Incentive stock options (ISOs) and taxes: the complete guide

If you work for a tech startup or pre-IPO company, it’s likely you’ve been granted incentive stock options (ISOs).

Hopefully, they’ll make you money someday. But how much you’ll make depends for a good part on how they’re taxed.

It isn’t easy to educate yourself on this.

Most info isn’t specific to the tech startup situation. Or it’s written in jargonese. Or it’s too high-level to be practically useful.

That’s why we put together this guide:

An in-depth resource on ISO taxes and strategies — written in plain English — with helpful visualizations.

Still have questions? Feel free to hit us up for a chat in the bottom right. ↘️

Note: this guide is complete, but a little simplified

ISO taxation is a rabbit hole of complexity – mainly because of the alternative minimum tax (AMT).

The page you're on now fully explains ISO taxation, but we've simplified the part about AMT.

That means you'll get the key takeaways, but you won't grasp why it works like this – and there will be some edge cases that this explanation won't cover.

For most startup employees, that will be more than enough.

But if you're the type of person who doesn't want to cut any corners, we'll show you how deep the rabbit hole goes. Enjoy 🐰

TL;DR

If your company exits and you sell your ISOs, the money you make is taxed.

But you get a major tax discount if you exercise them at least 12 months before selling (and you don’t sell them within 24 months after grant).

The problem? You already need to prepay a part of the taxes the moment you exercise.

If you can’t afford that, then you can't exercise and you miss out on the overall tax discount.

What makes it extra tricky is that the later you exercise, the more tax you'll need to prepay – assuming your company is growing (and its 409A valuation keeps rising).

So...

To get the most out of your ISOs when your company IPOs, exercise them at least 12 months before you sell them. And the earlier you exercise, the less cash you need to do so (assuming your company is growing).

Warning: when you exercise, your employer won't withhold the taxes you owe. It’s up to you to pay them.

(Want to know exactly how much you'll be taxed? Use our free Stock Option Tax Calculator for taxes on exercise and the Stock Option Exit Calculator for taxes on sale.)

What are ISO stock options?

Incentive stock options (or ISOs) are a type of stock option that gets a more favorable tax treatment than other types of stock options. When early-stage tech startups give you equity compensation, it’s usually in the form of ISOs.

Incentive stock options vs non-qualified stock options

With ISOs, you’re less likely to be taxed when you exercise them than with NSOs. And if you are taxed, it’s at a lower rate.

Then later, when you make money with them, you’re taxed again at an effective rate that’s often lower than with NSOs (more on that later).

ISOs can only be given to employees, and are specifically meant as a form of employee compensation. Startups can award NSOs more broadly, for instance to external advisors.

Finally, exercising ISOs are taxed under the alternative minimum tax system rather than the regular tax system. This makes it much more complicated to fully understand, but it does create the opportunity for some advanced tax optimizations.

The big picture: what’s the best tax strategy for your ISOs?

Before the rest of this guide dives into the details, let’s take a holistic look.

If you work for a constantly growing startup that ends up succeeding, the best tax strategy could be to exercise your ISOs as early as possible.

That’s because:

- You may net up to 27 percent more through long-term capital gains tax savings

- The earlier you exercise, the less upfront cash you need to exercise

Here’s a real-world example:

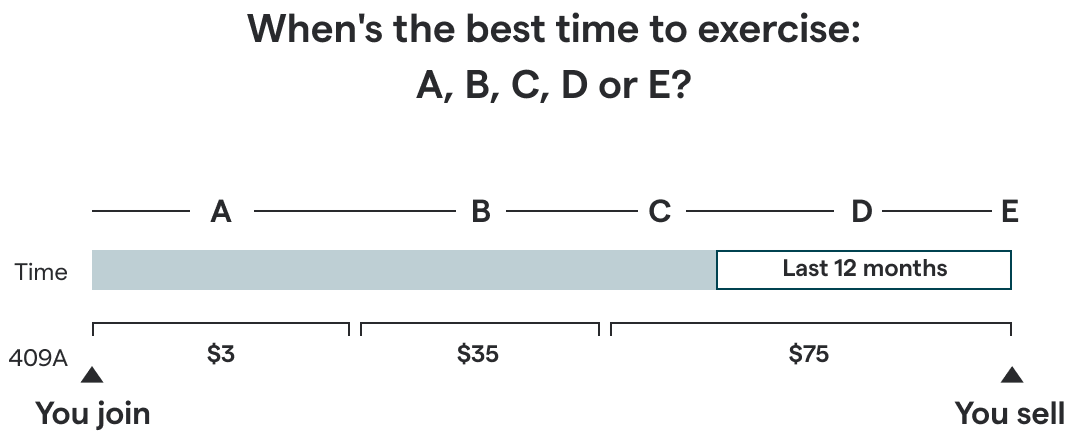

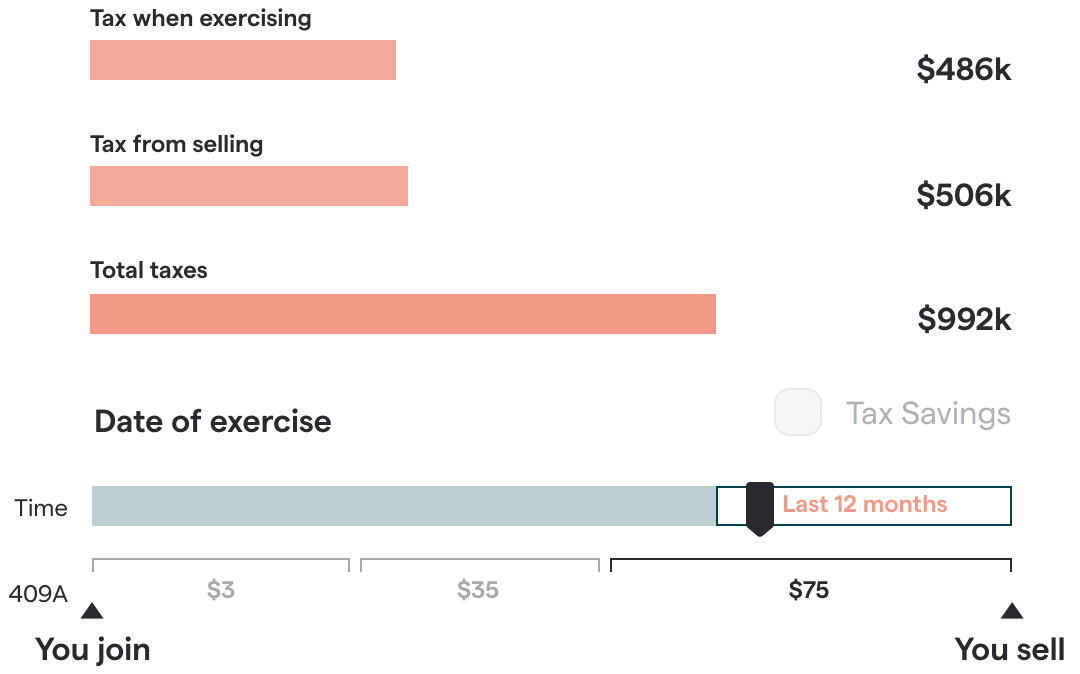

Say you join a startup and get 15,000 NSOs with a $3 strike price. Eventually, the company IPOs and you get to sell the shares for $150 each.

Over time, the 409A valuation (also known as fair market value) of your company grows.

