Jaime Moreno de los Rios

COO

Jaime is Secfi’s COO, bringing experience from Flexport and 10 years at J.P. Morgan where he advised tech startups on over $20 billion in capital raises, M&A, debt offerings, and IPOs.

0 result

Let's take a quick romp through the post-Labor Day IPO yard.

Over the past few years, only the best pedigree IPOs were let out. From 2022 through the first half of 2025, the market was reserved for exceptional companies: polished pedigrees, strong growth, profitability, and marquee sponsors. But in the last four weeks, the yard has gotten busy with dogs that aren’t quite so straight. A wider mix is now testing the market: some with low growth, others fresh off mergers, and a few riding the crypto heat. The IPO gate is open again, and investors are letting the dogs out.

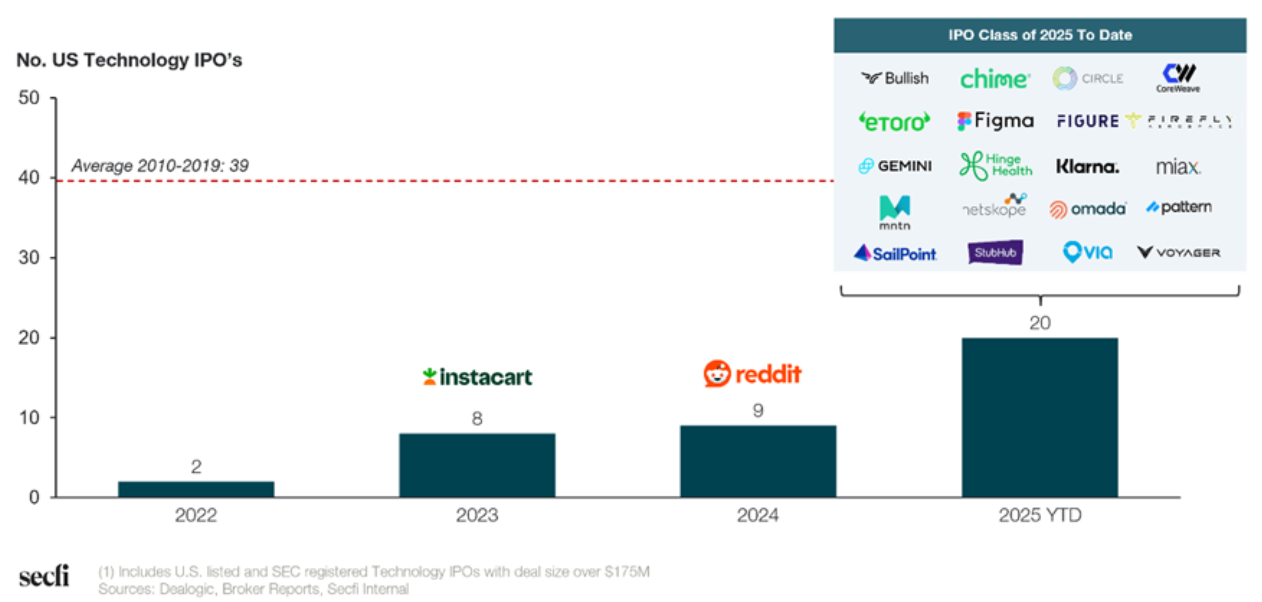

Until Labor Day, not many US Tech companies had gone public in the prior 3 years: 6 on average, which is 6x less than during 2010-20191. The ones that did had the scale, the growth and profitability, and often a marquee sponsor behind them. They ticked enough boxes that IPO was the logical next step. Contrast that with what we’ve seen in the last few weeks. The bar, while still high, is lower, and the mix is stranger. StubHub went out with low growth. Figure listed fresh off a split and remerger. Even the stronger ones, like Netskope, are still unprofitable. And then there’s Gemini, a crypto exchange that’s red hot but controversial.

Here’s the kicker: investors have still received them well. StubHub aside, which is proving to be the worst IPO in many years, most deals are trading up 15–20% out of the gate1. Gemini’s valuation spike was an outlier, but even the less polished names found buyers. The Fed cutting rates helped, sure, but more importantly, the market is signaling: the IPO window is open, and you don’t need a flawless story to get through it.

Quick review of the nine U.S. tech debuts over the past ~4 weeks (post-Figma’s spectacular debut, which I already talked about).

Netskope (Cloud security) — A classic “good” IPO: $700M+ ARR, AI-security tailwinds, and a clean debut. Still unprofitable, but improving. Oversubscribed books confirmed investor appetite for enterprise security.

StubHub (Tickets & Events) — Low growth, regulatory overhang, and a consumer cyclical business, investors passed. A reminder not all household names translate.

Bullish (Crypto exchange / digital assets platform) — Crypto exchange & liquidity platform. Surged ~+84% on its debut

Klarna (BNPL) — A large fintech float with sober messaging. Management admitted they’re still behind peers, which oddly gave credibility. Shares traded up ~30%.

Gemini (Crypto Exchange) — A ~30%+ debut pop and headline valuation spike. Controversial, but investors bought in.

Figure (Fintech/Blockchain) — Fresh from a split and remerger, not the cleanest profile, but still got public. Shows the window is broader than in past years.

Firefly (Space launch & vehicles) — First new age space launch & vehicles to IPO. First day surged ~+34%, then dropped ~-17% the next day

Via Transportation (Software/Mobility) —Transit tech & ride-sharing. Modest 7% pop on its debut

Pattern (AI-driven e-commerce accelerator) — AI-driven e-commerce accelerator. IPO at $14. According to IPO tables, 1-day return was flat ~0%

And expected to come soon is Navan (Travel + Spend) — Just filed its S-1. $329M H1 revenue (+30%), still loss-making. Investors will debate whether it’s a fintech or a travel company.1

The IPO market is open, but the outcomes are uneven. For employees, that makes planning even more important. Whether the stock trades up 200% (Figma) or drifts down (StubHub), tax decisions around ISOs, NSOs, AMT exposure can swing outcomes by hundreds of thousands or millions.

In this latest window, Secfi has helped employees at Netskope and Via finance their options early, potentially saving them significant taxes and giving them dry powder to capture more upside. We believe This cycle rewards preparation, not hope.

If you or your team are heading into an IPO, reply and we’ll model your tax and liquidity scenarios for pop, flat, and down markets.

1 Based on FactSet data as of Friday, September 26th