You're leaving your company — should you take the exercise deadline extension?

Hope that was helpful. Ready for personalized equity insights? Sign up for a free account.

0 result

When leaving a startup that awarded you ISOs, it used to be that you were pretty much screwed.

Your incentive stock options (ISOs) would expire within three months (due to their so-called 90-day post-termination exercise window), so you had to either buy the shares before the exercise deadline – often triggering a hefty tax bill – or let go of your hard-earned employee equity.

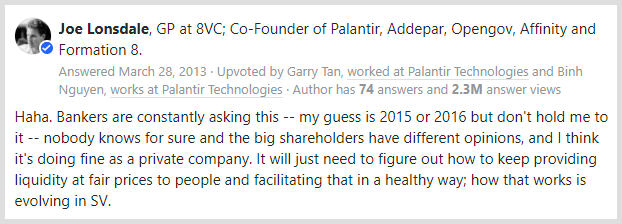

Luckily, more and more startups are now willing to extend exercise deadlines by 5 or more years. Examples:

There's one caveat. If you take the extension, your ISOs convert to non-qualified stock options (NSOs).

So – should you do it?

TL;DR

If you're optimistic about the company, it's probably better to exercise your ISOs now rather than converting to NSOs.

The reason? If there's a successful IPO (and you meet certain requirements – see below), you save on taxes, so you'll take home more.

Of course exercising isn't free, so this only works if the costs aren't too high – or if you are eligible for exercise financing at good enough rates (so you're still at a net benefit with the tax savings, despite the financing fees). Otherwise, take the NSO conversion.

The long answer:

Each with their pros and cons.

👍 Reduced IPO tax (you'll earn more in a successful IPO)

🚫 You pay exercise costs, including taxes

🚫 You risk losing money (if no/mediocre IPO)

👍 Doesn't cost you anything

👍 No risk of losing money (if unsuccessful IPO)

👍 Reduced IPO tax (you'll earn more in a successful IPO)

🚫 However, (a part of) your tax savings goes to financing fees

👍 Doesn't cost you anything

👍 No risk of losing money (if unsuccessful IPO)

🚫 High IPO tax, so you'll earn less in the IPO

Note that with a "successful IPO" I mean one where the exit value of your company is high enough, so you can sell your shares at a gain.

Which of these three options is the best?

...if you can afford it.

By exercising your ISOs, the gains you make in the IPO can get taxed as long-term capital gains. That's a substantially lower tax rate. The difference can be lucrative – see this Snowflake case study (tax savings: $135,000).

You'll get long-term capital gains if you check two boxes:

Of course Option A is only an option if you can afford the costs to exercise, including the tax bill you'd trigger. (You can use this online calculator to see what your costs would be.)

Also, going this route means putting your money at risk. If your company doesn't manage to have a successful exit, it's gone.

Optimistic about an IPO, but option A not possible?

Then Option B is best for you if:

Both depend on the company you work(ed) for.

If your company isn't eligible for exercise financing, Option B is also not an option and you should go with Option C: convert to NSOs.

But if you can get exercise financing at good enough rates, you're better off with Option B in case of a successful enough exit. Even though you'll owe fees, you'll be at a net benefit versus Option C due to the reduced IPO tax.

So, in summary. Assuming good financing rates and assuming a successful exit, your best option is A, then B, then C. For Option A you'll have to come out of pocket, while B and C won't cost you anything.

Step by step:

If you need a sparring partner, happy to help out. Just hit me up for a quick chat ↘️

If you're considering Option B:

You'll get a personalized chart that models out your specific scenario and shows your benefits under options A, B and C.

We'll also invite you for a quick "we answer all your questions" call, where we can discuss anything. Feel free to ask about rates, stock options, taxes, ISOs vs NSOs, how IPOs work...

For a lot of companies (e.g. Coinbase, Procore, Gitlab, Segment) we already have rates because we've worked with employees before. If you're at one of those, the process is fast-tracked and you'll have the proposal in just a few days.

If you want to exercise your ISOs but are not totally comfortable covering the costs with your own savings, it's perfectly possible to exercise up to a certain amount at your own cost, then use exercise financing for the remainder only. That way the fees will be a bit lower, and you'll have the best of both worlds.

You can decide up to what amount you're comfortable putting in. Just let us know, and we'll include that scenario in the financing proposal.

1. If you take NSOs and don't exercise right now, but later decide you still want to exercise after all, it's probably more expensive

The tax bill from exercising will be higher for two reasons:

If you want to see the impact of ISOs vs NSOs as well as higher 409A valuations, use our free Stock Option Tax Calculator. If you add your stock options twice – once as NSOs, once as ISOs – you can toggle both and see the difference.

2. An extended deadline is great, but still no guarantee your company will in fact exit within that deadline

If it doesn't, you'll still lose your equity when the deadline expires. That's not a risk if you exercise your stock options instead. Good to consider especially in case of a 5-year extension.