0 result

Vieje back here with a very timely newsletter — we learned last night that Capital One is acquiring fintech startup Brex for $5.15 billion. First, congratulations to everyone who built the company into what it is today. Getting to a multi-billion dollar exit is no easy feat, and those of us building companies know just how much the founders and employees had to push through to get here, especially over the last few years.

I’m always excited to see successful exits, but this one hits close to home for me. FinTech has been through a lot lately. We needed a win, and this was a big one. On a broader level, the ecosystem is off to a great start this year, and I hope it continues into an exciting 2026 for exits and liquidity.

Without having the full details, this looks like a strong outcome for both investors and employees. Oddly though, the tone on X and social media feels… a bit off. Yes, there are always trolls that love to hate, but beyond that, it seems like some people view this as a letdown.

Let’s jump in, break this down, and dispel some of the negativity.

For most startups, selling for $5B is the definition of “dream outcome.” But Brex was one of the few companies that had truly massive ambitions.

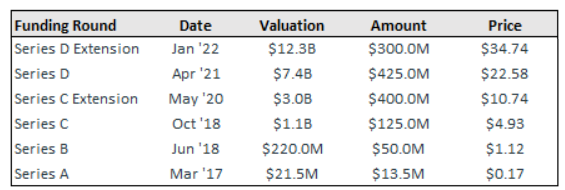

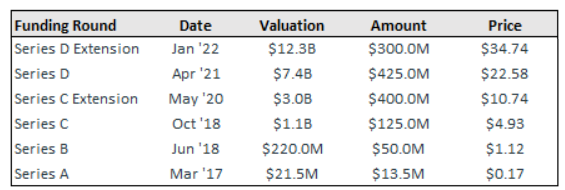

The company was hot right out of the gate and raised multiple rounds quickly after Y Combinator in 2017. Brex eventually raised a Series C at over a $1B valuation roughly a year after YC*.

In 2021–2022, the company raised at a peak $12.3B valuation in its Series D Extension round*. Like many companies during that era, it set a very high watermark valuation. And if you play the “what could have been” game, comparing a $5B exit a few years later doesn’t feel great, but that’s the wrong lens.

It seems like only a small handful of companies have been able to sustain and grow into their 2021 valuations. The vast majority of those companies won’t get to a great exit, and many have already shut down. Brex turning this into a multi-billion dollar outcome is impressive and worth celebrating.

Based on what’s publicly available, early investors did really well, growth investors did well, and late-stage investors did fine.

(Source: Caplight Markets)

It was a fantastic outcome for YC and Ribbit, who invested when the company was valued at $25M or less. I believe Series C investors (including extensions) likely made money, given entry points in the $1–$3B range. It may not have been the absolute bull-case for everyone, but in my view doubling or tripling is still a great venture outcome.

It gets more complicated with the Series D and D extension investors who invested at $7.4B and $12.3B*, meaning those rounds were “underwater” at a $5B exit. You might assume that means they lost money, but…

(Shoutout Coach Corso — happy retirement!)

Many of these investors were likely protected by liquidation preferences, which generally means they get paid back before common shareholders (after debt is repaid).

So, if the deal proceeds as a standard structure:

Absent anything unusual, both Series D and D-2 investors get all of their capital back. That’s not a “win,” but in the context of 2021–2022 vintage investing, it’s better than what many funds have experienced from their investments.

Good news: based on what I know, it looks like many of them did.

Using the same simplified flow:

Based on public reporting and the rough numbers (debt around $235M, Series D / D Extension around $725M combined), that could still leave $4B+ for common + earlier preferred holders1.

Two important caveats:

One thing I’m seeing on X is people assuming that anyone who joined after the $7.4B or $12.3B rounds “lost money.” Without knowing 409A history, that’s not necessarily true.

The key thing people miss: the preferred price (e.g., a $12.3B valuation) is not the same as the 409A or common stock valuation. For many companies, the 409A can be a fraction of the preferred price — sometimes 25% (or even lower). And after the market reset in 2022, many companies repriced grants or issued new ones at lower 409A valuations that lowered strike prices further. The Information reported that Brex did just that and repriced employees’ options.

Bottom line: a lot of employees could have likely done well — and even some later-stage hires may have had meaningful upside. The founders, as the earliest employees, likely took home very substantial outcomes to the tune of hundreds of millions.

If you reset expectations after 2022, this is a fantastic result for many of the people who built Brex. Congrats again to all our friends at Brex!

Feel free to reply if you think I’m missing anything or just want to say hi.

*Sources: Caplight Markets, Capital One

1 This is an estimate only.

Things we’re digging: