0 result

Hi there,

This is John, back again with a follow up newsletter on the Reddit IPO.

All I can say is WOW! Congrats to Reddit employees, what a debut! Reddit is one of the companies with the highest share of users on the Secfi platform and we’ve been supporting their employees since 2019. Reddit has been one of our favorite companies to work with because their equity and management teams genuinely care about their employees and their equity. Needless to say, we’re incredibly excited for all those employees who worked hard to build Reddit!

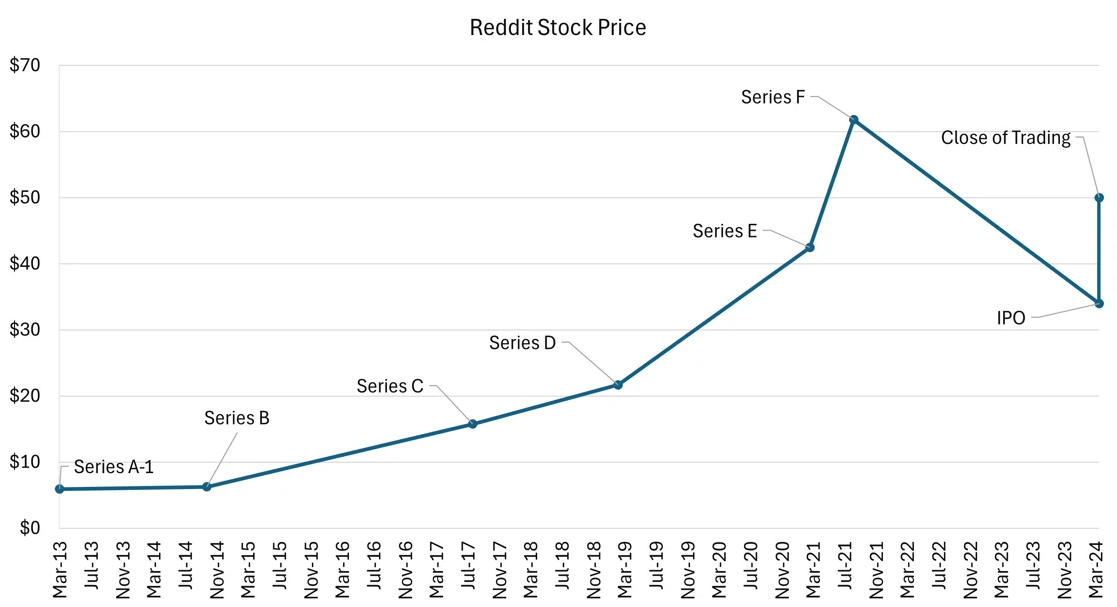

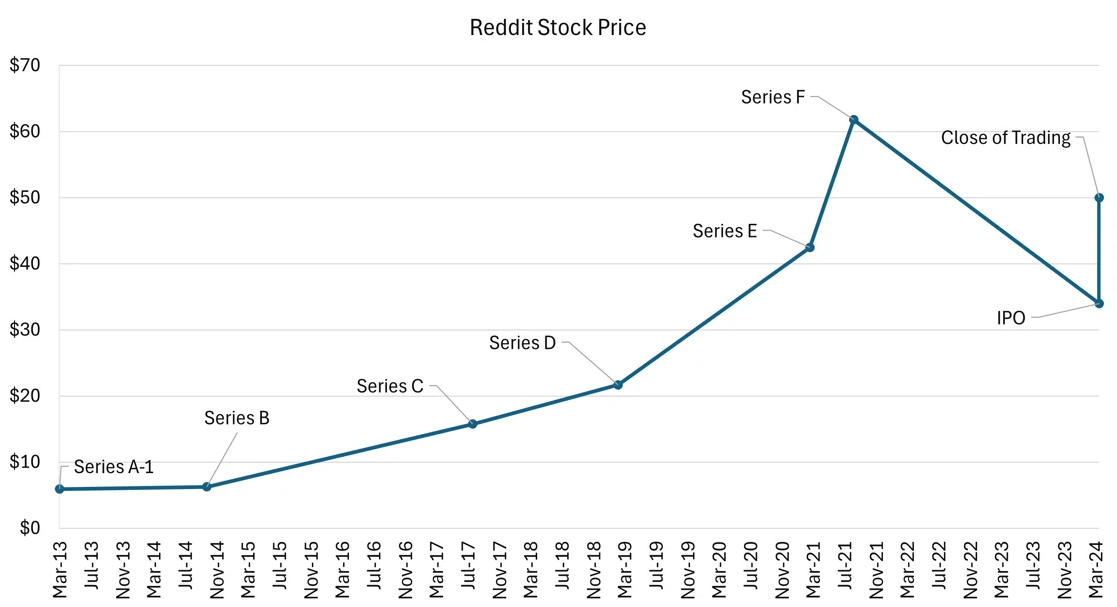

In the F&F issue where we dove into Reddit’s S-1, we speculated that a positive reception could bust open the IPO window and give other companies that have been waiting in the wings the confidence to go public themselves. We couldn’t have asked for much more! After pricing at $34, the top end of the range, in the IPO, the stock closed the first day of trading at $50.44 per share, a 48% increase over the IPO price. We believe this indicates that investors are hungry for new investment opportunities. There’s an old saying among bankers, “when the ducks are quacking, feed ‘em.” If your company can feasibly IPO in the near future, I’d bet good money that your executives are, or will be fielding calls from investment bankers. We’ll be keeping our eyes peeled for the next S-1 to drop.

Back in 2021, at the peak of the market’s euphoria, Reddit raised a series F at a $10B valuation. Shares were sold for $61.79 each.1 At the closing price on Thursday March 21st, that’s an 18% per share decline. Nobody likes a down round, but frankly, that’s not too shabby considering the environment. Think about where a lot of high growth companies were trading in 2021, how many of them are only down 18% from their peak?

In fact, every investor in Reddit except those in the last round made money based on the closing price yesterday. Even those in the Series F likely had exposure to earlier rounds at lower valuations. I suspect most employees with options/RSUs are also pretty pleased. The fair market value for common shares, which is used to determine option strike prices and has tax implications, peaked at $49.59/share in December of 2021. Even those with options at that peak price are in-the-money based on Thursday’s close. The fair market value declined from the peak with the rest of the market, and was just $29.27 in December of 2023 and into 2024.2 That means employee stock option holders had a chance to exercise when the price that impacts their tax obligation (the fair market value) was ~40% below the trading price today. I hope they went for it!

Differences of opinion make a market, and boy were there lots of opinions on this one. After the newsletter analyzing the S-1, I received replies from both sides, each supremely confident in their bullish or bearish position. The media also plays it both ways, and often with a negative slant to get clicks. Here’s a few headlines from the recent past:

