0 result

Hi there,

Vieje back here again. It’s September and fall is in the air. Everyone seems to be back in the office, judging by the size of my inbox the last two weeks. It’s good to see things moving again on the work front.

For myself, I’m happy to be home for the next few weeks after a busy summer travel schedule. My wife and I are expecting our first child in November so things are starting to get real. I plan on spending most of my weekends watching football and finally pulling the trigger on purchasing a stroller which my wife and I have been talking about for 6 months. Any and all recommendations and advice are welcome!

In the last newsletter, my colleague John wrote “What’s Your Number?” where he dove into the importance of compounding returns to figure out how much money you need to live life the way you want it. I loved reading it and it got me thinking about my own personal situation. But as a CPA, one of my initial thoughts was… how do taxes fit in this?

So today, I wanted to expand on John’s last newsletter and add some commentary on how taxes play a factor in determining, “How much money do you need before you ________?” Let’s jump in.

My legendary tax professor, Bill Resler would always say there are only 3 truths: life, death, and taxes. Like it or not, we’ll always have to pay the tax man on your hard-earned money so it’s important to factor in the tax consequences of your investment decisions. After all, it’s not about what you make, but what you keep.

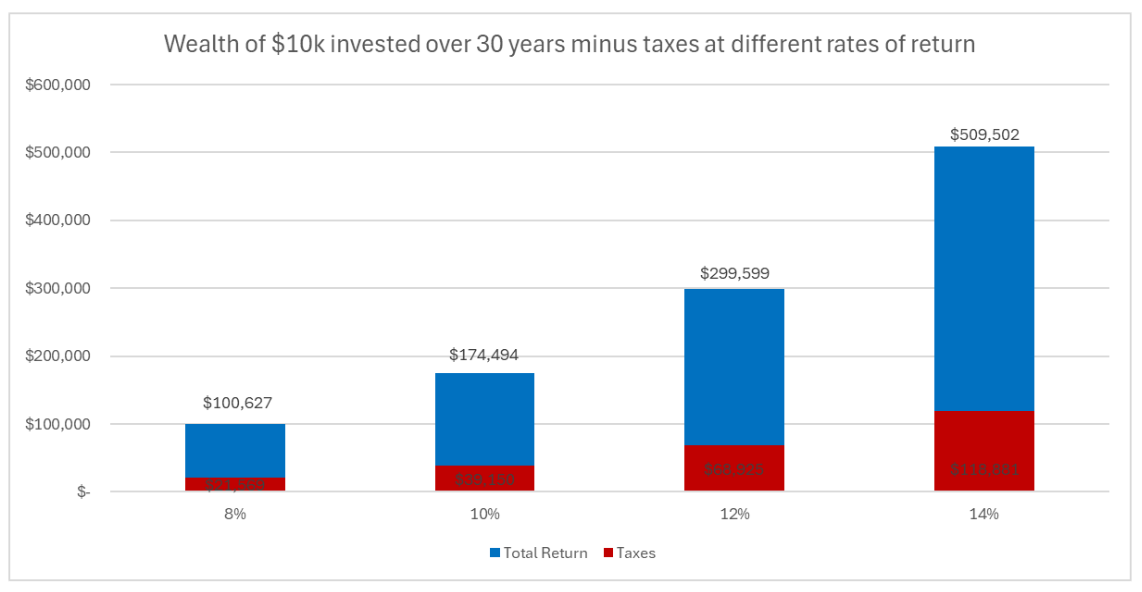

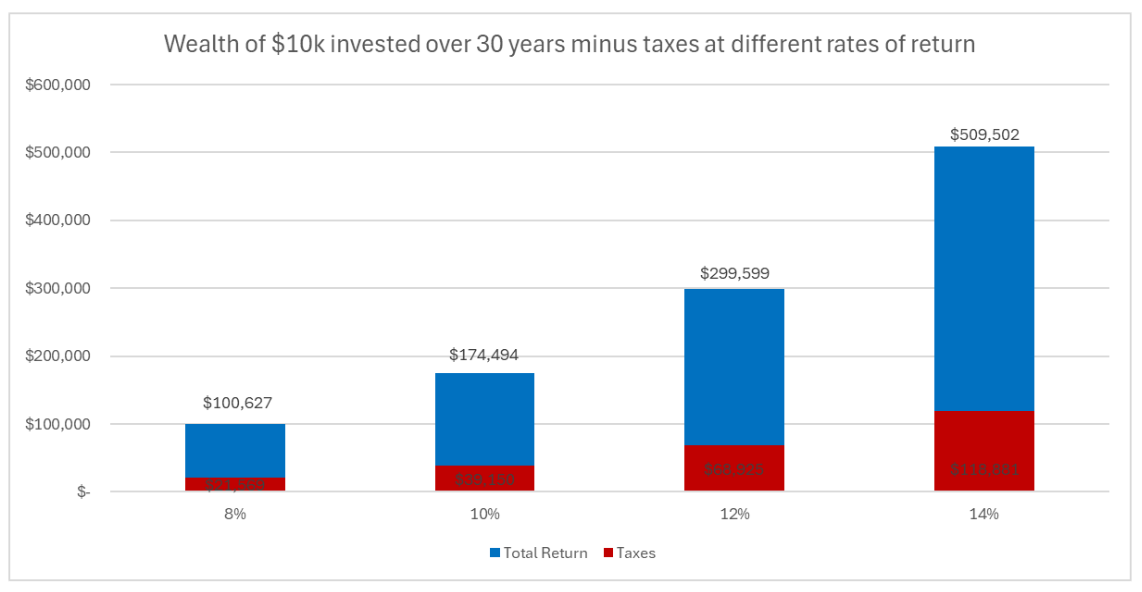

In John’s last newsletter, he wrote about the differences in wealth if you invested $10k for 30 years at various rates of return. I’ve taken that calculation but layered on the impact of taxes when you ultimately sell that investment. I used the highest Federal capital gains tax rate of 20% plus the net investment income tax of 3.8% for a total of 23.8% and ignored state taxes.

This is an example for illustrative purposes only. There may be other factors that may impact the amount of taxes that are owed or funds received by any individual. Please consult your tax advisor regarding your particular circumstance.

As you can see, taxes can definitely eat into your returns. If you invested $10k for 30 years at a 10% return, you could potentially have a gain of $164k and pay an estimated $39k in taxes on those gains, leaving you with about $135k. We know that as you make money, you have to pay taxes on that. But what if we introduced tax-efficient retirement accounts such as a 401K or an IRA?

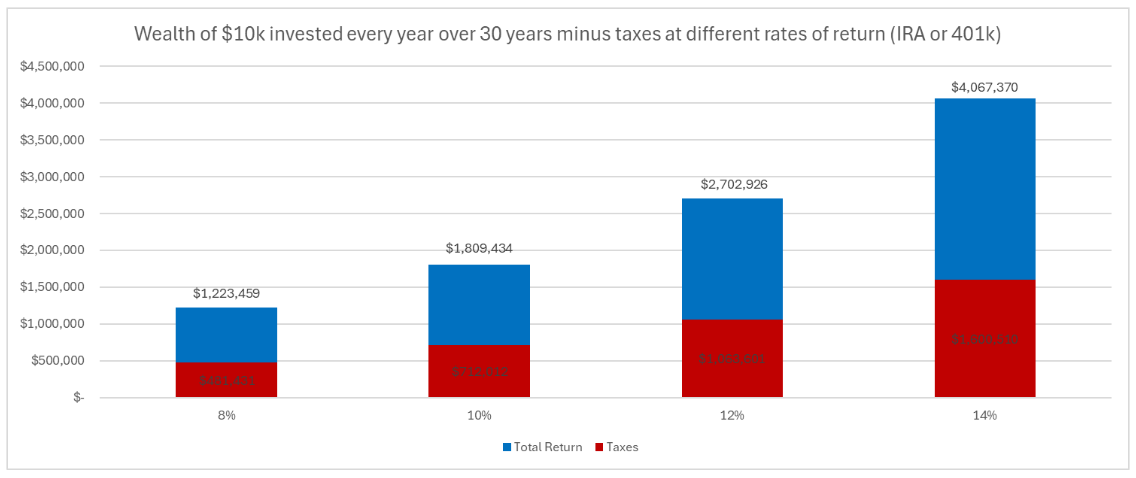

Let’s assume you use a traditional IRA or a 401K to invest $10k at the start and $10k at the end of each year for 30 years for a total of $300k.

This is an example for illustrative purposes only. There may be other factors that may impact the amount of taxes that are owed or funds received by any individual. Please consult your tax advisor regarding your particular circumstance.

At a 10% gross return, this leaves you with a total of $1.8M at the end of 30 years after you’ve invested $10k annually or $300k in total. You will pay $712k in ordinary income taxes and are left with just under $1.1M. Even ignoring any potential tax planning around the distribution timing to lower taxes, that’s pretty good! With just $10k a year, you can have over $1M in retirement funds even after paying the tax man at the highest rates.

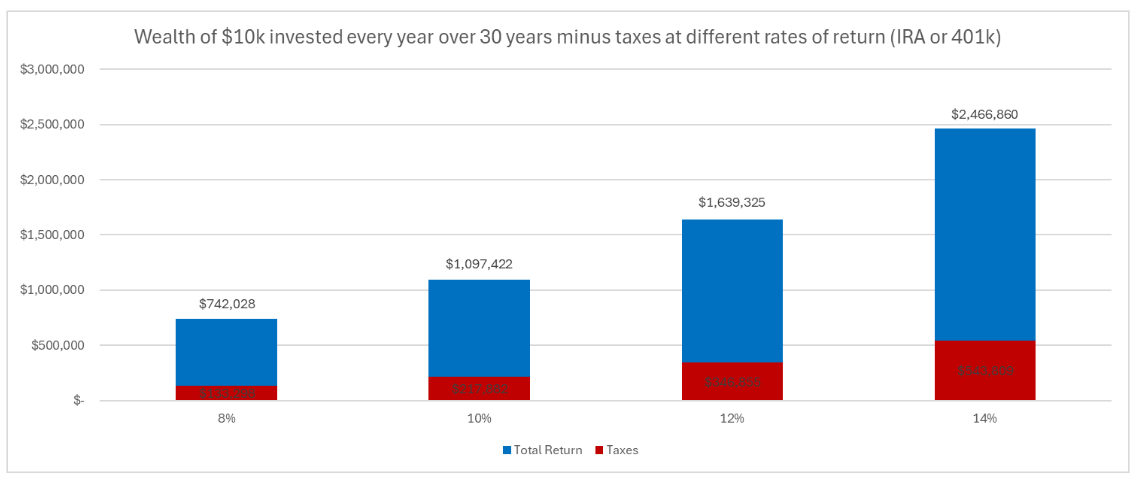

Now let’s take a look at what happens if you attempt to invest the same $10k annually, but do it in a taxable account outside of a retirement account.

This is an example for illustrative purposes only. There may be other factors that may impact the amount of taxes that are owed or funds received by any individual. Please consult your tax advisor regarding your particular circumstance.

Assuming a 10% gross tax rate of return, your total before taxes comes out to just under $1.1M and you’ll pay capital gains taxes of $217k on the gains, leaving you with just about $880k. That’s a difference of $280k compared to the tax-advantaged 401K or IRA.

This is also ignoring any taxes on sales during those 30 years as you can sell investments tax-free in a 401K or IRA as much as you’d like. Investing outside a retirement account is a double whammy when it comes to taxes — less money gets invested per year and you have to pay taxes in the year you sell.

The retirement accounts can make a huge difference in your net wealth. It may be hard to attempt to maximize your retirement accounts at times. After all, we’re human; it can be hard to sacrifice today for the future, but think how many rounds of golf or trips this pays for when you’re in your 60s.

Of course, there are limitations and requirements when it comes to these accounts. In 2024, the maximum contribution you can make to a 401k is $23k and $7k to a traditional IRA. You also have to wait to withdraw the money until your 60s without penalty.

Additionally, there can be lots of great planning opportunities that help you keep more of your wealth. It’s worth noting that the examples above are simplified and use the current highest Federal tax rates. Specifically, there can be a lot of strategy and planning when it comes to funding different accounts while you’re saving and withdrawing from different accounts at opportune times when you’re in retirement.

Hopefully these numbers can help validate your financial plan or encourage you to start making one. As always, we’re here for you if you want to chat about this.