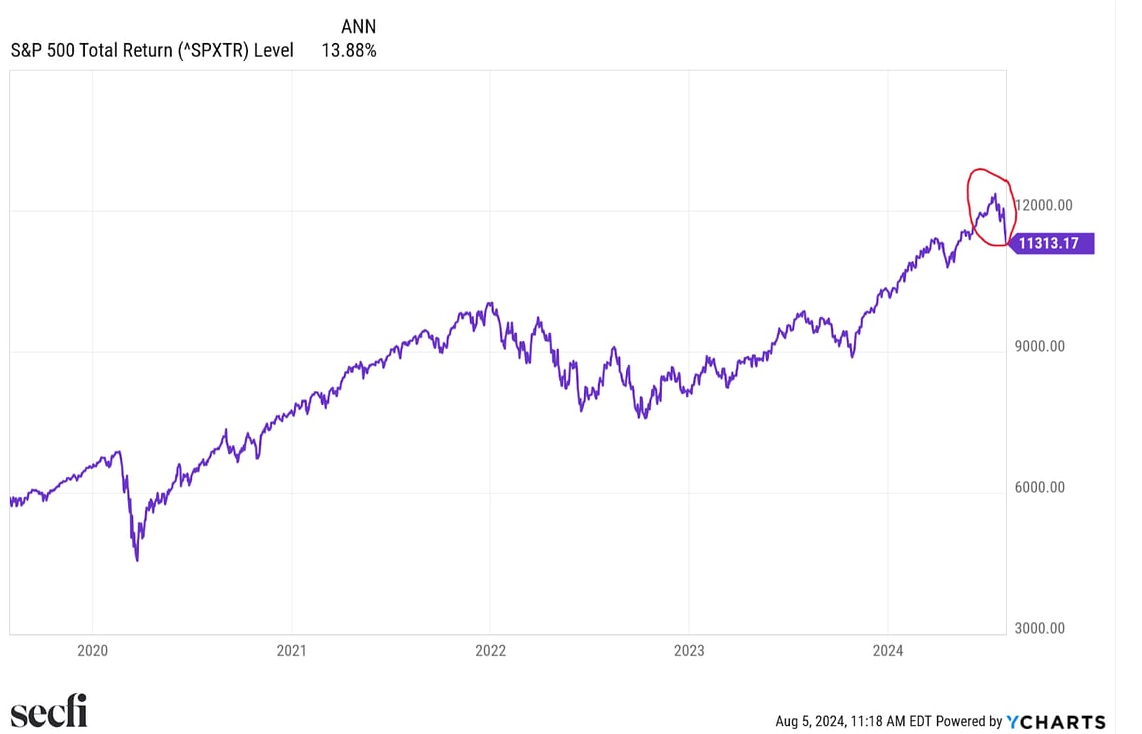

The S&P 500 was down 3% which was the worst day for the index since September 2022. On the surface, that is a scary thought as the index which tracks the largest companies listed on U.S. stock exchanges lost $1.3 trillion in collective value.1

These numbers can be daunting, however perspective is always key here. From John’s letter to Secfi Wealth clients:

“The market has fallen to what was an all-time high as recently as May of this year. Over the last five years, the S&P 500 has compounded at an annualized rate of nearly 14% , despite the COVID crash, the 2022 downturn, and, now, this latest dip. This is what markets do. They go up and down in response to new information all the time. This type of volatility is perfectly normal and nothing to write home about. Yes, the balance in your account has fallen from its all time high, but volatility is the price you pay for long-term returns.”

Source: Ycharts, accessed on August 5, 2024 Past Performance is not indicative of future results.

While the news may have made it seem like you just lost your entire retirement savings, the reality is that the big scary drop on Monday simply just brought us back to the market levels back in May of this year. This volatility can be scary if you’re monitoring things on a daily basis, but if you’re a long-term investor, then these dips are just part of the journey.