The uncertainty and avalanche of opinions, often from confident sounding individuals, can make it more challenging to take action on your equity. Hindsight is always 20/20, but that doesn’t mean that you can’t take calculated risks with your options ahead of an exit. That’s why we advocate for making a plan! Don’t leave it up to chance. We believe there are often actions you can take with asymmetric payoffs that can be worth the risk. Just make sure you understand the details or work with someone that does.

Reddit insiders are subject to a “lock-up agreement” meaning they are not allowed to sell their shares until the lock-up expires. According to the prospectus, the lockup expires “the third trading day immediately following our public release of earnings for the quarter ending June 30, 2024.”3 The earnings release date has not been announced yet, but most companies take at least a few weeks before they release quarterly earnings, which puts the lock-up expiration around the beginning of August. Lockup expiration can influence the share price, but we feel the far larger determinant will be the company’s financial results and the overall market. When talking with folks about a diversification plan for their newly IPO’d shares, I caution them to not get too cute when timing their sales, it’s incredibly difficult to "top tick" a sale. A better approach, in our opinion, is to figure out what the money means for your financial security and then plan out a liquidation over a period of time that you stick to in order to secure your future. Or hire someone to do it for you to take out the emotion.

Exactly which shares you sell can have a big impact on your overall wealth as taxes come into play. Some insiders who exercised options recently might hold out for long-term capital gain status before selling, which means they’ll have to hold for at least a full year from the exercise date. When helping clients make a decision to sell now or hold off for long-term gain treatment, I like to quantify the breakeven price drop it would take to make them indifferent between short-term gains now and long-term gains later. If it doesn’t take much of a move in the stock to make you indifferent, then it might not be worth the risk to hold. On the other hand, if the implied move is large or the one-year holding period threshold is near, it can save you several percentage points to delay. Everyone’s situation and risk appetite is different, but if you know how to think about and quantify the risks and potential rewards, you can make a better decision.

I have personally been a satisfied Redditor for years. I like the community I can find there. My local Austin subreddit has been a great source of hyper local information. When buying a house, I even hired a home inspector who frequently posts the stuff he finds during inspections to the sub. It’s a phenomenal resource for information that is tough to find anywhere else. I’m happy the Reddit team has built something valuable and useful and they get to benefit from that effort to build financial security for themselves and their families.

1. Page F-23 of the Reddit prospectus dated March 19, 2024

2. Page 123 of the Reddit prospectus dated March 19, 2024

3. Page 70 of the Reddit prospectus dated March 19, 2024