What is a cashless exercise?

Cashless exercise

A cashless exercise of stock options is when you exercise your options, and then immediately sell the resulting shares.

Here is a quick video overview:

Normally, you’d need cash to afford your option exercise. But that can be expensive.

With a cashless exercise, you cover your expenses with your sale proceeds and avoid the problem.

A cashless exercise allows you to exercise stock options and sell the resulting shares immediately. This approach, often called a ‘same-day sale,’ can help you cover exercise costs without needing upfront cash. Learn how this post-IPO strategy works, its tax implications, and alternative options.

If you own stock options in a startup, doing a cashless exercise is one of two strategies you can take.

With startup options, the big decision you’ll need to make is:

- Will you wait for the exit and do a cashless exercise?

- Or will you exercise them pre-IPO?

Waiting for a cashless exercise (#1) is the easy, low-risk route. It’s also the default option you’ll end up with if you don’t do anything.

But there are drawbacks:

- You’ll be slapped with the highest possible tax rate (up to 52% vs. up to 37%)

- You can’t do it if you leave the company before the exit (you’ll have to stick around if the company is still privately held)

Let’s dive into how a cashless exercise works, and how it compares to the alternatives.

Why do a cashless exercise (rather than exercising pre-IPO)?

Cashless exercise is popular for startup employees who don’t want the risk of upfront exercise costs or the uncertainty of a private company’s exit. Here are the primary reasons to consider this post-IPO strategy:

1. No Cash Requirement – A cashless exercise allows you to cover exercise and tax costs through the sale proceeds, avoiding a large cash outlay.

2. Low Risk – You aren’t putting your personal savings at risk, unlike pre-IPO exercise, which requires upfront cash with no guarantee of a successful exit.

3. Simplicity – There’s no action required before the IPO, making it the easy, hands-off, default choice if you don’t want to manage tax timing or exercise logistics.

Don’t let #3 be your reason!

Something we still hear way too often is: “I wish I had known all of this years before the IPO..."

Luckily, you’re now reading this article 🧠

The benefits of cashless exercise for startup employees

There are three main benefits of using a cashless exercise:

- It’s simple. There’s no action needed on your part prior to the IPO.

- You avoid the need for cash. Exercising options is expensive, especially when you factor in the tax cost. A cashless exercise can cover that expense without it coming out of pocket.

- It’s low risk. You’re not putting your savings on the line. Although it’s often better from a tax perspective to exercise before your company IPOs, you have no guarantee that an IPO will ever happen (and that you’ll be able to sell your shares). Since a cashless exercise happens post-exit, it’s basically a sure thing.

One thing to note about #2 and #3: there is also a low-risk, cashless option to exercise your options before IPO (so you can avoid the high taxation) — but not many people know about it. It’s called non-recourse financing — more on what that is below.

The disadvantages of cashless exercise

Cashless exercise isn’t always the best option, for two reasons:

- You’ll be taxed at the highest rate.

Even though you don’t need cash to do a cashless exercise, it’s still not free. You’re just deferring the payment until you actually make money. The money you make will be taxed at ordinary income rates. These can be as high as 52.65% (for federal + state taxes). If you exercise before your company exits and sell your shares at least 1 year later, you’ll get the lower long-term capital gains rate.This maxes out at 37.1% (for federal + state taxes). So you’ll increase your net gains by doing so. - You have to stick around at the company until the exit.

At the majority of startups, when you leave, you have to exercise your stock options (or they expire). So if you leave before an IPO or acquisition, you won’t be able to wait for a cashless exercise. Given how long startups take to go public, this cancels out the possibility of a cashless exercise for a large group of employees.

How is a cashless exercise taxed?

Regardless of whether you’re exercising incentive stock options (ISOs) or non-qualified stock options (NSOs or NQSOs), in a cashless exercise you will pay ordinary income tax rates on the difference between the strike price (the amount you can buy the stock for according to your options agreement) and the price you sell your shares for.

That’s the same tax rate as your salary, and can be as high as 52.65% for federal + state taxes if you live in California.

Your actual tax rate depends on your situation. Use our Stock Option Tax Calculator to get a personalized figure.

A real-life example of what a cashless exercise could look like

Let’s assume:

- You own 15,000 ISOs at a $3 strike price

- Your company IPOs, and you get to sell them for $150 each

- Your effective ordinary income tax rate, including state and federal taxes, is 45%. (That’s about what we often see for our California clients.)

Since you’re doing a cashless exercise, you didn’t exercise your stock options before the IPO, and are now exercising and selling them all in one go.

- Per share, before taxes, you’re making a gain of $147 ($150 - $3)

- In total, your gain before taxes is $2,205,000 ($147 x 15,000)

- You owe $992,250 in taxes (45% x $2,205,000)

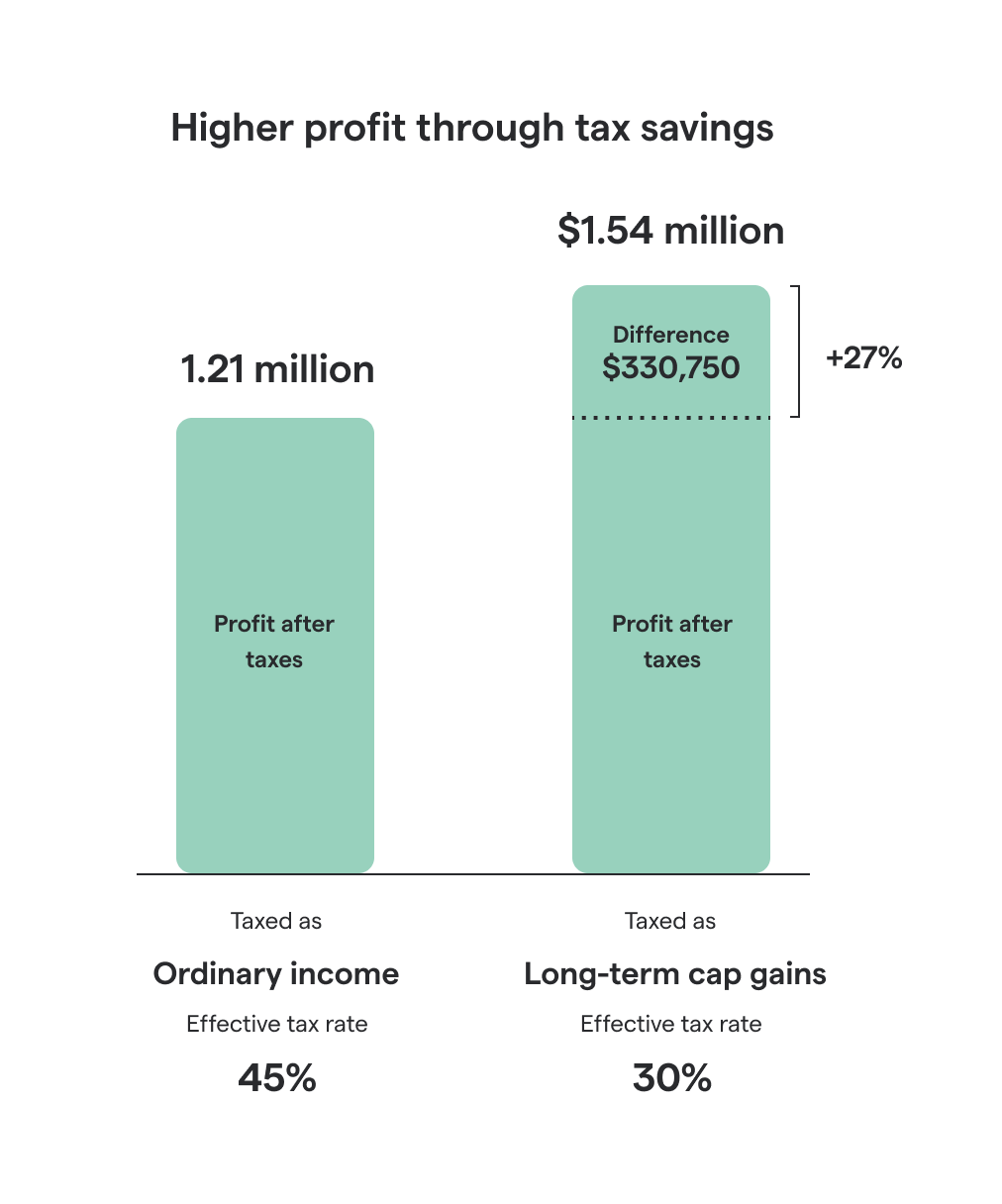

Your net gain is $1,212,750.

What if you’d exercised pre-IPO, at least 12 months before selling?