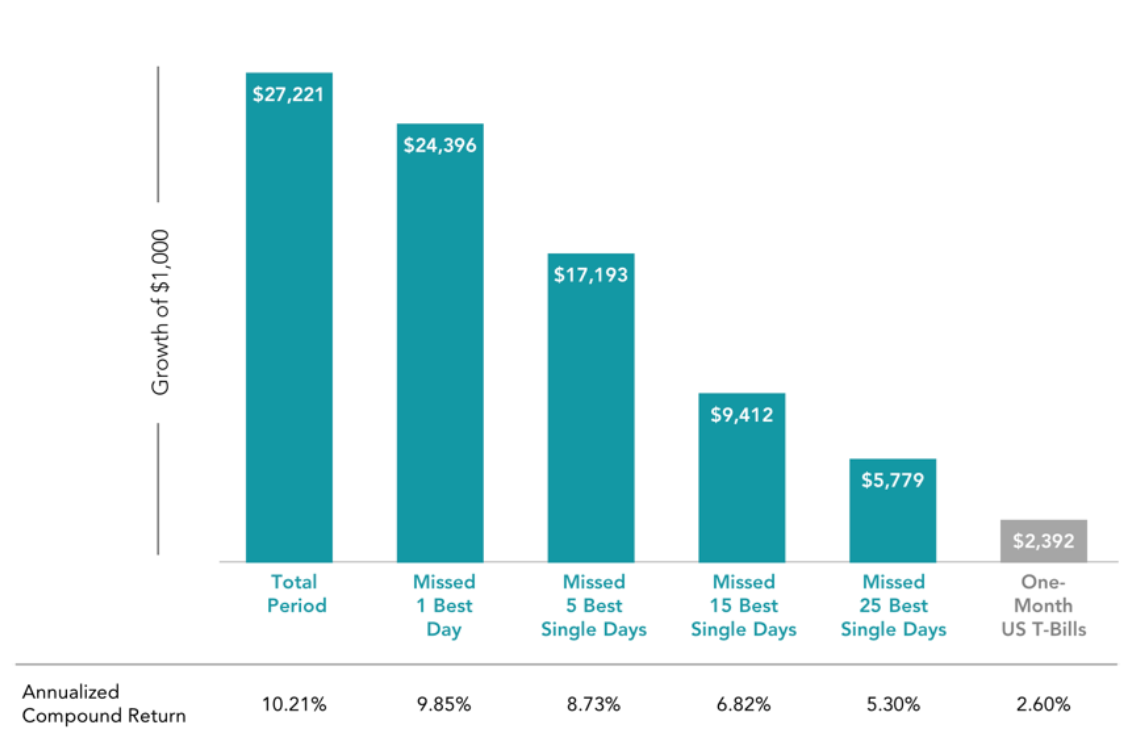

It may be tempting to get out of the market when stocks fall in an attempt to stop the bleeding. You may have the thought that you can sell the shares and buy them back in the future at a lower price. However, timing the market is incredibly difficult.

As John wrote on Monday:

“What will the market do tomorrow? It’s anybody’s guess! Don’t try to time it! Some of the best historical daily returns have happened in the midst of market downturns. If you hop in and out of the market, you risk missing those days which can be detrimental to your wealth.”

For illustrative purposes. The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed day(s), and reinvested the entire portfolio at the end of the missed best day(s). S&P data copyright S&P Dow Jones Indices LLC, a division of S&P Global. “One-Month US T-Bills” is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates.

As I sit here writing on Thursday evening, the S&P 500 closed today at a 2.3% gain. Those that sold stock earlier this week anticipating that the dip would keep dipping, may have missed out on today’s gains. Of course, we don’t know what will happen for sure in the days and weeks ahead, but we do know that this is normal and part of long-term investing.

Of course, we are Secfi and so I wanted to touch upon the potential impact in the private markets as well. In the short-term, market declines in the public markets do not typically have a major impact on the private markets. However, prolonged corrections can impact private markets down the road.

The private markets are inherently run by long-term investors. Traditional early stage venture capitalists typically invest in companies with a time horizon of 7 years or greater meaning they do not expect to sell their shares for 7+ years. Growth or later stage investors may have a shorter time horizon, but they too are often considered long term investors.

In addition, private market prices typically lag the public markets. That is to say that any impact, good or bad, in the public markets generally affects private markets later, as it takes time for updated valuation comps to work their way into the valuation marks for private stocks. For example, the market correction in public market tech stocks that we saw in the beginning of 2022 took a few months to affect private market prices.

Days like Monday typically will not have an impact on the pricing of your shares in the secondary market in the near-term. It’s important to note however, that in the long-run, if there is a prolonged public market decline, those lower prices may work their way into private markets in the subsequent weeks or months.

While the public markets can impact private markets, the bigger issue in private markets is illiquidity. The secondary markets do exist, but the vast majority of employees are not allowed to sell their company’s shares, and if they are, there’s no guarantee that there will be buyers. Liquidity opportunities are rare for private stock, so it’s important to keep this in mind.

Almost all readers of this newsletter, like myself, are invested in both public markets, through their retirement and brokerage accounts, and private markets, through their company’s equity. Bad market days like Monday can have an emotional impact and might cause some anxiety or panic.

While I can’t give out direct financial advice on this newsletter, I can share what my financial advisor, John Morrison, told me earlier this week:

“Every time the markets tumble, I receive a flood of messages from family and friends seeking advice. My message to them and you is to HAVE A GREAT WEEK focusing on you and yours.”

I can’t control, nor perfectly predict what the market will do. I can only control what I can control, which is executing on my financial plan. John, Chris and the rest of my Secfi Wealth team have created a long-term plan for my family and I which diversifies my investments across asset classes, countries, and sectors and complements my private tech company stock exposure.

My advisors and my financial plan help me block out the noise in the markets and prevent me from taking emotional reactions to my portfolio which can be detrimental to my returns and goals. If you also have a long-term mindset and a great plan in place, then you should’ve had a relatively stress-free Monday and will be ready for the next bad market day, month, or year.

I personally had a great week and I hope you did too. If you are someone that wants to get a financial plan in place, feel free to reply to this and I’ll connect you directly with the right team.

1 S&P 500 Index on August 5th, 2024

Things we’re digging: