Most companies have strict transfer restrictions, meaning that they may block you from selling shares outright or perhaps impose restrictions such as that you can only sell a percentage of your shares. Some even require that you sell the shares at or above a certain price to be approved, although this is rare and reserved for some of the top tier companies that can command a minimum. Some companies also may charge transaction fees for legal and administrative costs for selling on a secondary market. Some may also have a right of first refusal (ROFR) where you need to present your potential sale, and they have the right to buy back your shares first (not necessarily a bad outcome, but adds another layer to the process).

The reason for these restrictions is because, as a private company, they want to ensure their cap table is clean and most want to know who owns their shares. It’s about protecting the integrity of the company, but it doesn’t necessarily mean you can’t sell your shares.

But, it does mean two things on the secondary markets:

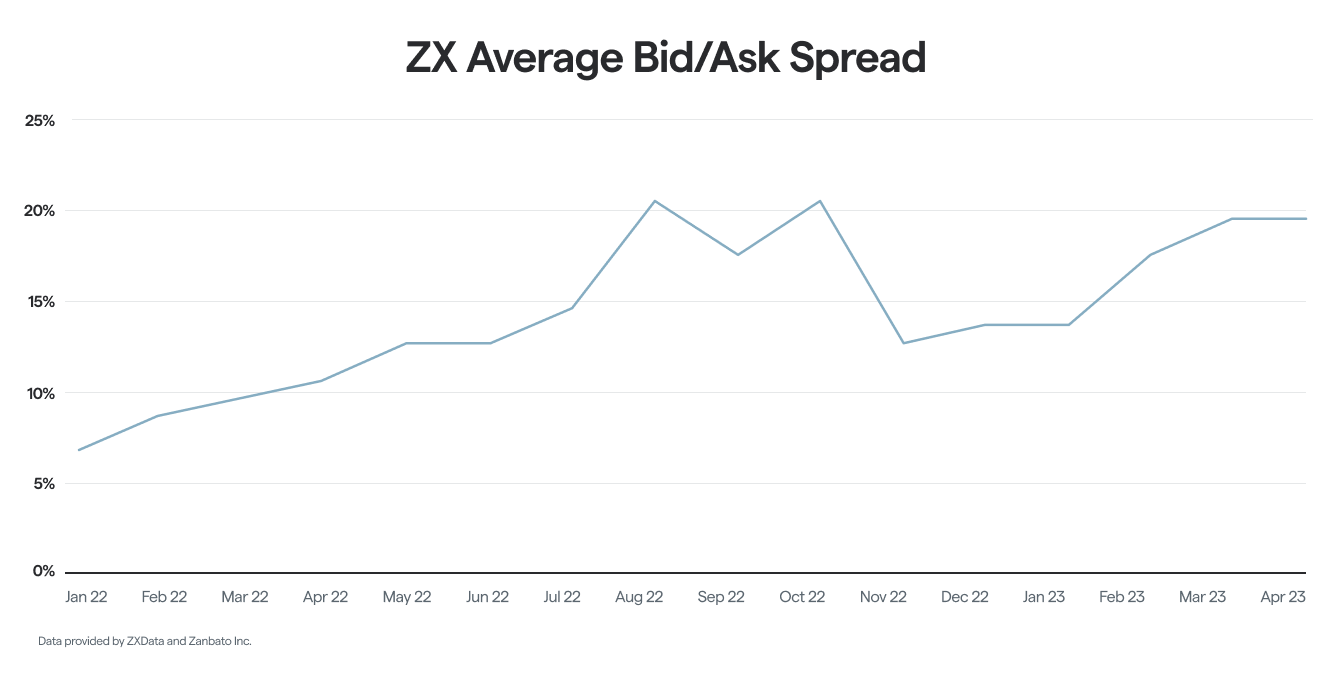

- Trading volume is lower compared to public markets.

- Information asymmetry between buyers and sellers can be very high.

First, due to these restrictions, the fact that buyers are typically looking at late-stage startups, and that not all potential sellers (employees or execs) are looking to sell means that volume is lower than public markets. Plus, volume can fluctuate based on macroeconomic trends — like when people are more interested in selling vs. holding out for an IPO.

Second, unlike public stocks where (generally) all information about a company is available to the public, that’s not true for a private company. There’s also no such thing as “insider trading” in the secondary markets. Good investors on the public markets will often ask, “who’s on the other side of this trade?” In the private markets, most buyers are institutional investors who can often know more about your company than even you.

