0 result

Hi there,

Vieje back here again. We’re in the middle of a heat wave here in San Francisco and I’m hoping most of you in the Bay Area made it out better than I did last night when it comes to sleep. As someone who likes their room ice cold, I spent most of the night in front of a fan tossing and turning. As I lay awake last night, I wondered how insane property values would be in San Francisco if we had this warmer weather more consistently.

Anyhow, it’s October and we’re in the last quarter of the year. Back in April, I wrote What does it take to go public today? We discussed IPOs and the metrics investors are looking for in this market. We were fresh off a successful Reddit IPO and we wrote the following prediction:

“We expect at least a handful to file in Q2 and aim to go public before the election heats up."

Unfortunately, that optimistic prediction did not quite come true as most companies and bankers decided to hold off until 2025 or later given the market conditions and macroeconomic factors. For this newsletter, I wanted to write more about IPOs and the market demands right now. Let’s jump in.

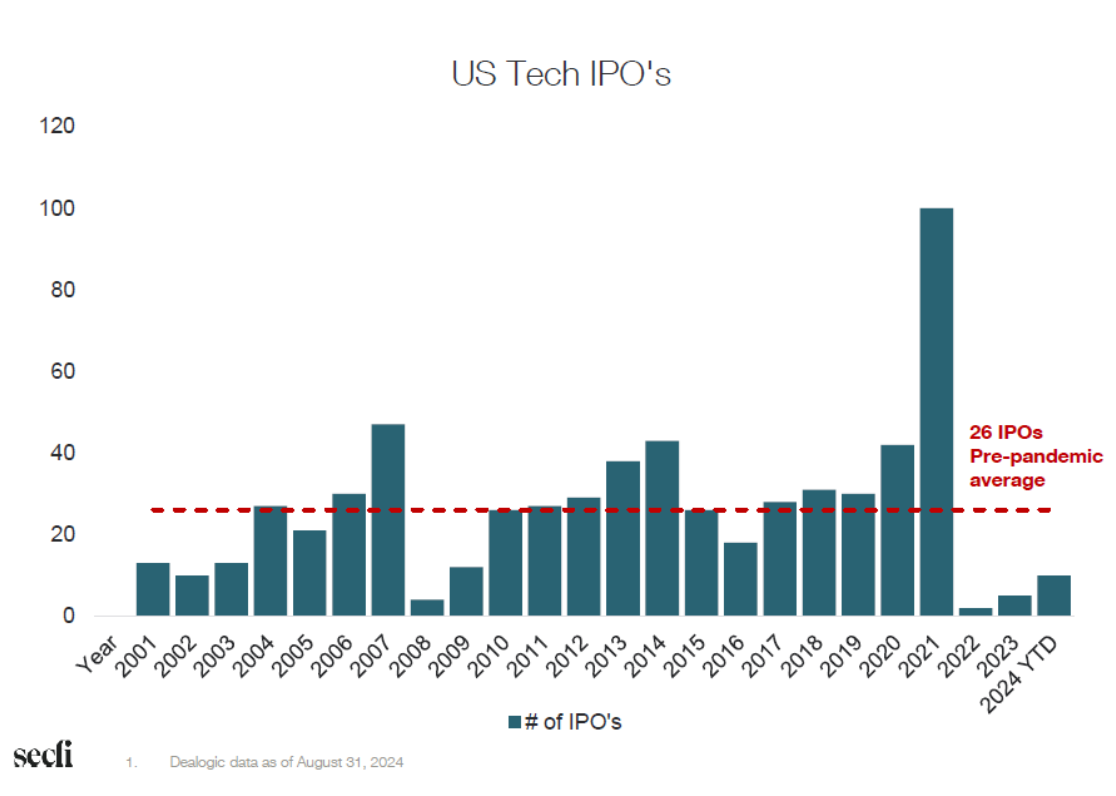

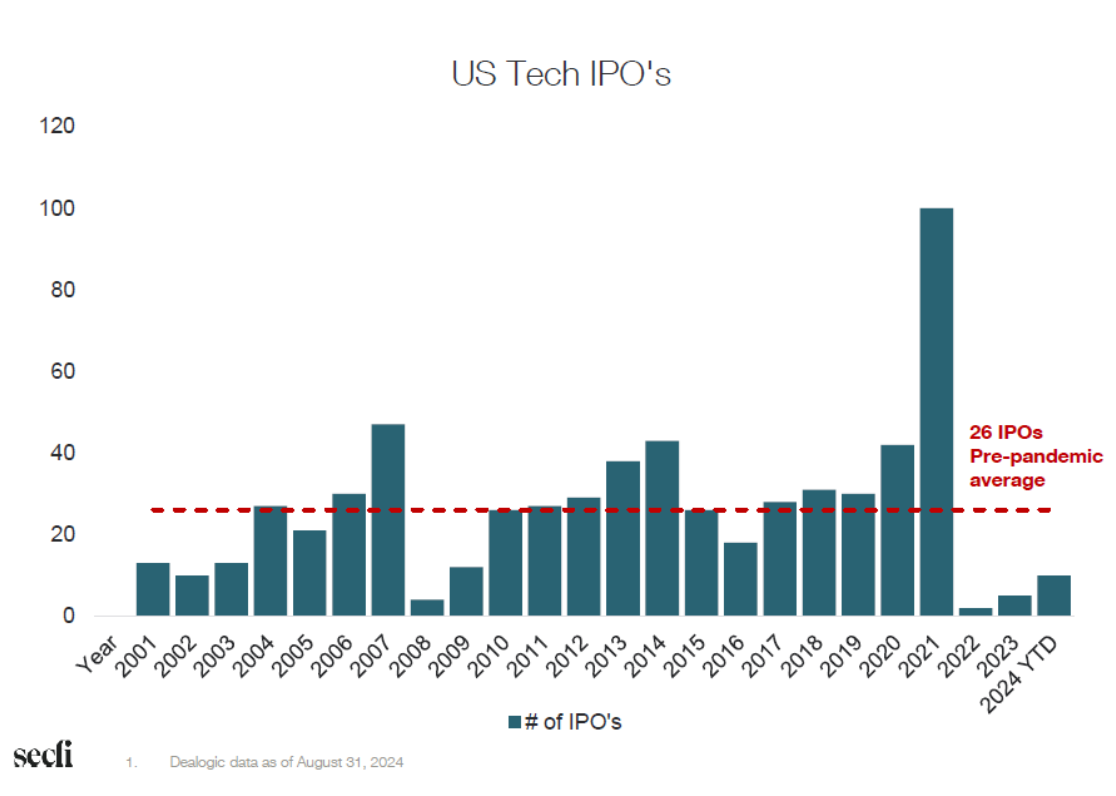

Unfortunately, we are in the longest IPO drought in the century.

For Illustrative Purposes only. Past Performance is not indicative of future results.

There were more tech IPOs after the global financial crisis in 2008 and 2009 than there were in 2022 and 2023. This year has fared a bit better, but 2024 is still behind 2009 in the number of tech IPOs.

At the beginning of the year, there was a lot of hope among investors and bankers that the IPO window would start to open. We saw Reddit go public in a successful offering and there was a lot of hope that others would also file and follow. Outside of a few cases like Rubrik and Ibotta, the window did not open as we had hoped and the consensus among bankers is that it will stay closed for the rest of the year.

Of course, there are macroeconomic events that impact this decision and the election is something that comes up a lot. However, the market demands for an IPO are much higher today than they were in previous years.

I spoke with a founder a few weeks ago who told me that when they started their company 10 years ago, the plan was to get to $100M in ARR and go public. But, here they are 10 years later, now needing to get to $200M to even think about taking their company public.

This is a tough realization for most startup founders and employees. The goalposts have moved significantly since the last downturn, especially as we recover from the ZIRP years.

There are many factors and not every tech company is the same, but we believe investors are focused on three major areas: scale, growth, and profitability.

