John Klingler

Senior Manager

John’s an Senior Manager at Secfi, helping founders, executives and employees navigate equity compensation and access to liquidity through his expertise in finance.

0 result

With ServiceTitan’s rumored IPO just around the corner, now is the time to start thinking about your equity and how you can make the most of it. We’ve created a 3-part guide to help you navigate the IPO and avoid costly mistakes, starting with today’s focus: the value of planning ahead.

The choices you make today can directly impact your tax bill and your future payout. We believe that the sooner you start planning, the better your outcome could be.

Many of you have Incentive Stock Options (ISOs) or Non-Qualified Stock Options (NSOs)—both of which come with significant tax implications.

Exercising before the IPO could mean:

Exercising early means you might pay less in taxes both now and when you eventually sell. Waiting until after the IPO could end up with a much higher tax bill for you to pay.

If you have Restricted Stock Units (RSUs), most planning will happen post-IPO. RSUs typically vest after the IPO date, and taxes will be deducted automatically by your company when that happens.

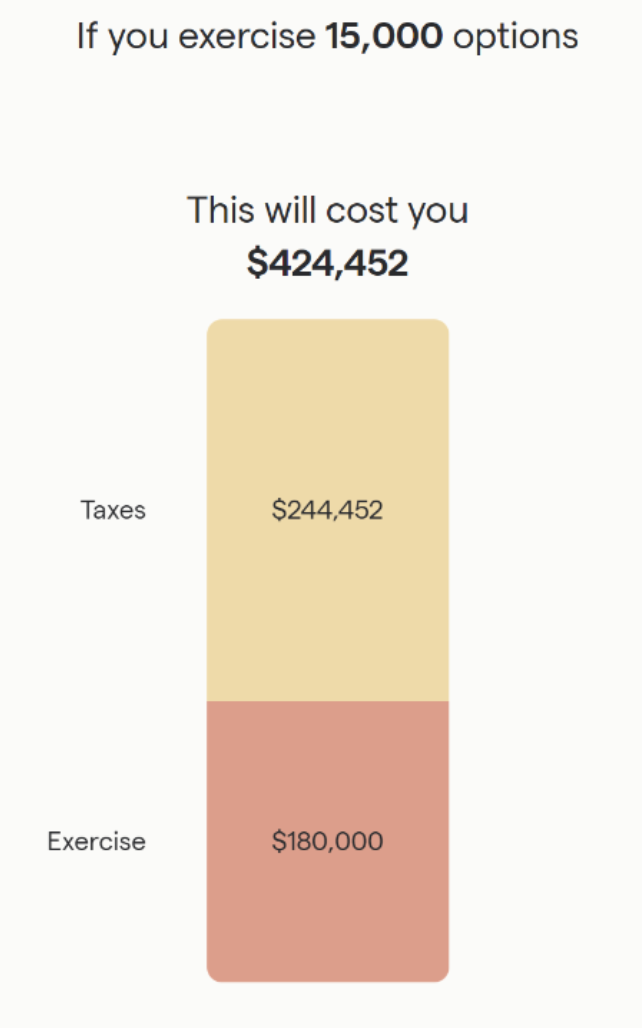

Let’s say you were granted 15,000 ISOs when you joined with a low strike price of $12. If you had exercised those options back when the 409A was at $12 or closer to that number, $180,000 may have been the only cost to exercise. Assuming you live in California and a 409A of $60, exercising them today could mean a tax bill of ~$244K.

