0 result

Hey everyone,

I’m Chris, the Lead Financial Planner here at Secfi. You’ll probably be hearing from me from time to time, especially now that we’ve officially launched Secfi Wealth. Just in case you missed the announcement 😏.

So, I thought it’d be a good time to share a little something on everyone’s favorite topic: taxes. OK, probably not, but this is a good time of year to get things in order before the next one begins. And — this year especially — may be a good one to take an extra look or two.

Let’s dig in.

Hello taxes, my old friend

🗓️ We are officially 75% of the way through 2022. And what a wild year it has been. Rounding out 2021, we were entering the 13th year of an extended bull market (not factoring in the swift dip and subsequent V-shaped recovery at the onset of the pandemic). It appeared the good times were going to keep on rolling: Interest rates were low, VC funding was abundant, and tech stocks were hovering near all-time highs.

It’s hard to believe that was just 9 months ago, as the economy, startup landscape, and stock market have all done a 180-degree turn since January.

🚨 If your portfolio resembles mine, you may be seeing a lot of red. Not only is your investment portfolio down, but you’re also probably feeling the pain every time you step into the grocery store or fill up your gas tank, thanks to inflation. Everywhere you look, there’s a headline that things are only going to get worse from here, so “sell” or “get out now.”

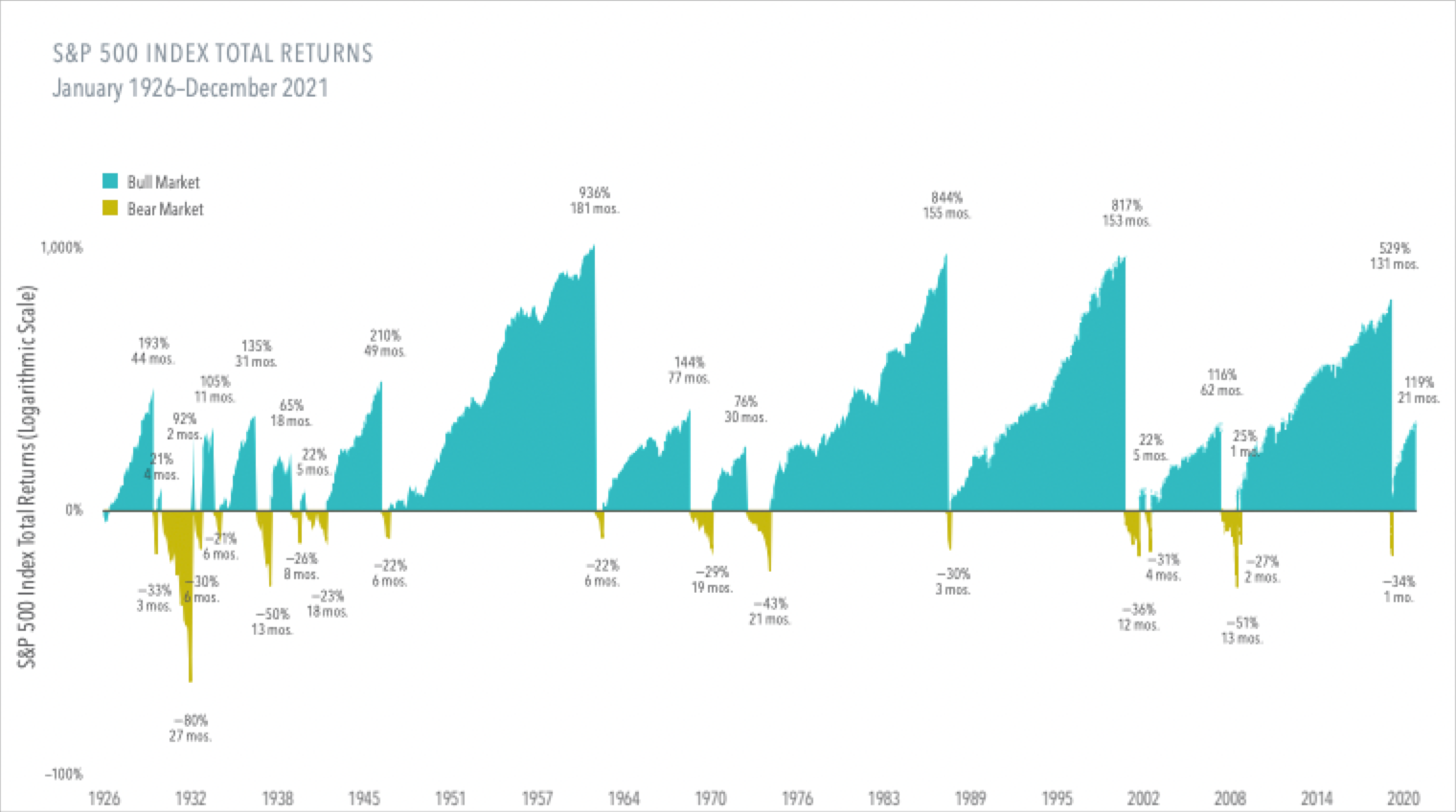

😌 But I have some good news for you: Bear markets do not last forever. The average duration of a bear market — defined by a market decline of more than 20% from its peak — is around 10 months. The average duration of a bull market is 55 months.

To illustrate how often and to what extent the good times outweighed the bad, here’s an illustration of historical returns and durations of bull and bear markets of the S&P 500 index.

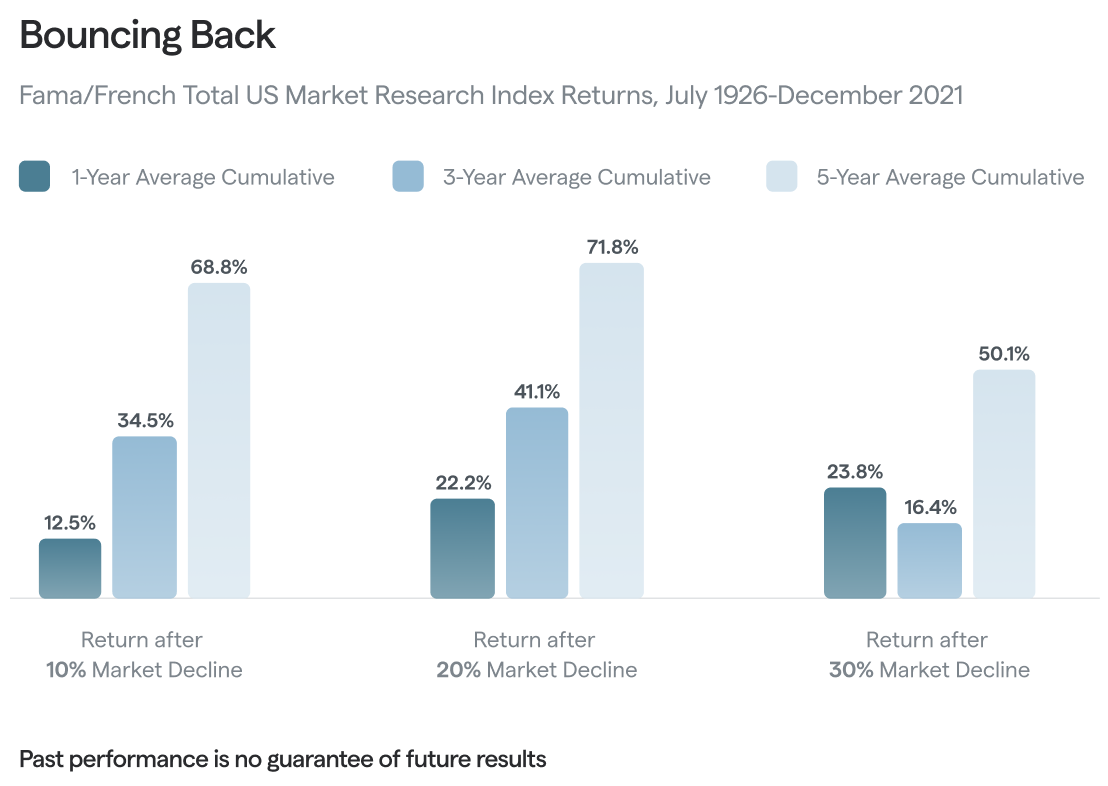

If anything, history tells us that after experiencing a 20% drop in the market, expected returns going forward are higher than they were to begin the year. If your portfolio is down double-digits this year, you have “paid the price” of being a stock market investor.

