0 result

Hi there,

John here this week. I’ve just returned home from New York where I was able to check off a bucket list item and attend the US Open at Arthur Ashe Stadium. I attempted to go 15 years ago, but when I arrived at the stadium everyone else was leaving due to a massive storm that postponed play. Everyone was soaked to the bone on the subway home. This time, the weather was perfect and I was able to watch the young Spanish star Carlos Alcaraz win his match.

According to the ATP, the 19-year-old Alcaraz has won over $8 million so far in 2024. That’s a pretty good haul…especially for a teenager, and because I am who I am, it got me thinking about financial independence.

“What’s your number?”, is a common question in some circles, and even if it's taboo to discuss in yours, you know you've thought about it: How much money do you need before you _____ (fill in the blank with your dream... retire, buy a house, have a kid, you name it)? It's a question we regularly confront and think about with our clients. We model different liquidity events, savings strategies, investment returns, retirement ages, etc. to get a handle on what it will take to reach that, or any other, goal. We aim to help our clients reach their goals and truly understand what will need to happen to get there. One big challenge though, the future is uncertain, more things can happen than will happen and we want to be prepared for as many of those possibilities as we can.

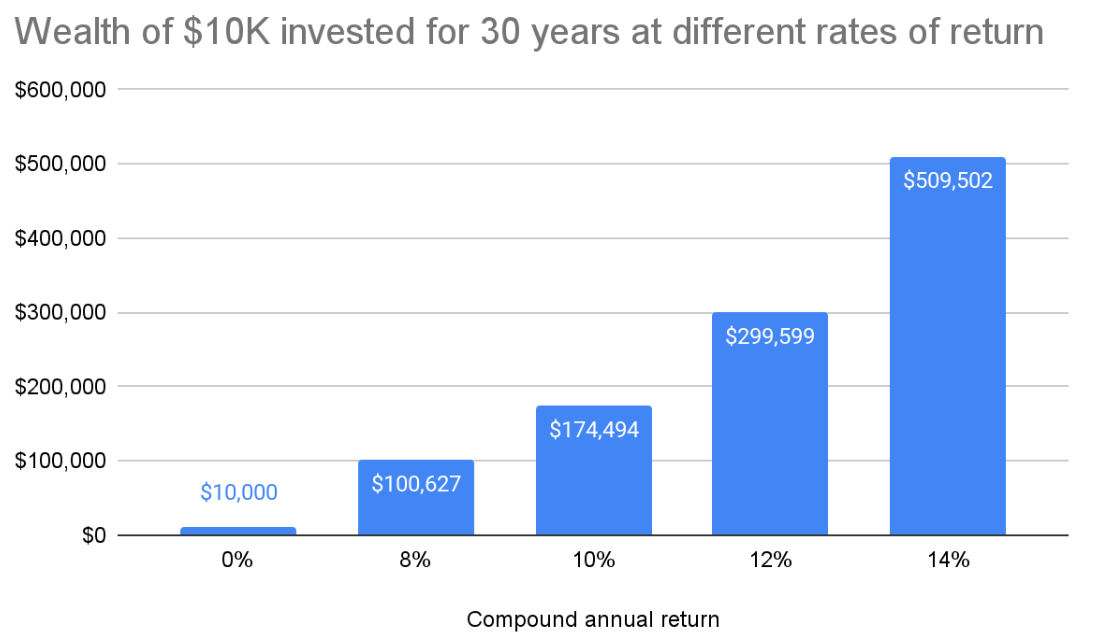

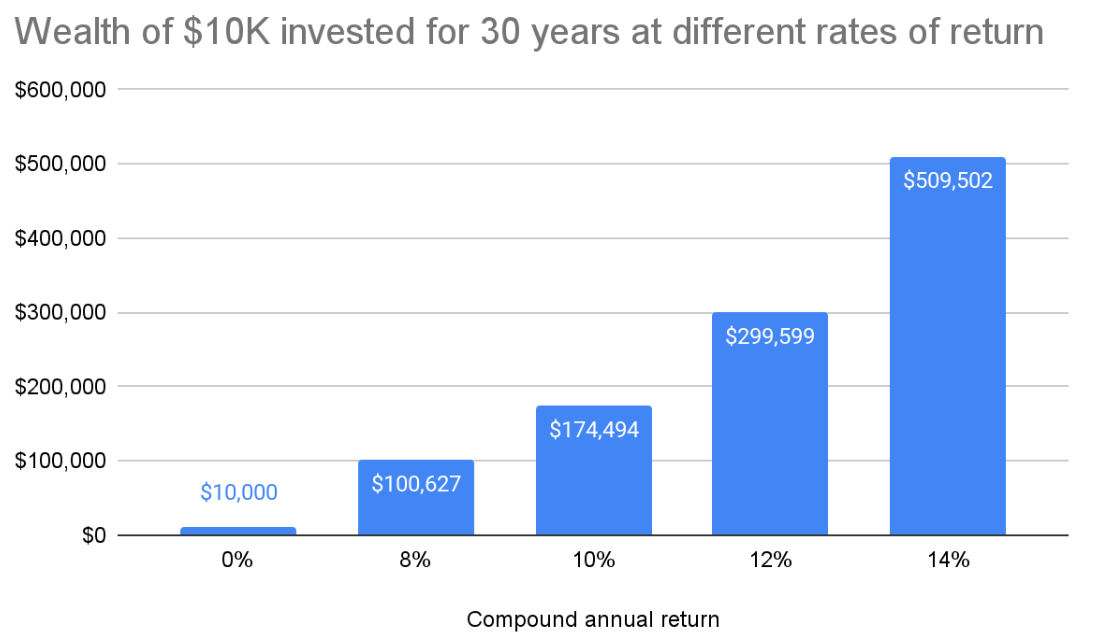

One of the uncertainties "your number" faces is the rate of return on your portfolio. In any plan, the assumed return will have an enormous impact on your timeline to achieve your goals. The power of compound interest is so large that Einstein allegedly called it the eighth wonder of the world. Check out the difference in wealth if you invested $10K for 30 years at various rates of return:

This is being shown for illustrative purposes only and does not represent actual performance. Actual performance of a portfolio can be affected by factors such as, but not limited to, fees, commissions, market volatility, interest rates, and other general market factors.

Because the power of compounding at higher rates of return is so powerful, a tremendous amount of brain power and effort goes into trying to maximize investment portfolio returns. However, higher returns often come with higher degrees of uncertainty or risk. A concentrated bet on a single company can turn into significant wealth (see Keith Gill and the ongoing Gamestop saga), but that is not the typical experience as most stocks underperform the broad market and some of them even go to zero.

Recognizing that we're unlikely to hit the lottery with a stock pick or with the Powerball, how should we build a portfolio, and what type of return should we expect from that portfolio?

Let's start by looking at historical returns. The US has been the darling of the world economy for a century or more. Returns to the US stock market have been wonderful over that time, at just over 10.4%2 annualized since 1926. International data is less available so the starting point isn't the same, but non-US developed country stocks have delivered an 8.5%3 annualized rate of return since 1970, while emerging markets have returned 9.6% annualized since 19884.