Say this is the timeline:

- Year 1: You join the company when the 409A valuation is $3

- Year 2: 409A grows to $35

- Year 3: 409A grows to $75

- Year 4: The company IPOs, and you sell your shares for $150

Then this gives 5 distinct moments at which you could exercise:

- A: While the 409A is $3

- B: While the 409A is $35

- C: While the 409A is $75, but you exercise more than 12 months before the day you sell

- D: While the 409A is $75, but you exercise less than 12 months before the day you sell

- E: You exercise on the same day as when you sell

When should you exercise your ISOs?

You could exercise at any of these points in time – but the tax implications would be different at each.

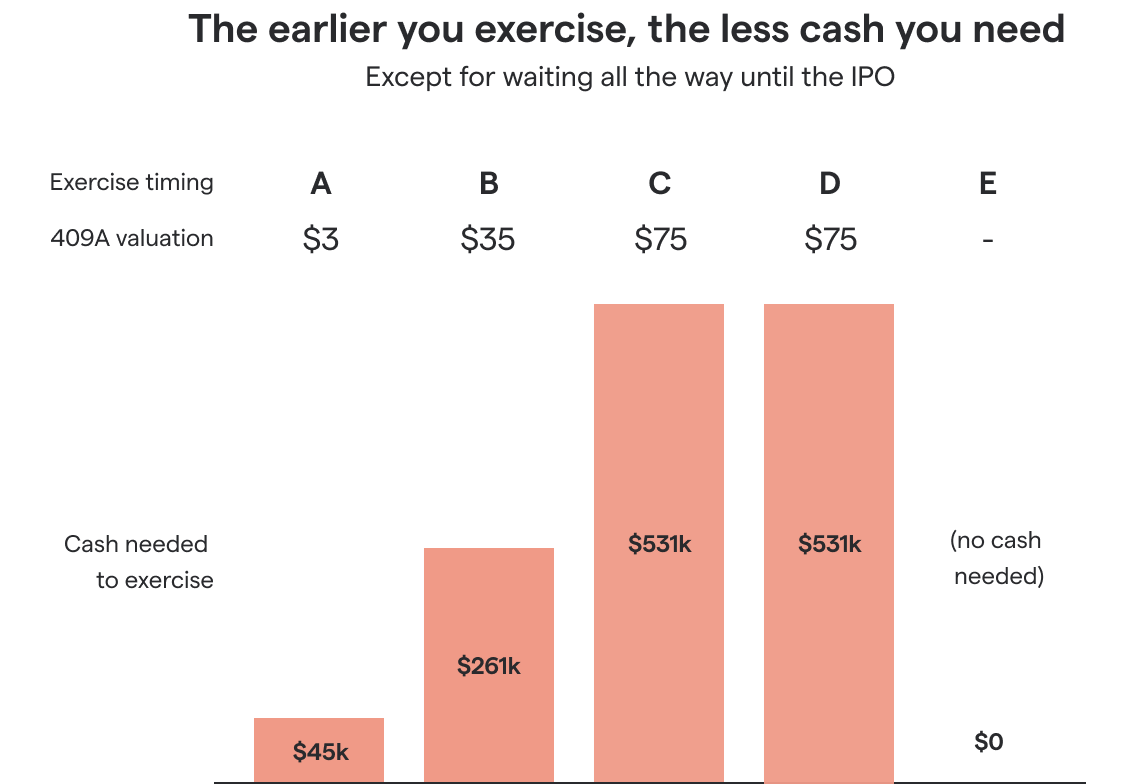

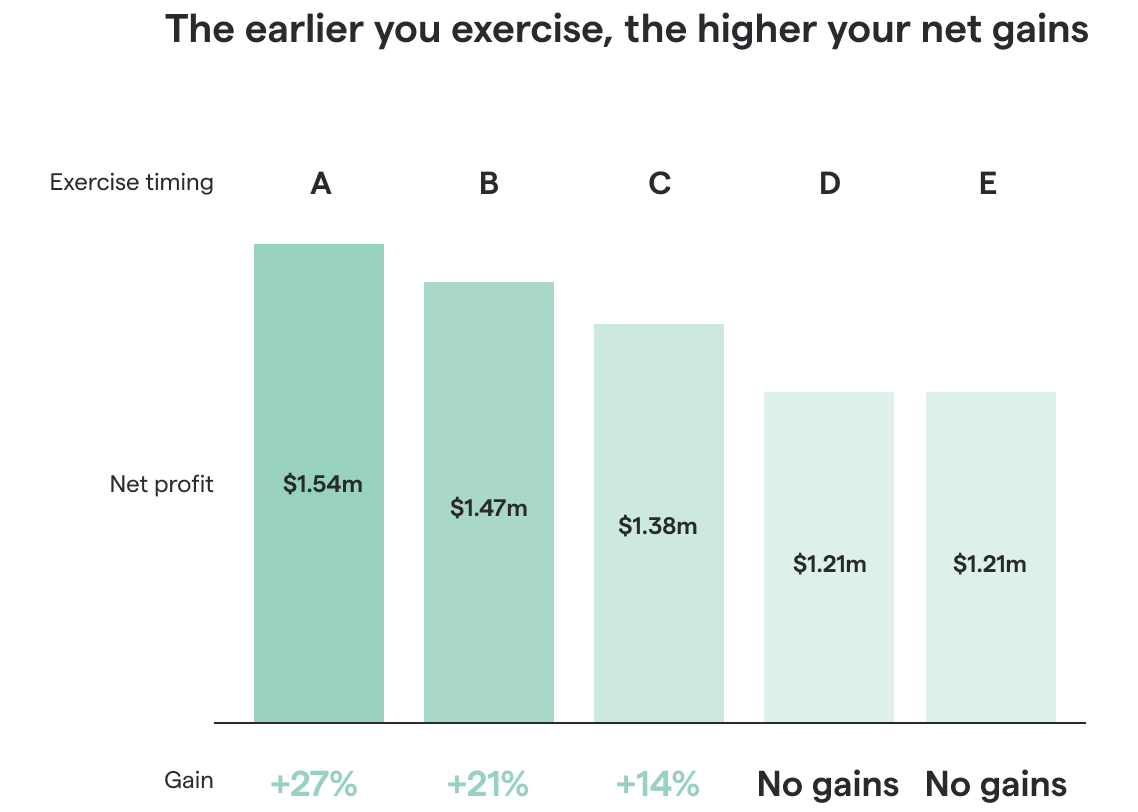

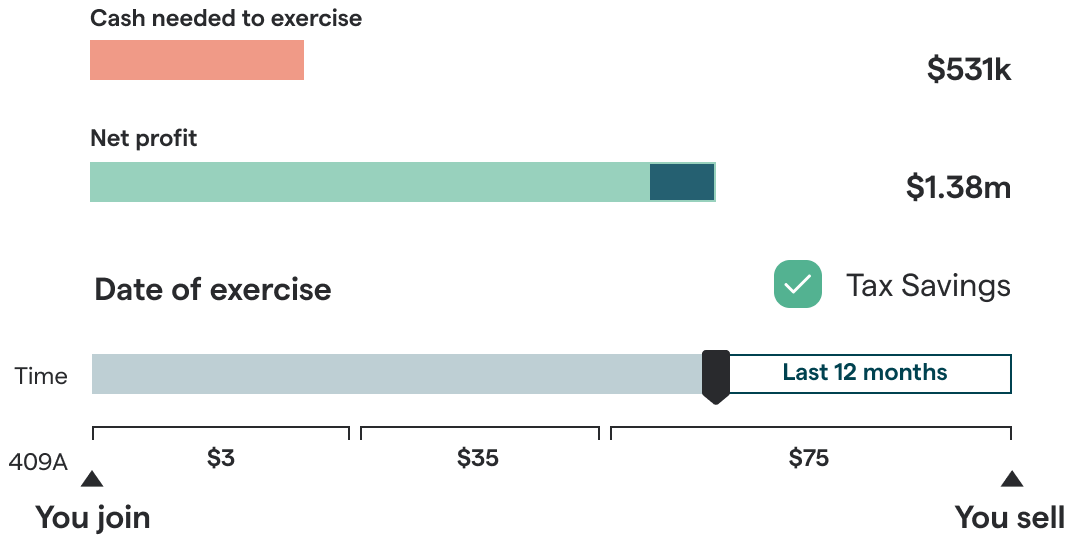

Depending on when you exercise, the amount of cash you need to exercise as well as your net gain will change.

Here’s the amount of cash you’d need to exercise at A, B, C, D or E:

If you wait all the way until you sell (point E), you don’t need any cash to exercise — because you can cover the costs with your proceeds.

But if you exercise before selling, you need to pay out of pocket.

And the higher the 409A, the more cash you need. (Because you trigger a higher tax bill – but more on that below).

So why exercise before selling?

Because if you don’t, you end up with the lowest possible net gain:

If you exercise at least 12 months prior to selling – in this case at A, B and C – your net gain is higher.

In summary, here's what happens depending on when you exercise:

Why it works like this 🤔

Normally, the money you make from ISOs is taxed just like your salary.

But if you exercise your ISOs at least 12 months before selling them – and sell them at least 24 months after grant – you get a tax discount.

That can increase your net gain by up to 27 percent – that’s what we saw in the green bar chart.

The problem?

- As soon as you exercise, you have to prepay a part of these taxes

- And the higher the 409A valuation of the company, the more tax you need to prepay

- For growing startups, this effectively means: the later you exercise, the more tax you need to prepay – because if a startup is growing, its 409A increases over time

That’s what we saw in the red bar chart – rising costs over time.

Essentially, exercising before an IPO is a trade-off: it means paying some tax now so you’ll pay less tax overall.

In our example, this is what the taxes do depending on when you exercise:

You might want to stare at that for a minute to grasp what’s going on – this is confusing stuff 😵

So:

If you work for a constantly growing startup, you can maximize your net gains by exercising in advance of the exit.

And the earlier you do this, the less cash you need.

What if exercising my ISOs is too expensive?

Of course, $206k or even $416k is a huge amount to pay for your ISOs.

Unfortunately, these are pretty common numbers for employees at the most successful and high-growth startups.

Even if you have that kind of money, putting your personal savings on the line is risky since it’s not guaranteed that your company will actually manage to reach a successful exit.

So what do you do if you still want that tax savings? Or what if you recently left your company and now have a deadline to exercise your NSOs?

That’s exactly why exercise financing exists, which is what we offer at Secfi.

Here’s how exercise financing works:

- We cover your exercise costs (including taxes)

- You pay us back after your company exits

- It’s non-recourse, meaning you don't risk your personal assets. If the exit never happens, you won’t have to pay us back

- You remain the owner of your shares – you’re not selling them to us

We make money only if there is a successful exit. If there is, you’ll pay us back more than the original amount. (But because of the tax savings, you’re often still at a net benefit vs not having exercised).

If there’s no exit, you don’t owe us anything (and we’ll take the hit).

Is it always better to exercise my ISOs as early as possible?

No.

In the example above, we made two assumptions:

- Your company successfully exits (i.e. you get to sell your ISOs at a gain)

- The 409A valuation of your company keeps rising

Regarding #1, most startups never get to that point.

That’s why exercising early is risky. If the company goes out of business, you’ve lost the money you spent.

If you want to exercise your ISOs but don’t want to risk losing money, non-recourse financing is a solution.

Regarding #2, sometimes the 409A valuation of a company temporarily dips. This means you can exercise at a lower cost, so in that scenario waiting actually makes it cheaper.

If you are long-term optimistic about the company, you should expect the 409A valuation to go up – unless you foresee a specific reason why the company would take a hit in the short term.

Now that you’ve got the big picture, let’s dig into the details of just how ISOs are taxed…

Tax on stock options

ISOs are taxed twice:

- When you exercise them

- Then again when you make money with them after your company exits

At exercise, ISOs are taxed at alternative minimum tax (AMT) rates. The higher the 409A valuation of your company, the more you owe.

When you make money selling them, they’re taxed at ordinary income rates (the highest possible rate, just like your salary).

Unless...

If you exercised them at least 12 months prior to selling (and sell them at least 24 months after grant), you pay long term capital gains rates instead. That’s a lower tax rate, increasing your net gain by up to 27 percent. More details on how this works below.

Whatever you paid at #1 will be subtracted from your liability at #2 – your exercise tax acts like a prepayment for your future sale tax. (You’re not double taxed!)

Are ISOs taxed when initially granted?

No. There’s no tax due when your company initially grants you the ISOs (i.e. awards you with them).

Are ISOs taxed when they vest?

No. After grant, most ISOs follow a vesting schedule that dictates when you actually ‘get’ them. But when they vest, there’s still no tax due.

How are ISOs taxed when exercised?

In short:

- You pay alternative minimum tax rates on the difference between the strike price and the 409A valuation

- But there’s a tax-free threshold, so you only owe the tax dollars beyond that threshold

- Your employer doesn’t withhold this tax – so it’s your responsibility

- The 409A valuation usually grows over time, so the longer you wait, the more you pay

Let’s go through it step by step:

When you exercise an ISO, you pay its strike price to your company to buy a share. Say you have ISOs with a $3 strike price:

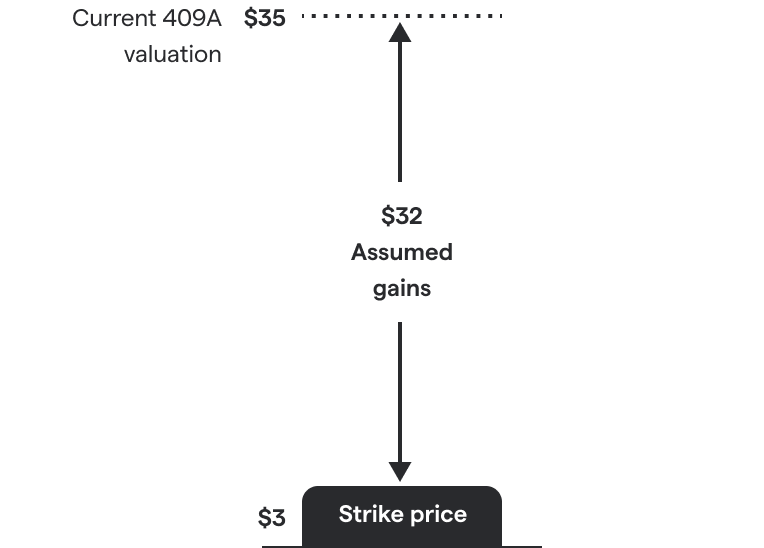

But even though you’re not making money, the difference between the strike price and the current 409A valuation is considered a phantom gain (also known as the spread) by the IRS.

Say the current 409A valuation is $35 per share. If you pay $3, you’re making a $32 phantom gain in the eyes of the IRS.

This phantom gain gets taxed. And that tax is called the alternative minimum tax (AMT).

Impressive how complicated they managed to make this, no? A true work of fiscal art...

If you’ve made it this far, it’s time to dive into:

ISOs and the Alternative Minimum Tax (AMT)

You might not have heard about the AMT. It's a tax you normally don't encounter, but it kicks in when exercising ISOs.