Another difference in the secondary markets is that not all sellers are on a level playing field. Volume-based pricing happens in the secondary markets and access to investors matters significantly in this world. Someone selling $10M worth of shares will likely command a better price per share than someone selling $100k worth of shares. Secondary buyers prefer to buy in large blocks to limit the administrative and legal work. Generally, people with more stock (founders and executives) tend to have better resources to bypass restrictions as well as find buyers.

Even when you don’t have these restrictions, or are able to bypass them, finding a buyer can take time. And, even if you find a buyer, you’ll likely still need to go through your company’s administrative and legal process. If you’re on a tight timeline — for example, you left your company and have 90 days before your equity expires — completing a transaction within that time frame may not be in your control.

All of this is not to discourage any of you, it’s just the reality of what happens on the secondary markets. If you do want to sell, you should find out if your company has any restrictions first and then set realistic expectations about the process. Selling on the secondary market can still be a great outcome and may make sense for you.

So, what’s happening in secondary markets right now?

🚩 The state of the secondary markets in 2023

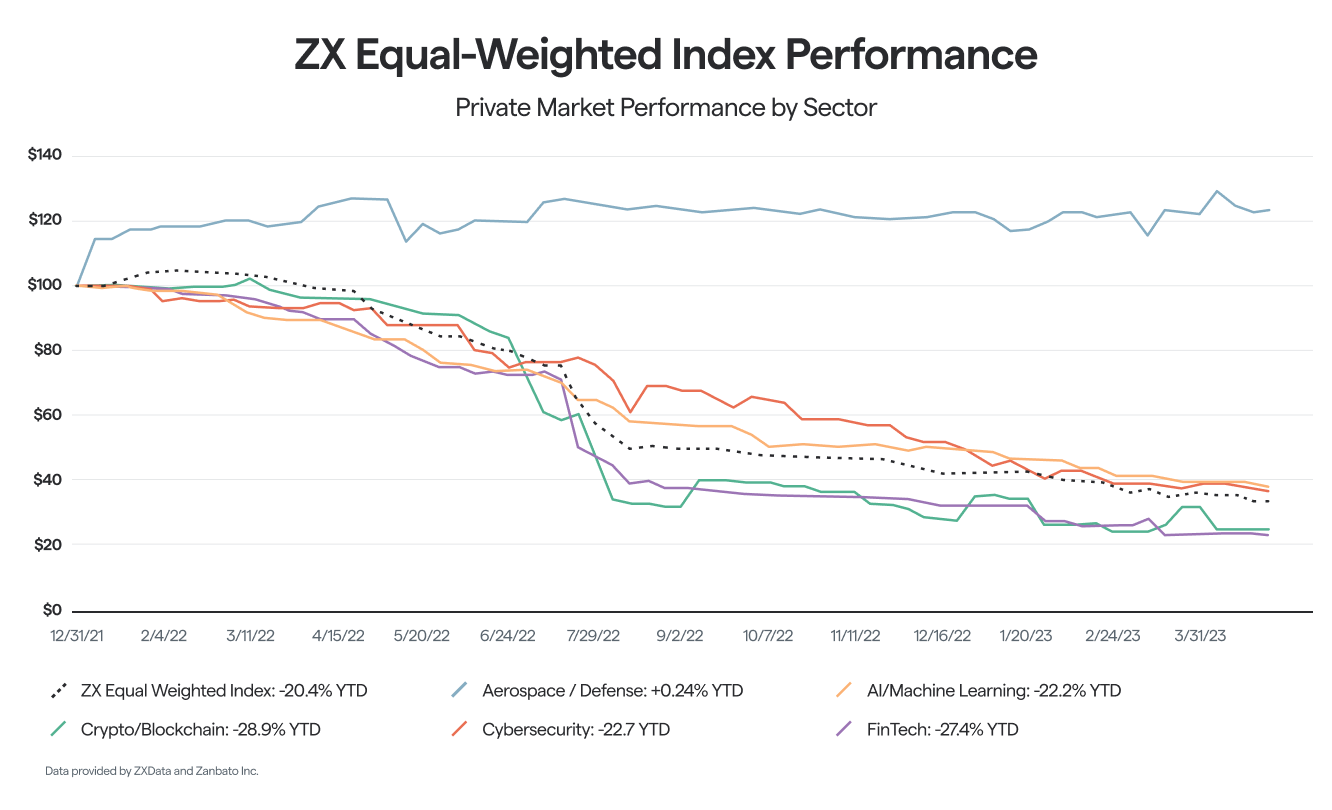

This should be no surprise given the pullback in tech, but the secondary markets aren’t as rosy as they were a couple years ago. Pricing and volume are down significantly since the start of the bear market, and that’s mostly true across all sectors.