0 result

Thanks for all the feedback on our first newsletter. There are a ton of topics you are all interested in us writing about and I’m excited to keep the ball rolling. Please keep it coming by replying to this email or hitting me up on Twitter @viejep.

Since we last spoke, we may or may not be in a recession depending on who you ask and what definition you use. The public markets had a nice bounce back in July. It was much needed after a long six months of pain. I’m not sure how the rest of the year will go, but it will sure be interesting.

OK, let’s get to today’s topic.

Most startup employees don’t really understand what stock options truly are. It’s a realization I’ve come to after working with so many employees over the years. I know: “isn’t that why Secfi exists?” But…hear me out.

💰Equity is compensation…sort of. Stock options are often lumped together with salary when you get a job offer. Taken together, it’s your “compensation package.” But, unlike your salary, your options aren’t just deposited into account on a regular basis.

But you gotta pay to play. Many don’t realize that you have to pay money for those options. (Note: how to best offer equity could be a future topic, and something we already help startups with).

This is important to understand because, if played right, the investment could pay off…big 📈

So…it’s sorta both. Let me unpack it.

The investment opportunity. Every company issuing stock options is required to obtain a 409A valuation — which is the tax code’s view as to the “value” of one share of your common stock.

When you are granted a stock option, your company issues you the right to buy a share of the company’s common stock. That price is based on the current 409A, now your strike price.

To own a piece of your company, you need to pay your company the strike price (times X options). The hope is that it will appreciate in value (to the moon, hopefully). 🤞

In order words, you’ve just invested in your company.

So…where does the compensation part come into play? Typically, you’re buying the shares at a discounted price when you exercise. That’s the compensation. Imagine being given the option to buy a Willie Mays rookie card for $5, only to sell it five years later for $100k (I assume baseball cards still have value?).

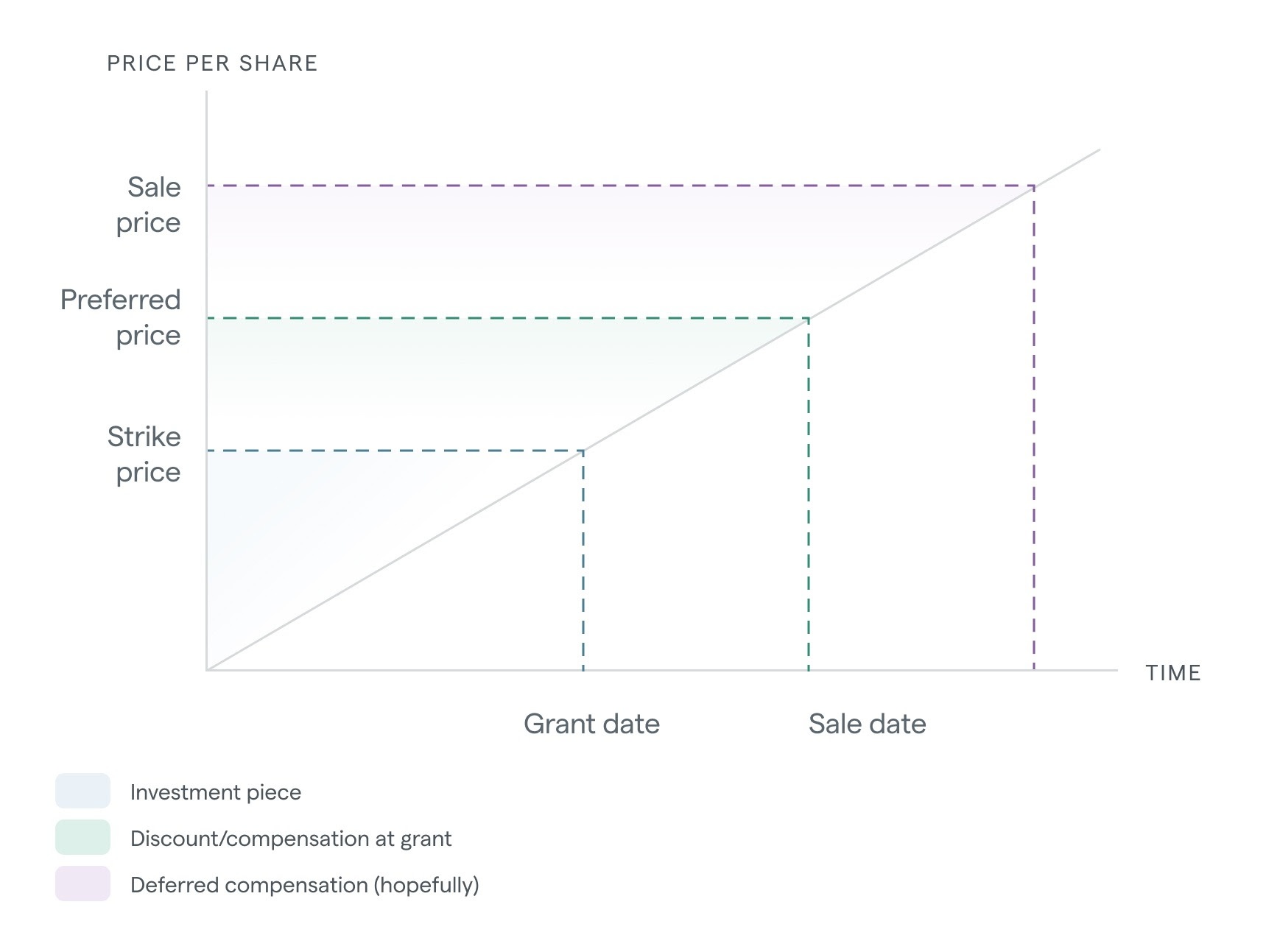

This part is actually a bit more complex to understand, so let’s go visual:

Excuse me, I’m preferred. When investors (like VCs) invest in a company, they’re buying preferred shares at a preferred price. In almost all startups, the preferred price is greater (sometimes much greater) than the 409A value. They are buying these shares with hopes that they will eventually sell them at a much higher price.

Exercising at a discount. When you exercise your options at the strike price ( 409A value when granted), you’re usually buying them at a fraction of the value that investors paid — or what they view as the true value of the company.

That is the biggest benefit of stock options.

The discount is the compensation. Your company grants you options as part of your comp package, not only to give you the right to invest in the company you’re building, but to do

AKA “Deferred compensation.” While there may not be cash value today, there is potential for some big down the road () ,which is why stock options are called deferred compensation. For us finance nerds, stock options are inherently leveraged instruments.

AKA “Deferred compensation.” While there may not be cash value today, there is potential for some big down the road () ,which is why stock options are called deferred compensation. For us finance nerds, stock options are inherently leveraged instruments.

OK, so what does it all mean to me? Most people don’t view their equity as an investment opportunity. And, you wouldn’t just go investing your money somewhere without a plan…right? Right??

The point is that too often people don’t know what to do with their stock options because they just don’t understand how it works. They either think they’re given stock (they’re not) or that they can’t afford it / it’s not worth the upfront cost (Hey, this is where Secfi comes in!).

It’s important to remember…what you’re getting is potentially a really great deal on a future (hopefully) valuable asset.

By not choosing to invest (or exercising your options), it could be seen as forgoing part of your comp.

Of course, there are more complexities to exercising, including risk, reward, taxes, preferred share rights, liquidity, etc. that we’ll save for future newsletters.

Things we’re digging

As always, feel free to let me know any feedback or request what you want us to write about in the future by replying or hitting me up on Twitter.

-Vieje