It’s a weird tax with its own set of rules.

In this guide we’ll just share the takeaways.

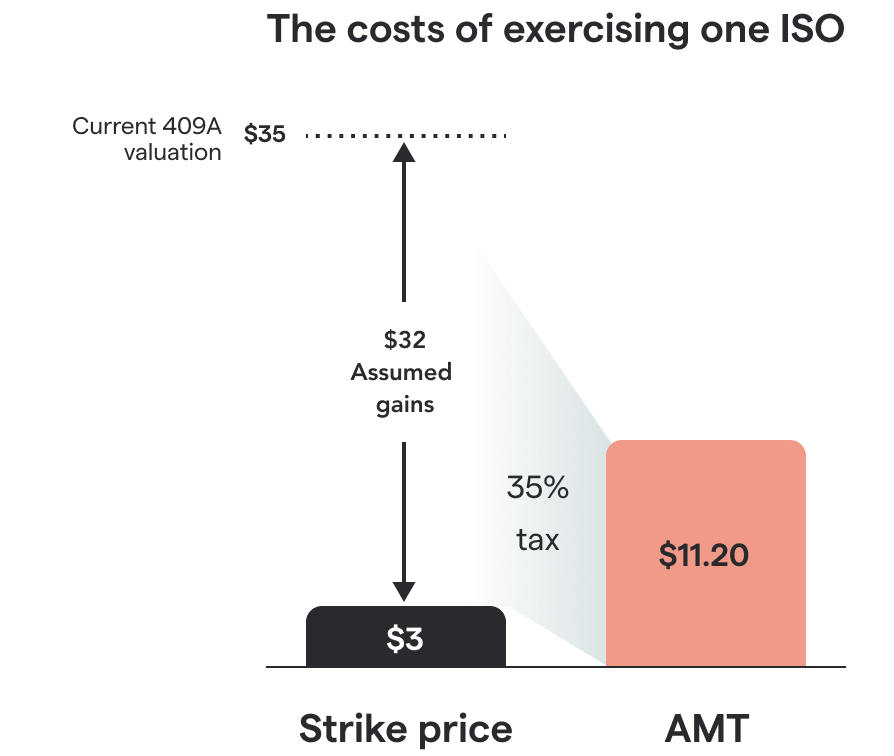

For our clients in California, the AMT is usually ~30-38 percent. We’ll assume 35 percent in this article.

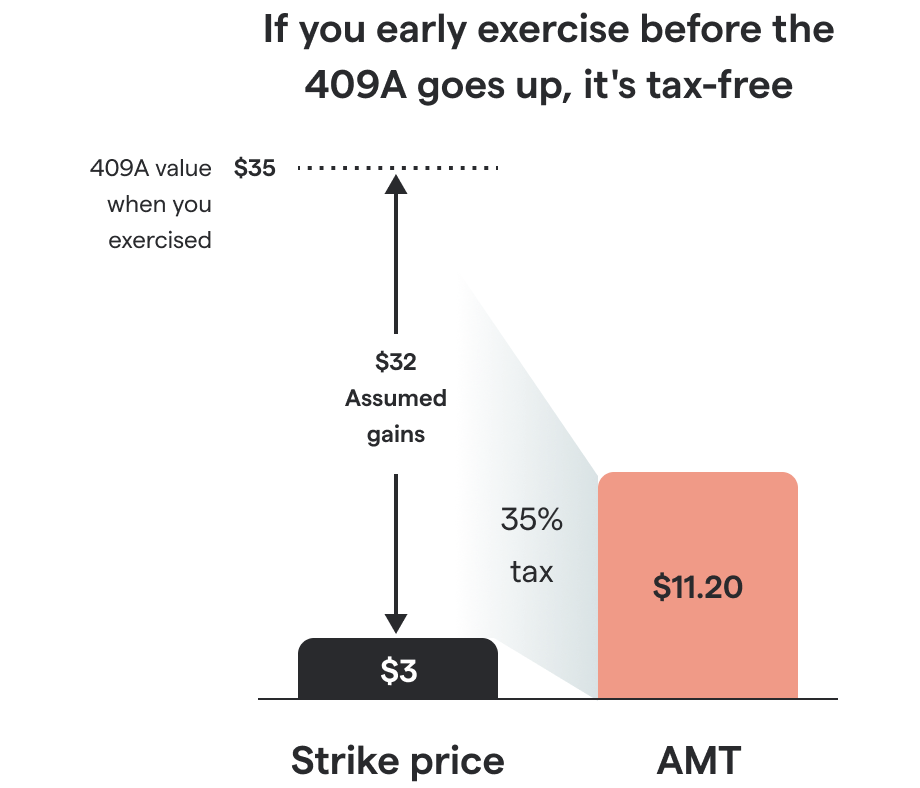

In our example, a 35 percent rate means that each ISO you exercise builds up $11.20 of AMT:

The $7,000 here is just an example. Your AMT threshold is probably a very different dollar amount. It totally depends on your tax situation for the year.

In fact, the AMT threshold isn't really a thing – as in, it's not defined and set by the government. Rather it's a result of the inner workings of the AMT, which effectively give you a threshold.

For the purposes of this guide though, all you need to know is that:

- There is a threshold up until which you don't pay AMT

- The amount depends on your tax situation for the year

- Our Stock Option Tax Calculator automatically accounts for it

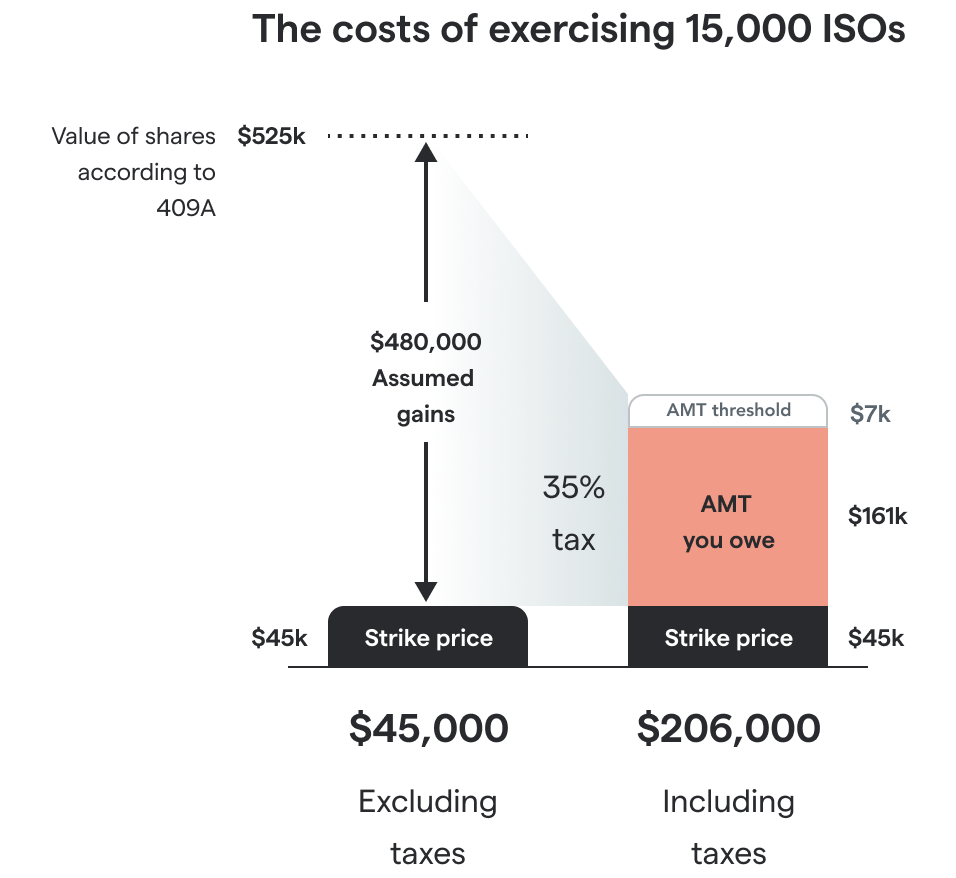

Here’s a real-life example:

Say in total you have 15,000 ISOs. (The rest of the numbers are the same as before: $3 strike price, current 409A valuation is $35, and your AMT threshold for the year is $7,000.)

If you exercise all 15,000 ISOs, then:

- You’re paying your company $45,000 to buy shares (15,000 × $3 strike price)

- The value of the shares is $525,000 according to the current 409A valuation (15,000 × $35)

- You’re making a $480,000 phantom gain ($525,000 − $45,000)

- You build up $168,000 of AMT liability ($480,000 × 35%)

But you only have to pay the AMT that surpasses your $7,000 threshold, so in the end your tax liability is $161,000 ($168,000 − $7,000).

Adding the taxes to the $45,000 strike price, and your total exercise costs are $206,000.

Note: The tax you pay when exercising isn't additional. It’s frontloaded. That means it gets subtracted from the tax you owe when you sell your shares at a gain, and won’t affect the overall net amount you make.

Wait – aren’t ISOs supposed to be tax-free to exercise?

No. They’re often touted as such, but that’s a dangerous misconception.

The idea is that they are in principle tax-free, and the AMT is just an "exception" that kicks in if you exercise a lot of ISOs (driving the AMT beyond your yearly threshold).

The problem is that many employees reach that threshold pretty quickly.

Warning #1: your employer won’t withhold this tax – you pay it when you file your taxes

Sometimes employers don’t even notify their employees of their ISO tax liability. And it’s your responsibility to pay this to the IRS.

In some cases, even tax advisors aren’t aware of this. We’ve heard horror stories of accountants letting their clients know that they owed an extra $60K — the day before taxes were due.

Warning #2: the later you exercise, the higher your tax liability can become

If your company keeps growing, then exercising your ISOs becomes increasingly expensive over time.

And the faster the company grows, the worse it gets.

This is because of the 409A valuation. The higher the 409A, the larger your phantom gain, the more tax you’ll owe.

The 409A is updated at least yearly and reflects company growth. If the company is in a better place than last year, the 409A will rise.

(The 409A valuation is an appraisal of the value of a company share for tax purposes. By law, your employer is required to have it re-assessed by a third party at least once a year – or when something substantial happens to the company, like a new funding round.)

Example:

Say the 409A valuation of your company grows from $35 now to $50 one year later and $75 two years later:

Then the total cost to exercise your 15,000 ISOs (including AMT) grows from $206,000 to $284,750 to $416,000:

Exploding exercise costs effectively lock you out from exercising your ISOs.

This is especially a problem at high-growth startups.

Tip: if your employer allows early exercising, you may be able to exercise ISOs tax-free

A higher 409A valuation means more taxes, but this also works the other way around. A lower 409A means less taxes.

And if the 409A is equal to your strike price, you pay no taxes at all (because your phantom gains zero).

That’s the case when you’re first granted your ISOs, because your strike price will be set to the 409A valuation at the time. So if you exercise before the 409A valuation goes up, it’s tax-free.

You can only do this if your company allows early exercising: exercising options before they vest.

At most companies you’ll have to wait for your ISOs to vest instead. But by that time, it’s likely the 409A has already increased.

⚠️ Warning: if you early exercise, you need to file an 83(b) election with the IRS within 30 days. This makes it official. If you forget to file it, you’ll still be taxed when your ISOs vest in the future.

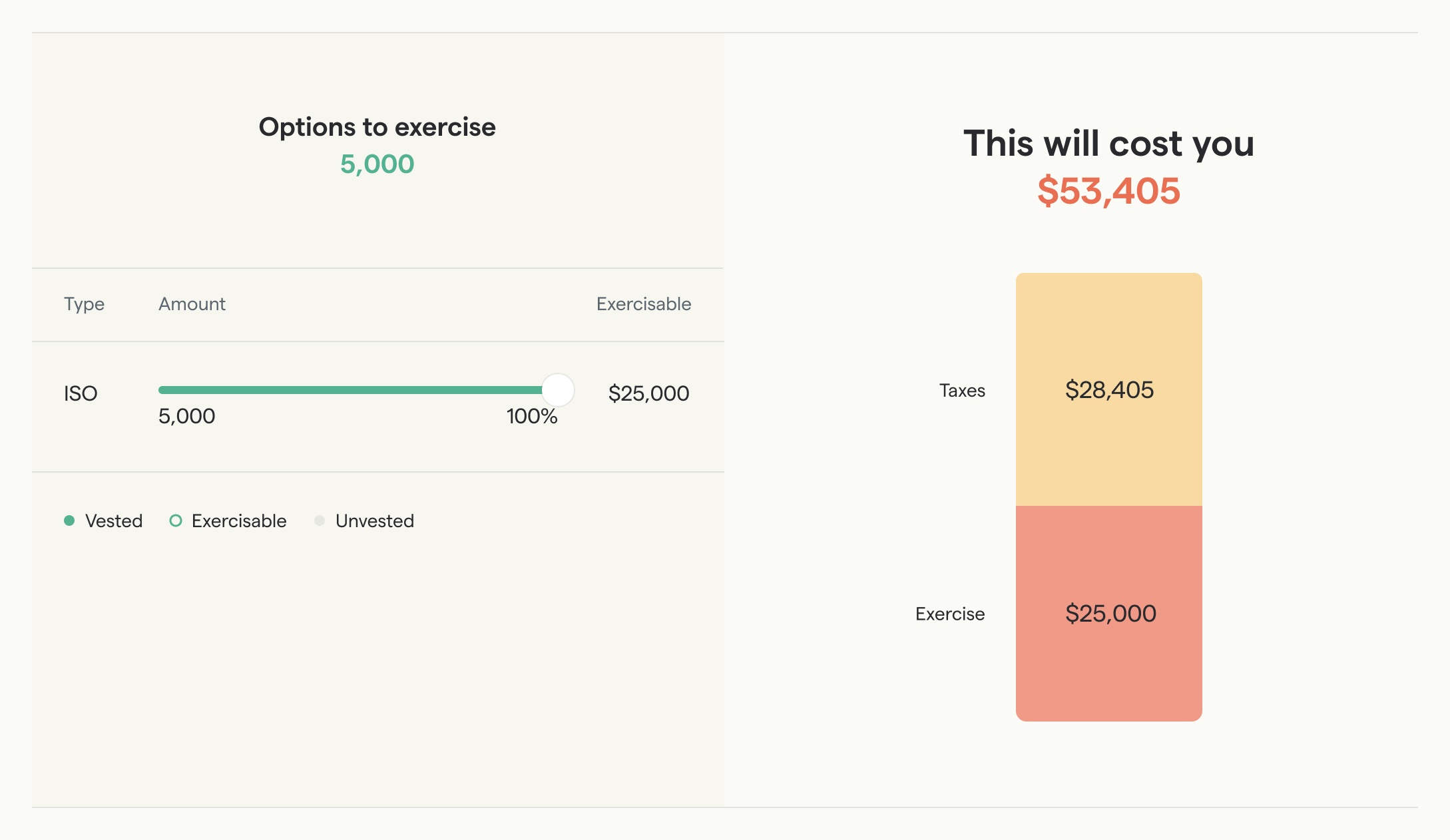

Use a stock options calculator to figure out your exact tax burden

In the above examples, we’ve used an effective AMT rate of 35 percent, which is what we often see among our clients in California. But it really depends on:

- Where you live

- How you file your taxes

- Your household income

- Your phantom gain (i.e. the number of ISOs you exercise, their strike price, and the 409A valuation)

- A lot of other factors

If you want a personalized figure, use our Stock Option Tax Calculator. It’s completely free. Just create an account, enter your tax and equity details and it runs the numbers for you.

