🐂 Are we in a new bull market or is it a head fake?

⏳ So…will it last?

I’ve already shared my aversion to predictions, but, if I had to put my money somewhere, it’d be a strong yes.

0 result

If you’ve been a dedicated reader of Founders + Funders, you may remember the first issue I authored last fall: #Bullish: Where do the markets go from here? I had recently joined Secfi — it’s hard to believe we launched Secfi Wealth nearly 9 months ago! — and we were in the middle of an economic downturn as the stock market had taken a nosedive, falling 20% year-to-date.

So, I wanted to introduce myself to the startup community with a piece of optimism but to also share my very real bullish belief about stocks, which, of course, was backed up by decades of data and trends.

Now here we are, less than a year later, and we are back in a bull market, which is generally defined as a 20%+ return from the market's lows. Since the end of September 2022 through June 20th, 2023, the S&P 500 has gained 24%. Developed international stocks are up even more over that time period, with Europe being the best performing region, rising 35% (yay for global diversification!).

In all seriousness, this is not to pat myself on the back as I’m usually the one waving my hands against making predictions, especially about the stock market. As Yogi Berra put it: “Predictions are hard, especially about the future.” But predictions can still be fun and sometimes, you may even be right!

Still, the old adage, “time in the market beats timing the market” is absolutely true. The boring truth is that setting an asset allocation based on your risk profile and goals and, most importantly, sticking to it is the best way to compound wealth for the long run — and I’m happy to talk through how to do that if you want to explore our wealth management services.

Now that we seem to be on the upswing, the question is: Is it real? Are we truly in a bull market or is it a last gasp before another downturn?

Well, let’s take a look…

Before we answer if it will last, it’s important to analyze what the current bull market looks like. No two are created equal and if the pandemic and post-pandemic periods have shown us anything, it’s that many of the rules we typically use to anticipate the economy may not apply.

Basically, things have been weird.

But let’s zoom in and see what’s happening.

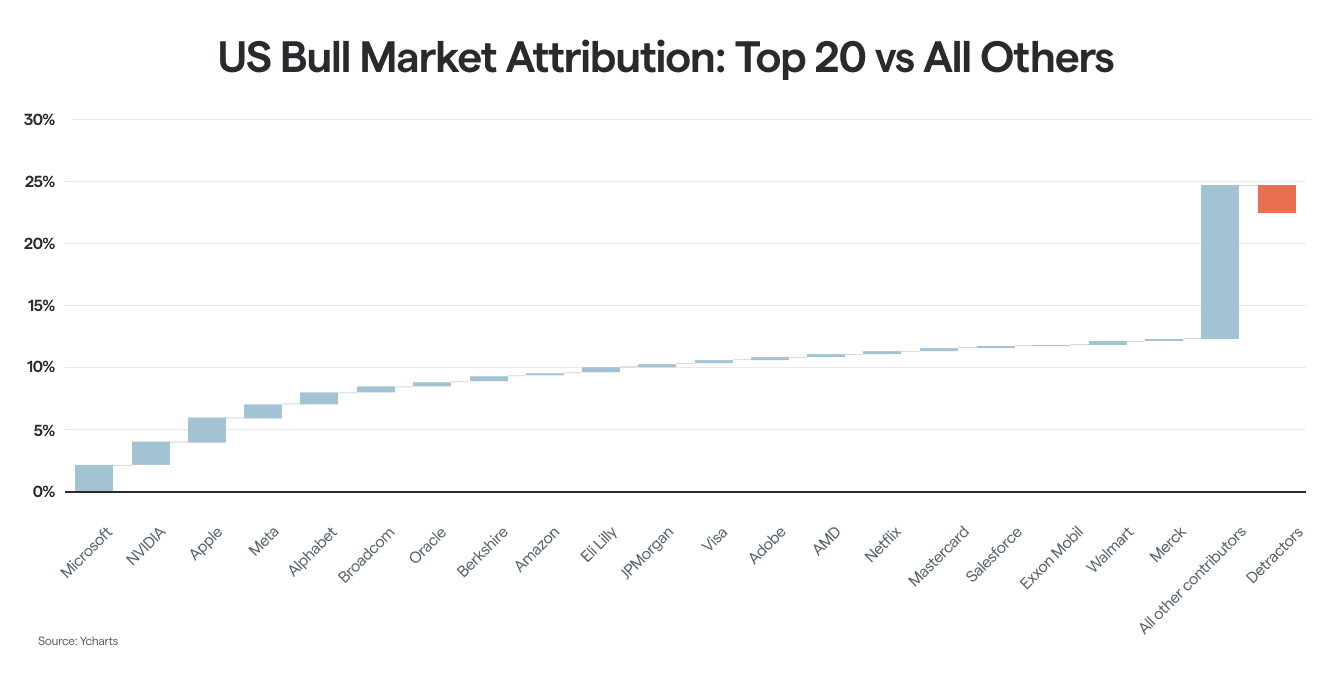

More than half of the Russell 3000 Index bull market return has been driven by just 20 stocks (see below). The other ~2,980 names make up the rest of the return, with a handful of names declining over the period. Is this weird? Not really. The biggest companies always have the biggest impact on market returns. It has to be that way because…math.

For example, Apple alone is larger than the smallest 2000 companies in the Russell 3000 Index. A single percentage point move in Apple can be more impactful to the market return than a small company moving thousands of percentage points. Media articles often make a big stink about the concentration of the stock market in the largest companies in an effort to get clicks. But it is true by definition and it’s always been that way. The leaders change over time, but the biggest are always the biggest. Nearly 50 years ago IBM was the top stock and represented more of the US stock market then than Apple does now.

What types of companies are in the top 20? There are quite a few technology names and the IT sector has been a phenomenal performer in this bull market. However, the technology sector is the biggest sector in the US stock market so we should expect tech companies to be the largest contributors to market returns too.

Is there anything to learn from this? Yes! The lesson is that diversification and patience works. Returns to individual stocks are always long tailed distributions with some stocks delivering fantastic returns and many other stocks delivering middling to poor returns.

For example, you would not have had a great investment experience if you bought IBM in the late 1960s, the pre-eminent tech company at the time, and held it. If you want to ensure you own the fantastic stocks, you better be diversified or have a crystal ball. I don’t have one, so I stay diversified and deviate from the market only when I have a good reason to do so (e.g. risks or expected returns). You can speculate if you want, but know that’s what it is and make sure your speculation won’t sink you if you don’t pick a winner.

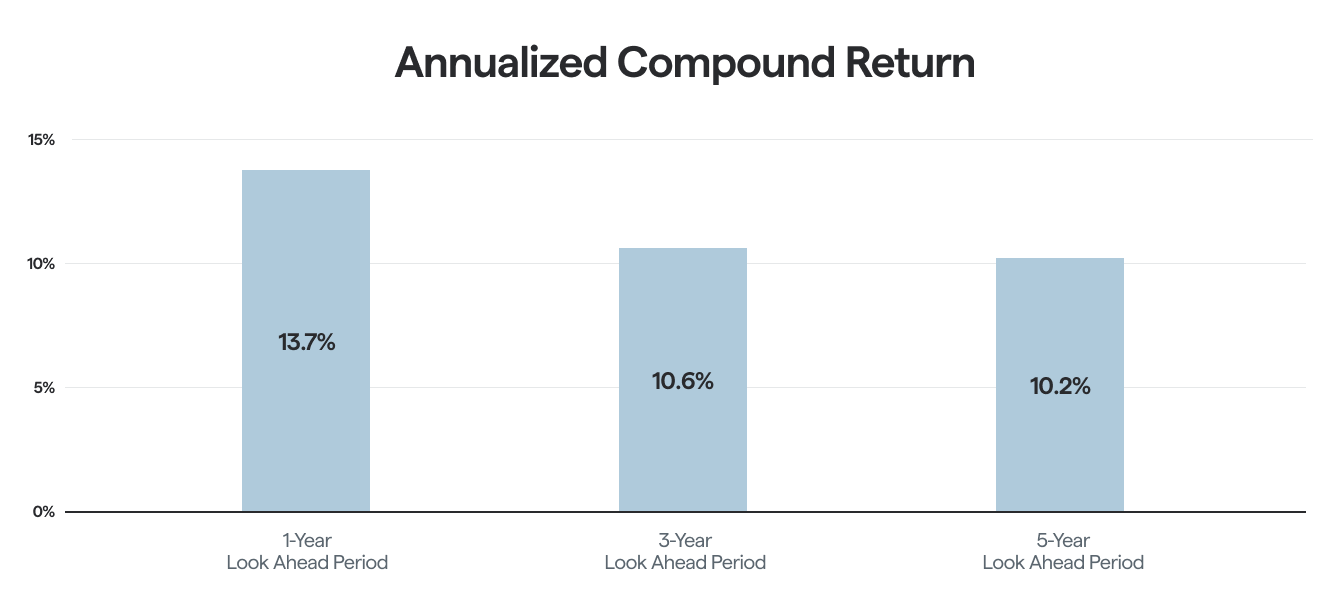

As a professional that doesn’t just speculate on stocks or “go with my gut” this opinion is based on research and economic theory. Through that research, I found this result, which may be surprising to folks. After every new market high since the great depression returns have been positive 1, 3 and 5 years later. You might think that new highs mean that stocks are “overbought” or “priced for a correction” but the data says that investing after markets hit a new high is pretty reasonable.

Sticking to a well thought out investment strategy in the face of recent market highs OR lows tends to pay off. It’s no guarantee but, usually, staying invested beats jumping in and out. So my money is on positive returns going forward.

Think back to last fall, or even just do a quick search of some of the top news headlines: People were constantly fretting about inflation and a recession. For many, it likely felt almost inevitable due to the wall-to-wall coverage of such predictions.

Then there were calls of a second financial crisis in March. with many influential people metaphorically shouting “Fire!” in a crowded theater. Yes, there were some fairly major bank failures, but despite the confident pronouncements of a severe recession, we’ve skirted that outcome and inflation has abated. The “soft-landing” scenario is looking increasingly likely. And that’s one big reason stocks are up!

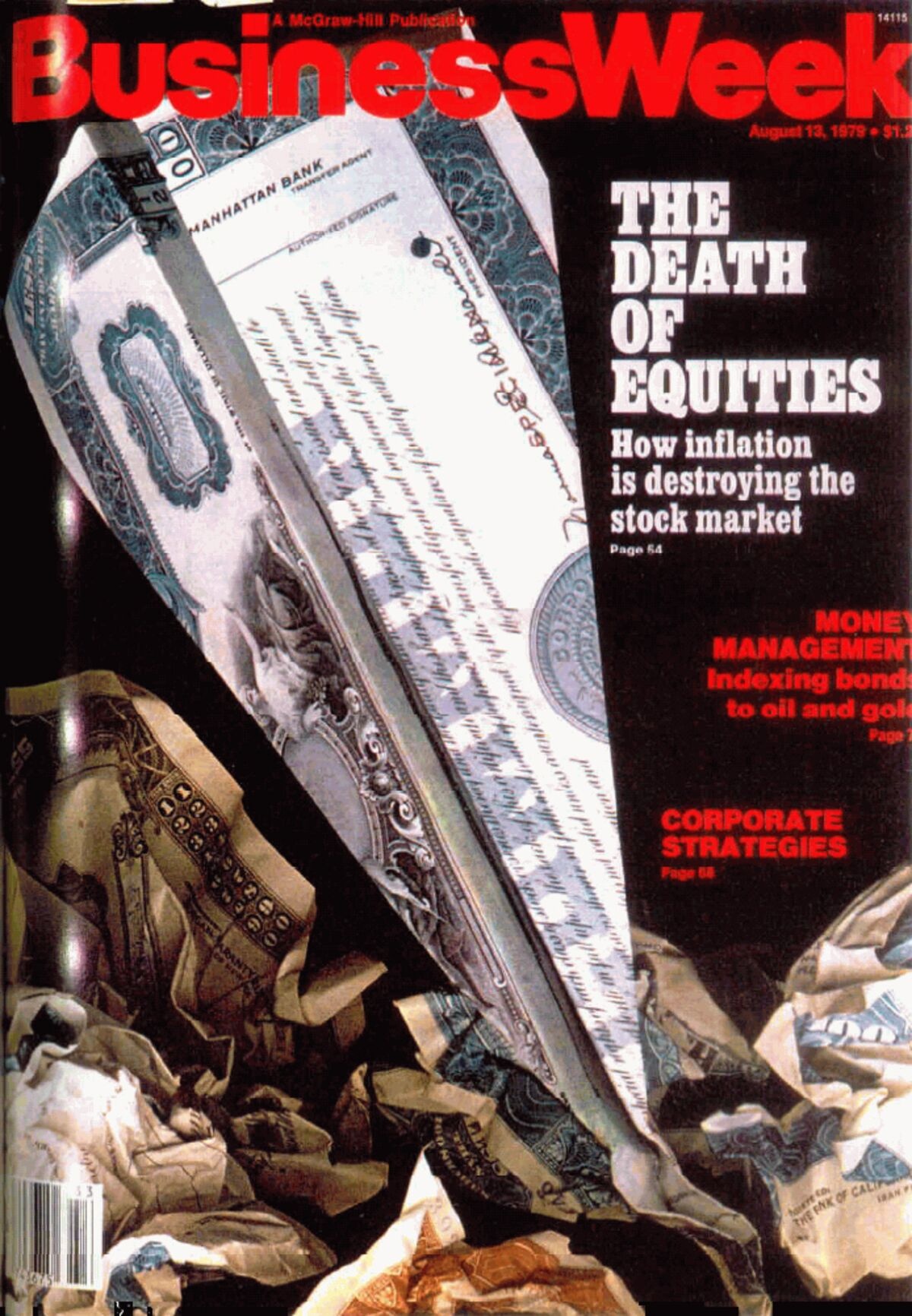

Look, there will always be something to worry about. The 1980s were one of the strongest decades for stock returns. Was it worry-free? Absolutely not. In fact, on the eve of the 1980s, “Business Week” published this iconic cover:

The cold war was raging, inflation was hot (much hotter than now), interest rates were rising, and new technologies were threatening to upend labor markets. Sound familiar? There’s ALWAYS something to worry about. The thing about stocks is they don’t wait for the “all-clear” announcement. They move in anticipation. It’s volatile, but over time, the noise washes out and the power of human innovation and adaptation shines through to deliver positive returns.

In moments of fear and uncertainty, it can seem prudent to move investments to cash and in moments of euphoria, it can seem prudent to go “all in.'' Neither is the right approach (yes, of course, you can hit the lottery but it’s not a very solid investment strategy to keep buying tickets in hopes of doing so).

Building a thoughtful allocation with all the information about risks and returns can take the emotion out of investing and help you stick it through so you don’t bail at the bottom and jump in at the top. If you want some help thinking through what risks you’re taking and what risks you should be taking, explore our wealth management services.

Things we’re digging: