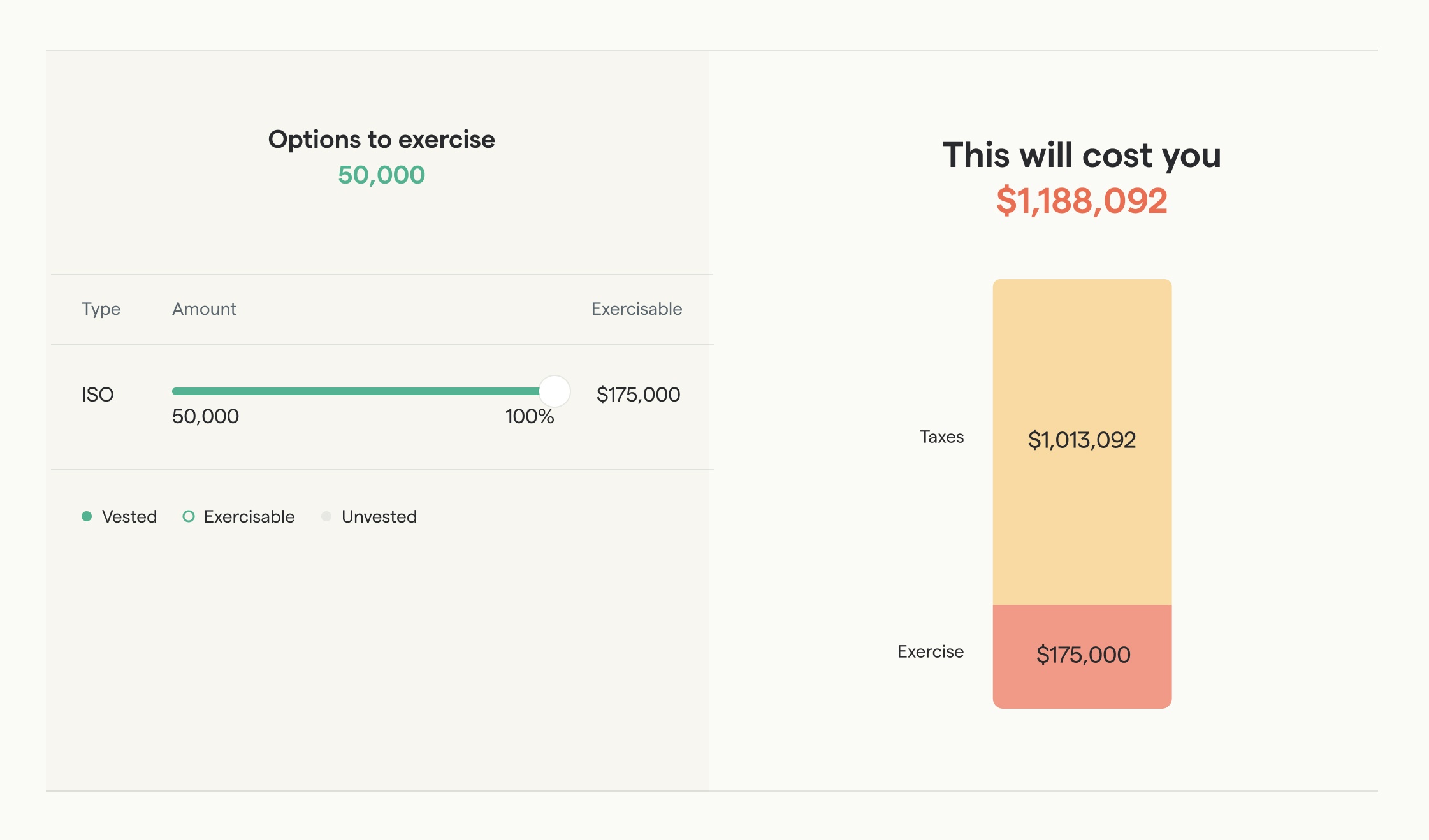

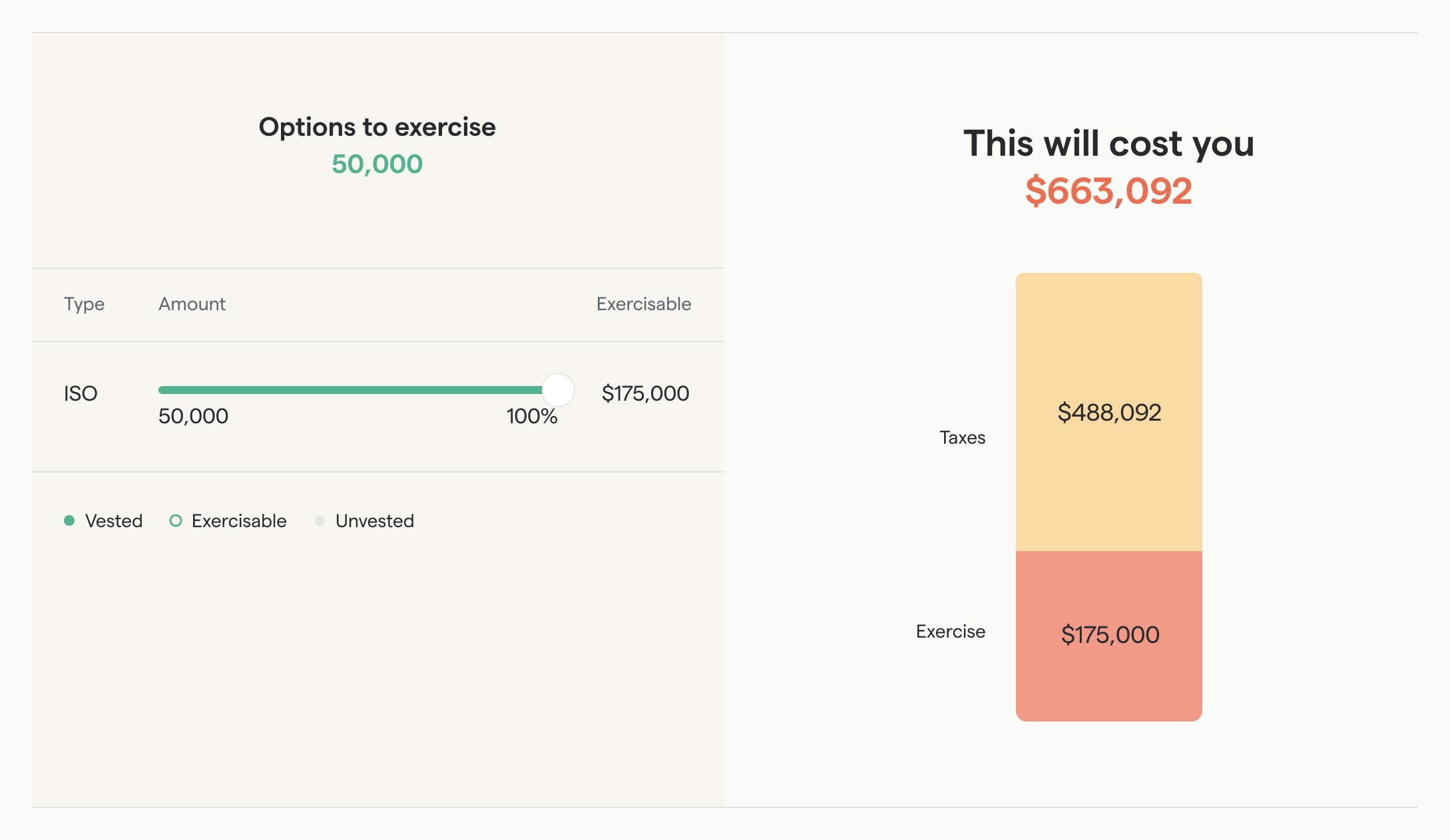

Still enormous – but 52% less.

It was a brief window of opportunity for the handful of Airbnb employees who still had unexercised stock options. As the company recovered and began planning for the IPO, the 409A also recovered and increased.

Due to the delayed IPO, early employees almost lost their equity because of expiration

While the trend seems to be reversing, startups generally take a long time to exit. Airbnb took 12 years.

The problem? Whether it's ISOs, NSOs or RSUs: employee equity has to eventually expire.

For companies like Airbnb that have been private for a while, many employees were coming up on their typical 10-year window. This was a major cause of stress for Airbnb employees.

The (unverified) rumor is that Airbnb did the right thing and worked out a solution for the employees with expiring options or stock grants so their equity was saved, but I'm sure it caused a lot of employees to sweat.

There's a fundamental reason why equity compensation expires

Startups don't grant employees outright stock. Technically they could do that... but it would trigger a tax bill for the employee.

With no cash to pay for it (because the stock is still illiquid: you can't sell it anywhere) that would cause problems.

Instead, employers give things that (may) become stock in the future: stock options and RSUs.

- With stock options, the employee can manually pull the tax trigger by exercising

- With RSUs, the tax trigger is pulled when they vest on exit

In this way, taxes don't need to hit before the stock is liquid, allowing the employee to avoid the cash flow problem.

However, for this ‘tax trick’ to work there needs to be a substantial drawback to the granted thing. There should be some drawback relative to plain stock – something that justifies the fact that the option or unvested RSU isn’t itself taxable yet.

The risk of expiration is that drawback.

Take the risk of expiration away, and the IRS will consider the thing that you’ve been granted not to be substantially less valuable than getting plain stock.

They'll then directly tax you as if it is indeed stock, defeating the purpose.

So, technically, there's a reason it works like this. Still, the practical implications are backwards. The idea of equity compensation is to reward employees for taking a leap of faith. That's especially true for early employees. Now it's exactly them who get in trouble.

Conclusion

Not every path to IPO is the same. Companies go through many ups and downs on the path to an exit and Airbnb is no exception.

The rocky 2020 road to the Airbnb IPO unfortunately created some winners and losers. Those impacted by layoffs lost out on future equity value, but those early enough with stock options were granted a golden window of opportunity to take home more cash.

Additional resources

- Calculator used: Stock Option Tax Calculator

- A comprehensive guide on how to decide whether to exercise, and how much to spend

- In-depth article on how to prepare for the IPO, how long-term capital gains works, and how you can calculate potential savings given your personal numbers

- If your exercise costs are so high they're unaffordable, there's non-recourse financing