Perhaps the hardest pill to swallow nowadays for later-stage startups is the scale requirement. Many of these companies in the current IPO backlog were started when the requirements for a successful IPO were much lower. Nowadays, investors are looking for companies on a much larger scale. Depending on who you speak to, in our experience, the magic number is somewhere between $200-300M in forward-looking revenue.

Even if you cross that $200M+ threshold, investors are also looking for growth which is also causing problems in this market. Many companies have struggled to sustain 30%+ growth rates. A lot of tech companies have revised their plans downward given the pressure in the markets creating yet another difficult hurdle for companies to navigate.

Of course, the icing on the cake here is profitability or a path to profitability. After the rush of 2021, investors are now also looking for at least a path to profitability. This can often clash with the previous requirement of growth—companies need to invest money in order to keep up with the growth rates but the market is also demanding that they cut costs to achieve profitability.

The dynamics right now are difficult, to say the least. Companies are having to navigate the high bar of scale while also balancing growth and profitability. For the select few that are meeting all the demands, they can likely go public at any time but are waiting for the right moment. But for most companies, this means that they will need more time to get their businesses in good enough shape for what the IPO market is demanding.

Our optimistic view is that the requirements to go public will come down when the cost of capital goes down, i.e., interest rate cuts. The Fed cut rates in September for the first time since the pandemic and has mentioned they will likely continue to do so in the quarters ahead. Under the assumption that the economy holds up, the prevailing thought is that rate cuts should help the IPO window open.

Another sentiment I run across in my conversations with pre-IPO company executives is that “they are ready to go public, but do not want to be the first”. Since everyone wants a successful IPO, some companies may be in a fortunate position to wait and have another company test the market before they do. If that IPO goes well, other companies may follow and prop the IPO window open.

Investors and bankers are waiting for these “blockbuster IPOs” to crack open the IPO window. In 2020, we saw Snowflake go public in September of 2020 followed by Doordash in December 2020 and then Affirm in January 2021. It was a different day and age in 2021, but the optimistic view is that we may see something similar starting in 2025.

The IPO market may be lackluster today, but the markets are cyclical and IPOs will pick up again. As always, feel free to reply here if you want to chat. We’re here for you!