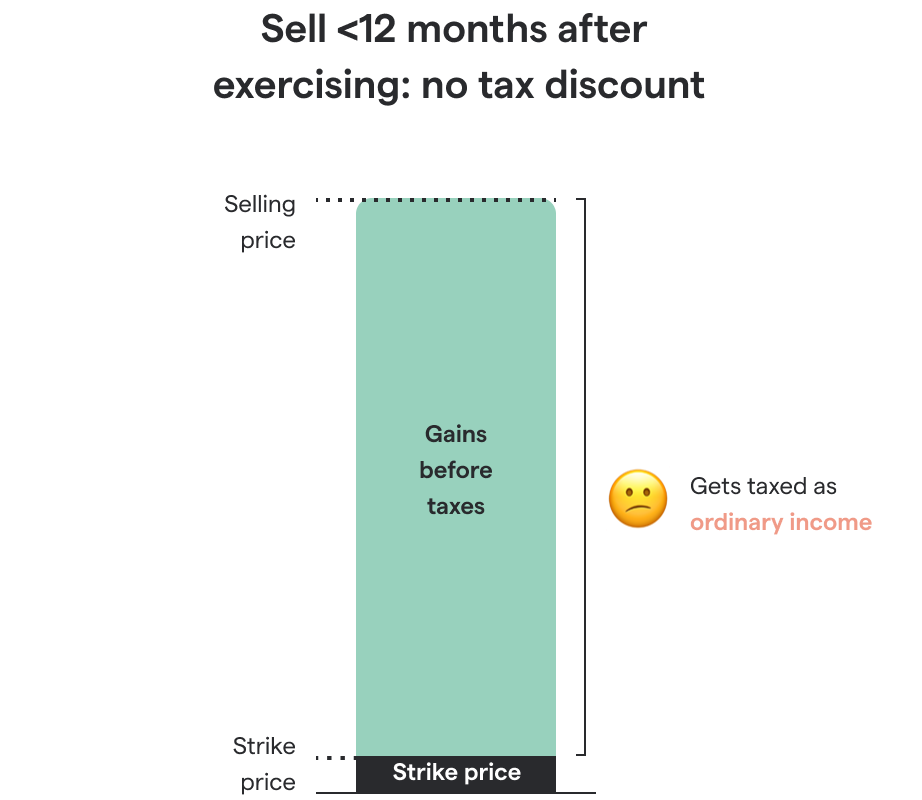

How are ISOs taxed when you make money (i.e. sell them after an exit)?

When you make money by selling your equity in an IPO or acquisition, your gain – ie. the sell price minus strike price – is taxed.

With ISOs, your gain gets taxed either as:

- Ordinary income (high tax rates)

- Long-term capital gains (lower tax rates)

By default, you get the ordinary income tax rates – that's the highest possible tax rate, and the same as your salary.

But…

If you exercised your ISOs at least 12 months before selling them, you get the lower long-term capital gains rates.

Lower rates means your net gain is higher: the gain can be up to 27 percent.

If you exercised before and already paid taxes over your phantom gain, then that gets subtracted from your sale taxes. (You’re not paying double tax 🙌.)

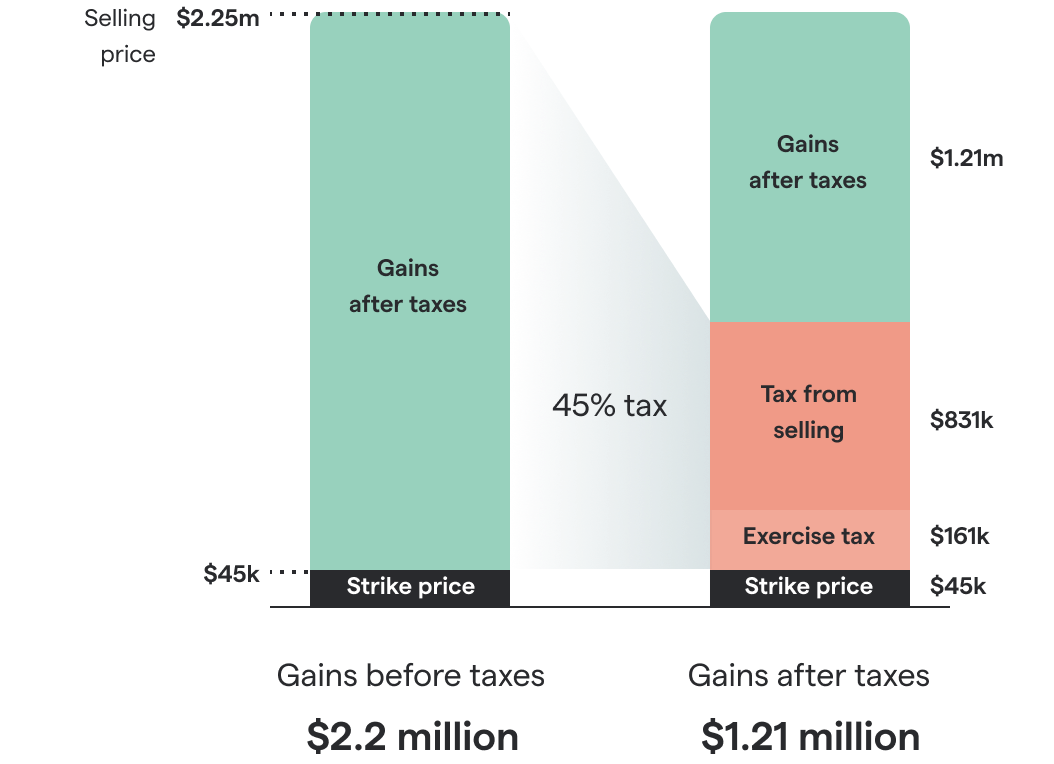

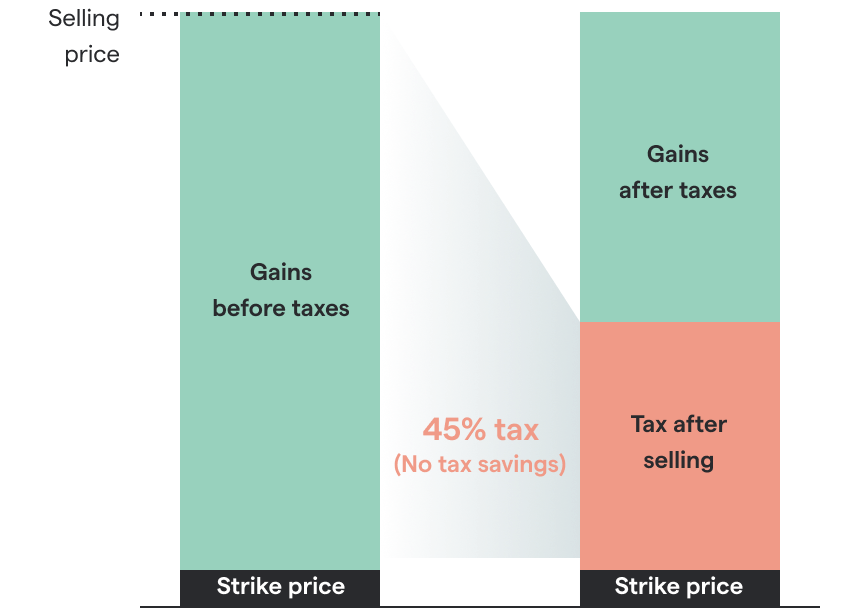

Real-life example with ordinary income rates:

Again, let’s say you have 15,000 ISOs at a $3 strike price. And you exercised them when the 409A was $35.

After the IPO, you can sell them for $150 each.

In this example, however, you exercised less than a year from the IPO, so you don’t get the tax discount.

The money you make is taxed at ordinary income rates.

In this example we’ll use 45 percent for federal + California taxes, but the actual rates depend on your situation. Use our free Stock Option Exit Calculator for a personalized figure.

Assuming 45 percent, your situation now looks like this:

- You make a $147 pre-tax gain on each ISO you sell ($150 − $3 strike price)

- For each sold ISO, you owe $66.15 in ordinary taxes ($147 × 45%)

Your net gain is $80.85 per ISO.

But when you exercised your ISOs earlier, you already paid $45,000 for the strike price and $161,000 in taxes.

So if you now sell all of your 15,000 ISOs, this happens:

- You sell for $2,250,000 ($150 × 15,000)

- Your pre-tax gain is $2,205,000 ($2,250,000 − $45,000 strike price)

- You owe $992,250 in taxes ($2,205,000 × 45%)

- You already paid $161,000, so your remaining tax liability is $831,250

- Your net gain is $1,212,750.

ISOs and long-term capital gains tax

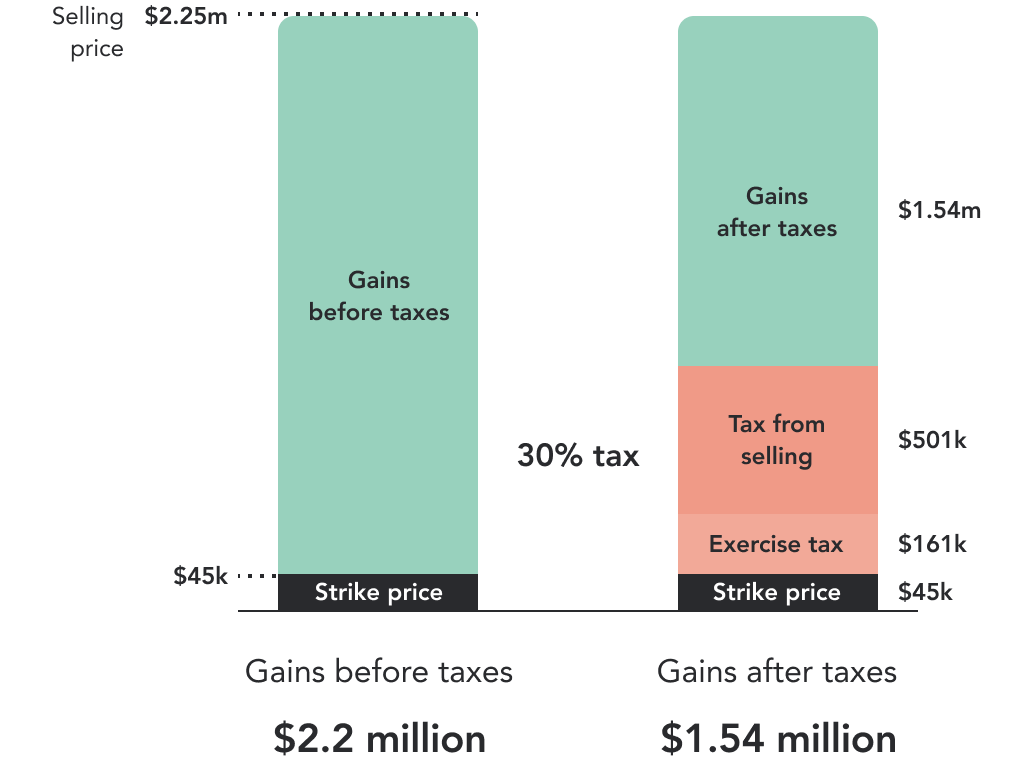

Now let's look at what happens if you do get the tax savings.

Same scenario, except this time you exercised more than 12 months before selling, so you’re taxed at long-term capital gains rates.

Again, the actual rates depend on your situation – in this article we’ll use 30% for federal + California.

The calculation is pretty much the same:

- You make a $147 pre-tax gain on each ISO you sell ($150 − $3 strike price)

- For each sold ISO, you owe $44.10 in taxes ($147 × 30%)

Your net gain is $102.90 per ISO.

Selling all of your 15,000 ISOs:

- You sell for $2,250,000 ($150 × 15,000)

- Your pre-tax gain is $2,205,000 ($2,250,000 − $45,000 strike price)

- You owe $661,500 in taxes ($2,205,000 × 30%)

- You already paid $161,000, so your remaining tax liability is $500,500

Your net gain is $1,543,500.

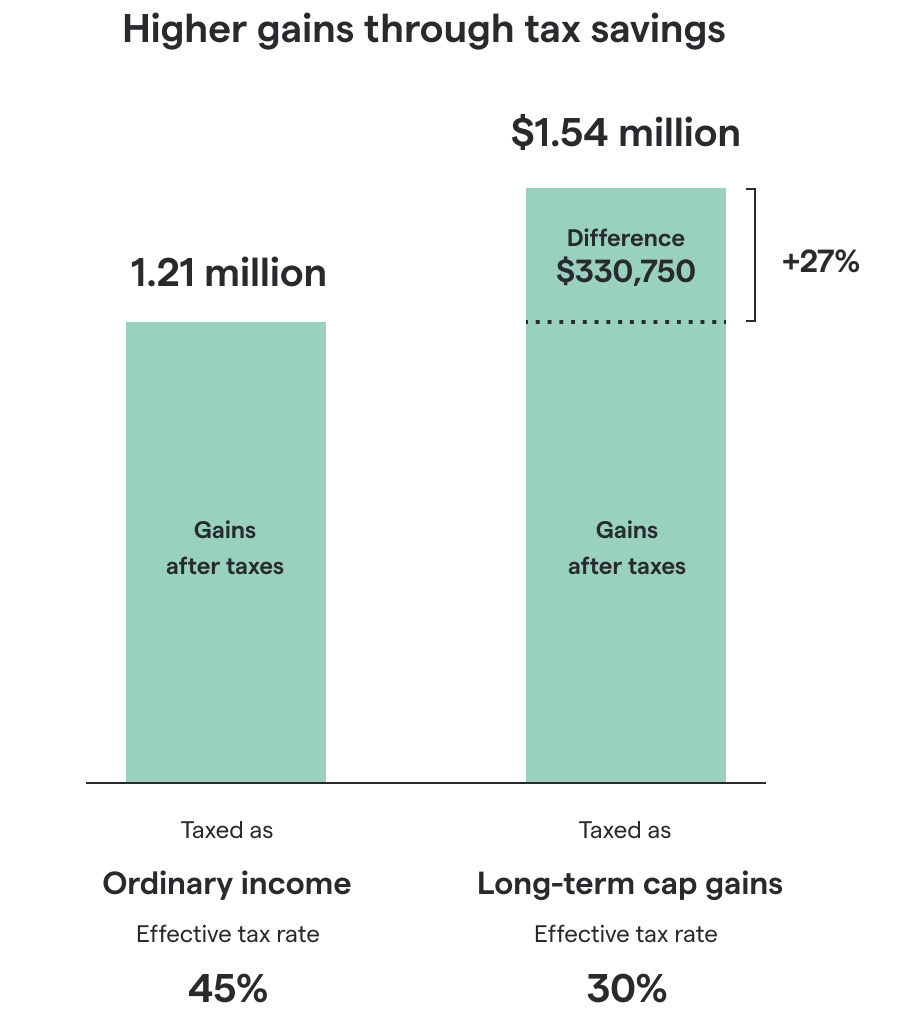

The benefit of long-term capital gains rates for ISOs

Exercising your options before the IPO is costly and risky, but the tax savings can be worth it.

In our example:

- Net gains with ordinary income rates: $1,212,750

- Net gains with long-term capital gains rates: $1,543,500

The difference is $330,750, a 27.3 percent gain.

For early employees at highly successful startups, the gain can be tens to hundreds of thousands of dollars.

How are ISOs taxed when you exercise and sell at the same time (i.e. a cashless exercise)?

Stock options are often explained as:

- You first pay money to exercise them, buying you a share

- Then, later, you sell that share at a gain (hopefully)

But #1 and #2 can happen at the same time – you buy the share, then immediately sell it. It’s as if you directly sold the ISO (rather than a share).

Of course, you can only do this if you wait until your company exits (otherwise its shares aren’t sellable).

This is called a cashless exercise, since you don’t have to come up with the cash to cover the exercise costs.

You immediately make money – the immediate costs are withheld from your proceeds, and you’re guaranteed to have enough cash to cover any taxes later on.

Waiting for an exit to do a cashless exercise is a popular strategy because exercising prior to the exit can be expensive and risky (after all, there’s no guarantee of a successful future exit).

Tax-wise, this means that you don’t get the long term capital gains tax discount.

The two taxable events – exercising and selling – blend into one. So since you didn’t exercise at least a year prior to selling, your gain gets taxed as ordinary income rather than long-term capital gains.

For instance, going back to our running example: say you have 15,000 ISOs at a $3 strike price. You don’t exercise them. Now your company IPOs, and you can sell your shares for $150 each.

With a cashless exercise, you buy and sell your shares on the same day. So per ISO, you pay your company $3. Immediately, you sell your share for $150, and make a $147 gross gain.

That gain will be taxed at ordinary income rates. If we again assume 45 percent for federal and California taxes, you'll hypothetically owe $66.15 in taxes.

Your net gain is $80.85 per ISO.

Doing this with all of your 15,000 ISOs means:

- You pay your company $45,000 to buy the shares ($3 × 15,000)

- You sell for $2,250,000 ($150 × 15,000)

- Your pre-tax gain is $2,205,000 ($2,250,000 − $45,000)

- You owe $992,250 in taxes ($2,205,000 × 45%)

Your net gain by doing a cashless exercise is $1,212,750.

With tax savings (due to having exercise earlier) it would’ve been $1,543,500.

How are ISOs taxed in California?

In California, ISOs are taxed at alternative minimum tax (AMT) rates when you exercise them, and at either ordinary income rates or long-term capital gains rates when you sell them.

That last part depends on the following:

- Are you selling your shares at least 12 months after having exercised the ISOs?

- Are you selling your shares at least 24 months after you were granted the ISOs?

If both are ‘yes’, your gain will be taxed at long-term capital gains rates. Otherwise, you’ll get ordinary income rates.

Below are the 2024 and projected 2025 tax brackets for California and federal taxes (we’ll assume married individuals filing jointly).

Alternative minimum tax (AMT) rates 2024 and 2025

Federal AMT rates 2024

| Tax rate | Income |

|---|---|

26% | Up to $232,600 |

28% | Over $232,600 |

Federal AMT rates 2025 projected

| Tax rate | Income |

|---|---|

26% | Up to $239,100 |

28% | Over $239,100 |

California AMT rate 2024 & 2025

| Rate |

|---|

7% |

Long-term capital gains tax rates 2024 and 2025

Federal long-term capital gains tax rates 2024

| Tax rate | Income range |

|---|---|

0% | Up to $94,050 |

15% | $94,051 to $583,750 |

20% | $583,751 or more |

Federal long-term capital gains tax rates 2025 projected

| Tax rate | Income range |

|---|---|

0% | Up to $96,700 |

15% | $96,701 to $600,050 |

20% | $600,051 or more |

California long-term capital gains rates 2024 & 2025 projected

| Tax rate | Income range |

|---|---|

1% | Up to $21,512 |

2% | $21,513 to $50,998 |

4% | $50,999 to $80,490 |

6% | $80,491 to $111,732 |

8% | $111,733 to $141,212 |

9.30% | $141,213 to $721,318 |

10.30% | $721,319 to $865,574 |

11.30% | $865,575 to $1,442,628 |

12.30% | $1,442,629 or more |

Ordinary income tax rates 2024 and 2025

Federal ordinary income tax rates 2024

| Tax rate | Income range |

|---|---|

10% | Up to $23,200 |

12% | $23,201 to $94,300 |

22% | $94,301 to $201,050 |

24% | $201,051 to $383,900 |

32% | $383,901 to $487,450 |

35% | $487,451 to $731,200 |

37% | Over $731,200 |

Federal ordinary income tax rates 2025 projected

| Tax rate | Income range |

|---|---|

10% | Up to $23,850 |

12% | $23,851 to $96,950 |

22% | $96,951 to $206,700 |

24% | $206,701 to $394,600 |

32% | $394,601 to $501,050 |

35% | $501,051 to $751,850 |

37% | Over $751,850 |

California ordinary income tax rates 2024 & 2025 projected (same as long-term capital gains)

| Tax rate | Income range |

|---|---|

1% | Up to $21,512 |

2% | $21,513 to $50,998 |

4% | $50,999 to $80,490 |

6% | $80,491 to $111,732 |

8% | $111,733 to $141,212 |

9.30% | $141,213 to $721,318 |

10.30% | $721,319 to $865,574 |

11.30% | $865,575 to $1,442,628 |

12.30% | $1,442,629 or more |

Final thoughts

Phew – that was a long read! If you made it all the way here, you probably belong to the top 5 percent percentile of startup employees when it comes to understanding how ISOs work.

A short recap of how your ISOs are taxed:

- You pay AMT when you exercise them (unless the AMT you owe is lower than your AMT threshold)

- You again pay tax when you sell them (or, to be precise, when you sell the shares you bought by exercising them) and make a gain

If you exercised early enough (at least 12 months prior), and if the sale is at least 24 months after you were granted the ISOs, you get a discount on your sale tax and maximize your net gain.

If you wait all the way until the exit to do a cashless exercise, you won’t get the tax savings.

For growing companies, the amount of AMT you owe grows the later you exercise, because the 409A valuation grows.

So if your company is growing, and manages to have a successful exit, then the optimal tax strategy could be to exercise your ISOs as early as possible.

We hope this was helpful!

Still have questions? Feel free to hit us up for a chat in the bottom right. ↘️

Additional resources:

- The Stock Option Exit Calculator is a calculator that shows your net gain after an exit, given various scenarios.

- If you want to exercise but the cost is too high, exercise financing may be a solution.