0 result

Hi there,

Hope you all had a good weekend! Vieje back here again with an extra special newsletter because today marks newsletter #50 of Founders & Funders!

Back in 2022, we had an idea to launch a newsletter for startup founders, employees, and investors. We knew that we had a lot of users at Secfi who wanted to learn more about equity compensation, startups, VC, and financial planning. But we had no idea if the newsletter would be well received or if anyone would actually read it.

I wrote our first newsletter Stonks don’t always go up (and that’s okay) back in July 2022. I went through about 10 different drafts with my colleagues and it took me about 30 minutes to finally press send. My emotions were a mix of relief and panic. Pretty much every negative thought crossed my mind at that point. What if it sucks? Is anyone going to read it?

Thankfully we have some awesome readers who provided both positive and constructive feedback, and continue to do so to this day. As I write this, I couldn’t be more grateful to you all for the kind words and feedback. On behalf of John, Chris, myself, and the rest of the Secfi team, thank you for making this newsletter what it is today. We’ve had a lot of fun writing this newsletter every couple of weeks for the past two years. We hope that you all have enjoyed reading it and have taken some of the tidbits to better your financial lives.

A lot has happened since we started writing this newsletter. For newsletter #50, we wanted to take a short look back on what’s happened in the past two years since we launched Founders & Funders, and then end with some feel good vibes on why we’re optimistic for the next two years when we hit newsletter #100.

Back when we first started in Q2 2022, it felt like the sky was falling for the tech and VC world. In our first newsletter, I wrote that H1 2022 was the worst first half of the year since 1970. The Nasdaq 100 was down by over 28%.

The first set of layoffs were just starting and valuations were plummeting both in the public and private markets. VC firms had mostly stopped deploying capital by the time Q3 hit. Investors were advising their portfolio companies to start planning for a rough year or two at least. That was sound advice back then.

Looking back, those were scary times in 2022. A lot of us, including myself, who joined the workforce after 2008 had not gone through a correction and bear market like this in our short work lives. Deep down, we knew these things were cyclical but how long was this going to last? And how many companies would need to go through more layoffs, down rounds, and even shutdowns until things came back?

Unfortunately, the answer was a lot more. 2022 was not a fun year for pretty much anyone in tech or VC. Optimism for a better 2023 was around and there was some hope that we’d have at least a bit of a recovery. Unfortunately, Q1 2023 brought a banking crisis that was not on anyone’s bingo card.

In March of 2023, Silicon Valley Bank which had been a stalwart institution supporting the tech, startup and venture capital world since 1970 went through a bank run. John wrote about it in a newsletter, Lessons from the Silicon Valley Bank Collapse. In short, the bank took on too much risk, and poor communication resulted in panic ultimately causing their downfall.

To make matters worse, some local and regional banks followed in SVB’s footsteps. The most notable was First Republic, another large bank with a focus on tech and VC. In a matter of months, tech and venture capital lost two of their biggest banking partners. This left a void for both companies and individuals across the ecosystem.

In the fall of 2023, we had a dash of hope as some tech companies decided to brave the choppy waters and go public via an IPO. ARM, Instacart, and Klaviyo decided to lead the way in September. While each was a relatively successful IPO, the market reception was mixed and the IPO window closed for the rest of the year.

However, for the first time… there was a glimmer of hope.

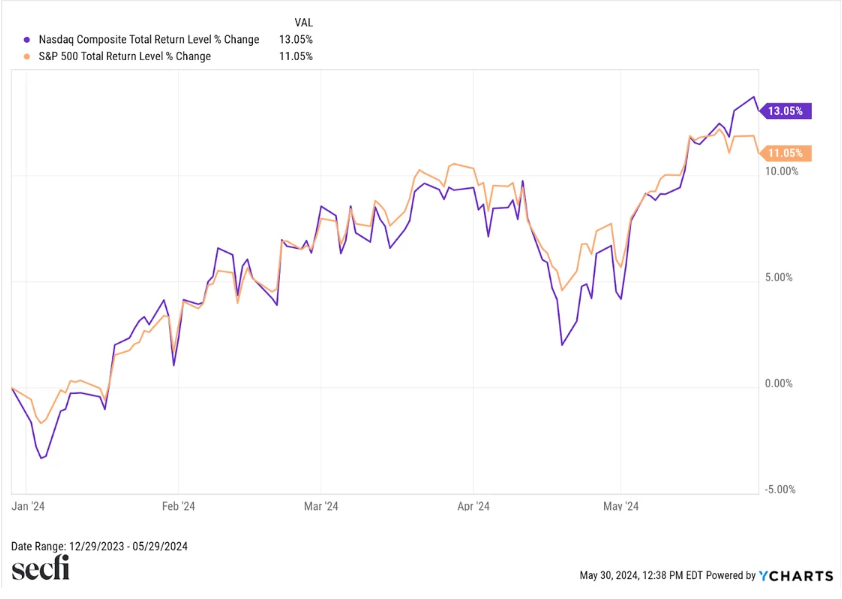

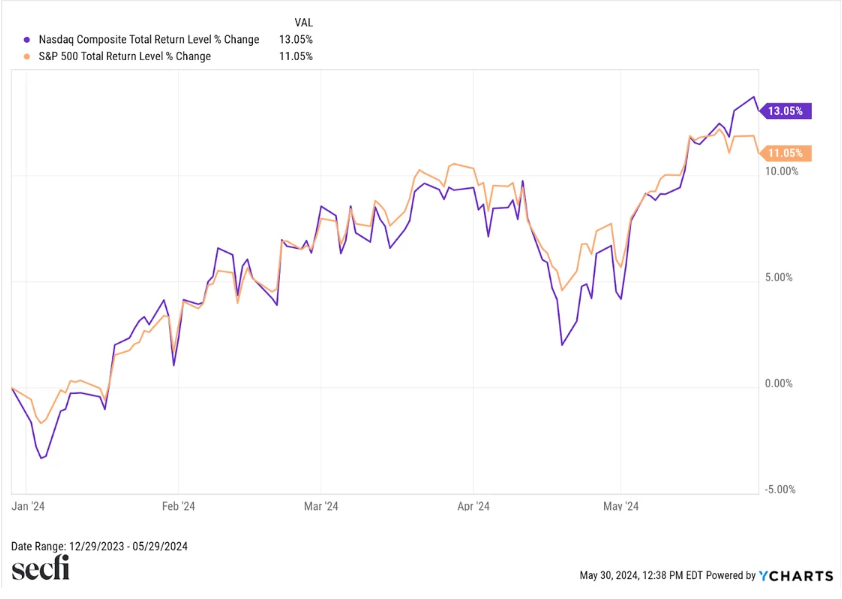

So far, 2024 has largely been a positive one for all of us, especially considering the relative position to the last 2 years. The S&P 500 is up 11.05% YTD and the Nasdaq 100 is up 13.05% YTD as of May 29, 2024. Secondary market activity has picked up significantly in Q1 and Q2.

Source: Ycharts. Data accessed on May 29, 2024.Past performance is not indicative of future results.

Successful Reddit, Rubrik, and Ibotta IPOs have sparked renewed investor interest in tech and the consensus expectation is that there will be more IPOs this year. IPOs mean liquidity for both employees and investors. That liquidity will get recycled back into the tech ecosystem. Markets are cyclical and recent indicators have been quite positive.

Besides the market resurgence, there’s plenty to be excited about. First, we believe we are in a much healthier position now that the “tech tourists'' are gone. I’m not sure who to give credit for the terminology, but it’s been widely used to describe the individuals who came into our world during the bull market times and left when things started getting hard.

I welcome all who want to come into the startup and tech ecosystem and build. We need more builders. But anyone that’s worked at a startup knows that it takes a lot of hard work and dedication to grow a company. Using another Silicon Valley cliche, we want missionaries not mercenaries. Our ecosystem is much healthier nowadays that the tourists have left.

Another reason for optimism? Advancements in technology over the recent years have been exciting, specifically AI. By now, we’ve all seen the power of tools like ChatGPT and DALL-E. We now have the ability to automate more mundane tasks, freeing up valuable time for us to work on higher level projects.

My future kids might be able to have an AI tutor accelerating and supplementing their education. I envy kids in school nowadays a bit. Having trouble understanding a certain topic? Our children will be able to plug that into an AI tool and have it explained in a way that resonates and works for them.

Back in the late 2000s and early 2010s, mobile and cloud technology ushered in a new era of startups. We went from calling taxis to booking a ride via our phones through Uber and Lyft. Food orders went from phone and website directly to apps like DoorDash. The gig and sharing economy was born as a result. New jobs were created and our lives became easier and more convenient.

The emergence of mobile and cloud technology resulted in a decade-long boom in tech. Looking back on that time, you can draw parallels to today’s new boom in AI. The emergence of AI technology could usher in a new generation of startups solving today’s biggest problems and improve quality of life for everyone. Additionally, who knows what else smart and creative people will come up with that I haven’t even imagined!

Innovation never stops and I believe when we write newsletter #100 in two years, there will be even more new things to be excited about because of what you all have built.

Thanks again for being awesome and we can't wait to continue to this newsletter to edition #100 and beyond!

Things we’re digging: