0 result

Hey Secfi fam,

John here. I’m filling in again for Vieje. If you don’t remember me from a few weeks back, I joined Secfi as Head of Portfolio Management over the summer.

While much of the country is getting chilly, down here in Austin, Texas, where I live, it’s finally pleasant. If you’re looking to visit Austin, I would highly recommend late Fall or early Spring as the best time to do it. What’s not so pleasant right now is the local housing market. The house we bought in 2020 has yo-yoed. After appreciating a mind blowing 60% from purchase to peak, it has fallen ~20% since the highs early this year.

Listings in my neighborhood have reduced asking prices dramatically or have been taken off the market altogether. Mortgage rates and economic uncertainty seem to be having quite an impact at the aggregate level and in my neighborhood. You’re probably observing similar dynamics near you, and it’s all linked to today’s topic: Inflation.

❄️ When will inflation chill out ?

Inflation is like that neighbor you aren’t particularly fond of, but they just won’t stop knocking at your door. If you’re tired of hearing about it, you’re not alone. And you’re likely wondering when they’ll finally just go away.

Yes, inflation is worse than it’s been in a long time. But like that nagging neighbor, sometimes you just need to meet halfway to achieve some understanding.

I hope that my commentary (on an admittedly complex topic) will give you some mental models for thinking about it, especially what you can, should, or should not do about it.

And, yes, inflation is at least partially to blame for the recent mass tech layoffs. Though, if the Fed gets their way, it might be part of the inflation solution too.

First, let’s take a step back.

💩 2022 has been, to put it mildly, a sh*tshow.

We’ve had persistent global supply chain issues, the Russian invasion of Ukraine (and all the ramifications), political instability in the UK, China’s zero-Covid policy, and a rising dollar, to name a few.

These all have global economic impacts. China’s COVID policy has had direct impacts on supply chains due to factory shutdowns. Russia’s invasion has upended oil and gas supply, particularly in Europe. And they’ve all impacted inflation, to some degree.

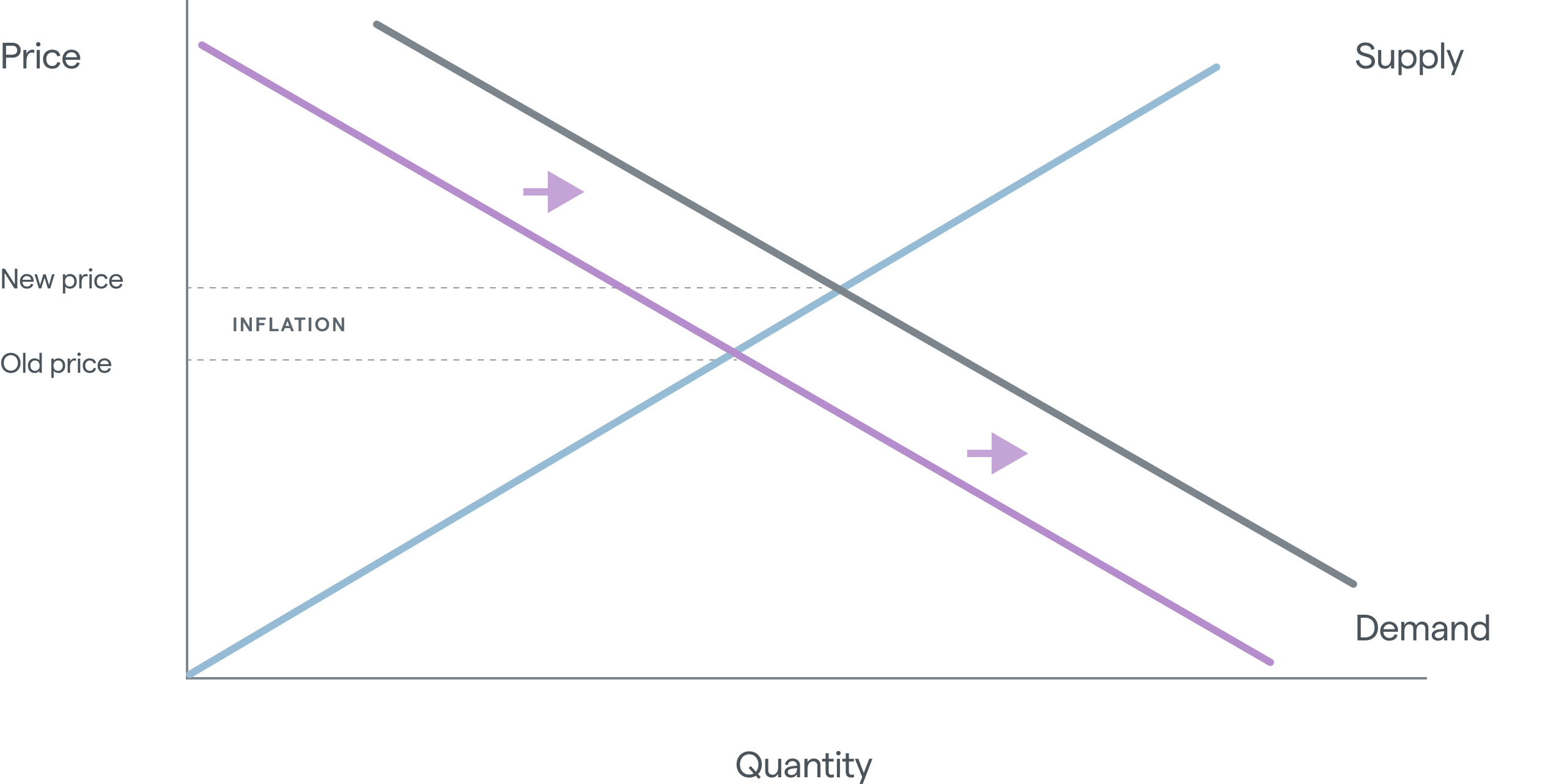

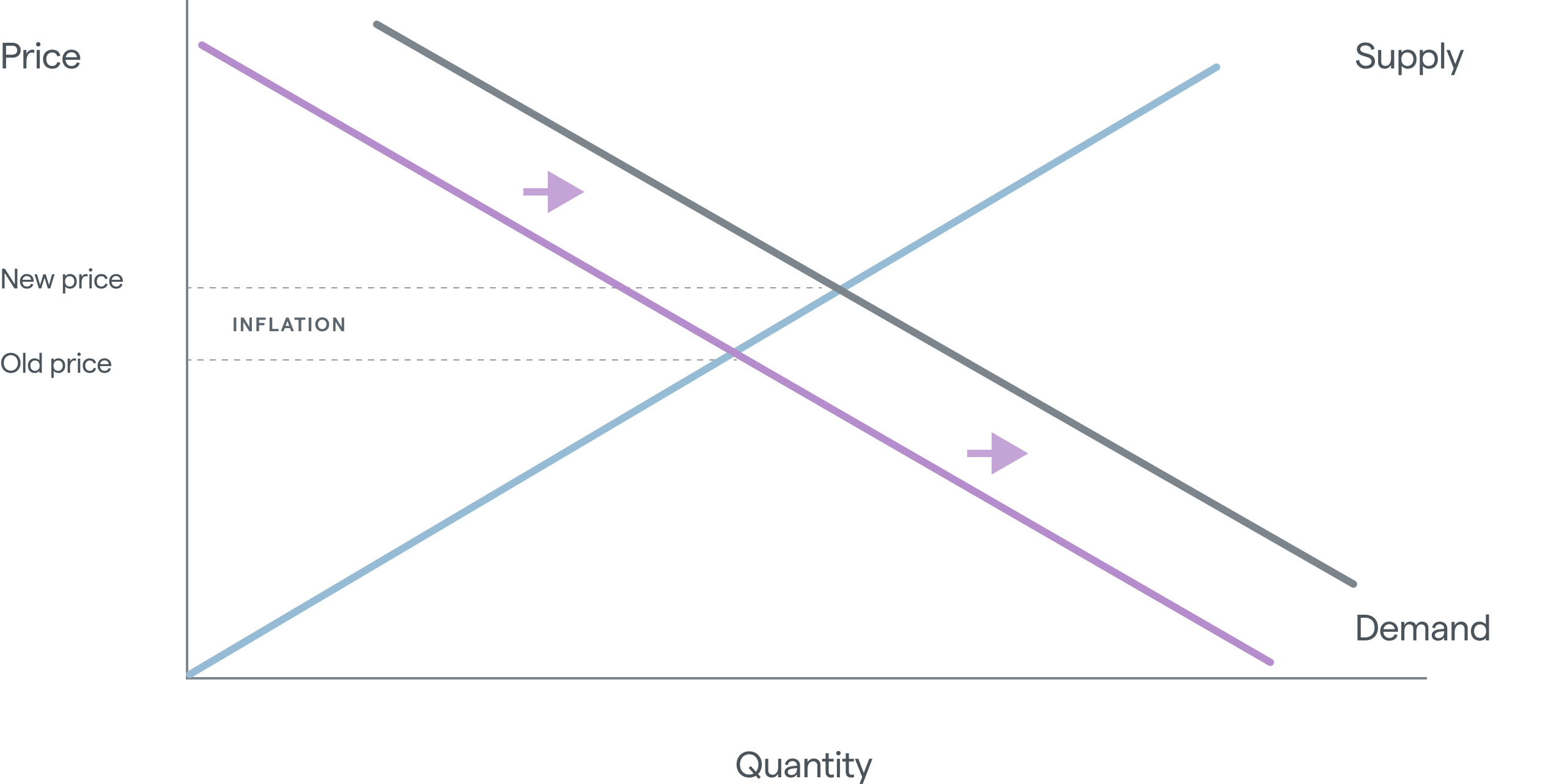

❓OK, but what drives inflation? “Demand pull” and “cost push” is a simple but useful model for thinking about drivers of inflation.

2. Cost push: High costs (e.g., due to supply shortages or other production issues) push up prices. On the supply and demand curve, rather than the demand curve shifting, this can be thought of as a leftward supply shift (a decrease in supply). With no change in demand, this moves the market clearing price up, which, again, gives us inflation.

📦 Demand pull in action: Like me, I’ll bet you were buying a lot of stuff online during the pandemic. Remember the rush to find toilet paper? The pressure for goods like those have eased somewhat, but we’re now seeing more pressure on services.

I know I’m going out with friends more than I did last year, and I’m traveling a lot more too. Maybe you read about all the flights getting canceled in the last few months?

This is all fairly intuitive, but it is a complex system of cause and effect. The magnitude of the changes and the speed of supply chain adaptation is a gigantic question mark.

I think it’s safe to say that policy makers did not expect the supply chain issues (“cost push”) to persist as long as they have, nor did they anticipate the impacts of the war in Ukraine, to say little of the impact of “helicopter money” from pandemic relief programs.

