0 result

There’s one question I seem to get every day: When will IPOs come back? You’re probably wondering the same thing. All of us in the startup community are asking because it’s when many of us can start realizing the full value of the shares we own in the businesses we helped build.

Look, I can’t give you a precise date, nobody can — and if they say they can, beware! — but I can give some insights into what’s happening in the public and private markets, what might indicate that IPOs could be coming, and where things currently stand.

I’ve also asked Gregor Feige, Co-Head of Technology and Communications Equity Capital Markets at Citi, to weigh in with some of his thoughts and what he’s hearing from the financial community. Feige focuses on raising equity capital for high-growth, as well as more established, private and public companies. He advises on both primary capital raises to fund companies and the sale of stock from existing investors. Typical offering sizes range up from $100 million or more given the institutional (mutual fund, hedge fund, sovereign wealth fund and large family offices) investor base targeted on IPOs.

Before we dive in, I wanted to share that Chris and I will be doing a live session that digs deeper on this topic, more specifically what to do with your stock options in the current down market. It's taking place on May 9 at 10am PST / 1pm EST, and you can RSVP here. Even if you can't make it, sign up and we'll share the recording!

Ok, let's talk about IPOs.

The first thing to know is that for IPOs, or any other exits (like M&As, SPACs, direct listings etc.), to happen there needs to be supply and demand at a mutually agreed upon price. If the sellers are too far away from the buyers on price (asking too much/offering too little), there’s a stalemate. The sell, or supply, side here is private companies and their founders while the buy, or demand, side is investors.

Before we do a pulse check on the IPO market, let’s take a step back and give some context on what we’re actually looking at.

Basically. Investors invest because they expect to get back more money than they put in.

When it comes to getting money from a stock — public or private — there are two ways they can do it: Sell shares to another investor or receive dividends from the company. The investor’s total return is the money they get out divided by the money they put in, which is expressed as a percentage.

