6 min

Eric Thompson, CFP®

Lead Financial Advisor

As a CFP® at Secfi, Eric guides clients through the complexities of equity compensation, integrating it into their broader financial goals.

0 result

Whether you already have employee stock options or are considering a job offer that includes options as part of the compensation package, you likely have questions about your equity — and that’s a good thing. When it comes to maximizing the value of your stock options (ISOs, NSOs, etc.) knowledge is power.

Stock options can unlock life-changing wealth, but many employees typically have the same question: How can you determine the potential worth of your equity?

100,000 options may sound like a lot but it doesn’t inherently tell you much. In many cases, 10,000 options could be worth more. That’s because other factors, like the company’s valuation and dilution, play significant roles in determining their value. Plus, the value of your options can often change as your company’s value fluctuates — hopefully for the better.

The good news is it’s entirely possible to grasp the key points to get a base understanding of the value of your options. Knowing how to value your stock options can help you feel confident about negotiating a job offer, planning when to exercise, and managing your financial future.

Here we’ll walk through a simplified method for thinking about the value of your stock options.

Your company should be able to provide you with the following figures:

Next, estimate your company’s future valuation, particularly at exit (IPO or acquisition). Most people focus on the company’s valuation at exit since that’s often the first time you’ll have an opportunity to sell shares — thereby converting your hard work into cash.

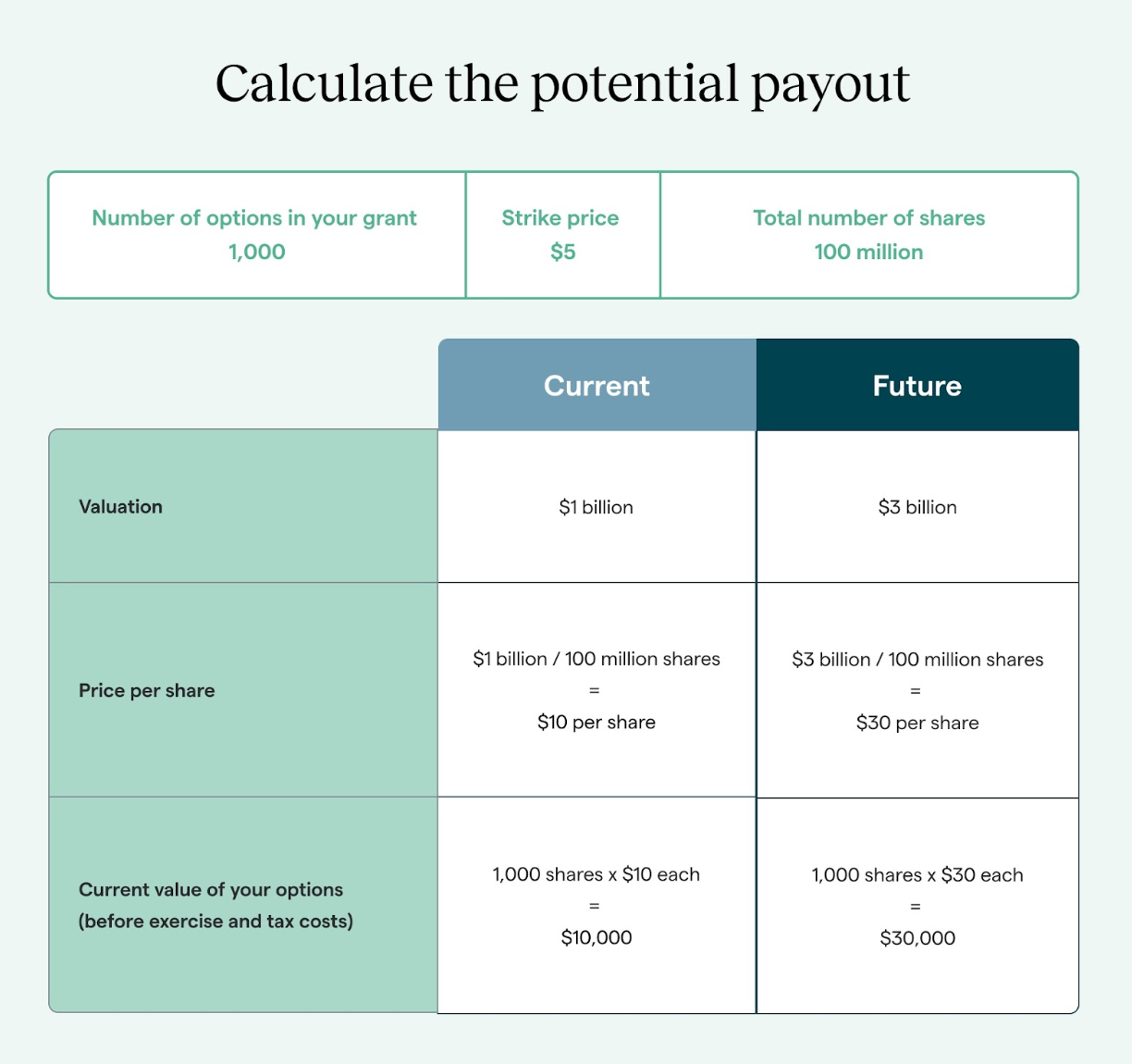

You could certainly also estimate the value of your options today, especially if you are being offered equity at a new job. If you have 1,000 options in a company with 100 million shares outstanding, your ownership stake is .001%. Multiply your ownership stake by the company’s current $1 billion valuation to find that your options are theoretically worth $10,000 minus the costs to exercise (strike price and taxes; more on that below).

Let’s continue with the example, adding in a projected exit value for the company:

Exploring different exit scenarios can help you set realistic expectations. If the company’s exit valuation grows by 5x, what would that mean for your options? What if the valuation grows more modestly or even declines over time?

It’s worth noting that our example is simplified and assumes no dilution takes place, which is not always a realistic assumption.

Dilution is when your company increases the amount of outstanding shares. This happens during fundraising when your company issues new shares for investors to buy. Dilution means the exit value would be divided among more shareholders.

To arrive at your potential take-home gains, you’ll need to subtract your costs from the resulting gain in the stock's value. Your costs have two parts:

Let’s start with the cost to buy your options. If you have multiple grants, you’ll need to calculate the cost for each one.. Returning to the example above, your future gains rang in at $30,000, but you will have paid $5,000 to acquire shares. So, your projected gains are $25,000.

You’ll also have to pay taxes, which are more complicated and depend on when you exercise:

For a more precise breakdown, check out our Stock Option Tax Calculator to explore different tax scenarios and potential outcomes.

Unfortunately, you can’t be 100 percent sure how much money you’ll make from your options; their value is uncertain. Simply put, a successful exit isn’t guaranteed — and exit valuation has a very strong influence on the value of your options.

Key Factors That Impact Stock Option Value:

Ultimately, every person will weigh these factors differently, which means they will value their options differently. We have several resources to help you continue thinking about the value of your options, including our stock option starter guide. The guide also includes ideas to help you decide when to exercise and how much to spend. Additionally, you can check out our Stock Option Exit Calculator to see how much your shares could be worth in a future IPO.