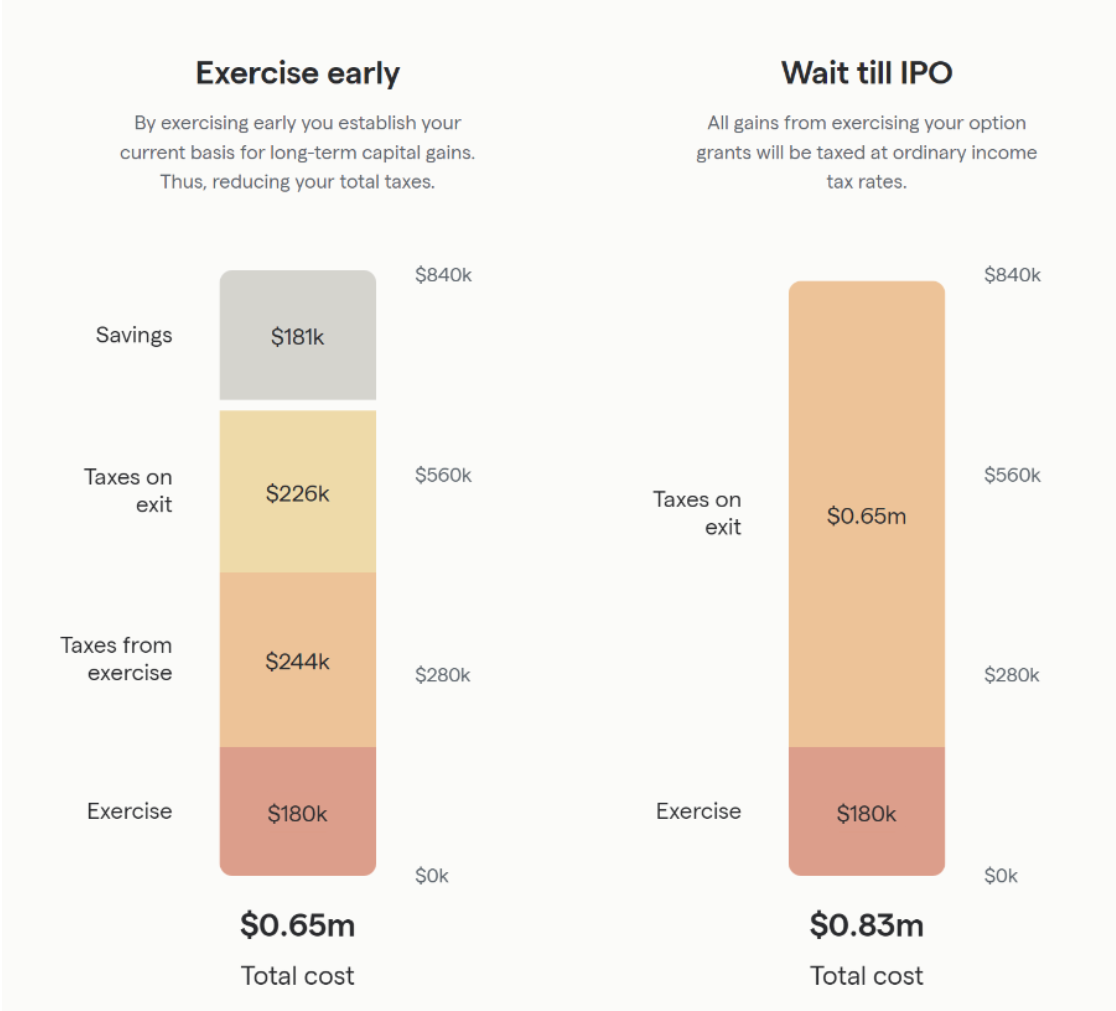

Quite a lot in taxes — you may be thinking…well why would I want to pay that money to exercise my options prior to the IPO? It’s a good question. By default, most will just decide to wait until after the IPO and pay the higher ordinary income tax. But let’s take a look at what would happen if you exercised a year before selling compared to selling in a cashless exercise.

Let’s say the IPO is planned to go exceedingly well and the price is set at $100.

For Illustrative Purposes Only. Actual results may vary based on your particular circumstances. Please consult your tax professional for particulars of your circumstance for actual owed taxes.

If you had exercised when the 409A was still $60 and held those shares for at least a year before selling, then your ultimate tax bill would come out to $470,000. Compare that to a total tax bill of $650,000. You will pay an extra $180,000 to the IRS and California if you don’t exercise for a year before selling.

This is why planning early can help put more money back in your pocket. The scenario highlighted above is just one example of the many outcomes that could occur with your ServiceTitan equity. Please check out our various planning tools to better understand your specific situation.

In Parts II and III, we’ll discuss how the IPO process works, what to expect next, share data from previous IPOs, and discuss how to execute your plan. Stay tuned for more insights!

If you have any questions in the meantime, feel free to reach out to start planning.