0 result

Hi there,

It’s John here. This is my last newsletter before I take off on a vacation with my wife to celebrate her being cancer free! The last couple of years have been fairly stressful for us with a lot of uncertainty in markets/startups and a cancer diagnosis to boot. We’ve been through a lot and I can’t wait to disconnect and relax for a bit! If you have any recommendations for our time on the big island of Hawaii, I’m all ears.

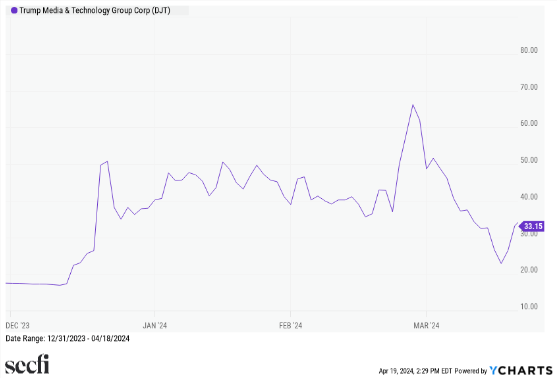

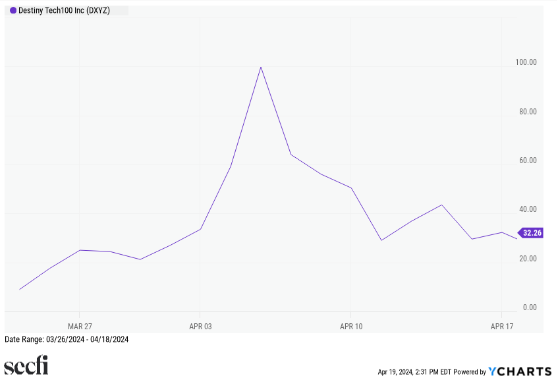

In the past couple of weeks, we’ve witnessed some odd market behavior. Particularly in two stocks, Trump Media & Technology Group (DJT) and the Destiny Tech100 (DXYZ) closed end fund. Both have experienced incredible volatility.

DJT is the owner of Truth Social and had paltry revenue of $4.1M in 20231, but reached a market capitalization of nearly $8 billion at its peak, and as of the close on April 18th, 20242, it still had a market cap of nearly $4 billion. Investors are paying nearly 1000x revenue for this stock. I believe this is insane. I don't think anybody in their right mind would value this company based on fundamentals at $4 billion. And yet, here we are!

DXYZ is a “closed end fund”, meaning it owns a portfolio of investments and that portfolio is traded on the exchange. The unique thing about DXYZ is that its portfolio is made up of private companies that are not available to the general public. It’s a way to access exposure to hot startups, which is pretty cool. But the net asset value (NAV) of the portfolio is ~$50 million or $4.84/share3, while DXYZ traded as high as $105/share on the open market, and as of the close on April 18th 2024 traded for $32.26/share, a premium to NAV of 667%. That means that the underlying portfolio needs to appreciate 667% for buyers at $32.26 to just break even! The risk/reward tradeoff seems crazy to me. When you buy a share of DXYZ, you get $4.84 of startup exposure and $27.42 of silliness.

Like almost everything, prices in the stock market are determined by supply and demand. In these two situations, there’s clearly lots of demand. And that demand doesn’t seem to be based on fundamental business reality (i.e. they’re memes). Maybe the demand side changes, but who knows, that’s anyone’s guess. The supply of shares is more straightforward. All you have to do to push the price down is flood the market with more shares!

Supply of shares can come from the company itself, insiders selling their closely held shares, or short-sellers. If these companies wanted to, and could successfully jump through the administrative hoops, they could issue more shares to the public at these high valuations and use the cash to hire engineers for their platform, buy more shares in private startups, or whatever they want. Flooding the market with supply this way would probably decrease the value of any single share, and bring the valuation closer to something reasonable. The other way for supply to meet demand is for insiders to let go of their shares and sell them to the public. I’d wager a large sum of money that insiders at DJT will do just that as soon as they are no longer prevented from doing so by lockup agreements.

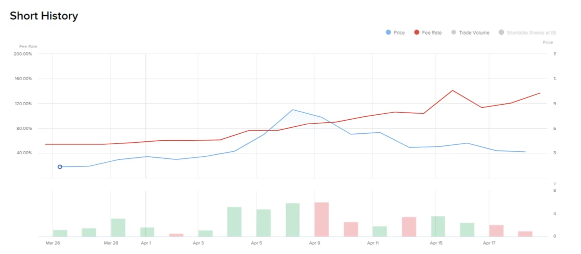

The third way for supply to be created is via short-selling. And both of these companies look like good short candidates at these prices. But short-selling isn’t free. To short a stock, you have to borrow it first. To borrow it, you have to find someone that has it and is willing to lend it to you. And they will, for a price! And that price is determined by the demand to borrow.

Check out the interest rates being charged to borrow shares of DJT and DXYZ on Interactive Brokers. It costs you nearly 300% annualized to borrow a share of DJT right now. Over the past few weeks that rate has reached nearly 900%. Borrowing DXYZ will cost you a cool 160% annualized right now4.

If the companies themselves aren’t issuing more shares, insiders can’t sell, and short-sellers can’t economically borrow shares to sell, supply is constrained and prices can remain stupidly high. At some point, I believe the forces of economics will prevail and supply will come into the market, but when is anyone’s guess.

Personally, I find this amazing. Prices contain so much information. Here we have some absurdly priced assets that many people believe will fall, but they can’t profit from that view in a reliable way because the cost to borrow the shares, which is another price, is so high!

While the reasons for these weird market situations are interesting (at least to me), the deeper point here is that markets have an incredible ability to equilibrate supply and demand via prices. I believe investors who have a long-term approach that considers price in the investment process can more easily kick back and rely on that to help generate wealth over the long run and, in my opinion, those investors can ignore this type of silliness when it rears its head.

1. Trump Media & Technology Group S-1

2. Ycharts data accessed on April 18, 2024

3. Destiny Tech100 Inc. form N-2

4. Interactive Brokers data accessed on April 19, 2024; Past performance is not indicative of future results.