0 result

Rokt is growing fast. A $335 million tender offer in January 2025 valued the company at $3.5 billion, provided over $100 million in employee liquidity, and came on the heels of 43% revenue growth.

This kind of growth and scale signals one thing: an IPO could be around the corner.

If you’ve been at Rokt long enough to accumulate stock options, now is the time to think about how you’ll handle them before an IPO. Planning now could mean the difference between a major tax bill and a potentially life-changing outcome.

Let's take an example to walk through what pre-IPO planning might look like.

Let’s say Alex joined Rokt in 2018 and was granted 55,000 Incentive Stock Options (ISOs) with a $5.00 strike price. Today, those shares are fully vested. The company’s current 409A (Fair Market Value) is $35/share, and the most recent preferred share price is also $35/share. For illustrative purposes, we’re assuming a 50% premium at IPO, putting the IPO/exit price at $52.50/share.

Alex's ROKT equity breakdown

| Metric | Amount |

|---|---|

Shares | 55,000 |

Strike price | $5.00 |

409A | $35/share |

Last preferred price | $35 |

So what are Alex’s options?

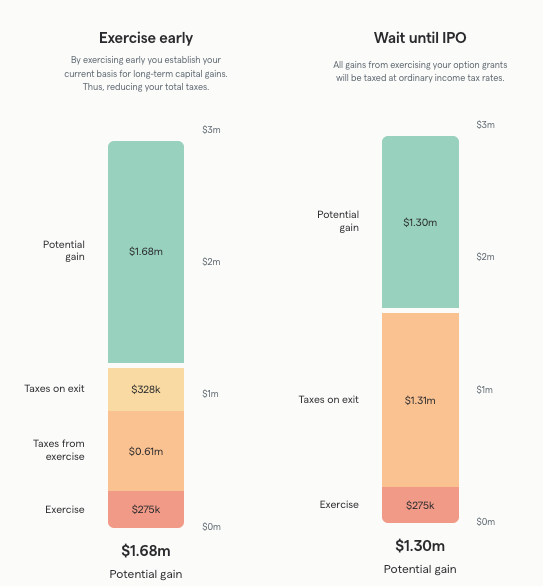

By exercising now, before a potential IPO, Alex locks in the current 409A as their cost basis and starts the clock for a qualifying disposition. That means they could benefit from significantly lower long-term capital gains tax rates—if they hold the shares for at least one year after exercising and two years from the original grant date.

Another potential benefit? Because these are ISOs, if Alex pays AMT when exercising, they may be eligible for an AMT credit in future years. That credit could help reduce their tax bill down the line.

Here’s what Alex’s outcome could look like if they exercise now:

Alex's ROKT equity outcome if they exercise now

| Metric | Amount |

|---|---|

Total share value | $2,887,500 |

Exercise cost | $275k |

Taxes from early exercise (AMT exposure) | ~$610k |

Taxes on exit (capital gains) | ~$329k |

Total net gain | $1.68M |

If Alex waits until the company goes public to exercise, they’ll be taxed at ordinary income rates on the entire gain between their strike price ($5) and the IPO price ($52.50). This could push them into the highest federal tax brackets.

Here’s what that looks like:

Alex's ROKT equity outcome if they wait to exercise

| Metric | Amount |

|---|---|

Total share value | $2,887,500 |

Exercise cost | $275k |

Taxes at IPO (ordinary income) | ~$1.31M |

Total net gain | $1.30M |

That’s the power of long-term capital gains. Exercising early reduces total tax exposure, which can make a significant difference, especially at Rokt’s scale.

This example is for illustrative purposes only. Actual Results may vary. Please consult a tax professional for your particular circumstance.

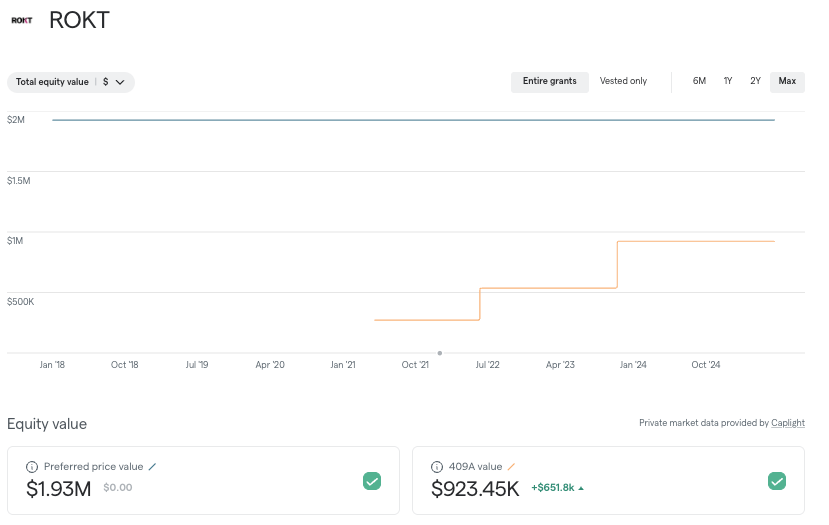

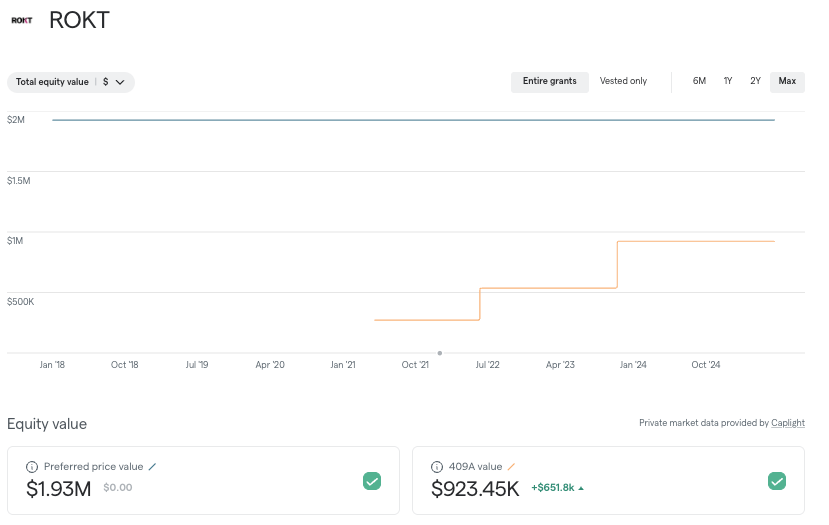

Rokt’s valuation has grown steadily over time. Today, we’re assuming both the 409A and preferred share price sit at $35, reflecting strong internal and investor confidence in the company’s value.

Alex’s total equity value at that price is just over $1.9M.

While there’s no spread between the 409A and preferred price today, that could change. As Rokt continues to grow, the preferred price may rise faster than the 409A, increasing future tax exposure if you wait to exercise. Planning early gives you more control over that outcome.

With a potential IPO on the horizon, now is the time to:

At Secfi, we help employees like Alex make informed decisions and access non-recourse financing to cover exercise and taxes, without dipping into savings.

We can walk you through your specific numbers, model different exit scenarios, and show you how much you could save by planning ahead. If you’re considering exercising or just want to explore your options, now’s the time.

Ready to get started?

Submit a request