Eric Thompson, CFP®

Lead Financial Advisor

As a CFP® at Secfi, Eric guides clients through the complexities of equity compensation, integrating it into their broader financial goals.

0 result

Eric Thompson back this week following an incredible ski trip with colleagues. One thing I’ve always appreciated about the startup world is a culture that places genuine emphasis on enjoyment and connection. Sharing meals and experiences over amusing stories from our past, conversations around what makes us tick and highlighting what our lives are like outside the workplace has a way of making the work itself feel more meaningful. Secfi feeling more like a team than disparate cogs working at desks scattered around the globe. Appreciating the human connection that binds us all in this growingly virtual world.

But enough from what’s starting to sound like my gratitude journal. I’m kicking this off with a hot take:

The democratization of finance is just Wall Street's latest product launch.

I get that you’re no stranger to private equity. Reading this newsletter, there’s a high probability that you’re holding a sizable part of your balance sheet in a private, illiquid company. This naturally comes with its benefits (exclusivity, potentially enormous upside), alongside its drawbacks (illiquidity, complex administration and taxation). Such investments have their place when properly allocated and well understood.

What gives me pause is the growing push to repackage complex, esoteric assets and market them as “access” for everyday retail investors. In many cases, what’s being framed as democratization is really a hunt for fee-generating exit liquidity. The dam is being opened wide enough to pass the risk downstream. The more wealth you accumulate, the more of these pitches you’re likely to experience. Some compelling, others risky.

To that, I’ll simply say: caveat emptor.

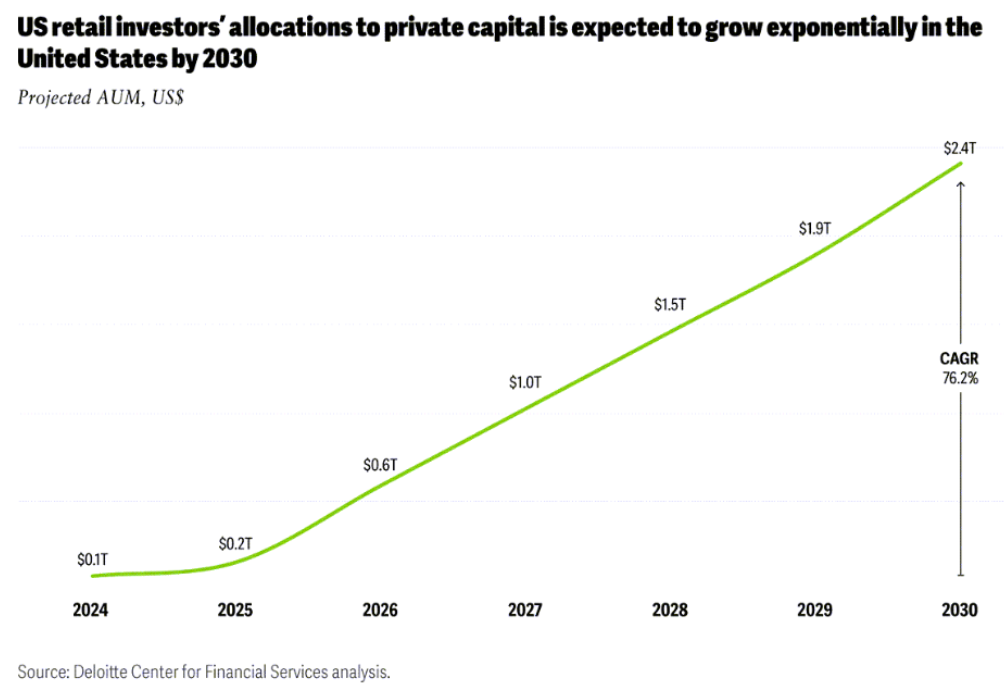

Late last year, the SEC published and discussed “Retail Investor Access to Private Market Assets”, highlighting a growing trend of private equity and credit alike: managers are increasingly seeking new sources of capital to raise funds, deploy assets and generate fees. The opportunities that have historically been pitched to family offices and institutional investors is moving downstream to retail. The everyday investor. And this opportunity is growing:

This push is being driven by a number of converging factors including: the rapid increase in total private market assets, the development of new and innovative investment vehicles designed to broaden access, coupled with lobbying efforts influencing regulatory and policy discussions.

At a high level, proposed regulatory changes fall into three categories:

While seemingly innocuous, these changes could alter the way individual investors access capital markets.

While it’s never been easier or less expensive to get access to a diversified investment portfolio thanks to a mix of low-cost brokers, low-fee index funds, and low-cost to free trading, the industry is adapting.

You have a well-performing, diversified portfolio of low-cost index funds that are providing market exposure for very affordable costs. But isn’t that a bit… boring?

What I have for you is something that is:

With the rest of your portfolio being so low cost, it just makes sense to invest in some ways that can expect risk-adjusted outperformance for a higher fee. Spread across your whole portfolio, the overall cost is still pretty low.

Incorporating more complex, less liquid and higher fee investment products into your portfolio can come with conflicts of interest and misaligned incentives across the financial industry. Keeping you in esoteric assets for longer time periods, while glossing over some of the embedded risks, makes for stickier clients that rack up significant fees for advisors and fund managers alike.

Retail investors without the balance sheet to withstand illiquidity or delayed withdrawals from their retirement accounts can be in quite a pickle.

Family offices, pension funds, insurance companies. These investors can think in generations and match long-duration assets (like illiquid private equity funds) with long-duration liabilities (the decades of time before those funds are needed). For them, lockups are manageable. But for the 40-something planning to retire in their 50s, that illiquidity can come with underappreciated risk.

While some of those commonly cited claims and benefits (tax optimization, low correlation, etc.) of private assets may be partially true, they often rely on a financial sleight of hand. The lower volatility of private markets is a function of assets being “marked-to-market” less frequently than the daily price movements you experience in the public markets. Recent data is showing that locking up your funds for longer may not, in fact, lead to greater returns in private equity.

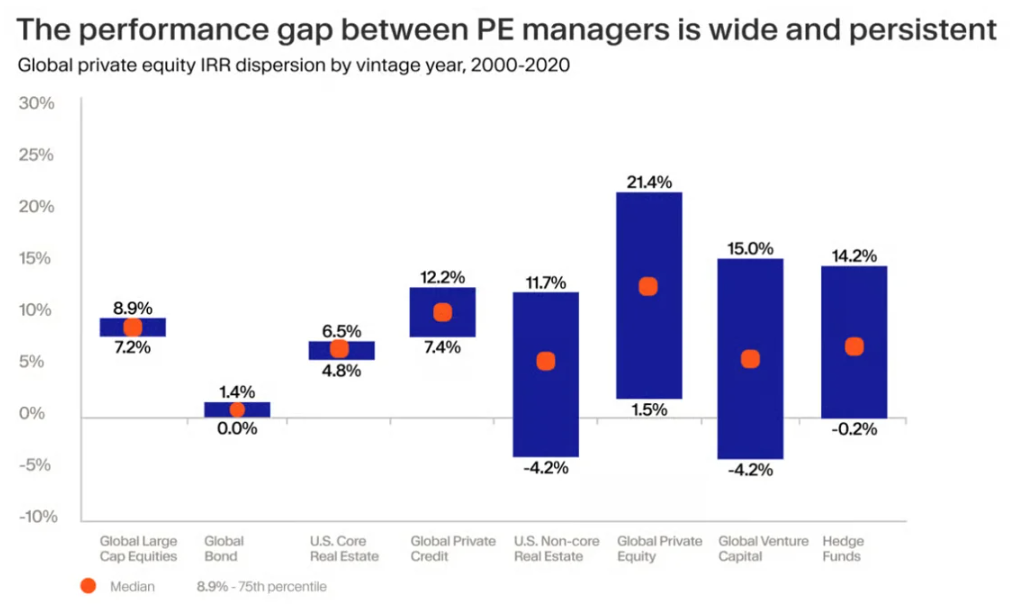

Outperformance of some private asset managers does exists, but the chasm between quality managers and underperformers is WIDE. As shown below, top-quartile managers in areas like private equity, venture capital, and private credit can meaningfully outperform public markets, sometimes by a large margin. But the median experience tells a very different story. Across several private asset classes, the average manager has delivered returns that lag global large-cap public equities over the same period.

Without the edge that the right managers, structures and vintages can provide, investors are often taking on more complexity, less liquidity and higher fees for returns that don’t beat a simple public equity benchmark.

Source: Burgiss, Morningstar, NCREIF, Pitchbook | LCD, PivotalPath, J.P. Morgan Asset Management. Data are based on availability as of May 31, 2025.

Exclusivity says nothing about a fund’s strategy or ability to (out)perform. Some special purpose vehicles (SPVs) created to offer exposure to equity of top AI labs have layers of management fees and carry that can meaningfully reduce, if not eliminate, an investor's upside even if the underlying company performs well.

And while investing into exclusive, vanity assets like sports teams may make for exciting conversation, one has to wonder why league owners are suddenly willing to sell minority stakes in their teams after reaching all-time high broadcast rights deals.

Some retail-focused alternative asset products have recently produced dismal headlines and outcomes for investors:

Expanding retail access to private markets may be inevitable, but it should come with caution and education.

I’m not against private assets. Far from it. But access requires an understanding of the risks, incentives, and fees involved. After all, Wall Street is not democratizing private investments out of the kindness of their hearts.

I’m always a proponent for knowing what you’re invested in, the fees you’re paying, and how it fits into your broader financial picture. Proper diligence of a fund, their management, and supporting documents - including but not limited to the Private Placement Memorandum (PPM), Limited Partnership Agreement (LPA), and subscription documents - are important to protect yourself and your capital.

Strip away the sales pitches, and understand how the calculated risks fit into your financial future. Also consider working with someone that can demystify the financialized jargon, help you know what you own, and find the right opportunities for you.