Forge Global (formerly Sharespost) vs. Equityzen vs. Secfi

Stock Option Exit Calculator

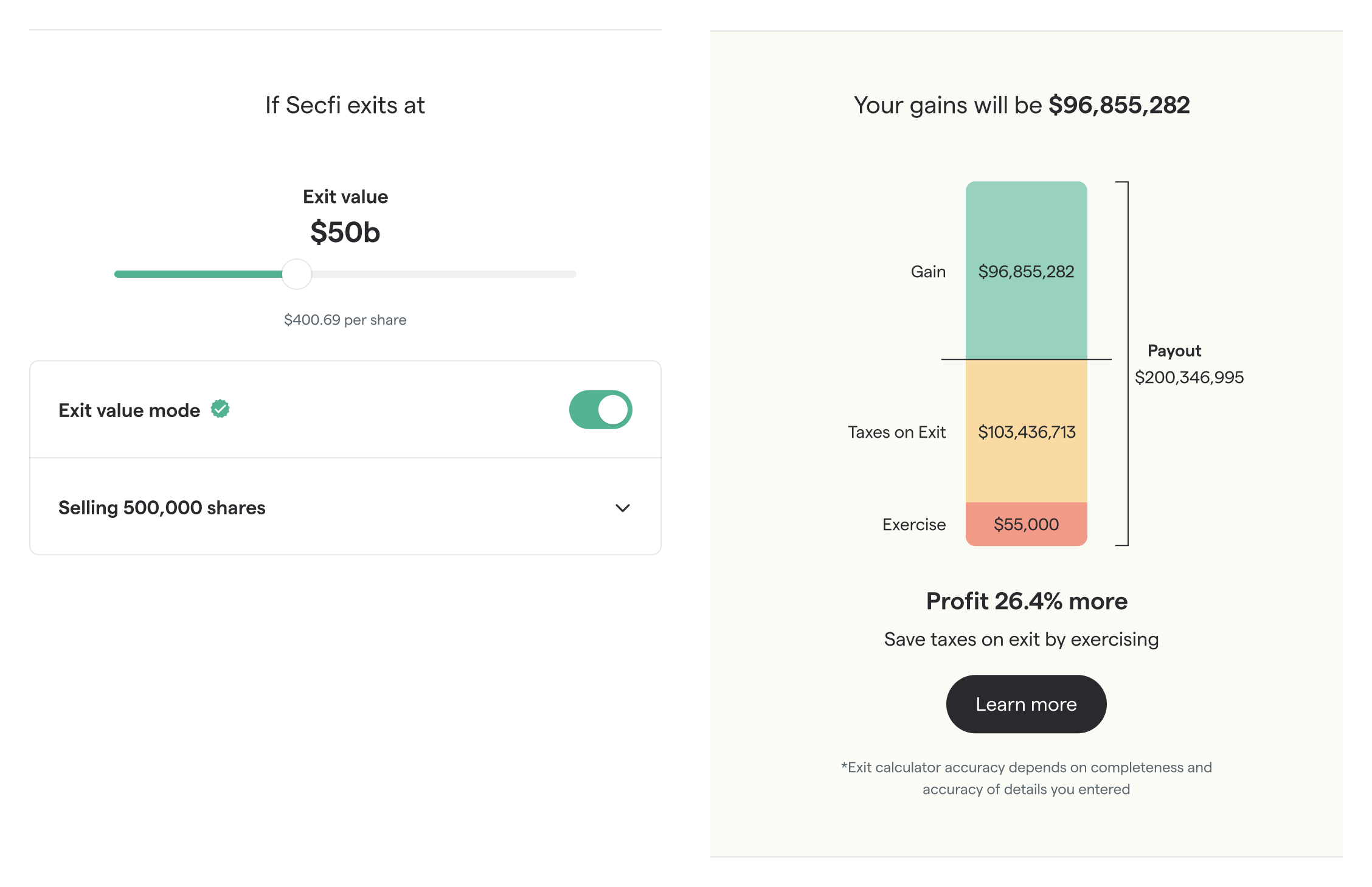

Find out how much your options would be worth at different selling points (and, importantly, after taxes) by using this calculator.

0 result

If your stock options have fully (or partially) vested and your company’s valuation has gone up, then you’re sitting on a pile of paper wealth.

And if you want to turn that paper wealth into actual wealth – but can’t afford to exercise your options on your own – you’ve got two alternatives:

Depending on your situation, one will definitely be better than the other.

In this post, we’re going to break down the differences between two secondary marketplaces: Forge Global (formerly SharesPost) and EquityZen. We’ll also look at one company that offers exercise financing – Secfi – to help you determine which one is right for you.

Here’s the bottom line, in our view:

Before we dive into the advantages and disadvantages of these different platforms – and who they may or may not be a good fit for – let’s take a quick look at the general differences between selling your shares on a secondary market versus financing the exercise of your stock options.

Secondary markets like Forge Global/SharesPost and EquityZen are platforms where you can buy and sell private company shares.

Essentially, you list the number of shares you want to sell, how much you want to sell them for, and then brokers help you to find an interested party who wants to buy them.

While you can get cash for your shares on a secondary market (if you find a buyer), there are downsides.

Financing the exercise of your stock options is very different.

When you work with a financing company, they’re not buying or selling your shares. Instead, they’re giving you the cash you need now to exercise your stock options, while you still retain all rights and ownership of those shares.

So if the value of your company’s shares go up, you get to participate in that. And if you exercise early enough, you can end up saving big on taxes (thanks to the long-term capital gains tax rate).

Because most financing solutions are non-recourse (more on what that means later), you only have to pay it back once the company goes public or gets acquired. If that doesn’t happen – or even if your company goes bankrupt – you’re in the clear.

Lastly, with financing solutions you're often just working with one party (instead of looking for a seller on a marketplace). This can be nice if you're on a deadline.

With that in mind, let’s compare these alternatives head-to-head.

Because exercising stock options ends up costing way more than most people expect, it can quickly move out of reach for many startup employees.

And if you wait until an IPO to exercise, you may end up losing a lot of money on taxes.

To help startup employees in this situation, Secfi offers non-recourse financing.

Essentially, non-recourse financing is a cash advance that covers the cost of exercising plus any tax burden that exercising incurs (because yes – it stinks, but you’re probably going to pay taxes when you exercise).

You only pay that amount back when there’s an exit. If there’s no exit or the company fails, you don’t owe Secfi anything. And because your shares act as collateral for the amount financed, none of your personal assets are on the line.

We're selective. Because we partner with employees at companies that we believe are likely to have a successful exit, we both share in the potential gains.

That lets us spread the risk out over a number of different companies. So if your company goes downhill or never exits, we take the hit. Not you.

In addition to the non-recourse aspect of the financed amount, there’s a number of other benefits you get through financing with Secfi:

If you sell your options on a secondary market, you get the benefit of getting a bunch of cash upfront. But if the value of your company continues to rise and your shares are worth way more tomorrow than they are today, you don’t get any of those gains.

With financing, you get to exercise your options and retain ownership of the shares.

So if you think that your company’s value is going to continue to rise, it’s may be in your best interest to hold on to those shares until there’s an exit.

The single biggest surprise most employees face when they exercise is the size of their AMT (alternative minimum tax) liability.

For many employees at rapid-growth startups, that amount can easily soar past $100K or even $1M (yes, really).

Worse: the AMT is calculated based on the current fair market value aka 409A valuation (also known as fair market value). The higher the 409A valuation, the more AMT you’ll have to pay.

And because the 409A valuation keeps increasing as your company grows, then – assuming your company is doing well – the longer you wait, the more AMT you'll have to pay on exercise.

If your AMT bill puts exercising out of your reach, financing can cover the total cost of exercising before that bill grows any higher.

(Note: you use our free Stock Option Tax Calculator to figure out how much you’ll owe when you exercise)

It's frustrating when your stock options are worth a lot on paper, but you can’t tap into that liquidity. Especially if you want to buy a new house, renovate your existing home, or take care of unexpected expenses.

When financing your exercise, you can also get a cash advance on top of your exercise costs, which you’re free to use however you like. That way you won’t have to wait for an IPO to make use of the value of your equity. We call this liquidity financing.

It’s not as much as you would get by selling now on a secondary market, but you get to retain ownership of your shares.

Unlike Forge/SharesPost and EquityZen, there’s no minimum amount for how much you finance. You can finance as much or as little as you like.

Many secondary markets will require a minimum of $100-$175K worth of shares to be sold.

We won't leave you hanging. Just let us know you're on a deadline, and we'll either let you know upfront that we can't make your deadline, or we'll work hard to get it done in time.

