3 min

Tim Lee, CFP®

Financial Advisor

Tim’s a CFP® at Secfi. He specializes in helping tech professionals navigate the complexities of equity compensation and integrate it into their holistic financial plans.

0 result

If you recently left your company or are planning to leave and have vested stock options, you’ll be faced with an important decision: Should you exercise your options or not? You’ll need to act quickly because most companies only allow 90 days to exercise stock options before you lose them.

At Secfi, we believe that if you pour your heart and soul into growing your company (um... just about every startup employee!) and want to become a shareholder, you should have the tools and financing available to do so. Full stop.

The 90-day post-termination exercise (PTE) window is the period you have to exercise (ie, pay) for your vested incentive stock options (ISOs), or else you lose them.

We call it the “90-day oh sh*t” window because there’s generally a race to figure out:

Most startups universally accept this rule as standard practice based on IRS regulations around tax treatment for ISOs after employment ends. Yet it’s recently been challenged by many and some companies have extended this window. But... the devil is in the details and in most cases, you’ll lose any tax advantages if you wait because your ISOs turn into non-qualified stock options, or NSOs.

In short, ISOs carry significant tax benefits because you can turn everything north of your strike price to capital gains (a better tax rate) if you meet the holding requirements.

Even if you have an extension beyond 90 days, your ISOs automatically convert to NSOs and you lose this tax benefit forever.

Fortunately, we have a Stock Option Tax Calculator to help you determine your tax liability (including alternative minimum tax or AMT) for ISOs and NSOs.

So... you’ve done the math and it turns out that you will have to use all your savings to exercise your options. Or, you can’t afford it. And you are worried you’ll make a mistake. We hear this all the time, unfortunately. This is part of the reason that 76% of all stock options go unexercised.

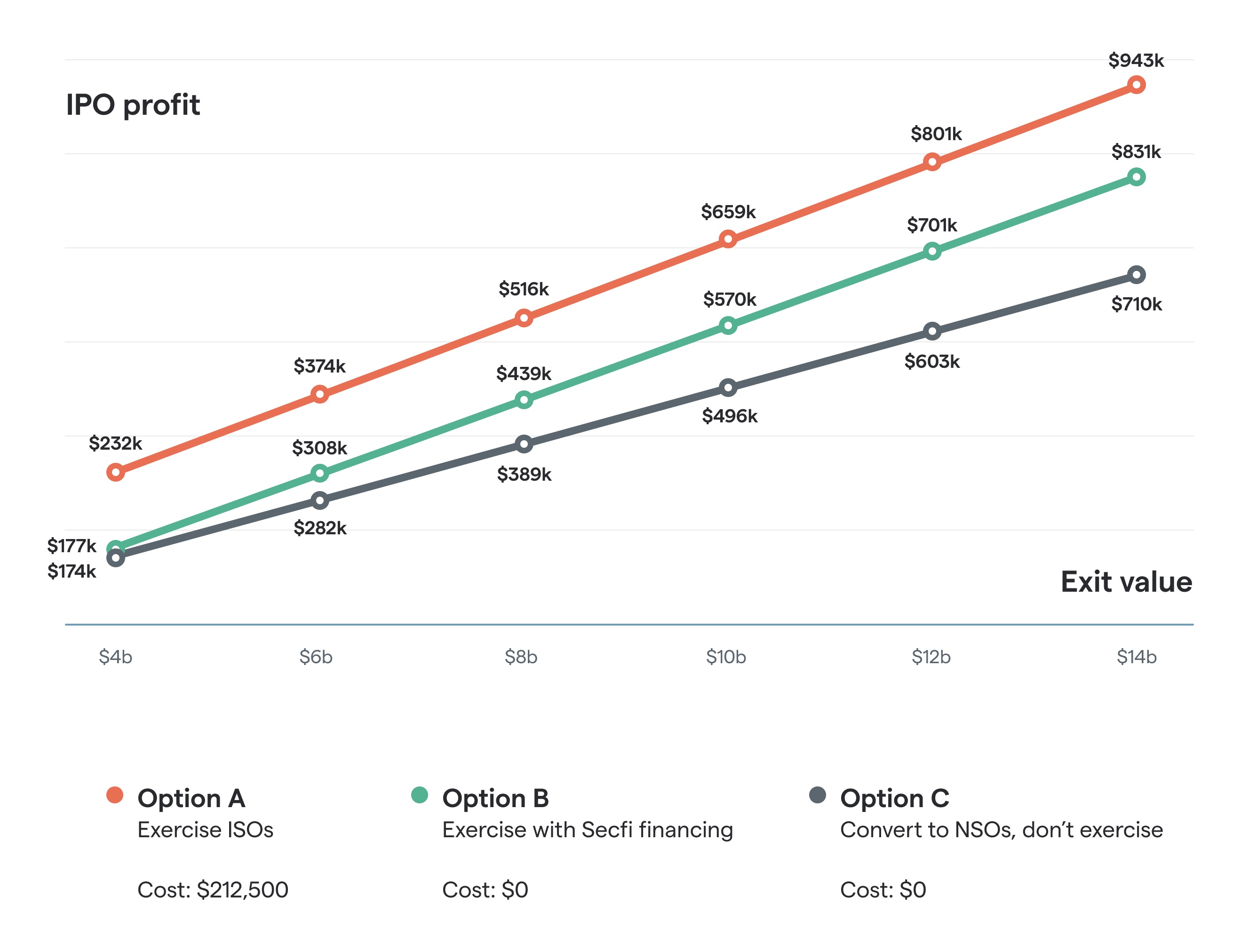

If you’re an employee of a high-growth startup that is planning an exit in the next few years, you may qualify for non-recourse financing. This means that we can help you fund the cost of your options exercise (including tax liabilities) and you wouldn’t need to pay us back unless your company exits. And there’s no need to sell your shares on the secondary market. If your company never has an exit, we will all be bummed, but you still don’t need to pay us back.

Secfi was founded by fellow startup employees who experienced the confusion and challenges of the stock option world firsthand. We’re committed to helping startup employees understand, maximize and unlock the value of their equity.