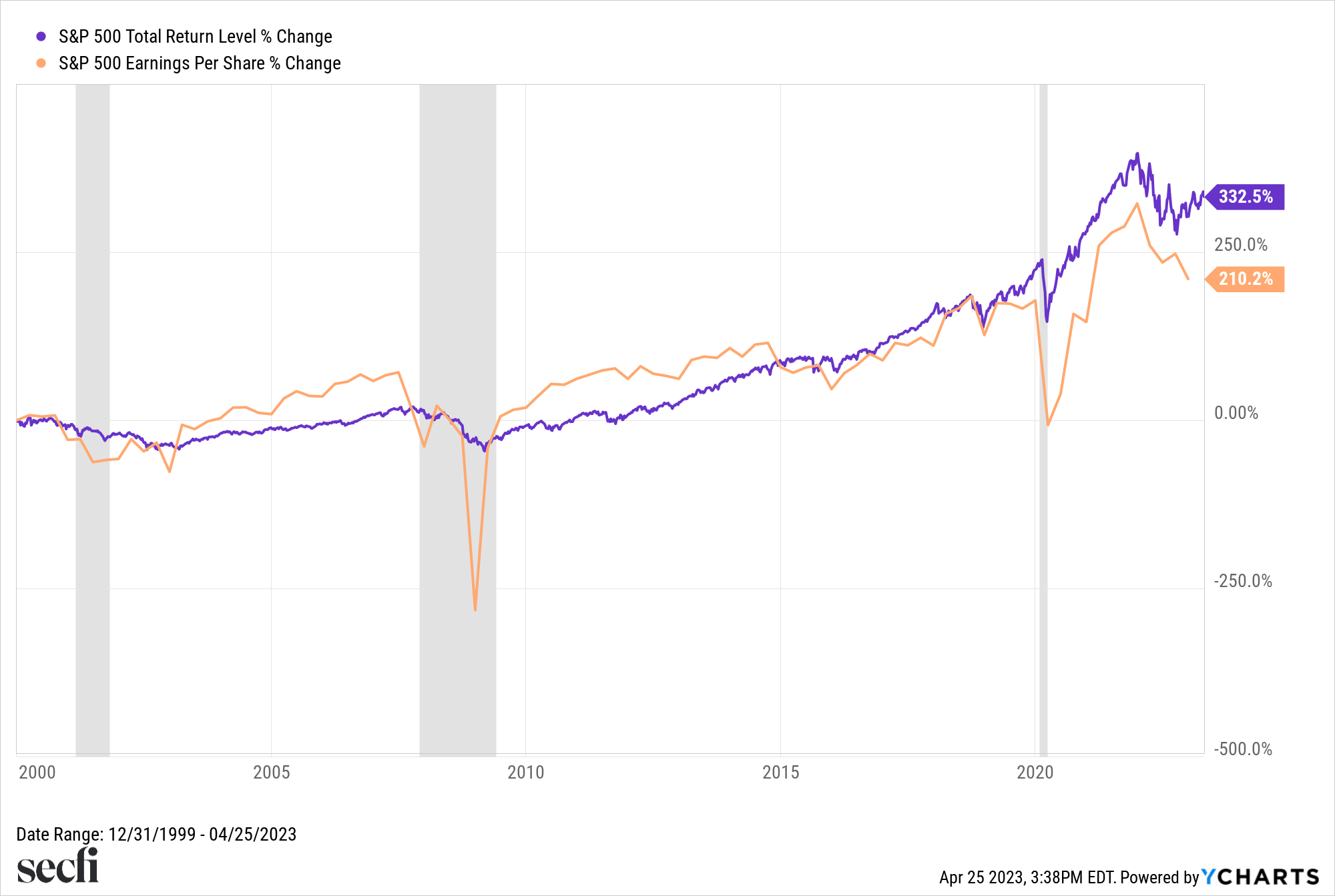

The price they pay initially, when buying in, and the price they receive when selling are both driven by expectations for the future. But, expectations for what exactly? Profits! Stock prices are driven by profits in the long-run. The chart below shows the S&P 500 return in purple and the total earnings of companies in the S&P 500 index in orange — the shaded areas are recessions. As profits grow, stocks go up.

Dividends, of course, are only able to be sustainably paid out of profits currently generated by the company. If this sounds a bit rudimentary for some of you, there’s a reason I’m hammering this point. Right now, current and near-term profitability are the most important factors for every investor.

What happened to growth? Well, growth is great, but only if it credibly leads to profitability. You can’t sell a dollar for 50 cents and make up for it with volume. Plus, investors have been burned by excessive optimism on growth in the recent past. The SPAC boom, for example, is emblematic of this.

Recent research found that only 35 percent of SPACs actually met the revenue projections they put forth when marketing the deal. SPACS are a small part of the market, but it illustrates why investors are skeptical of growth stories right now. Of course, this is also tied to the increase in interest rates — money is no longer free! — and so many are keeping their wallets closed and their investments less risky.

For investors, vision is OUT and tangible results are IN.

It’s true, companies — especially private startups and tech companies — have been claiming for years that the era of growth is over and profitability will reign supreme. But this time, it may actually be true.

Let’s take a look at a recent example: Meta is one of the best performing stocks year-to-date. That may be a surprise to some of you. It seems like last year, everything was working against the company: Apple’s privacy update was supposed to kill revenue on the platform, the first look at Zuck’s metaverse was met with chuckles, and there were some serious charges brought to light (and to Congress) by whistleblowers.

What changed? Mostly, the rally has been driven by expectations for future profits. They expect Zuckerberg is turning, and will turn, the ship around.

Specifically, he has taken his foot off the Metaverse gas pedal and has decreased the expense profile of the company by cutting costs, namely laying tens of thousands off. While it may have hurt morale at the company, it certainly has made investors happy: The stock is up nearly 80 percent year-to-date.

I reached out to Gregor Feige, Co-Head of Technology and Communications Equity Capital Markets at Citi, to ask what he’s been seeing and hearing:

“Investors have decisively pivoted from the 2020 to 2021 mantra of ‘growth at all costs’ and today are focused on a balance of growth and profitability,” he said. “Companies with a durable sustainable growth trajectory, strong unit economics, and long-term cash flow characteristics are where equity investors are looking to deploy capital, both publicly and privately.”

Investor’s hunger for profits probably also has something to do with increasing interest rates.

Now, you can get nearly five percent returns in short-term government bonds. Before the recent rate hikes, those bonds were yielding essentially zero percent for the better part of a decade. If investors can get five percent on a riskless bond, why would they pay a high price for the risky equity of a tech company that may turn a profit, but only in a few years at best.

That’s not to say, that growth doesn’t matter at all, it does, but investors are less willing to look towards the far horizon for profits to start showing up. That’s why private companies hoping to IPO (and sell shares to the public) need to credibly demonstrate to investors that they will, or more importantly already are, turning a profit, and can grow those profits over time.

The 2020-2021 mentality — which, arguably began years earlier — of “growth at all costs” just won’t cut it in this environment. The era of “free” capital was an anomaly, and one that isn’t likely to return any time soon.

The companies that do go first, are likely going to be profitable. Klaviyo is supposedly preparing for an IPO as soon as September, and the big takeaway is that they’re reporting themselves as profitable.

The other side of the equation is, as I said upfront, aligning on price. I asked Feige what he’s hearing:

“The IPO market is open, but the bid/ask spread on valuation expectations between boards/management teams and public market investors remains a challenge. The bar has been raised for the quality of companies that will be in the first wave of IPOs coming out of the quietest IPO market environment in the last 20+ years. Public investors also expect to extract deeper ‘IPO discounts’ to compensate for the risk of newly public companies — particularly in the context of significant underperformance in the class of 2020 and 2021 IPOs.”

This mismatch in price is a major driver of the frozen IPO window. Many companies are still tied to valuations from the 2020/2021 peak. Stripe, for example, drastically dropped their valuation from $95B to $50B during the recent fund raise. Like Stripe, there are a number of private startups that have cut their valuations — Instacart and Klarna, to name a couple — and it could all be in service of a future IPO.

Others, however, are still hanging on tight to their 2021 valuations. Coming down from that high is painful and it’ll take time for some to do so. Similarly, it’ll take time for companies to reach profitability, or close enough to it.

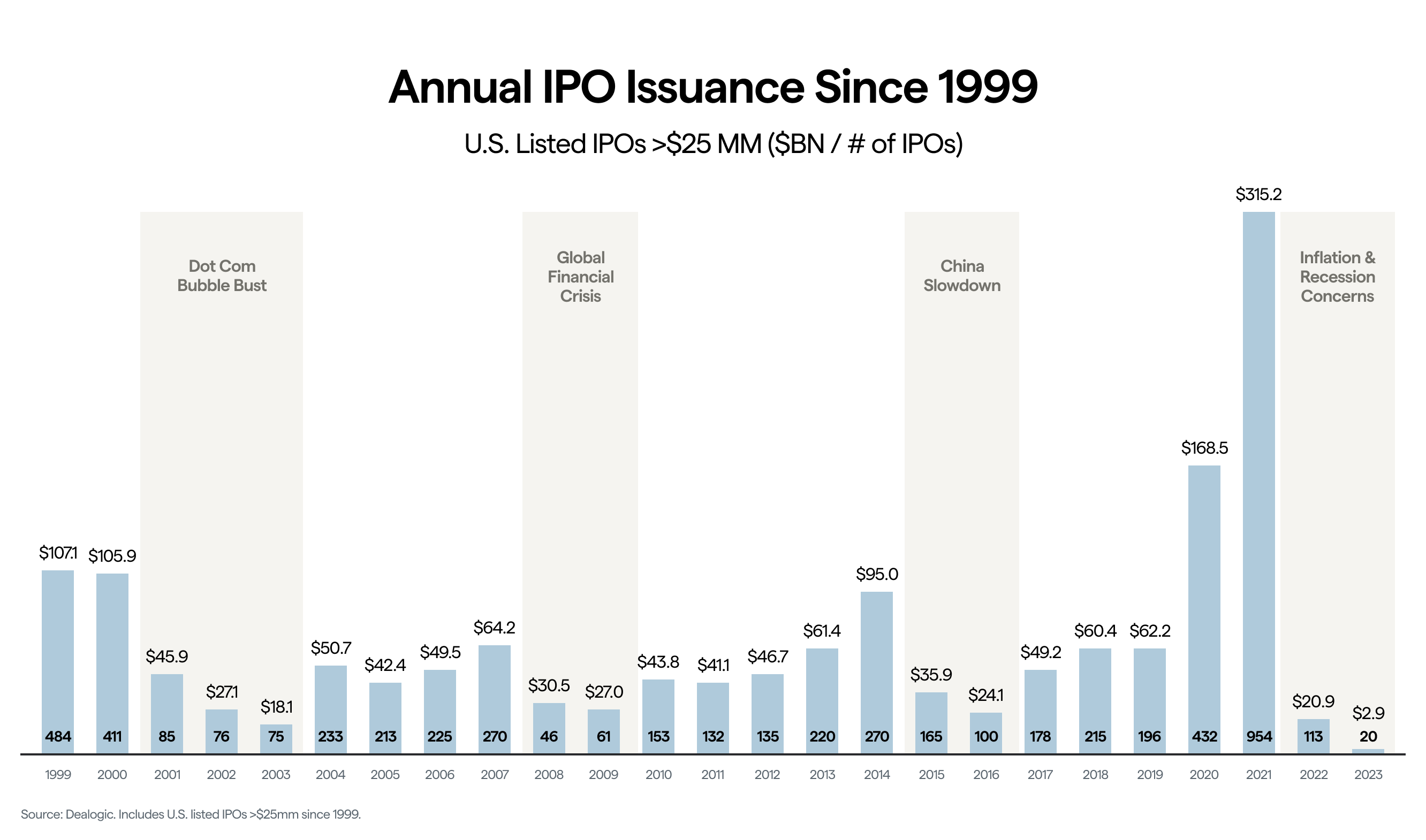

How long that will take, is anyone’s guess but here are promising signs, like the Klaviyo news, though the window ain’t open until it’s open. My colleague Natalia, our Senior Director, Head of Capital Markets & Strategy, previously gave a little history lesson on how long past IPO windows remained shut.

Still, there is a lot of pent up pressure to get the window open. According to Feige, there are a number of companies have filed publicly or privately to go public. Plus, as Vieje alluded to the other week, many of these companies need to do something. It’s why Stripe did what they did.

Like Stripe, some companies need to IPO because their employees’ stock options are expiring. Others need to because they need the capital to continue growing their businesses and executing on their strategies. Despite the headlines about how venture capital pockets remain deep, public market investors still have the deepest pockets by a significant margin — the global stock market is worth ~$90 trillion.

What’s Feige seeing on the ground?

“Given the dearth of IPOs in 2022 and start of 2023, the IPO backlog has grown with an increasing number of companies filing recently with the SEC to preserve that option of going public in 2023 or 2024.”

Here’s a chart of IPO deal volume back to 1999 from Feige’s team at Citi. As you can see 2020 and 2021 are the anomalies — so don’t expect that to come back anytime soon — but you can also see that 2022 and 2023 are also much lower, similar to past crises like the dot com bubble and the 2008 recession, which should give us some hope that things will pick back up again.

The bottom line is, if you need the capital, going public is the biggest well to draw from.

Yes, companies will go public and, hopefully, in the near future. But some companies that want to IPO may not. However, it’s not the only exit strategy.

Acquisitions can also provide liquidity to early investors, founders, and employees. And, there are signs M&A activity may pick up too.

Feige has been watching this trend too:

“Most companies pursuing an IPO also test the potential to sell the business via M&A — a so-called ‘dual-track process’ — but what we are seeing increasingly is companies contemplating IPO, sale, and private capital raise in a ‘tri-track process’ to maximize flexibility in an uncertain market backdrop. The valuation bid/ask spread impacting the IPO market also flows through M&A, but we are seeing that normalize in 2023 and anticipate a more private company M&A market as a result.”

What an M&A means for an employee can depend on the specific deal. The common stock that employees typically own can sometimes get squeezed out to liquidation preferences, but an acquisition can still be positive — and it’s why having a plan for your equity before that happens can be critical to maximizing your exit opportunity.

If these trends continue, you could be seeing more liquidity opportunities for your stock over the next year— whether that’s via an IPO, M&A, or more frequent tender offers on the backs of fundraises.

While the tunnel seems — and has been — long, there appears to finally be some light. That’s why it’s so important to have a plan for your equity now before the window starts opening.

Things we’re digging: