The surprise factor: Why exercising stock options can be more expensive than you think

2. Add your stock options

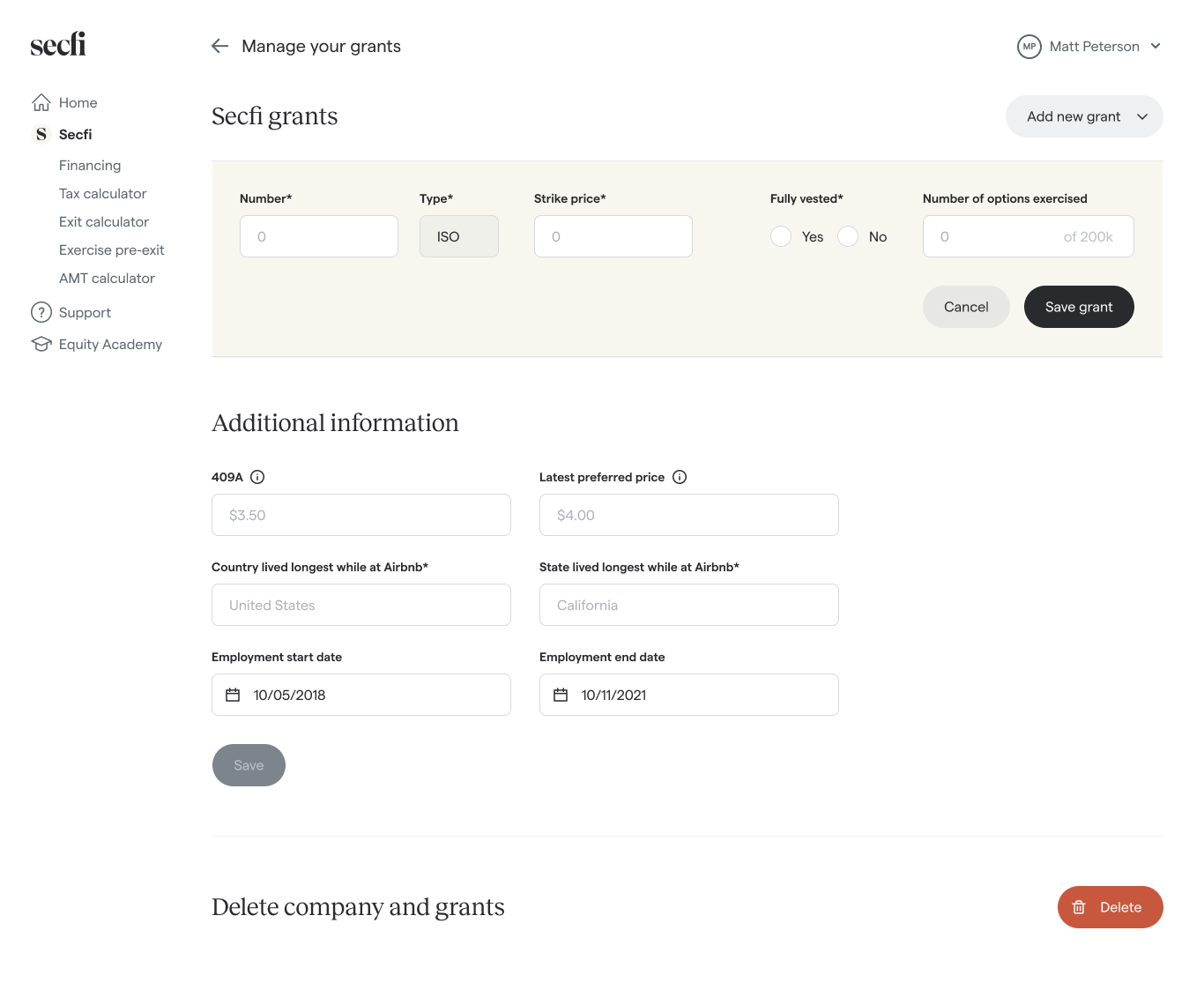

3. Open the Stock Option Tax Calculator

0 result

For startup employees who are not aware of taxes, exercising their stock options is on average 3.5x as expensive as expected. That's based on a quick sample of 25 recent users on the Secfi platform. Within the sample, the median was 2.0x and the highest one 9.8x.

You're taxed when you exercise your stock options. Almost always.

The cost of exercising your ISOs and/or NSOs is higher than just the strike price – often much higher. If you didn't know that, you're up for a fiscal surprise.

It's why Wouter Witvoet started Secfi – he got caught by that fiscal surprise.

The startup world would be better off if every employee knew about this. To raise awareness, I shared how this affected Snowflake employees. But that's anecdotal.

So let's quantify this problem and give it a name.

