What is a cashless exercise?

Cashless exercise

A cashless exercise of stock options is when you exercise your options, and then immediately sell the resulting shares.

Here is a quick video overview:

0 result

Normally, you’d need cash to afford your option exercise. But that can be expensive.

With a cashless exercise, you cover your expenses with your sale proceeds and avoid the problem.

A cashless exercise allows you to exercise stock options and sell the resulting shares immediately. This approach, often called a ‘same-day sale,’ can help you cover exercise costs without needing upfront cash. Learn how this post-IPO strategy works, its tax implications, and alternative options.

If you own stock options in a startup, doing a cashless exercise is one of two strategies you can take.

With startup options, the big decision you’ll need to make is:

Waiting for a cashless exercise (#1) is the easy, low-risk route. It’s also the default option you’ll end up with if you don’t do anything.

But there are drawbacks:

Let’s dive into how a cashless exercise works, and how it compares to the alternatives.

Cashless exercise is popular for startup employees who don’t want the risk of upfront exercise costs or the uncertainty of a private company’s exit. Here are the primary reasons to consider this post-IPO strategy:

1. No Cash Requirement – A cashless exercise allows you to cover exercise and tax costs through the sale proceeds, avoiding a large cash outlay.

2. Low Risk – You aren’t putting your personal savings at risk, unlike pre-IPO exercise, which requires upfront cash with no guarantee of a successful exit.

3. Simplicity – There’s no action required before the IPO, making it the easy, hands-off, default choice if you don’t want to manage tax timing or exercise logistics.

Don’t let #3 be your reason!

Something we still hear way too often is: “I wish I had known all of this years before the IPO..."

Luckily, you’re now reading this article 🧠

There are three main benefits of using a cashless exercise:

One thing to note about #2 and #3: there is also a low-risk, cashless option to exercise your options before IPO (so you can avoid the high taxation) — but not many people know about it. It’s called non-recourse financing — more on what that is below.

Cashless exercise isn’t always the best option, for two reasons:

Regardless of whether you’re exercising incentive stock options (ISOs) or non-qualified stock options (NSOs or NQSOs), in a cashless exercise you will pay ordinary income tax rates on the difference between the strike price (the amount you can buy the stock for according to your options agreement) and the price you sell your shares for.

That’s the same tax rate as your salary, and can be as high as 52.65% for federal + state taxes if you live in California.

Your actual tax rate depends on your situation. Use our Stock Option Tax Calculator to get a personalized figure.

Let’s assume:

Since you’re doing a cashless exercise, you didn’t exercise your stock options before the IPO, and are now exercising and selling them all in one go.

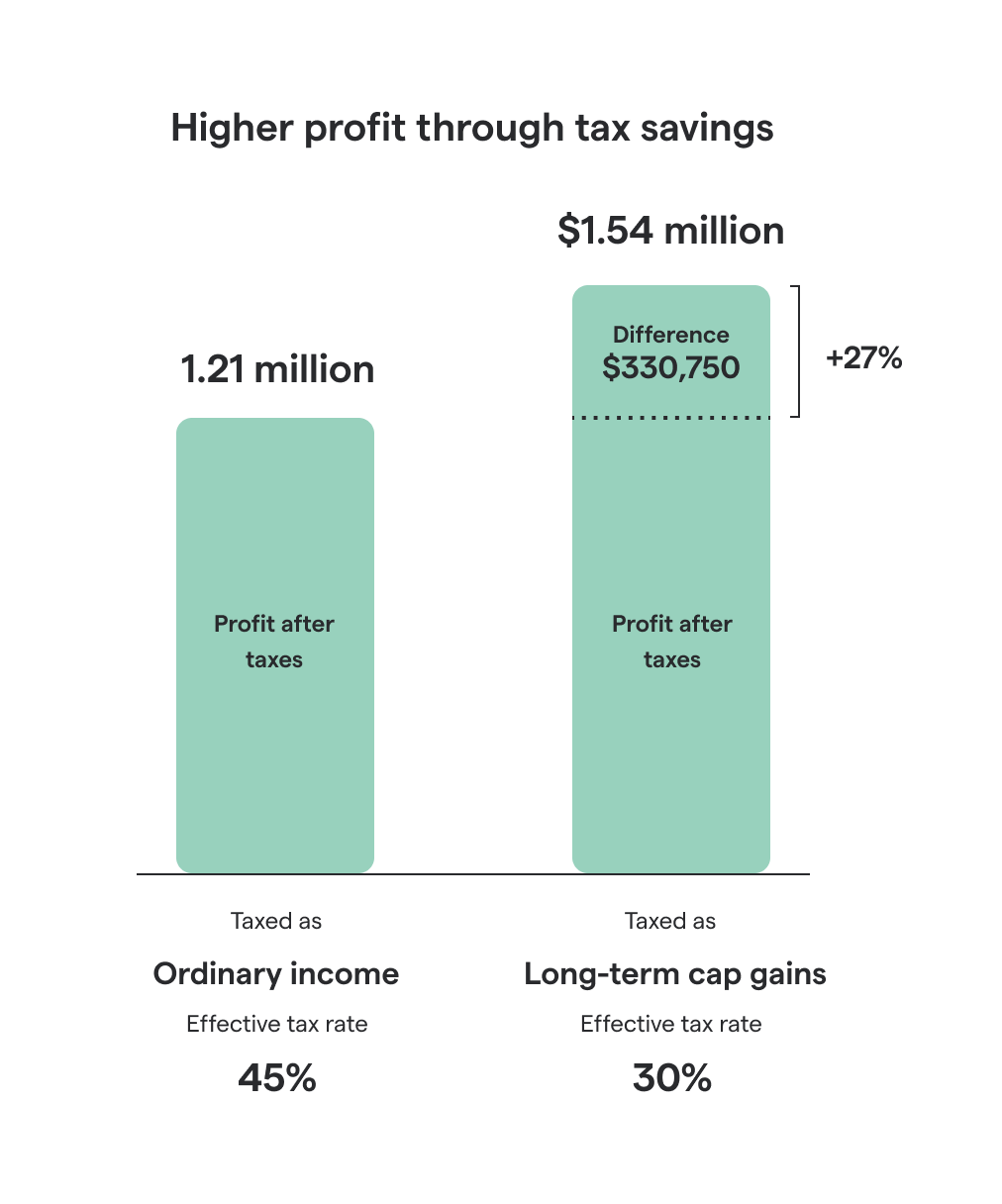

Your net gain is $1,212,750.

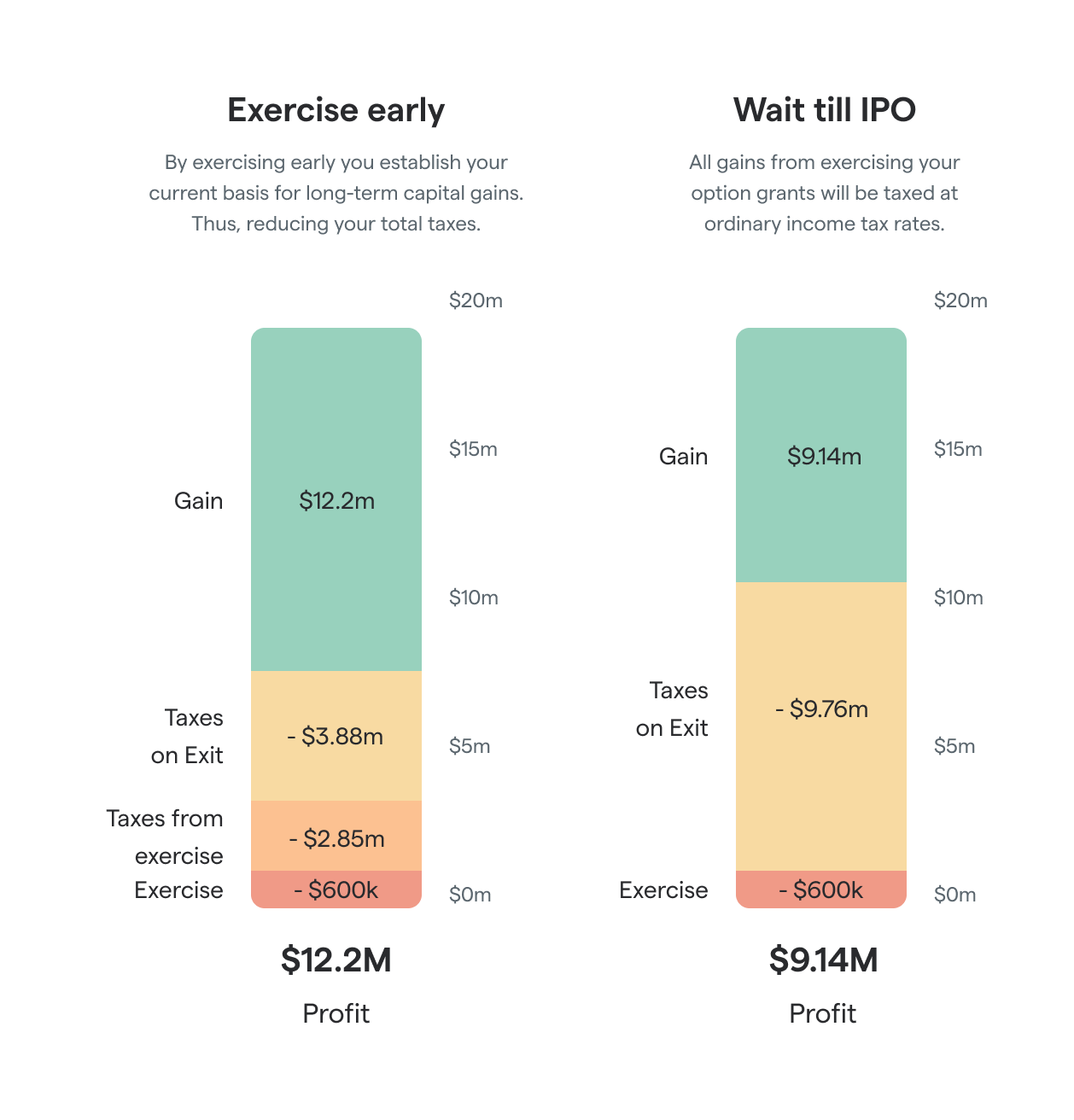

Now assume you didn’t wait for a cashless exercise, but exercised your ISOs in advance.

You’d have to pay the company $45,000 ($3 strike price * 15,000).

In addition, you’d owe tax. The amount of tax depends on the 409A valuation (also known as fair market value) at the time of your exercise.

Let’s assume the 409A is $35, and you owe $161,000.

So including taxes, you’d need to come up with $206,000 in order to exercise.

Assuming you sell your shares at least 12 months later, your proceeds now get taxed at long-term capital gains rates.

Let’s say the effective rate, in your situation, is 30%. (Again, that’s around what we often see for our California clients.)

Now:

This time around, your net gain is $1,543,500.

The difference is $330,750. That’s a 27.3% gain because you exercised pre-IPO instead of doing a cashless exercise.

We built the Exercise Timing Planner.

It takes in your equity and tax situation, and allows you to compare both scenarios. Use it to figure out whether it’s worth it to exercise in advance of the IPO, or if it’s better to wait.

If you decide you don’t want to wait for a cashless exercise, your next step is to figure the costs of exercising your stock options using your own money — including the tax liability.

You can do that using the Stock Option Tax Calculator.

Unfortunately, for many people, the cost will be so high it’s unaffordable. Luckily, there are a couple of alternative ways to cover the costs.

Secfi offers non-recourse financing to employees of select companies.

If you’re eligible, our financing allows you to purchase your options prior to an IPO without spending your own money.

If your company exits, you’ll pay us back with fees at that time. But — and that’s what non-recourse means — if your company doesn’t exit, you don’t pay anything at all.

We pre-vet the startups that we work with, so we’re able to take on that calculated risk.

Your company might offer to buy back shares from you while it’s still private. More and more, late-stage startups are offering this as a way to raise funds before they exit.

You can use this to sell a portion of your shares, enough to cover your exercise costs.

It's basically a cashless exercise but before the IPO.

In some cases, you can sell your pre-IPO shares on a secondary market like Forge Global (formerly SharesPost) or EquityZen.

This is not an option for every company, but it can be worth investigating.

Like a tender offer, you can use this to sell a portion of your shares and cover your exercise costs that way.

Regular old loans, like a personal loan, margin loan, or loan from friends or family, are also an option for covering the exercise costs.

It’s risky, though, because it’s not guaranteed your company will exit. If it doesn’t, you’ll still be on the line to pay back the loan. More about the pros and cons of loans here.

If your company has IPO’d, a cashless exercise is facilitated by a brokerage firm.

When you’re ready to exercise your options, the firm covers the share cost, transaction fees and taxes with a short-term loan.

Then, they turn around and sell at least a portion of your new shares to pay back the loan.

From your perspective, it will feel like one seamless transaction that leaves you with cash, shares or a combination of both.

If your company doesn’t IPO but is instead acquired for cash, cashless exercises are often simply handled by your employer.

In the above scenarios, we’ve talked about using a cashless exercise to exercise your options, immediately selling all the shares, and cashing out completely.

This strategy is called ‘exercise and sell.' As discussed, it means being taxed at the highest tax rate.

Alternatively (if you didn’t exercise prior to the IPO) you can also do a cashless exercise to ‘exercise and hold.'

Also known as ‘sell to cover,' it means you sell just the right amount of shares to be able to cover the costs, holding the rest for another 12 months.

This way, you still get the tax benefits — although partly.

After a successful IPO, you may have life-changing wealth locked up in your employee equity.

If you keep that locked up in the form of company shares for a year, the stock might go down by much more than what the tax benefits make up for.

A cashless exercise can be a convenient option, but the big lesson here is to think ahead so it’s not your only option.

If you’re able to exercise options pre-IPO, you could save a hefty amount on taxes.

But if you’re not, it’s good to know how a cashless exercise works because it could be your only route to reaping the benefits of your employee stock options.