Eric Thompson, CFP®

Lead Financial Advisor

As a CFP® at Secfi, Eric guides clients through the complexities of equity compensation, integrating it into their broader financial goals.

0 result

Happy 2026, and welcome back to reality. Hopefully you got to take some time off over the holidays to take some deep breaths, spend time with family, and separate from the grind.

Eric here this week with a look back at the year that was and a look forward to the year ahead. For me, 2025 was a year of personal growth and meaningful life stages. A year ago, I left one of the largest registered investment advisory firms to join Secfi and help build our Wealth practice. I also had the pleasure of getting married in the mountains of Colorado last summer. One can only hope for another great year of building, learning, and purpose ahead.

As for the markets, the IPO window was thrown open in 2025 as companies finally found their footing in an easing U.S. economic environment. Public listings roared back to life. According to EY, Q3 2025 was the most active quarter for U.S. IPOs since 2021, a milestone that signaled a long-awaited thaw after years of rate hikes and regulation.

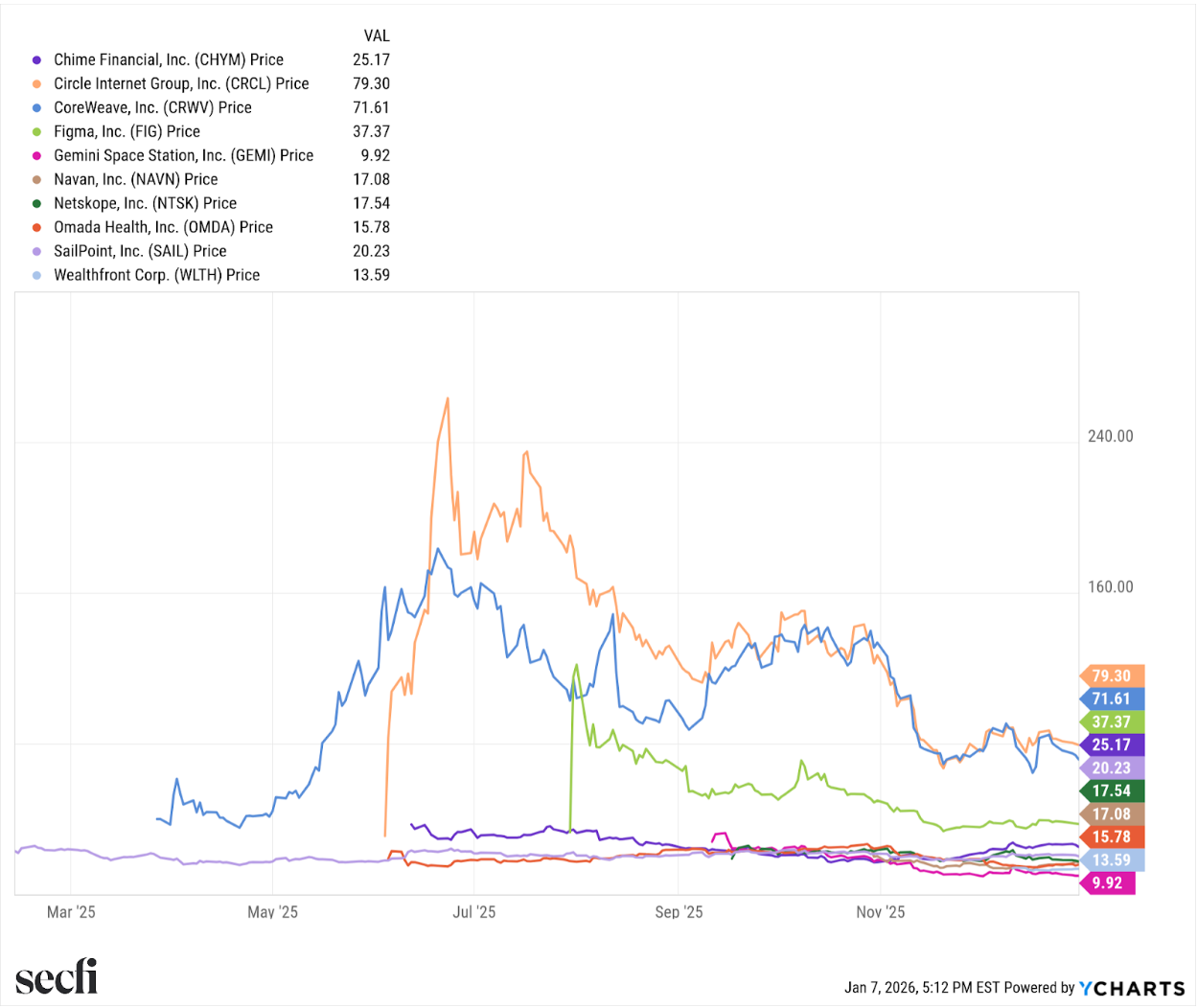

Fueling the resurgence was the dominance of AI. CoreWeave (CRWV) delivered the largest tech IPO since 2021, riding insatiable demand for AI infrastructure and proving that public investors were ready to pay for real compute at real scale.

The long-anticipated Figma (FIG) debut finally arrived in July, kicking off with the kind of explosive first-day performance bankers dream about.

Crypto also had its moment back in the spotlight. Circle (CRCL), Gemini (GEMI), and Bullish (BLSH) all tapped public markets, marking a renewed appetite for digital asset platforms. Meanwhile, names like Netskope (NTSK), Navan (NAVN), Omada Health (OMDA), and Wealthfront (WLTH) rounded out a class of IPOs that had been patiently waiting in the wings for years.

While each company had its moment in the spotlight, post-IPO performance has been decidedly mixed. Strong opening days, powered by a limited float of available stock to trade, followed by choppy weeks and months ahead as countless new participants engage in price discovery and expiration of lockups. A pattern that has become increasingly familiar as companies transition from the private to the public markets.

Past performance is not indicative of future results.

I believe this dynamic ties directly into the broader “private for longer” trend that has made headlines in the post-ZIRP era. For high-growth companies, more and more value creation and capital appreciation is occurring while companies remain private, with businesses reaching meaningful scale and maximizing their market cap before finally going public. Operators appear to be maximizing their final opportunity for a meaningful capital raise at top valuations, using the hype of US IPO markets to do so.

One clear takeaway from recent history: for employees at leading private companies, maximizing equity ownership and upside capture ahead of an IPO has historically proven to be advantageous. Thoughtful strategies around participating in late-stage tender offers or secondary transactions can help lock in gains and reduce concentrated exposure to the inevitable volatility that comes with public markets, often without meaningfully sacrificing long-term upside.

In my view, there’s no capital raising arena quite like the U.S. public markets. Looking ahead, the hope is that this momentum carries forward into 2026 with recent confidential IPO filings from Kraken and most recently Discord, while a SpaceX signals a potential 2026 IPO after a meaningful bump in valuation. When conditions are right, I believe the U.S. public markets remain unmatched in their ability to fund innovation, absorb scale, and foster growth.

As an optimistic capitalist, I’ve been excited by the advancements and competition in the AI model space. The bubble narrative: raising meaningful questions about future data sources, energy requirements, and profitability, is being sidelined by investors' insatiable desire to fund our future digital overlords (kidding of course - love you guys) along with the willingness of public companies to spend their immense free cash flows in effort to lead in this space. While it currently looks uncertain that any of the private model companies will IPO this year, betters on Kalshi are putting a 65% chance on an Anthropic exit this year.

In 2026, big tech will likely continue to get bigger. Significant cash flow is allowing for investment into talent (see massive pay packages for top AI researchers) and inflated valuations allow for all-stock deals. Couple this with an easing FTC regulatory environment and the startup ecosystem is primed for growth, deals, and exists.

The trend of private for longer in the startup space is likely to continue as well, along with purchase and tender offers to provide late-stage employees liquidity amidst new rounds of capital raises. If you work for one of the companies that has yet to go public (looking at you Canva, Databricks, and Plaid amongst the countless others), now’s the time to plan ahead.

As my colleague Vieje laid out earlier this year:

Liquidity is on the horizon, taxes and potentially AMT credits are coming, and this meaningful event can shape your future life and lifestyle. As paper wealth transitions to tangible, liquid wealth, there are questions to ask yourself - from ‘What’s my selling plan’ and ‘How do I make the most of this opportunity’, to ‘What do I want my life to look like after this amount becomes reality’? For those with a large enough stake to reach financial independence, where might you seek purpose without the need to work? Maybe a question we’ll all be asking ourselves when AI takes over.