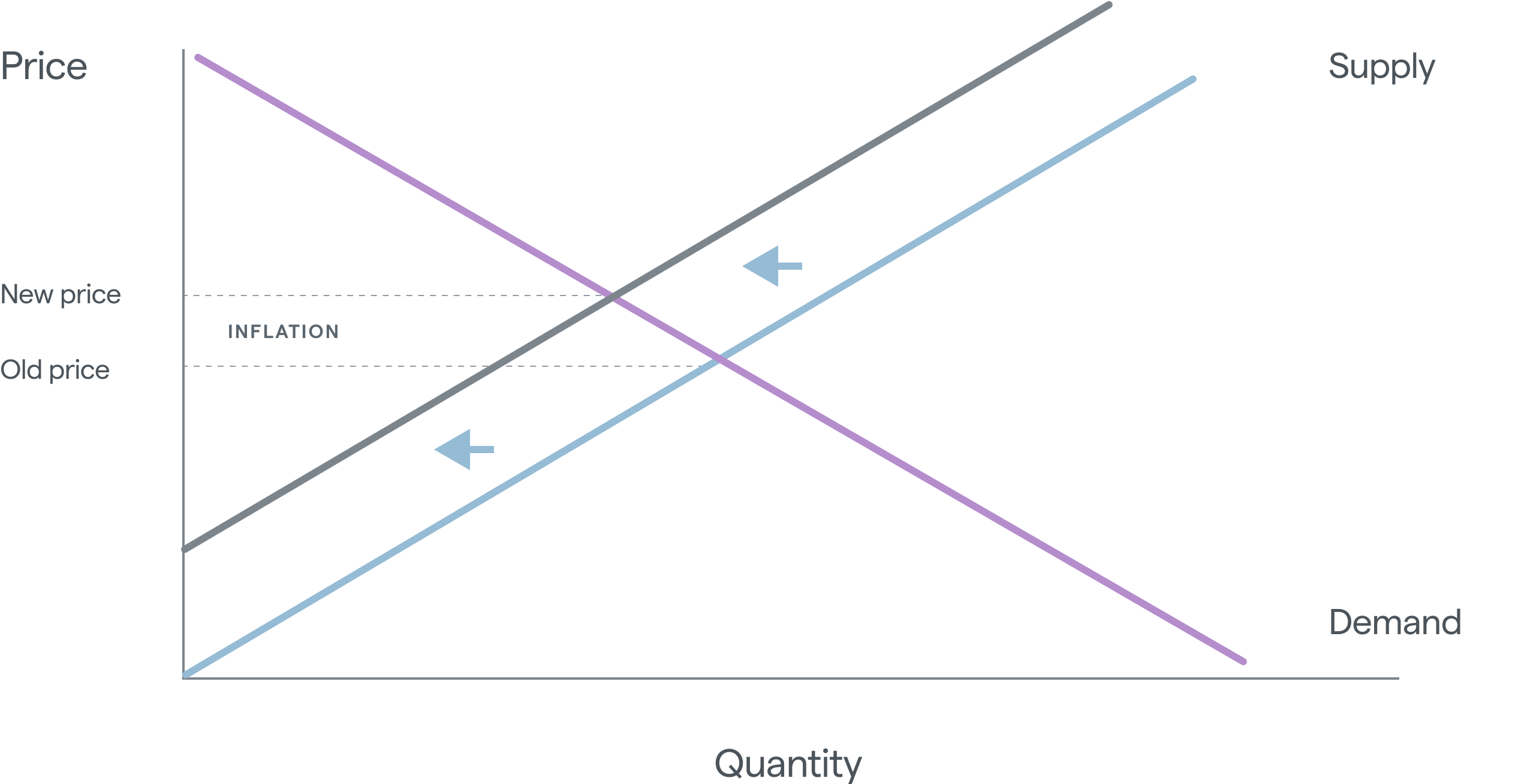

🥴 So, is the Fed trying to kill demand? Short answer, yes. The Federal Reserve has a dual mandate:

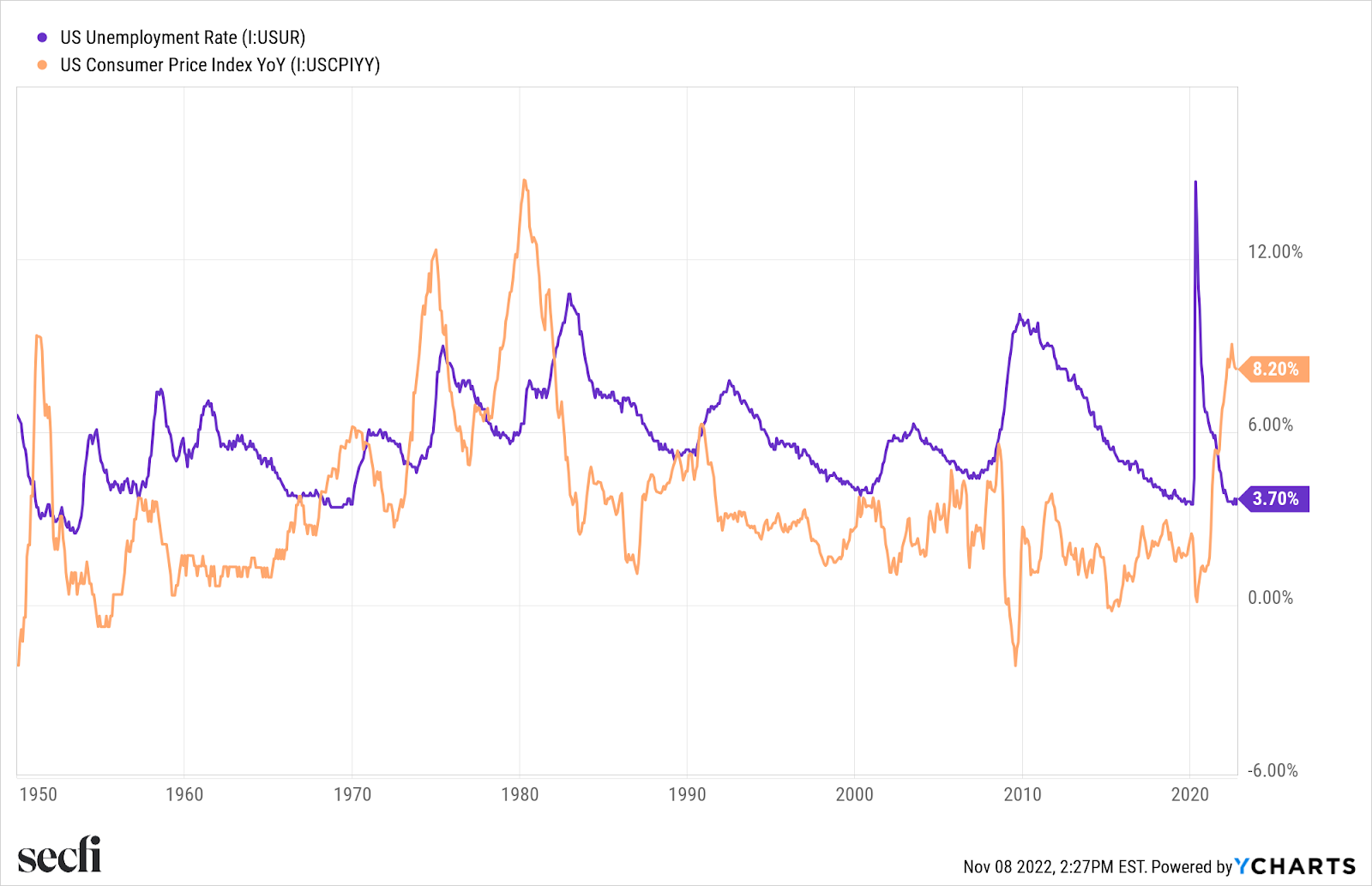

These two goals are often in conflict with one another, and right now, that’s the issue. Inflation is at a 40-year high, and unemployment is at a 20-year low.

So, the Fed is tightening financial conditions by raising interest rates and shrinking their balance sheet. This is sometimes called “quantitative tightening”: Letting bonds that they own mature and not reinvesting those proceeds.

🚗They’re trying to put the brakes on the economy, and inflation. Tightening financial conditions should do this.

Higher interest rates means capital is more expensive, which makes it harder to justify a new business venture or home-renovation project, which reduces economic activity (demand), which slows inflation. That’s the hope, anyway.

🙎It doesn’t feel like it’s working, does it? That’s the big question, of course. And it’s why you keep hearing about a “soft landing” or a “hard landing.” Things need to slow down (the soft landing) but nobody wants a deep recession (the hard landing). Right now, the debate among market watchers centers on these points. Will we get a soft landing, or a hard one?

Thus far, the labor market has been surprisingly strong, despite historic rate increases.

📉This uncertainty is one reason why valuations are dropping, especially for tech. When the future becomes uncertain, investors require greater expected compensation for taking risk. That means prices fall today such that expected returns going forward compensate them adequately for the risks they are taking.

Many tech companies are, today, unprofitable or not cash-flow positive. They’re valued on their future ability to be these things. But in uncertain times, their future ability to be those things (profitable, cash-flow positive) is…less certain. And investors demand more compensation for taking that risk.

Note, private companies are not immune. Potential profitability is much scarier than being profitable right now. A bird in the hand is worth two in the bush, and all that.

🤔So, that’s why they’re laying people off right now? Partially, yes.

Cash is obviously harder to come by: IPOs have ground to a halt, VCs are holding onto their wallets, and public companies are seeing their stocks sink. So, they’re looking to pad their runways and cut where they can to survive until the good times start rolling again.

Many companies announced layoffs in the past week or so (looking at you Twitter, Meta, Salesforce, Redfin, Cameo, etc.) so maybe next time the employment data comes out, it may not look so good, which could — emphasis on could — influence the Fed to slow or halt rate hikes. What they’re looking for is slowing inflation and rising unemployment, if they get it, it’s more likely they’ll change course.

🗓️So…are we headed for another 2008 or even *gulp* a 2000?? Nobody knows for sure, not even the Fed. The truth is: We’re all living in an uncertain, complex world.

That said, the wisdom of the crowds might be able to shed some light on what is expected to happen.

🎷Market prices for different financial instruments can be used to understand what the market is expecting to happen with inflation. These are unbiased estimates because they come from prices driven by willing buyers and sellers, not some “expert” opinion.