So if you have already experienced the risks that come with investing, don’t you want to stick around to capture the financial benefits of participating in the stock market? I am not going to predict when the stock market will recover, however, I have included data on 12 other bear markets and their ensuing one-, three-, and five-year forward returns.

💪 Focus on what you can control. It’s a fool’s errand to try and predict what will happen next, but you still can put yourself in a stronger financial position when markets do recover. To help you take advantage of this current situation, I have outlined a few year-end planning opportunities for you to consider.

1. Tax projection. No one likes a surprise when it comes time to file your tax return. If you exercised stock options or sold stock when prices were higher this year, make sure your withholding or tax payments are sufficient to avoid late payment penalties. Additionally, the silver lining of a down market is that you can use investment losses to your advantage come tax season. Losses can become even more powerful if your company goes public and you’re planning to sell highly-appreciated company stock.

2. Exercise ISOs up to the AMT threshold. Due to the challenging fundraising environment, most companies have not taken on new funding this year, which may result in a stable 409A valuation for your company stock. There’s even the possibility that it has decreased, as some companies look to create favorable equity packages for new and current employees. If your company has a strong growth trajectory ahead and you want to limit the total dollars you put toward your stock options, consider exercising ISOs up to the point where Alternative Minimum Tax kicks in. The Secfi AMT Calculator is a nice planning tool to determine how much you can exercise without triggering AMT (sorry, couldn’t help the plug).

3. Review your retirement plan. If your employer offers a 401K plan, you can contribute up to $20,500 into a Pre-Tax or Roth 401k. Looking to supercharge your retirement savings? A backdoor Roth IRA can be a great option for high income-earners to set aside additional dollars to grow tax-free.

4. Consider a Roth conversion. Another opportunity to take advantage of a down market is converting pre-tax dollars into a Roth IRA. Since every dollar distributed from a traditional IRA or Pre-Tax 401K is subject to income tax, converting funds into a tax-free bucket while the prices of your investments are depressed allows you to capture future investment growth tax-free when the market recovers.

5. Contribute to your Health Savings Account. Are you enrolled in a high-deductible health insurance plan (HDHP)? If so, you’re eligible to receive a tax deduction on income you contribute toward a Health Savings Account (HSA) up to $3,650 (this amount is doubled if your family is covered on your health plan). It gets even better. Unused dollars in a HSA can be carried over into the next year and if the funds are used for medical expenses, they can be withdrawn tax-free. Win, win!

6. Establish a Donor Advised Fund. Receiving a year-end bonus? Participate in a tender offer this year? If your income is higher this year than in a typical year and you desire to make charitable donations, a great vehicle to support your charitable intent and reduce your tax bill for the year is a Donor Advised Fund. You may receive a tax deduction this year when you make the contribution, however, you can make charitable grants over a multi-year period.

7. Rebalance your investment portfolio. One of the by-products of a volatile stock market is your investment allocation likely doesn’t look the same as it did to begin the year. This time of year can be a great time to rebalance your accounts to make sure your allocation aligns with your targeted investment strategy. Additionally, for non-retirement accounts, rebalancing could result in a tax boon by taking advantage of tax-loss harvesting.

8. Factor in any life changes. Did you get married this year? Relocate to a different state? Maybe you bought a house or had a child? These are all life events that affect your taxes. If you have encountered any of these events, you will want to check your paystub to make sure your tax withholding is accurate. If you’re not sure what to look for or where to start, we’re here to help.

Of course, everyone’s personal situation may differ but I hope these suggestions are helpful. If you are seeking guidance, or want help implementing any of these strategies, I’m here to help. You can learn more about how we help startup employees with their financial decisions here.

Things we’re digging.