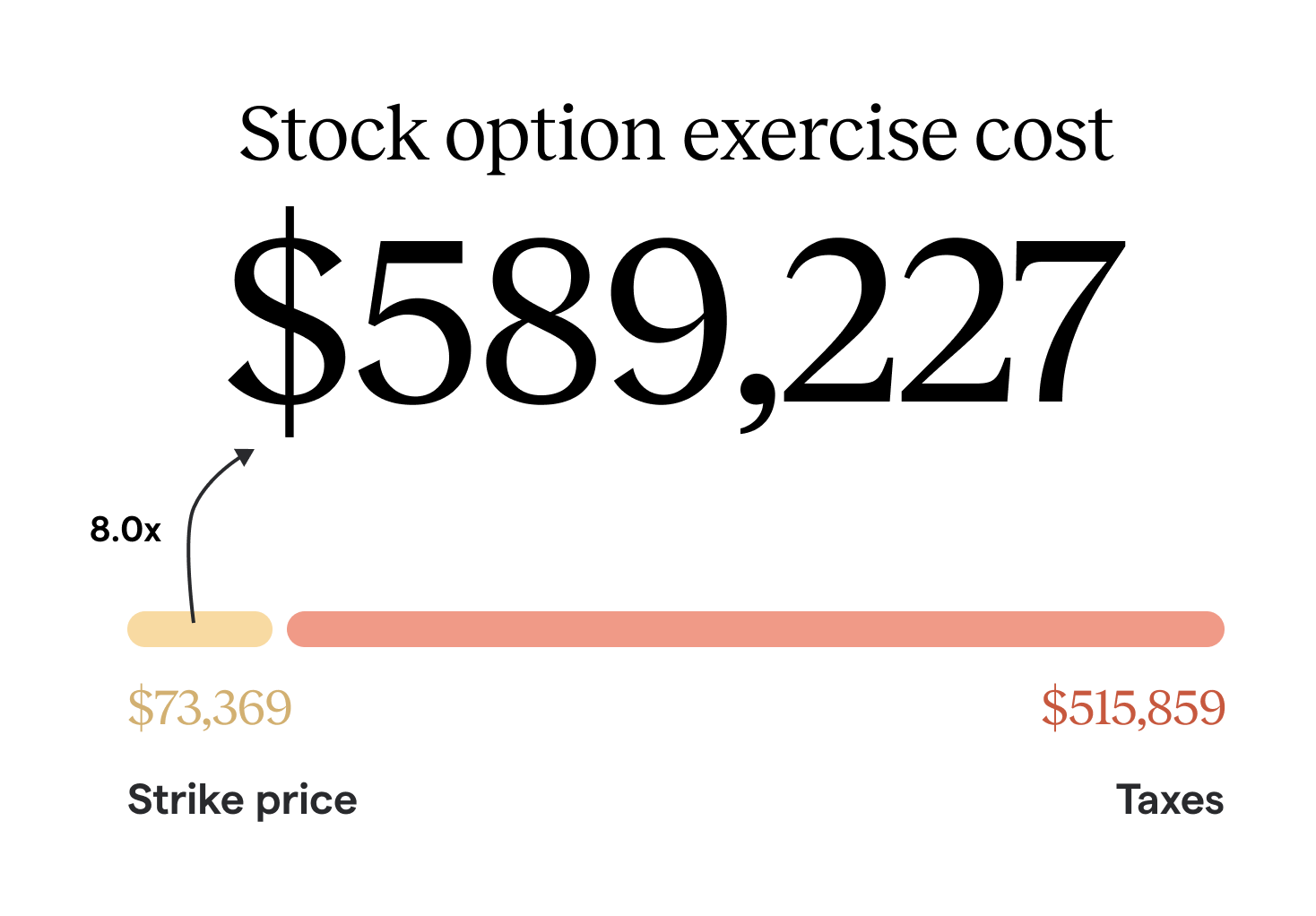

If you thought you would only have to pay your options' strike price when exercising, then your surprise factor is the metric that says:

How much higher are your exercise costs, relative to what you think they are?

Definition: surprise factor = (exercise cost including taxes) / (strike price * number of options)

For instance, someone in the following situation would have a surprise factor of 8.0x:

In theory, there's no limit to this metric. When you exercise, your tax liability is driven by the 409A valuation (also known as fair market value) of the company, which can grow indefinitely.

So how large does it get in practice for high-growth U.S. startups?

I pulled a quick sample from recent users on the Secfi platform. With N=25 this is by no means representative, but it sketches an idea of the impact of exercise taxation in practice.

The sample includes employees from companies such as

The stats:

It's not distributed evenly, though – it gets especially bad for early employees at very high-growth companies. These were the worst three:

That's an almost 10x higher than expected cost due to taxes

Here's the full dataset:

It can bite in a couple of ways.

Maybe you were aware that, should you leave your company, you're forced to exercise within 90 days (which is the case for 91% of startups).

Say you have 100,000 vested NSOs at a $0.5 strike price. Now if you didn't know about exercise taxation, you might have concluded that's no problem since you're able to afford $50,000 with your savings.

If you later actually decide to leave and then are notified about the tax bill you're about to trigger, you have two options:

Both pretty disappointing outcomes after years of hard work.