Now assume you didn’t wait for a cashless exercise, but exercised your ISOs in advance.

You’d have to pay the company $45,000 ($3 strike price * 15,000).

In addition, you’d owe tax. The amount of tax depends on the 409A valuation (also known as fair market value) at the time of your exercise.

Let’s assume the 409A is $35, and you owe $161,000.

So including taxes, you’d need to come up with $206,000 in order to exercise.

Assuming you sell your shares at least 12 months later, your proceeds now get taxed at long-term capital gains rates.

Let’s say the effective rate, in your situation, is 30%. (Again, that’s around what we often see for our California clients.)

Now:

- You owe $661,500 in taxes (30% x $2,205,000)

- But you already paid $161,000 when you exercised, which is subtracted

- So the remaining liability is $500,500

This time around, your net gain is $1,543,500.

The difference is $330,750. That’s a 27.3% gain because you exercised pre-IPO instead of doing a cashless exercise.

So, should you exercise pre- or post-IPO? (Free cashless exercise calculator)

We built the Exercise Timing Planner.

It takes in your equity and tax situation, and allows you to compare both scenarios. Use it to figure out whether it’s worth it to exercise in advance of the IPO, or if it’s better to wait.

Cashless exercise alternatives

If you decide you don’t want to wait for a cashless exercise, your next step is to figure the costs of exercising your stock options using your own money — including the tax liability.

You can do that using the Stock Option Tax Calculator.

Unfortunately, for many people, the cost will be so high it’s unaffordable. Luckily, there are a couple of alternative ways to cover the costs.

1. Non-recourse financing

Secfi offers non-recourse financing to employees of select companies.

If you’re eligible, our financing allows you to purchase your options prior to an IPO without spending your own money.

If your company exits, you’ll pay us back with fees at that time. But — and that’s what non-recourse means — if your company doesn’t exit, you don’t pay anything at all.

We pre-vet the startups that we work with, so we’re able to take on that calculated risk.

2. Tender offers

Your company might offer to buy back shares from you while it’s still private. More and more, late-stage startups are offering this as a way to raise funds before they exit.

You can use this to sell a portion of your shares, enough to cover your exercise costs.

It's basically a cashless exercise but before the IPO.

3. Secondary markets

In some cases, you can sell your pre-IPO shares on a secondary market like Forge Global (formerly SharesPost) or EquityZen.

This is not an option for every company, but it can be worth investigating.

Like a tender offer, you can use this to sell a portion of your shares and cover your exercise costs that way.

4. Loans

Regular old loans, like a personal loan, margin loan, or loan from friends or family, are also an option for covering the exercise costs.

It’s risky, though, because it’s not guaranteed your company will exit. If it doesn’t, you’ll still be on the line to pay back the loan. More about the pros and cons of loans here.

So how exactly does a cashless exercise work in practice?

If your company has IPO’d, a cashless exercise is facilitated by a brokerage firm.

When you’re ready to exercise your options, the firm covers the share cost, transaction fees and taxes with a short-term loan.

Then, they turn around and sell at least a portion of your new shares to pay back the loan.

From your perspective, it will feel like one seamless transaction that leaves you with cash, shares or a combination of both.

If your company doesn’t IPO but is instead acquired for cash, cashless exercises are often simply handled by your employer.

What about ‘exercise and hold’ vs. ‘exercise and sell’?

In the above scenarios, we’ve talked about using a cashless exercise to exercise your options, immediately selling all the shares, and cashing out completely.

This strategy is called ‘exercise and sell.' As discussed, it means being taxed at the highest tax rate.

Alternatively (if you didn’t exercise prior to the IPO) you can also do a cashless exercise to ‘exercise and hold.'

Also known as ‘sell to cover,' it means you sell just the right amount of shares to be able to cover the costs, holding the rest for another 12 months.

This way, you still get the tax benefits — although partly.

After a successful IPO, you may have life-changing wealth locked up in your employee equity.

If you keep that locked up in the form of company shares for a year, the stock might go down by much more than what the tax benefits make up for.

Is a cashless exercise right for you?

A cashless exercise can be a convenient option, but the big lesson here is to think ahead so it’s not your only option.

If you’re able to exercise options pre-IPO, you could save a hefty amount on taxes.

But if you’re not, it’s good to know how a cashless exercise works because it could be your only route to reaping the benefits of your employee stock options.