Should we assume the global stock market will continue to deliver 8-10% per year? Sure, I think that's a reasonable assumption. There is lots of debate over the true "expected return" to equities with some arguing that historical returns are too high for the associated risk and represent getting lucky or a persistent bias by investors to favor lower returns with more certainty. Many point to the valuation expansion that has occurred in the US over time as a reason to lower return expectations going forward. On the other hand, innovation doesn't seem to be slowing down (maybe that's why multiples have expanded?).

Whatever the true "expected" return number is, anchoring your expectations for diversified equities to high single-digit compound annual returns will put you in a realistic ballpark. There will be periods where stocks deliver returns way above the long-run average and way below the long-run average.

Once you're in the ballpark of a reasonable return assumption on a diversified portfolio, what matters is risk management. If we want to increase the likelihood of hitting "your number" we want to reduce the volatility of the portfolio as much as possible for a given expected return. At Secfi Wealth, we seek to achieve this by building portfolios that are complementary to employment in growth companies (i.e. they should be less correlated to growth stocks than the broad market and especially relative to the tech-heavy portfolios I often see with new clients).

A portfolio with an average return of 10% and volatility of 12% will result in more ending wealth than a portfolio with the same average return but higher volatility. Here's a simple example: suppose you invest $100 each in two different assets. In the first period, asset 1 returns 20% and asset 2 returns 10%. In the second period asset 1 returns -20% and asset 2 returns -10%. Both assets have average returns of 0% but asset 1 is worth $96 while asset 2 is worth $99.

Reducing volatility increases certainty. If most of your wealth is tied up in a single asset, it's pretty much impossible to say whether or not you're on track to meet your goals. Too much can happen with one stock/company. Once you truly diversify your exposure and take compensated risks instead of concentrated bets, you can really feel comfortable and confident about "your number". Getting you there in the most efficient way possible and helping you understand the tradeoffs involved is what an advisor should be doing for you.

For many folks reading this, concentration through equity compensation is unavoidable and is often a way to supercharge hitting that number (bet on yourself and all that). But that doesn't mean you should continue to make concentrated bets when you don't have to! Secure the bag, my friends! Then you might have the option to confidently sail off into the sunset, found that company, become a park ranger, take up painting, or (insert dream here).

Things we’re digging:

1 The S&P 500 index is used as the proxy for the US Stock Market. Returns from 8/31/2009 through 8/31/2024. Source: YCharts

2 The S&P 500 index is used as the proxy for the US Stock Market. Returns from 1/1/1926 through 8/31/2024. Source: Standard & Poors Index Services Group and Ibbotson Data

3 The MSCI World ex USA Index (net dividends) is used as the proxy for the non-US developed country stock market. Returns from 1/1/1970 through 8/31/2024. Source: MSCI

4 The MSCI Emerging Markets Index (gross dividends) is used as the proxy for the emerging markets stock market. Returns from 1/1/1970 through 8/31/2024. Source: MSCI