🔐 Yes, private equity can be an engine for portfolio growth

Private equity is the talk of the town right now because of its return history. So let’s dive into the considerations for including private equity in your portfolio.

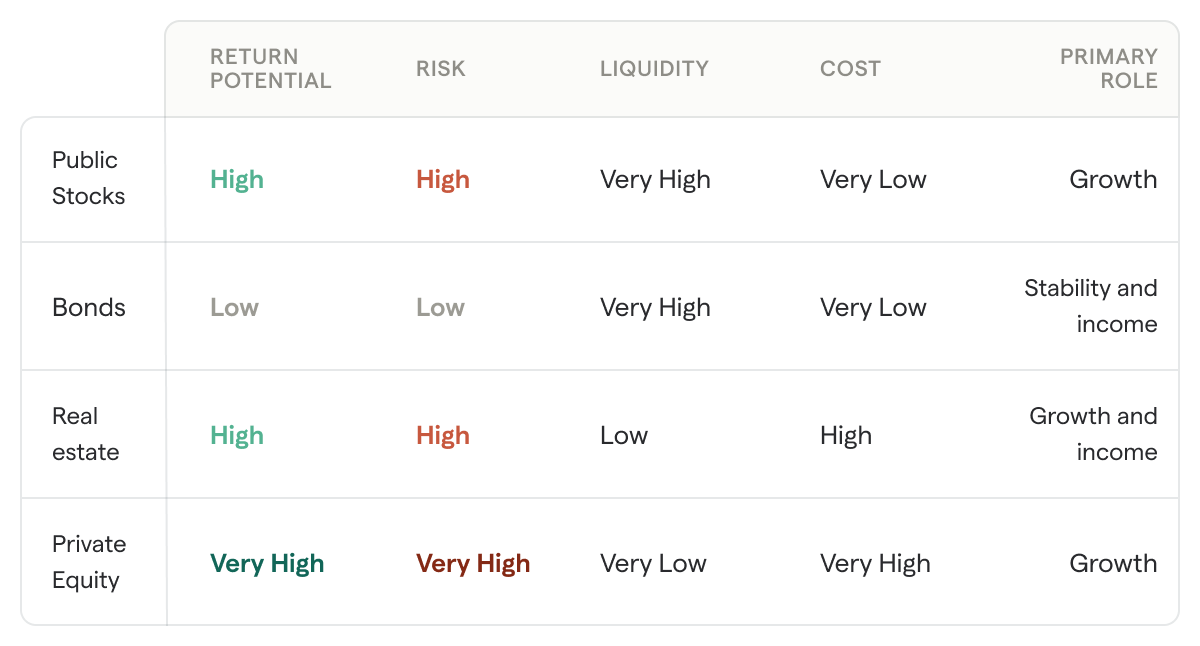

Private equity is a broad category, but generally it just means ownership in private companies. The primary ways folks get exposure to private equity is by investing in a private equity or venture capital fund, making angel investments, or through stock compensation at a private company.

You’re likely reading this because you either have significant exposure to your employer’s private stock or you generated a significant portion of your wealth through ownership of your employer’s private stock.

📈 The difference between investing in the private and public markets

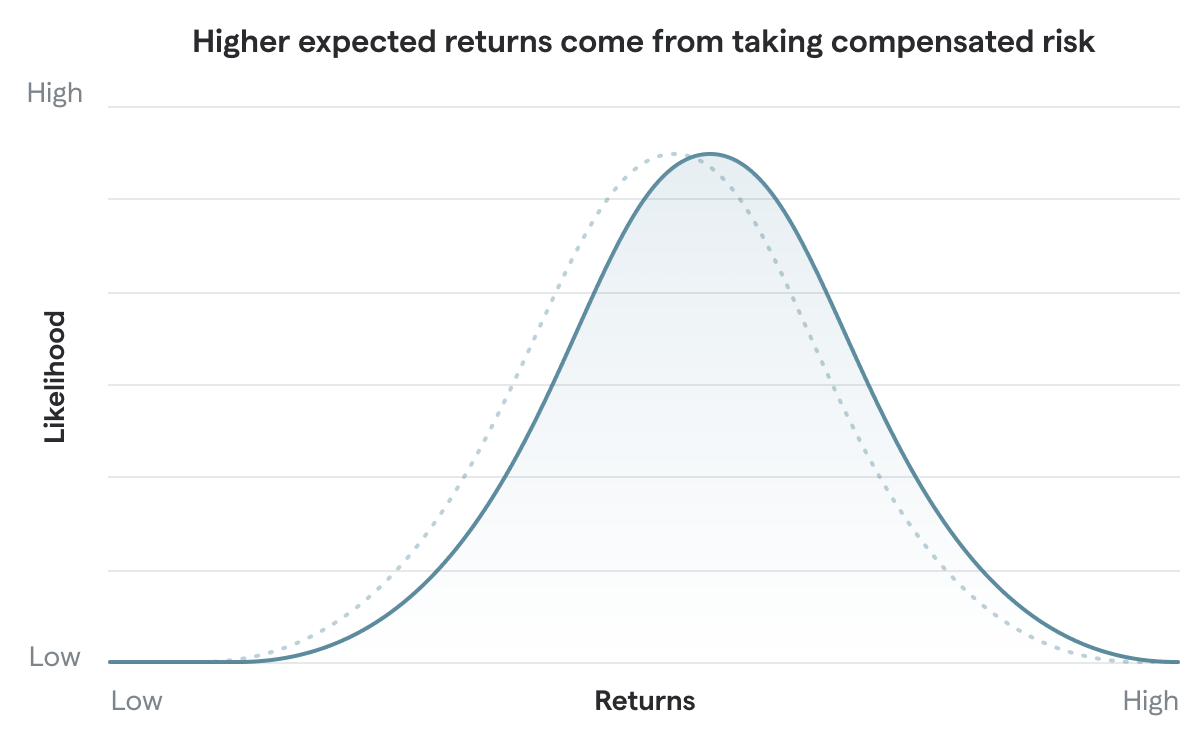

First thing’s first: Data on private equity funds is much harder to come by than public equity because…they’re private. However, in recent years, better datasets have been collected and analyzed by scholars and practitioners. And the available data across all private equity funds (both buyout and venture capital) does suggest that returns have been higher in private equity than in public equity.

A study first published in 2020, using returns generated from private equity funds raised from 1984 through 2015, showed that private equity funds, on average, outperformed the S&P 500 by roughly 3% per year through 2019.

The study also showed that performance among VC investors was persistently positive, a result not found for buyout funds or public equity fund managers. The authors hypothesize that the performance persistence is driven by the early stage of companies VCs invest in and the incentives that provides.

Here’s an excerpt from an interview with the author:

“Kaplan suggested that in buyouts the seller is often going to be looking simply for the highest bidder. This compares to a VC deal in which the seller still owns the majority of their company and, as such, has an incentive to choose the investor who can create the most value.

A VC firm with a reputation for creating value has an advantage in this scenario where the seller might take a lower valuation in order to work with a high performing firm.”

Seems plausible! There’s a sensible economic rationale for the outperformance of certain VCs. The data history isn’t as long or as standardized as public equities, but there is evidence of a return premium for private equity investing compared to the S&P 500.

🌹 But…it’s not all roses