The Snowflake IPO: A case study in tax savings from exercising early

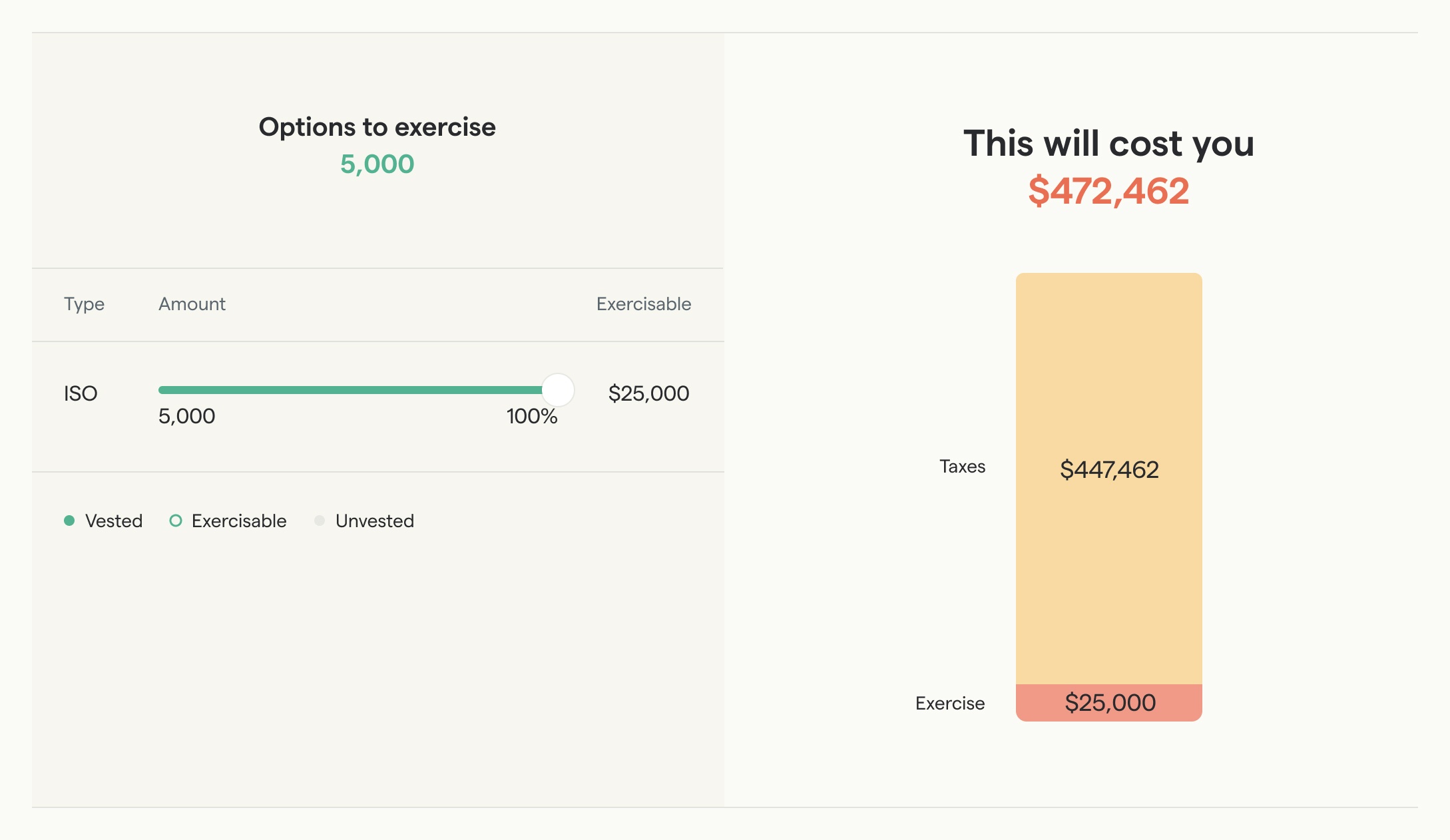

Costs to exercise, now: $472,462 🥵

You probably know what's coming next. If Employee A waited until today to exercise at the $250 public price, then the tax bill goes up to ~$447k.

0 result

Yesterday was Snowflake's IPO. The first day of trading has ended and shares are now trading at around $250+.

Employees who built the company have to be excited. Of course the share price will change before they can sell their shares (there's the usual lock-up period, which you can read more about here), but it looks like there will be a good outcome.

Unfortunately, employees who didn't exercise their stock options likely left a lot of money on the table.

The big decision: when should an employee exercise their stock options?

It's the million-dollar question. It's also difficult to answer as there are lots of implications, and unsurprisingly most end up defaulting to doing nothing.

Unfortunately, that can be a suboptimal decision. Stock options – particularly ISOs – can have huge tax benefits if you exercise early. Assuming your company (and 409A) continues to grow, exercising earlier means:

That's because your taxes at sale get converted to long-term capital gains, which is a lower tax rate. (As long as you meet the holding requirements: sell at least one year after exercising your ISOs, and at least two years after your employer granted them).

Let's use rounded/estimated numbers here. Note that this is all just illustrative.

Employees who started at Snowflake in 2018 likely all have incentive stock options (ISOs) at a <$5 strike price. Say Employee A at Snowflake is granted 5,000 ISOs at $5 strike price.

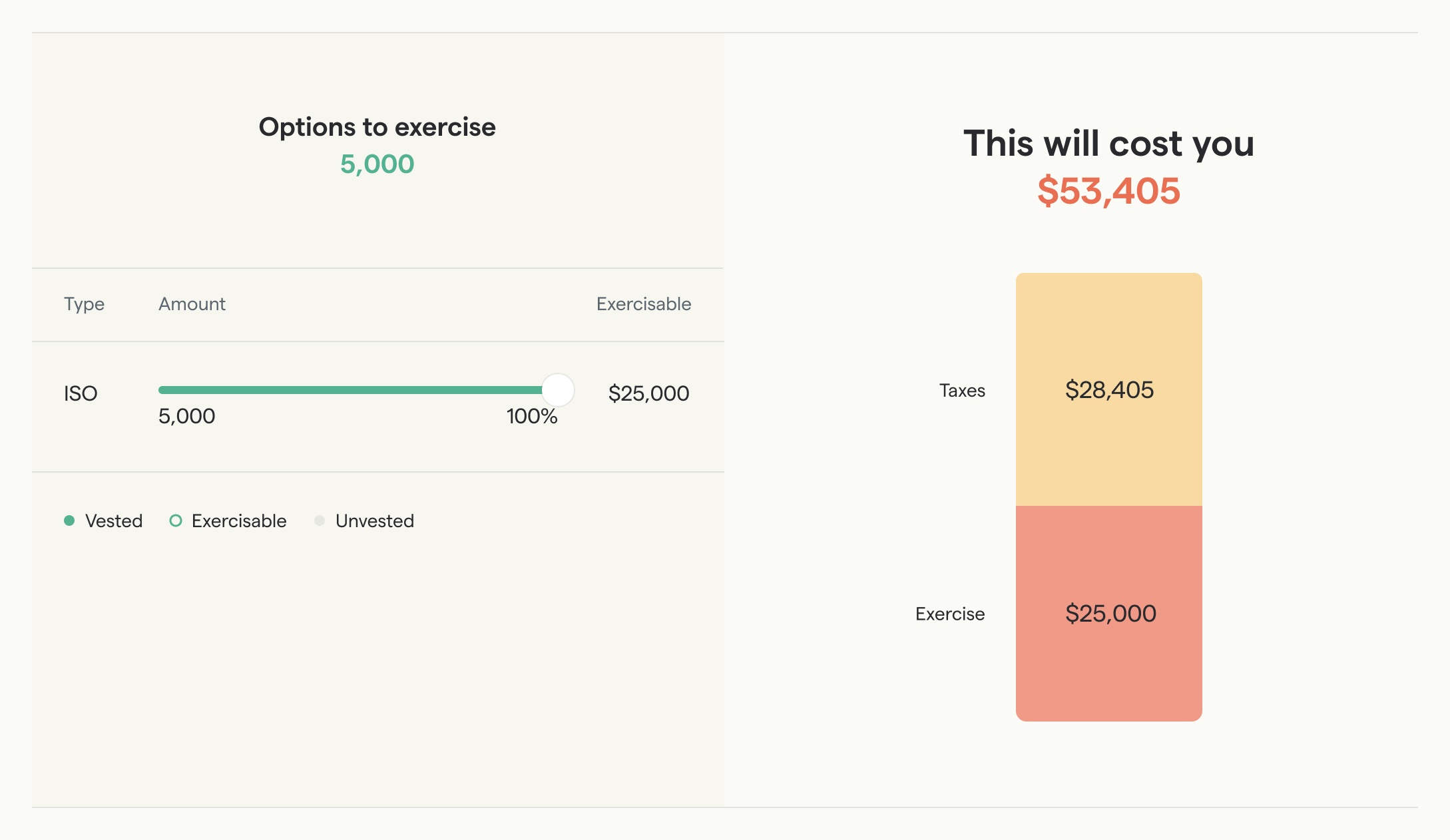

Fast forward to mid-2020 and assume the 409A valuation (also known as fair market value) is $30. Employee A would now need to pay $25k to Snowflake for the strike price and ~$28k in taxes for a total of $53k.

Assumptions: CA resident, married filing jointly, $200k base income

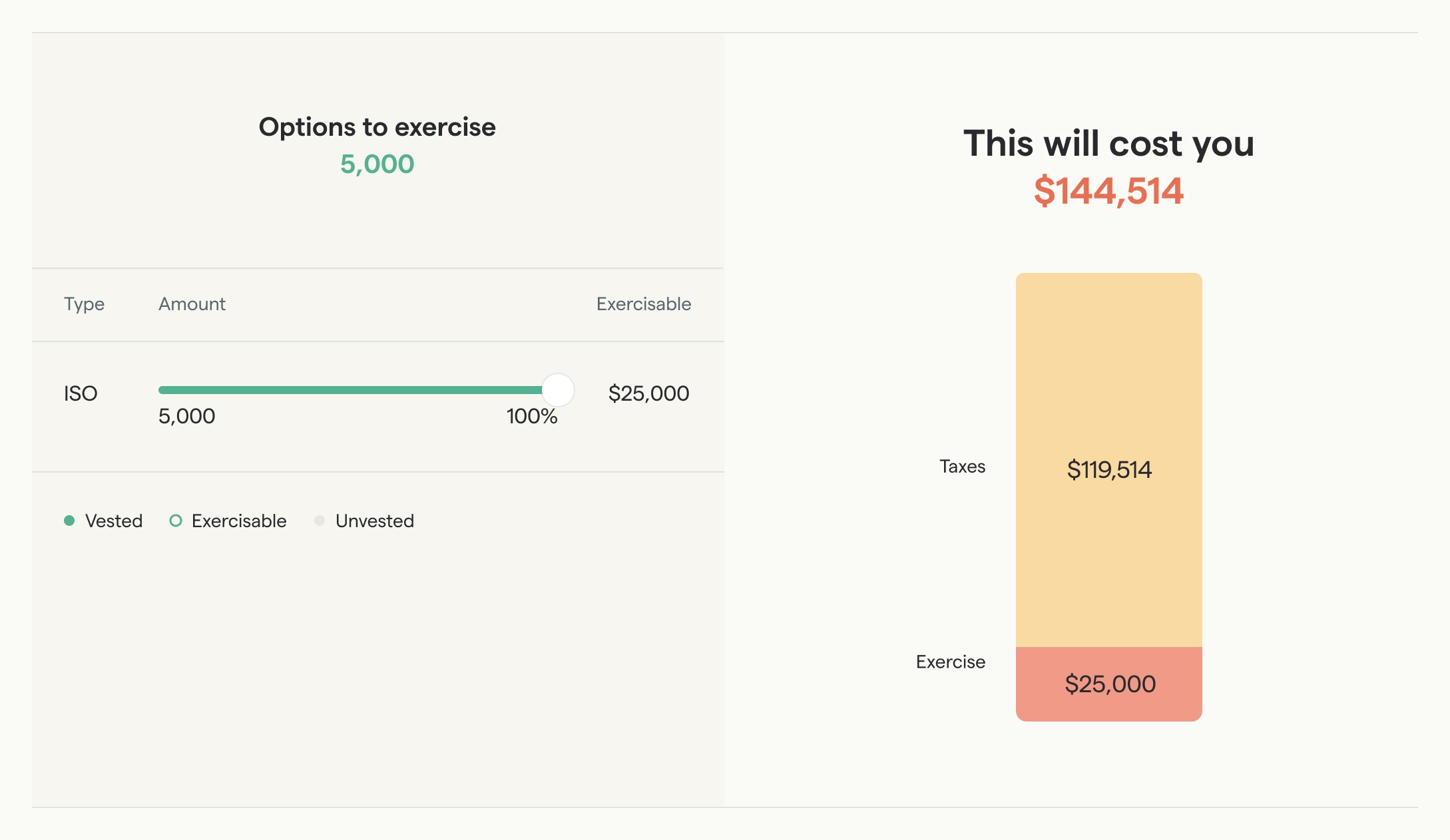

If Employee A waited to exercise until the first IPO pricing of $80 a couple weeks ago, the tax bill jumps up to ~$119k.

Stock options typically get more expensive to exercise over time. After an IPO, most will have to resort to doing what's called a cashless exercise, which means you buy and sell your shares in the same transaction.

It's cashless because you don't need cash upfront: you can cover the exercise costs with your sale proceeds. Taxwise though, this is the worst scenario. You'll pay ordinary income rates (=high) on ALL gains.

So why would anyone volunteer to pay cash to exercise ISOs prior to IPO?

If you exercise and hold on to your equity for two years after grant and one year after exercise, you sell in a so-called 'qualifying disposition' and convert everything north of your strike to long-term capital gains tax rates (=low).

Let's say Employee A decided to exercise in mid-2020 when the 409A was $30. She pays $53k then waits a year before selling after the IPO. If we assume the share price will be $250 when the lock-up period ends in a couple of months, she converts her gain to long-term capital gains and gets an extra ~$135k in her pocket. In other words, she's 20% better off 🥳

By the way, that extra ~$135k is with the $53k exercise costs already factored in. So it's all additional upside.

Don't just wait and see. Each IPO is bittersweet. I'm always happy for the employees, but I also talk to many who realize how much they left on the table. After each IPO, I always hear the same thing:

"I wish I'd exercised years ago."

Stock options and taxes are complicated, and startup valuations are uncertain. Most startup employees do not feel well equipped to make these decisions. Investment risk, available cash, personal situations, ability to leave job, etc. all play a factor. Planning ahead allows you to anticipate these risks and avoid (some of) the costs.

So startup employees: Make sure you're being conscious about your stock options. Know the potential risks and benefits from exercising. If you don't know, talk to an equity strategist or people that do know. There's too much money on the table to ignore.

Feel free to hit me up for a quick chat in the bottom-right if you've got any questions.

Disclaimers:

There is no guarantee of future performance or success. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any investment strategy will achieve its objectives.

No private company is guaranteed to conduct an Initial Public Offering (IPO). Investing in private companies involves significant risk, including the potential loss of your entire investment.