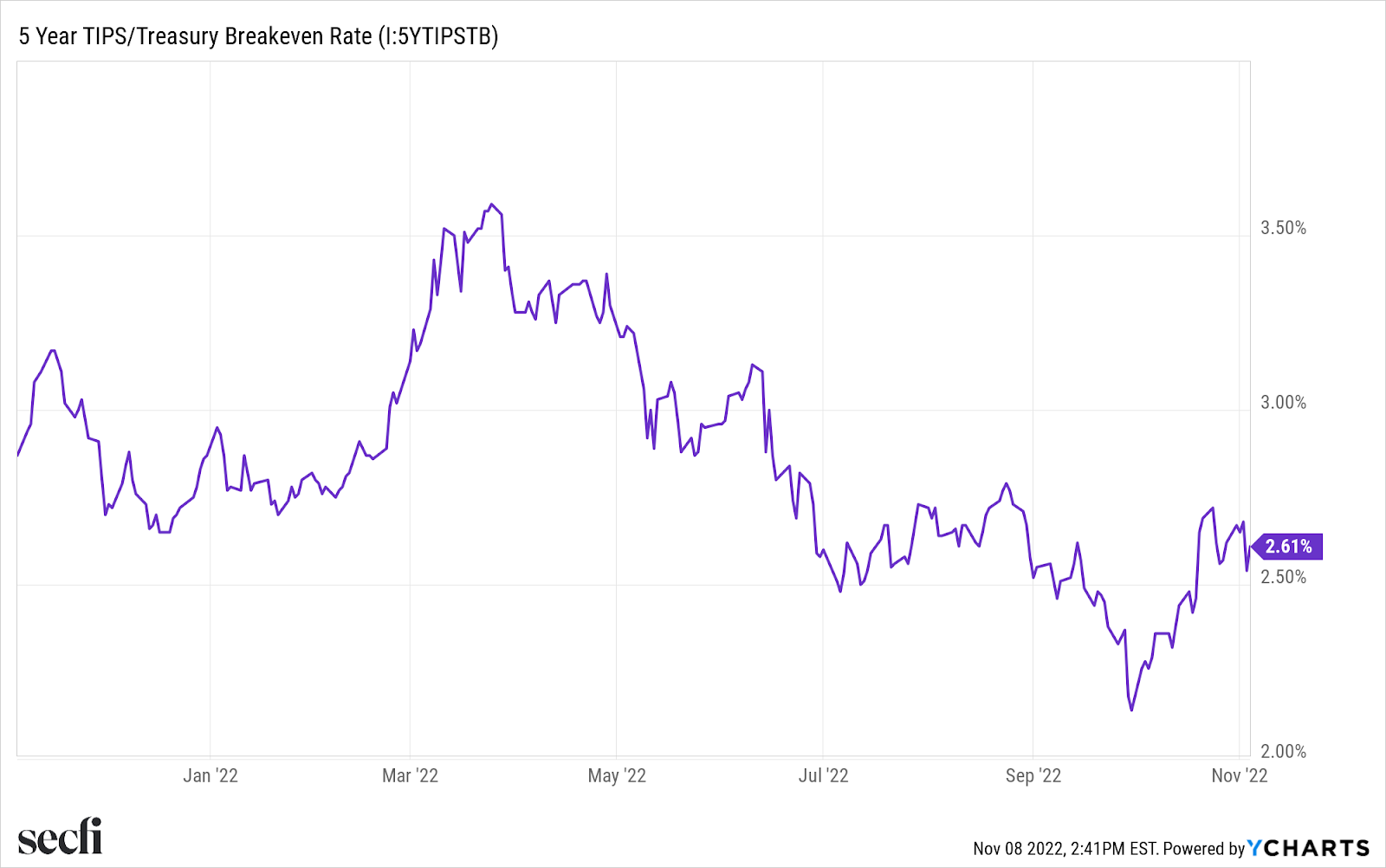

The five year “breakeven rate” is at 2.6% right now. That means over the next five years, market participants are expecting inflation to average 2.6% per year. That is quite a bit lower than the realized inflation over the past year of 8.2%. In fact, this forward looking metric, the five-year breakeven rate, peaked back in April in anticipation of the actions we are seeing the Fed take now.

🤷 Ok, John, but what can I do about it? Let’s start with what you can’t do: None of this will help you time the market because anyone with any influence in markets already knows this stuff.

It’s not a secret that inflation is high and that it’s expected to come down. It’s not a secret that it gets cold in the winter and Europe will need gas to heat their homes. And, again, it’s no secret layoffs now will impact future employment reports.

As a general rule, stuff everyone knows already is baked into prices today. Because prices today bake in aggregate expectations about the future, we should expect positive returns to risk assets going forward. That is indeed the average historical relationship too, even during high inflation periods.

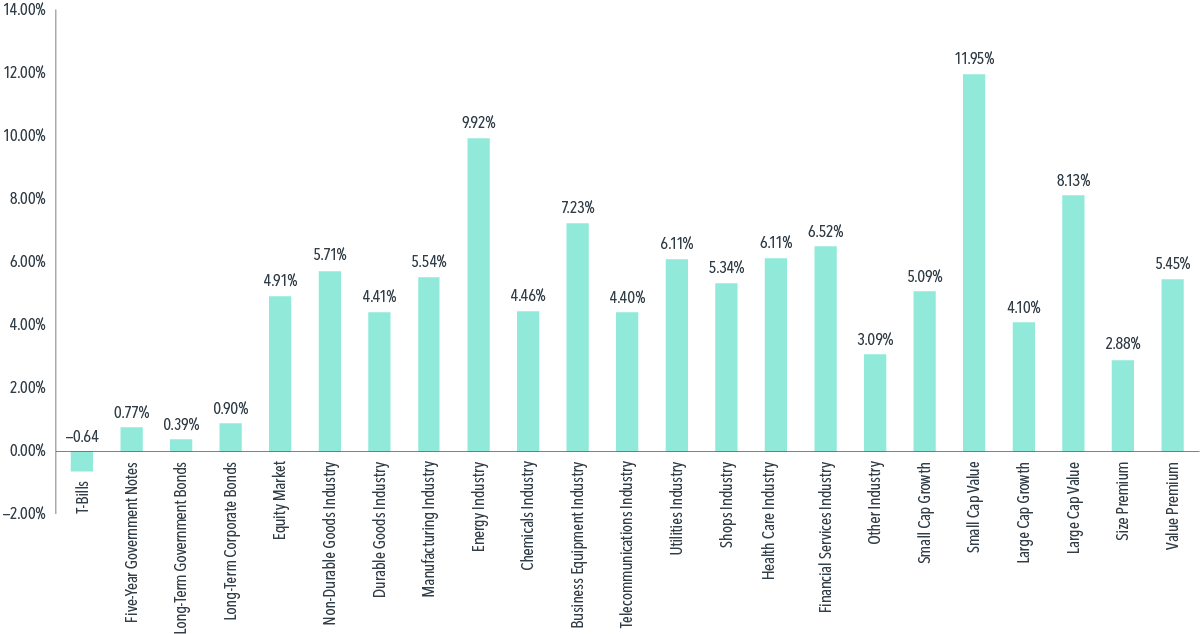

Here is a chart of average annual real returns to different assets/sectors in years with above-median US inflation, 1927–2020.

💨Every “risk” asset beat inflation, on average. That’s what you would expect! Investors set prices today such that they expect a positive return going forward. “Riskless” assets like cash or treasury bills underperform inflation.

Returns to risk assets are noisy, but over the long-run, the noise cancels out and investors have received pretty good real returns (“real” returns are the returns above the inflation rate) for owning productive assets. Cash, or t-bills, are riskless in the sense that they don’t lose their nominal value. But they ARE risky if your goal is to preserve or grow your purchasing power over time. To grow your wealth, you better be putting your money to work, wisely. Scared money don’t make money, as they say.

🌳If you are particularly sensitive to changes in inflation, you could hedge inflation. Meaning, you put your dollars into something that moves with inflation.

The only asset that gives you a reliable inflation hedge is an “inflation protected bond." These bonds, called treasury inflation protected securities or TIPS, are indexed to inflation. When the consumer price index rises, the principal amount of the bond also rises. TIPS take out a lot of risk, they’re government bonds and they are hedged against inflation. Because they protect you from inflation and are government obligations, they don’t provide juicy expected returns, but if you need a hedge, it’s really the only one you’ve got.

🏃It’s about staying in it for the long-run. Without a reliable way to time the markets (please let me know if you find one!), the best course of action — based on the data and the theory — is to stay invested.

That may be cold comfort, but when I step back and think about what I'm really doing when I am investing, it makes a lot of sense to stick with my strategy even in a high inflation environment. When someone buys a share of stock in a company, they are becoming a fractional owner of that company. And companies are made of people, and people adapt.

I believe that on the whole we'll adapt, as we've done before. I don't know when the tide will turn, but I'm confident that it will, and investors with diversified, well constructed portfolios who stay in their seats will be rewarded, while those that panic and get out, are liable to miss out when things do turn around.

⛏️If you want to dig deeper, and get academic, about inflation, I recommend this podcast and this paper about the relation between inflation and the performance global asset classes.

Things we’re digging: