0 result

Hi there,

John here again. Something interesting to sink your teeth into this week.

Reddit’s highly anticipated IPO is officially on the horizon. Last week they filed their preliminary S-1 with the SEC. It’s chock full of information about Reddit’s business results and plans. The whole startup ecosystem is eagerly awaiting the listing. A positive reception from investors could be a sign the IPO market is thawing out, giving others the confidence and opportunity to go public themselves.

We’re certainly rooting for their success. Reddit will be the first major IPO since last fall and is such a widely recognized name it will probably get even more attention than usual.

At Secfi, we’ve been nerding out on the Reddit S1 filing. Being one of the most anticipated IPOs in a while, we thought it would be fun to dig into the S1 and share some of the highlights with you all. Let’s take a look at some of the interesting things we found in Reddit’s prospectus.

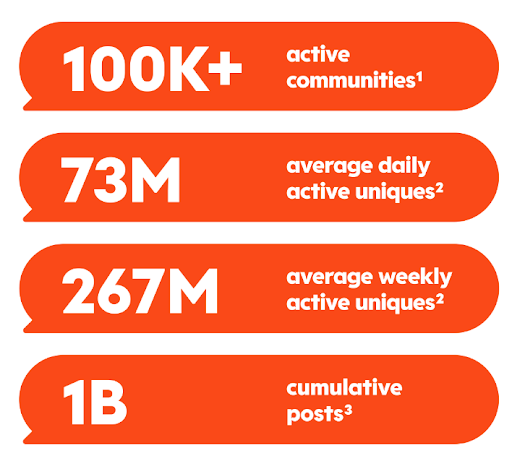

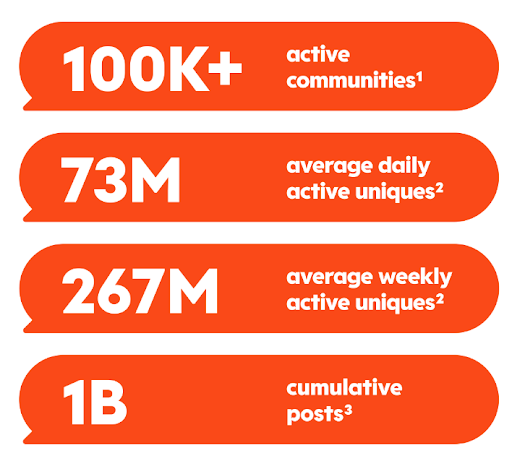

For companies like Reddit, one of the most anticipated numbers to be disclosed in the S1 is the active user count. Reddit tells us up top that they have ~73 million Daily Active Unique Users and ~267 million Weekly Active Unique Users.

The vast majority of Reddit’s revenue comes from advertising to these users (98%).1 To highlight the value of their platform, they tell us that many of their users are not active on other social media sites. This means that advertisers could be getting access to a cohort of people they may not be able to reach otherwise.

Many Redditors are not active on traditional social media platforms; according to Comscore data for the three months ended December 31, 2023, of people who visited Reddit in the United States, 32% were not active on Facebook, 37% were not active on Instagram, 73% were not active on Snapchat, 41% were not active on TikTok, and 53% were not active on X.2

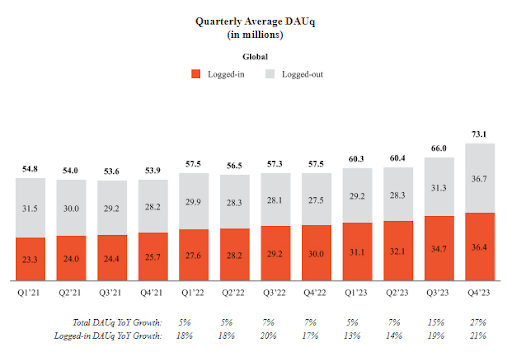

Interestingly, user growth has accelerated in recent quarters.

For comparison, at the time of Facebook’s IPO in 2012, they had 512 million DAUs and had grown DAUs 26% year-over-year for the prior quarter3. Up until that time, Facebook’s growth had been faster and more consistent than Reddit’s growth, but that was evident in the valuation too. Facebook IPO’d at a valuation of $104B whereas the rumored valuation for Reddit’s IPO will be closer to $5B. Looking at an analogue like Facebook can be instructive, but it’s important not to extrapolate too much. As a reminder of how much things can change, at the time of their IPO, Facebook had just barely acquired the nascent Instagram and Zynga related payments were a substantial portion of Facebook’s revenue. Things can and will change. How a company adapts to the changing environment is extremely difficult to predict but is arguably more important than any backward looking numbers.

One remarkable stat that speaks to Reddit’s potential is the fact that they are one of the top trafficked websites in the United States. They rank third on this list, just ahead of Facebook and just behind YouTube. Can they figure out how to turn that traffic into more dollars for shareholders? That’s a bet buyers in the IPO will be making.

Reddit is highly reliant on advertising but they are looking to expand into other revenue streams like data licensing and what they call the “user economy”.

Reddit’s data has long been a subject of discussion among the community. Of course, the company can monetize that data by selling ads, that’s the tried and true business model for most internet companies. But Reddit’s data might be monetizable in other ways. Reddit’s vast trove of user generated content could be valuable in the training of AI models. Indeed, they give us some info on their progress on this front.

In January 2024, we entered into certain data licensing arrangements with an aggregate contract value of $203.0 million and terms ranging from two to three years. We expect a minimum of $66.4 million of revenue to be recognized during the year ending December 31, 2024 and the remaining thereafter.4

Seems promising! And it has just begun. For further validation of the AI potential, Sam Altman affiliated entities own 9% of Reddit.5

Additionally, Reddit highlights the organic commerce that has popped up in various communities where users buy and sell services and goods among themselves. Reddit believes the organic commerce happening on the platform will open up more monetization opportunities for them in the future.

This is more speculative than the rest of their business where they have a track record of producing revenue. But, the company discusses their hopes to turn Reddit into a platform that becomes a go-to place to buy and sell goods and services. They have experimented with cryptocurrency and blockchain technology in the past and it may play a role in the future of Reddit too.6 They even tested the sale of Reddit NFT avatars last year. We’ll have to wait and see how things develop, but there is speculation about crypto being integrated in Reddit. It wouldn’t surprise me if Reddit decides to take the plunge and become a crypto-first platform when it comes to commerce.

Reddit grew top line revenue ~25% year over year in Q4 of 2023 while operating expenses grew just ~7% over that time period. Growing revenues faster than expenses is obviously a good thing, and helped Reddit turn in a quarterly profit of $18.5 million in the last quarter of 2023.7 With attractive gross margins, top line growth, and slower growing expenses, Reddit could be poised for significant profit growth in the future. Adding in the future revenue streams they highlight as part of their long-term strategy, there are reasons to be excited. The ultimate valuation of the shares in the IPO largely depends on the extent to which investors believe the growth story and discount the risks.

This wouldn’t be a Secfi newsletter without a mention of stock options. Per the notes to the financial statements, there appears to be about 20M vested and unexercised stock options as of December 31st, 2023.8 These options have a weighted average exercise price of $5.97. If the company IPOs at the rumored $5B valuation mark, we expect that share price to be around $30 per share. That comes out to about $600M of unexercised stock options.

At a ~$24 gain from strike price to IPO, that’s a nice profit. While it’s hard to know exactly without knowing the breakdown of NSOs vs ISOs, the IRS should be fairly happy. If all those options get sold in a cashless exercise, the IRS will tax the $24 gain at the higher ordinary income tax rates which comes out to about $177.6M in taxes. On the flip side, if those were exercised at $5.97 and sold at $30 at lower capital gain rates, that would only be about $96M in taxes.

The Reddit IPO is a bellwether for the strength of the IPO market and will likely impact other companies' decisions to go public. We’ll be watching it eagerly along with all of you.