And that's actually the best case.

Worse is when your employer doesn't notify you of the due tax, and you only discover this after having exercised when there's no way back. You are now on the hook for that $125,000 tax liability, regardless of whether you actually have that kind of money.

Rather, they're typical of the kind of startups Secfi often works with: late-stage companies that have been on a trajectory of high growth, and are poised for a successful exit.

Growth increases the 409A valuation, which drives the tax liability.

The average startup doesn't grow as fast. Their 409A valuation won't explode, so their employees won't experience the problem as severely.

The irony is that it's precisely at skyrocketing startups that employees have reason to exercise. At these companies the IPO tax savings can be enormous, and when a killer IPO is on the horizon, people leaving these companies don't want to see their equity go up in smoke.

The more successful the startup, the bigger the incentive to exercise – yet the harder it is to do.

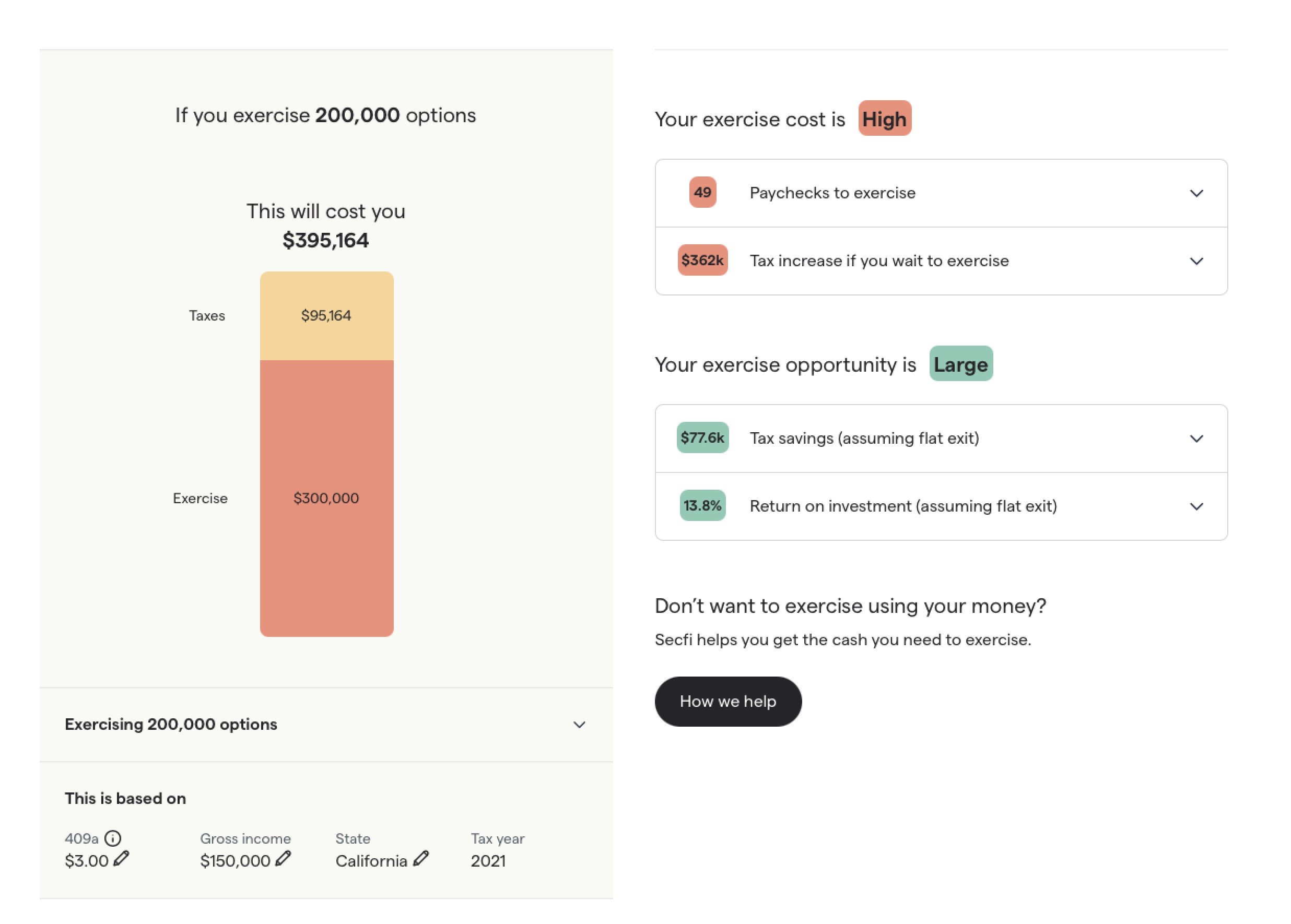

It's good to be aware of the tax bill you'd trigger by exercising your stock options. You can use our Stock Option Tax Calculator, which is free.

Here's how:

1. Sign up here (3 minutes)