For many companies, we can provide financing in a matter of days (because we've helped some of their employees before). For other companies we still need to do a risk assessment, which takes more time. We'll let you know either way so you can plan accordingly.

Because our founder, Wouter, had to walk away from millions in equity when he left a former company, we wanted to make sure that no one else makes the same mistake.

That’s why we created a series of free tools to help you understand what’s going on with your equity:

Stock Option Tax Calculator

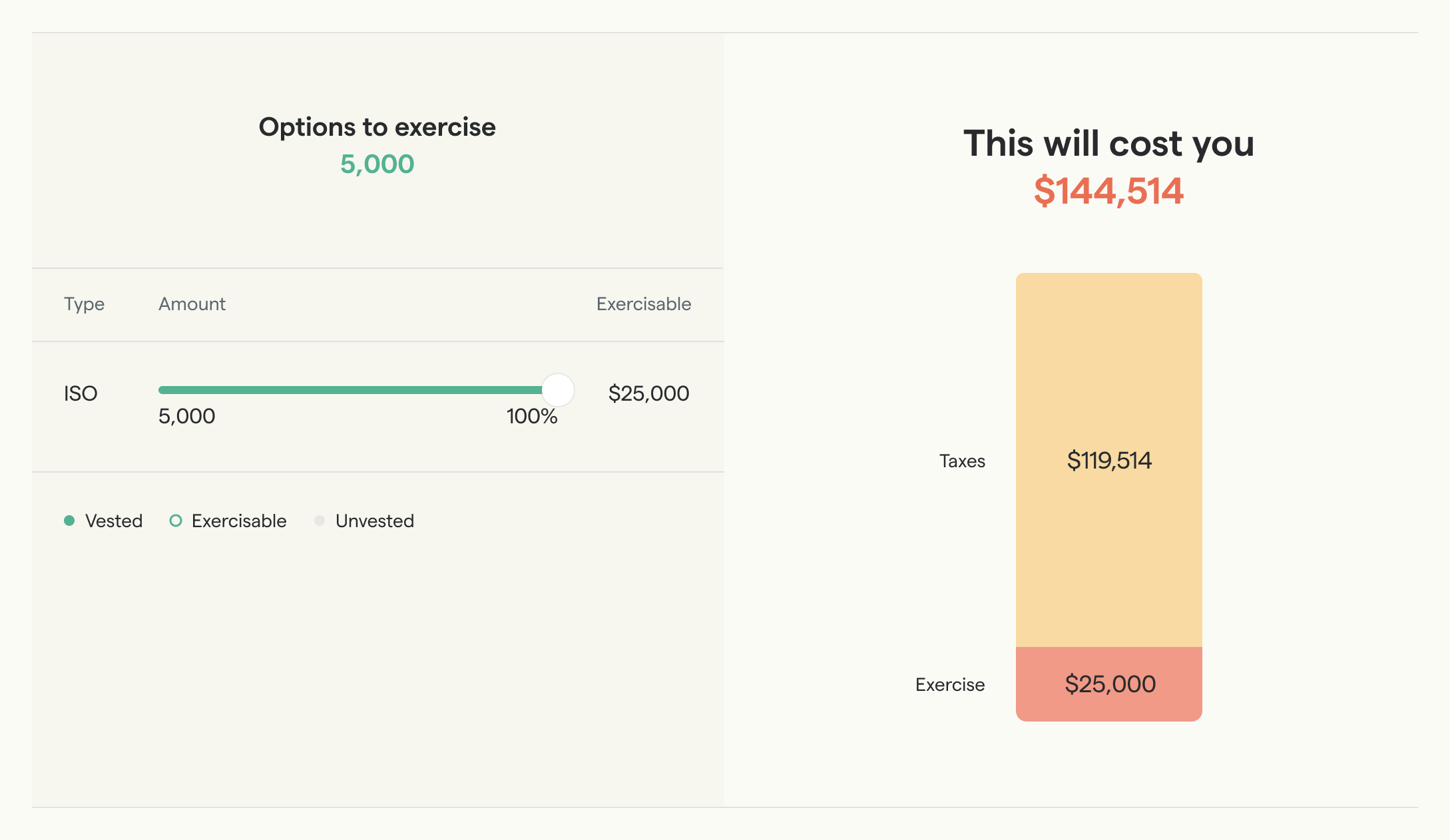

In order to find out how much exercising your options is really going to cost, you need to know what the tax liability is going to be. It's a complicated calculation by hand, but enter your details and this calculator tells you exactly that.

Exercise Timing Planner

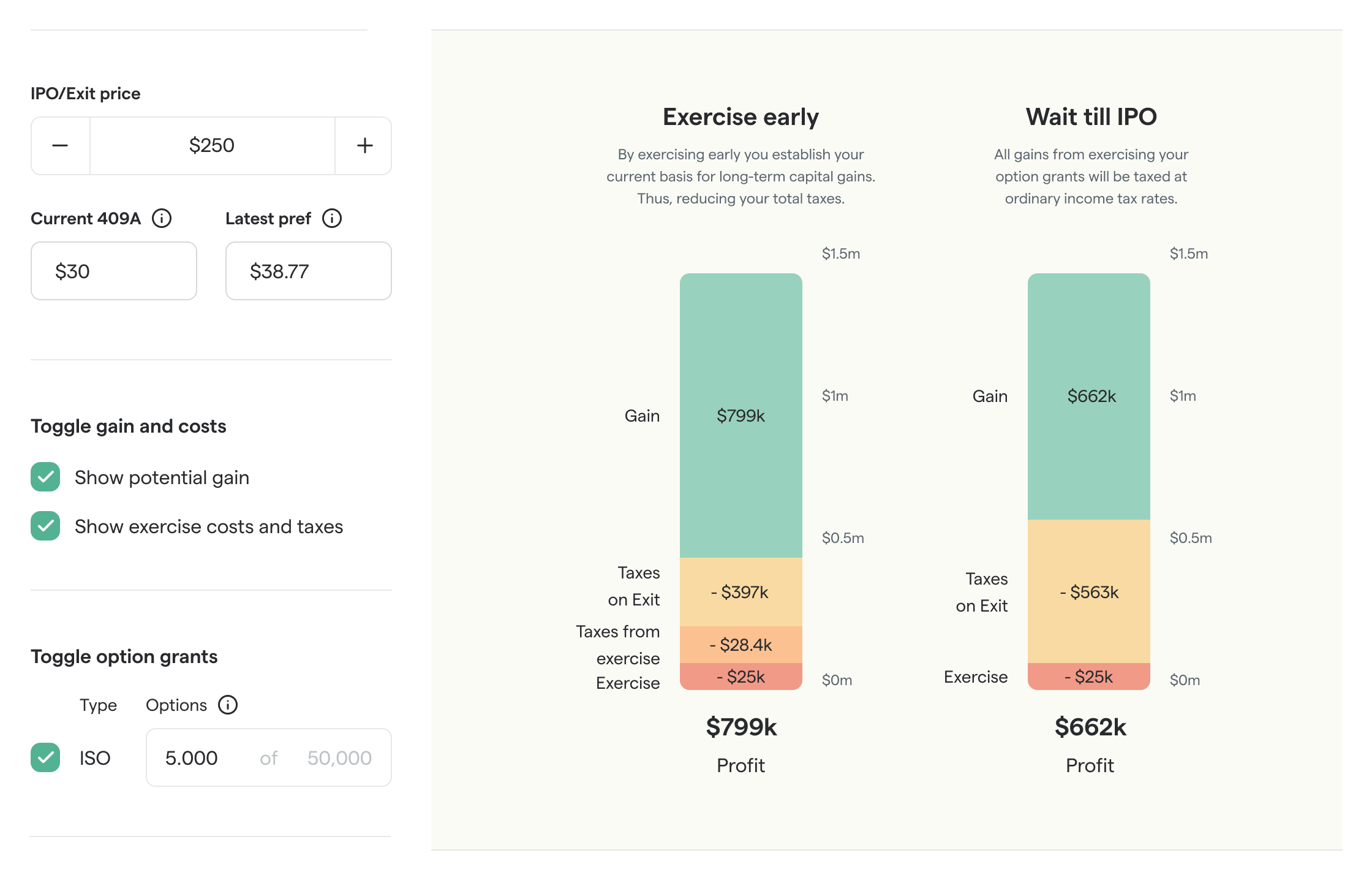

How much more would you earn if you exercise and hold onto your shares for at least a year (and unlocking the long-term capital gains tax savings) versus waiting for the IPO to exercise? This calculator runs the numbers and tells you the additional net gain you could make under various selling scenarios.

While Secfi lets you tap into the value of your options through financing, you won’t get as much cash upfront as you would if you sold your options instead (even though in the latter case you would lose the upside).

The full truth is you don’t know when your company is going to IPO.

So if you finance instead of selling your options, you don’t know exactly when you’ll experience an exit. If you instead sell your shares on a secondary marekt, you get cash as soon as the deal is done (which is often a matter of weeks or months).

SharesPost merged with Forge Global in 2020 and now the combined company operates under the name Forge Global.

Forge/SharesPost acts as a marketplace for selling private company shares so startup employees can turn their equity into liquid assets (aka cash 💰).

It's an advanced platform that has the feel of a publicly traded marketplace.

Basically, you (as the seller) set the price and quantity you want to sell. A broker gets assigned to you, and they try to match you with a buyer. They don't always find one. In terms of time, the process can go quickly (especially for companies in popular demand) but can also sometimes take weeks or months.

As of 2020, Forge/SharesPost charged sellers a baseline fee of 5% for all transactions.

Startup employees that want cash now and don’t want to wait for an exit can sell their shares and gain liquidity.

This is especially ideal if the employee doesn’t feel confident in the future of their company and isn’t optimistic about the potential value of their shares.

The process of selling shares, looking for a buyer and closing the deal can be messy, so it doesn't hurt to have a well-designed environment to place your listing. Forge also offers helpful visualization tools and some information on recent price points.

When you sell your stocks through a secondary market, you get immediate cash but you’re letting go of your ticket to the IPO.

Fair warning – you may wake up with a major case of FOMO one day if your company has a successful exit.

Many companies don’t allow selling shares on secondary markets. For those that do, company approval is required to sell on a secondary market.

It’s not always in a company’s interest to let their pre-IPO shares be traded, so many of them refuse.

Many companies reserve the Right of First Refusal (ROFR). That means when you attempt to sell your shares, your company can step in and decide to buy the shares back themselves.

If that happens, you're still on the hook for the 5% fee to Forge/SharesPost.

Secondary markets tend to favor buyers, not sellers.

The buyers expect to make a profit on the deal, so you can expect to get somewhere in the range of 80% of your shares’ current value.

The money you make is taxed at the highest possible rates

When you make the transaction to sell your options, you're on the hook for the taxes for the money you just made. And unfortunately, your profit from selling your options will be taxed at ordinary income rates – the highest tax rate there is.

You won’t gain any tax benefits the way you could by exercising early, holding your shares for over a year, and then selling – in which case the money you make could be qualified as long-term capital gains and receive a more favorable tax treatment.

Forge/SharesPost requires a minimum selling amount of $100,000. Unfortunately, you can’t pool your shares with other shareholders to meet this minimum (like you can on EquityZen).

Founded in 2013, EquityZen is another secondary market similar to Forge/SharesPost.

It works basically the same way. You list your shares and a broker helps you find a buyer. As of 2020, EquityZen also charged a 5% fee on all transactions.

The biggest difference is that there’s a $175K minimum sale size (as opposed to $100K with Forge/Sharespost), but EquityZen allows sellers to pool their shares together.

Besides that, Forge/SharesPost offers a full-blown marketplace experience while EquityZen has a simpler messageboard-like look and feel.

EquityZen has the same advantages as Forge/SharesPost: if you want to cash out as much as possible on short notice, you can use their platform to find a buyer and sell your equity.

Additionally:

If the shares you want to sell aren’t worth enough to meet the minimum amount on either Forge/SharesPost ($100,000), EquityZen allows you to pool your shares with your colleagues to meet their required $175,000.

The disadvantages of EquityZen are similar to those of Forge/EquityZen:

Additionally, you'll need to pool up with coworkers if the shares you personally want to sell are worth less than $175,000.

It really comes down to whether financing versus selling on a secondary market is best for you.

Secfi was built for startup employees who want to exercise their options before an IPO occurs, who are looking to save money on taxes (and increase their profit), and/or who only have 90 days to exercise their options and need cash to make that happen.

Sharespost/Forge and EquityZen are better options for startup employees who want to be more liquid as soon as possible, or who aren’t optimistic about their company’s future / don't believe in a successful exit like an IPO.

If you've decided that selling is right for you rather than financing, choosing between the two platforms often comes down to which one you can actually find a buyer on. Their platforms have slight differences, but your best bet is simply to try both.